Many of the fears, uncertainties, and doubts about cryptocurrencies are not so reasonable - it is important to see how much progress we have actually made.

Author: Gaby Goldberg & Bridget Harris

Translation: DeepTechFlow

On the cryptocurrency Twitter timeline, negative emotions are more rampant than ever. Price guides emotions, so it is understandable that people are uneasy about this industry and its use cases. However, if we take a step back, many of the fears, uncertainties, and doubts about cryptocurrencies are not so reasonable - it is important to see how much progress we have actually made. After all, good things always take time.

"But cryptocurrencies have no use case!!!"

In fact, there are use cases, you just may not have noticed. Many people expect progress to be presented in a certain way, perfectly 1) consistent with their expectations, or 2) similar to the development trajectory of other industries. The progress of each industry is different - especially when a brand new asset class is created from scratch. It is easy to feel cynical about the industry's stagnation in our own circle. However, this is not true, and below we will try to provide a positive view of the current state of cryptocurrencies today and how it is getting better.

Cryptocurrencies have achieved product-market fit (PMF), if you know where to look

From a broader perspective, over 66% of cryptocurrency users live in developing countries, and lower-middle-income countries continue to show sustained demand (as of March 2024, India, China, Brazil, and Vietnam are leading in cryptocurrency adoption). The situation in the United States is also good, but Americans do not necessarily need to use cryptocurrencies to hedge against inflation or obtain stable currency. Instead, for developing countries, cryptocurrency is now a necessity: it is a mechanism to protect them from the influence of their (often dysfunctional) governments and financial systems. For example, in Latin America, people generally immediately deposit their salaries into USDT or USDC after receiving them. More than a third of Latin Americans have already used stablecoins for daily consumption, indicating that companies are also starting to accept cryptocurrencies. Globally, USDT is particularly strong on Tron, with a circulation of about 60 billion US dollars, held by about 44 million unique addresses. In short, global access to the US dollar has become a killer use case for cryptocurrencies.

"If people only see monkey gifs, it's not the fault of cryptocurrencies." - Scott Alexander.

Cryptocurrencies as a competitive advantage

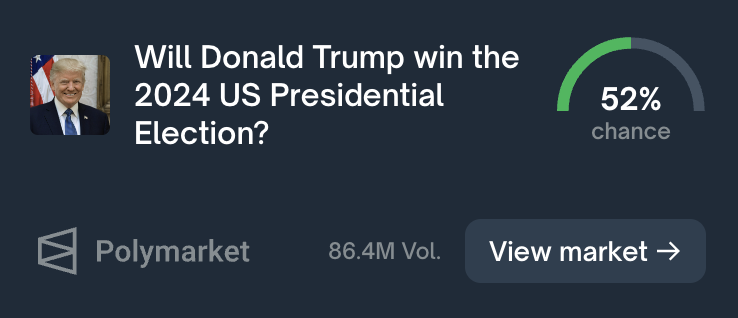

In the above example, cryptocurrencies as a technology are the product. But there is also a complete application ecosystem and use case, where cryptocurrencies are just infrastructure, making the user experience better than before. One breakthrough application is Polymarket, the world's largest prediction market. The uniqueness of Polymarket is that it is built on top of crypto infrastructure. There are many obvious and not so obvious reasons why cryptocurrencies provide a competitive advantage for such applications, as stated by Joey Krug:

Global accessibility. If the market is not global, it will face huge liquidity and accuracy issues.

Refund risk. How do people bet $100,000 with a credit card? If you lose the bet, would you choose a refund? This risk is huge for non-crypto betting sites, which is why they historically charge high fees. Polymarket currently has no fees.

Complex coordination. For prediction markets operating across borders without cryptocurrencies, there are huge coordination challenges between banks, regulatory jurisdictions, and forex service providers. This not only brings additional costs to users, but also makes these types of prediction market platforms slow, painful, and difficult to grow.

