The integration of digital trading with traditional banking may be the best solution for cross-border compliant transactions in the medium to long term.

In the era of accelerating global integration, cross-border payments have undoubtedly become the lifeblood of international trade, remittances, and commercial operations. However, the traditional financial system has proven inadequate in meeting the demands of a rapidly digitizing world, facing numerous challenges. On one hand, the high transaction costs have deterred many businesses and individuals, adding to the burden of global economic activities. On the other hand, the lengthy settlement times have severely affected the efficiency of fund circulation, greatly constraining the pace of commercial activities. In addition, complex regulatory barriers have also brought uncertainties to cross-border payments, hindering the smooth conduct of international trade.

With the rapid expansion of global trade demand, the market urgently needs more flexible, cost-effective, and technologically advanced solutions. In this context, digital currency-based cross-border payment methods have naturally emerged, promising to completely overturn the traditional cross-border payment model and bring about a new revolution in modern international trade.

Challenges of Traditional Cross-Border Payments

In traditional cross-border payments, the involvement of multiple intermediary banks in the entire process makes the settlement time potentially extend to several days (T+N). In the current context where real-time transactions are becoming the norm, this undoubtedly leads to significant efficiency waste.

Furthermore, each intermediary bank involved in the transaction charges fees, significantly increasing the total cost for the remitter. For businesses relying on timely payments to effectively manage cash flow and individuals remitting funds to cross-border family members, these delays and costs are almost unbearable.

Moreover, the complex and diverse regulatory environments in different jurisdictions pose challenges to traditional cross-border payments. During the lengthy transaction period, the unpredictable risks of exchange rate fluctuations further exacerbate these challenges.

In summary, the traditional interbank payment process presents numerous issues, and the market urgently needs innovative solutions that can provide faster, more cost-effective, and more reliable cross-border payment options to support the speed and scale of global trade.

Digital Assets: The Game Changer in Global Financial Transactions

In the era of accelerating global integration, cross-border payments have undoubtedly become the lifeblood of international trade, remittances, and commercial operations. Digital assets and blockchain technology are increasingly seen as viable solutions to address these challenges.

Firstly, by achieving real-time settlement and eliminating the need for intermediary institutions, blockchain-based payments significantly reduce transaction costs and improve the overall efficiency of cross-border transactions. This not only reduces delays but also addresses the complexity and high cost issues associated with traditional financial systems, making it more convenient for both businesses and individuals to conduct cross-border payments and enhancing their reliability.

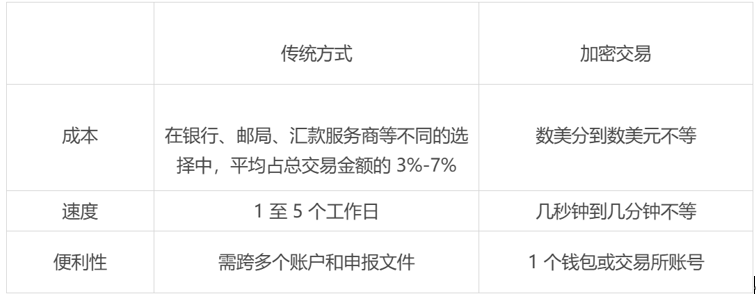

As can be seen from the above image, digital assets have significant advantages in terms of cost and speed compared to traditional payment systems. By directly processing payments between parties, they eliminate the need for intermediary institutions, thereby significantly reducing transaction costs and saving a substantial amount of expenses.

Furthermore, they can achieve near-instantaneous cross-border transfers, representing a significant improvement compared to traditional cross-border payment systems based on multiple intermediary banks, which may take several days to settle.

Of particular note is that digital assets enhance financial inclusion by providing financial services in regions where traditional banking infrastructure is limited or nonexistent, especially benefiting emerging markets. This convenience and efficiency make digital assets an increasingly attractive choice for both businesses and individuals.

Driven by digitization, cross-border payment solutions have begun to disrupt traditional cross-border payment channels by offering faster, cheaper, and more secure alternatives.

Emerging Landscape of Digital Payments

For this reason, cross-border payments have become a core topic of discussion in recent events such as Money20/20, with industry leaders focusing on the challenges and opportunities brought about by this evolving new landscape.

The complexity of cross-border transactions is particularly pronounced in emerging markets (such as Asia), where it is expected that by 2023, the use of digital wallets will account for over 58% of all digital payment transactions. Despite the rapid adoption of digital innovations, Jody Perla, Managing Director of Payoneer, emphasizes that cross-border transactions remain complex and costly, highlighting the urgency of continuously improving cross-border payment methods to meet the needs of modern global trade.