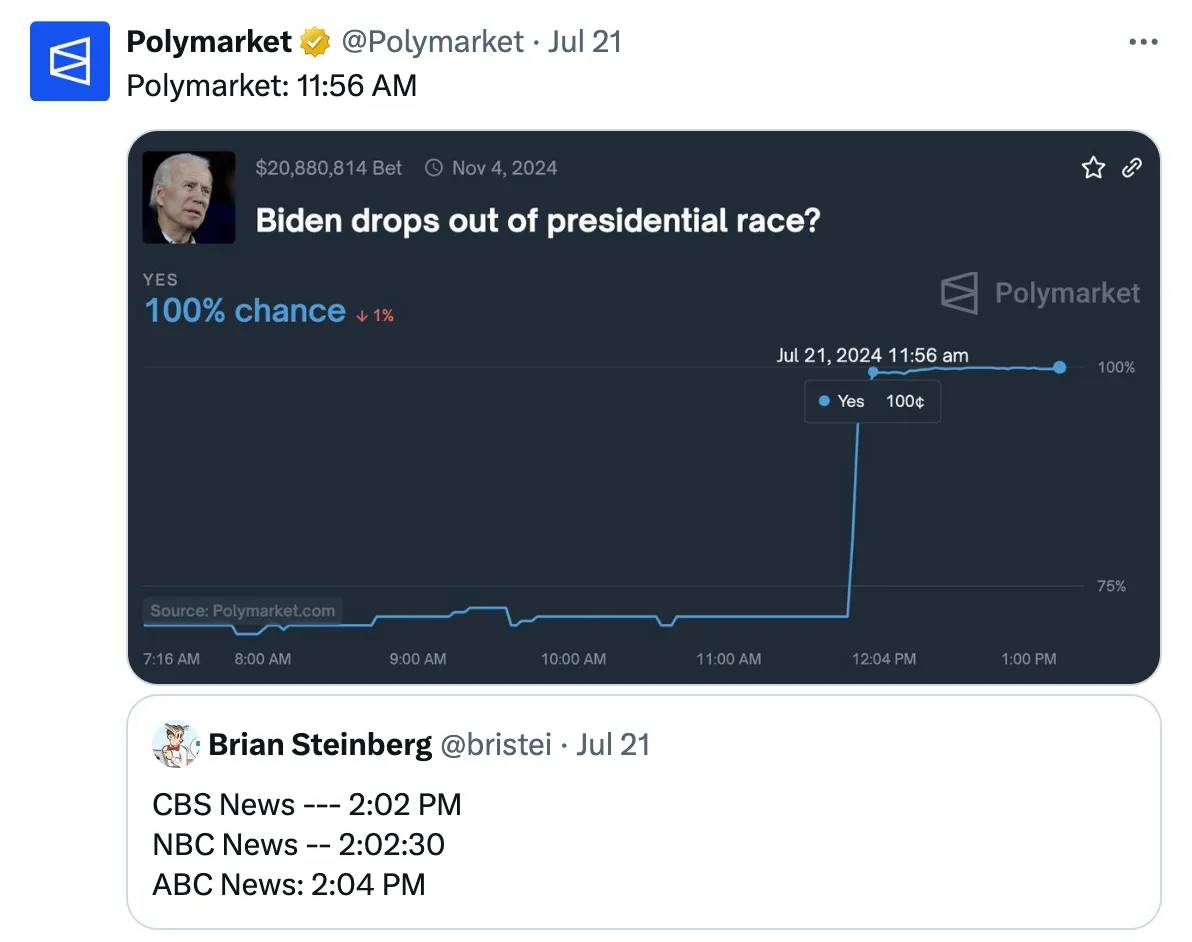

Polymarket is a prime example of cryptocurrencies, as it is a powerful new example that shows how cryptocurrencies unlock use cases that were previously unable to operate on a large scale. Polymarket is largely 1) faster than traditional news sources, and 2) evolving towards a new form of media. This new media form serves as a source of truth, a peer-to-peer social platform, and a mechanism to incentivize accuracy (or at least as close to accuracy as possible, considering the available information).

We can even see real-time Polymarket embeds on Substack (Example A):

These small victories continue to accumulate, gradually bringing cryptocurrencies into the mainstream.