With the continuous development of these trends, an increasing number of payment companies are viewing digital payments as an effective solution. For example, PayPal Ventures has invested in the digital payment startup Mesh, indicating the increasing recognition of digital assets as a force for financial service transformation. Amman Bhasin, Partner at PayPal Ventures, outlined this vision, stating, "As financial services rapidly transform, we believe that user ownership and portability of assets will be a key cornerstone of product innovation, and digital assets will be the first beachhead to achieve this goal."

The World Bank also recognizes the increasing application of digital assets such as stablecoins in addressing challenges in the existing monetary system, especially in emerging markets and developing economies (EMDEs), where these digital assets are seen as key tools to enhance financial inclusion and improve cross-border payment efficiency in regions lacking traditional financial infrastructure.

The use of stablecoins pegged to stable assets (such as the US dollar) plays a crucial role in mitigating risks associated with currency fluctuations, ensuring stable value in transactions, making it more reliable for both businesses and individuals.

The adoption of stablecoins is evident in several key indicators: as of May 2024, there are over 27.5 million active users, reflecting a 50% year-on-year growth in transaction volume. Additionally, approximately 30% of global remittances are facilitated through stablecoins. This growing acceptance highlights a broader trend where businesses and consumers are increasingly turning to digital-driven solutions to address the inefficiencies and limitations of traditional cross-border payment systems.

As the financial landscape continues to evolve, digital assets are expected to play a more critical role in shaping the future of cross-border settlements and global finance.

Bridging the Traditional and Digital Divide: OSL OTC Trading Services

As a licensed and compliant digital asset service provider in Hong Kong, OSL stands at the forefront of this historically significant technological trend, committed to seamlessly integrating the advantages of digital currency with traditional methods by providing services that connect digital assets with traditional banking systems.

The OSL over-the-counter (OTC) trading service is a key focus, characterized by its strong banking relationships, particularly close cooperation with major banks in Hong Kong, enabling significantly shortened settlement times — a crucial aspect for digital finance:

Unlike cross-border transactions in traditional financial systems, which may take several days, OSL leverages advanced blockchain technology and banking networks to achieve near-instantaneous settlement.

This speed is crucial for institutional clients requiring rapid execution of large-scale transactions in different markets, ensuring the rapid and secure transfer of funds globally. Additionally, OSL adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, adding an extra layer of security and trust.

It is worth noting that speed is the cornerstone of OSL's OTC trading service, but far from its only advantage. As one of only two licensed exchanges in Hong Kong, OSL has set new industry benchmarks in regulatory compliance and security — as a continuously regulated exchange with comprehensive insurance coverage for digital assets, OSL has obtained SOC 2 Type 2 certification and undergoes regular audits by reputable accounting firms, ensuring the highest level of asset security for clients.

Furthermore, OSL's OTC trading service also provides the best market liquidity, facilitating low-friction seamless execution of large trades. It supports various trading options through its advanced REST API and Request for Quote (RFQ) system, enabling clients to efficiently trade and obtain guaranteed quotes, eliminating the risk of on-exchange price slippage commonly seen on traditional exchanges.

In addition, OSL's customized client services and strategic global partnerships enable it to meet the diverse and evolving needs of its clients in major global markets.

As the digital economy continues to evolve, the role of digital payments in revolutionizing financial transactions becomes increasingly significant, especially as the demand for speed, security, and efficiency in cross-border transfers continues to grow. Digital assets are poised to become the cornerstone of the global financial infrastructure.

Standing at the forefront of change, innovators undoubtedly need to integrate the characteristics of traditional finance and digital trading. Just as OSL's OTC trading service cleverly integrates the advantages of digital assets with the reliability of traditional banks, it ensures that clients can thrive in the dynamic digital economy by providing fast, secure, and compliant solutions.

The future is here, and the integration of traditional finance with digital trading may inject new vitality into the global financial system.

*Note: The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the views or positions of OSL Group Limited or its affiliates. Any forecasts and opinions contained herein are for general market commentary purposes only and do not constitute a securities or investment offer, invitation, advice, or guarantee of returns. The information, forecasts, and opinions contained herein are as of the date of this article and should not be considered as investment product or market advice if there are changes, they will not be notified separately, and should not be considered as investment product or market advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。