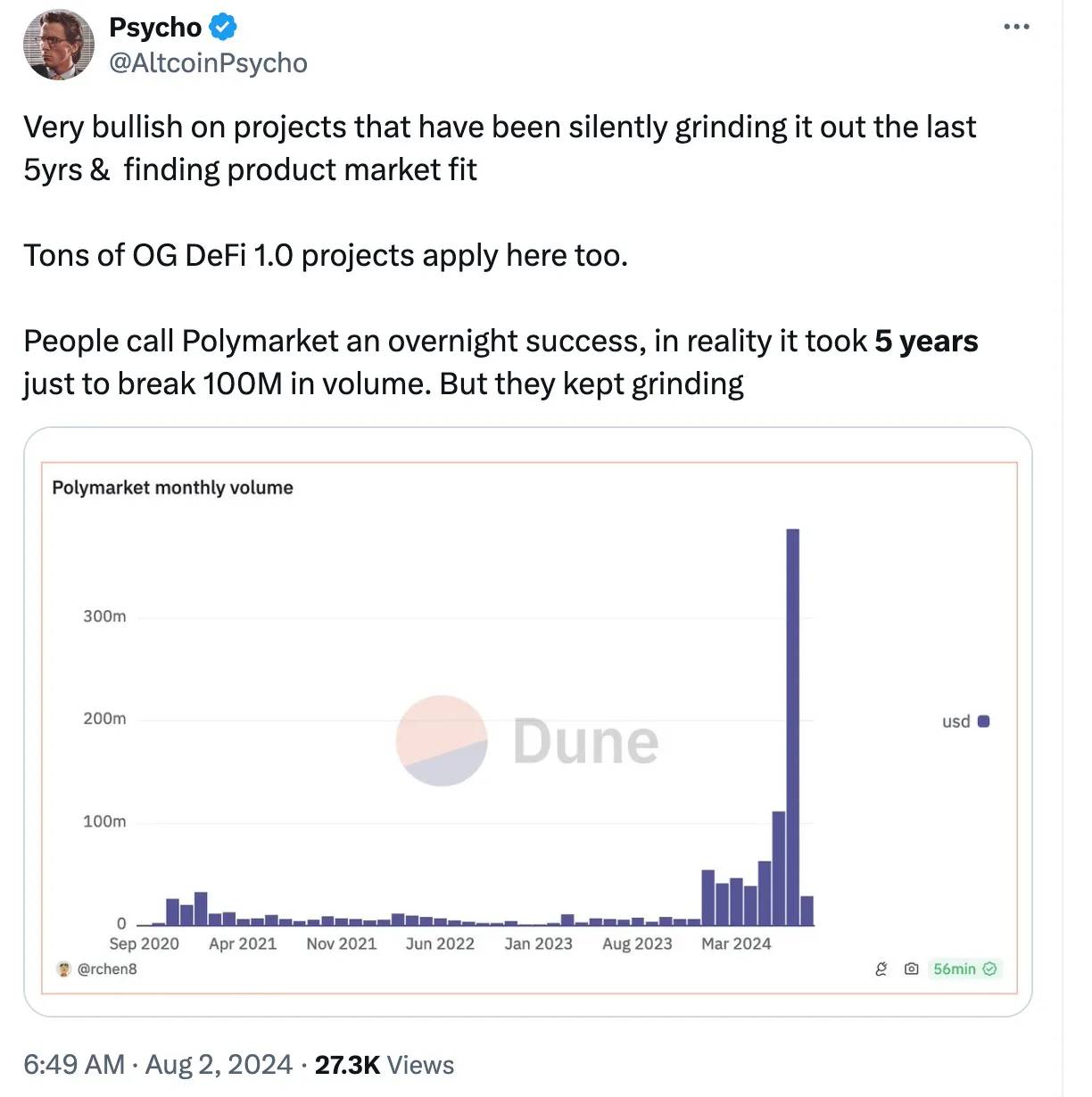

Polymarket teased the news before the official announcement

One final point about Polymarket is how long the team has been working on the same vision. Their trading volume has been low and steady over the past five years, but they have persevered - even when the company was almost bankrupt due to a CFTC fine of $1.4 million. Cryptocurrencies always have inherent biases against current affairs™, but people often fail to realize how much time (and work) is required for eventual "overnight" success.

Another company that transcends cryptocurrency users is Pudgy Penguins, whose products are now sold at Target, Walmart, and Walgreens in the United States (with toy sales exceeding one million). They are using their distribution channels as a way to attract the masses to cryptocurrencies; rather than adopting a "build it and they will come" strategy, Pudgy is actively serving its existing user base. Specifically, they are building an easy-to-use Layer 2, a game with blockchain elements, and even a show centered around their cute brand (originally just an NFT collectible). It is noteworthy that Pudgy first focused on having its own distribution channels before building low-level infrastructure in its tech stack. So far, most other Layer 2 solutions have taken the opposite approach: build the technology first, then try to launch a community and attract applications to build within their ecosystem.

Pudgy has come up with creative ways to attract users: for example, each physical Pudgy toy comes with a QR code that can be redeemed in the Pudgy World game (in a Webkinz style). By gradually guiding users into cryptocurrencies and ensuring they have fun in the process, they are more likely to 1) stay engaged, and 2) explore cryptocurrencies more deeply.

Bridging the gap between applications

One company providing critical infrastructure for multiple projects in the consumer application space is Bridge. They are developing a stablecoin API, specifically for issuance and orchestration - a problem that companies previously had to solve internally, which Bridge has modularized. Bridge demonstrates that doing one (important) thing well is a robust strategy in cryptocurrencies, and this is why they are attracting numerous clients. What seems like a simple API is actually quite complex on the backend: Bridge handles all KYC and compliance issues, while businesses only need to integrate with them to immediately convert between fiat and stablecoins (or different forms of stablecoins). While stablecoins are a core use case in cryptocurrencies, finding a solution that allows for fast and compliant on- and off-ramps has been challenging. Additionally, there are many stablecoins in the market, and each platform typically favors a certain stablecoin. Bridge solves this problem in a flexible and user-friendly manner.

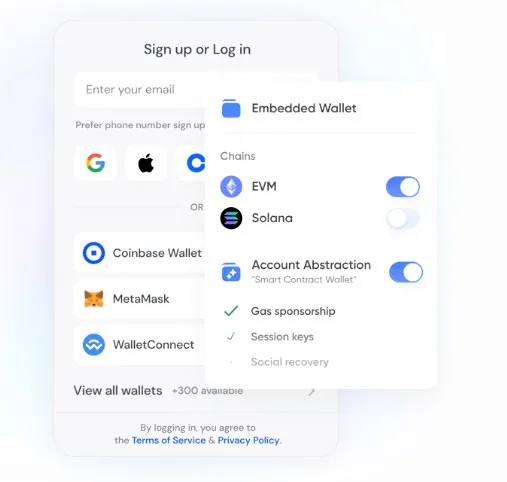

You get a wallet!

In cryptocurrencies (especially among newcomers), a common complaint is wallets - which one to choose, how to choose a wallet that connects with the most decentralized applications (dapps), and whether there are alternatives. Many providers - such as Dynamic, Privy, Capsule, and Coinbase WaaS - are addressing this issue for cryptocurrency applications and their users, allowing individuals to move on-chain without downloading third-party wallet apps or managing mnemonic phrases. Constantly fixing integrations, managing updates, and adding new wallets when they are released (to ensure the total addressable market (TAM) is not limited) consumes critical engineering resources for companies. On the user side, the pain points are obvious: without these embedded wallets, users may not have supported wallets (or, if they are cryptocurrency novices, they may not have a wallet at all). Simplifying the onboarding process for new users into cryptocurrencies is a key part of achieving mass adoption. These companies - many of which were founded only in the past few years - are playing a crucial role.

Embracing the unfamiliar

That being said, there is still a lot of work to be done as an industry - but this does not negate the achievements we have made so far. Ultimately, if you believe that the financial system should be fast, global, low-cost, accessible, and serving the people, then cryptocurrencies are the ultimate choice.

It is worth noting that every new category goes through growing pains as it matures - or often faces explicit opposition. When the printing press was first introduced, it was opposed by monks and religious authorities because it weakened their control over information. Printing was even completely banned in Islamic authorities. Swiss scholar Conrad Gessner "called for laws to regulate the sale and distribution of books in European countries. He believed that ordinary people should not have access to so many books." In the late 15th century, Italian writer Filippo di Strata wrote, "The pen is virgin, but the printing press is a whore."

If the printing press is a whore, I'm not sure if the public's description of cryptocurrencies is suitable for publication. But we will gladly accept this criticism to celebrate progress. Embracing the unfamiliar means understanding that new technologies often look strange in the early stages.

We also acknowledge that most cryptocurrency experiments may not succeed. But if you are still making this argument, then you fundamentally misunderstand the evolution of breakthrough technologies. This is not new. The maturation of the internet also required us to bid farewell to internal server farms, webrings, and Sony's AIBO robot dogs. This is a natural and healthy evolution as people experiment with new technologies. The "power law" of successful products is what investors commit to when entering these fields.

Infrastructure Empowering Applications

The realization of many groundbreaking applications in this cycle has benefited from entirely new infrastructure that was almost non-existent in the previous cycle. Indeed, there is currently more infrastructure than applications, but without a robust underlying framework, applications cannot actually exist or scale. With this infrastructure finally ready, innovation in applications is accelerating.

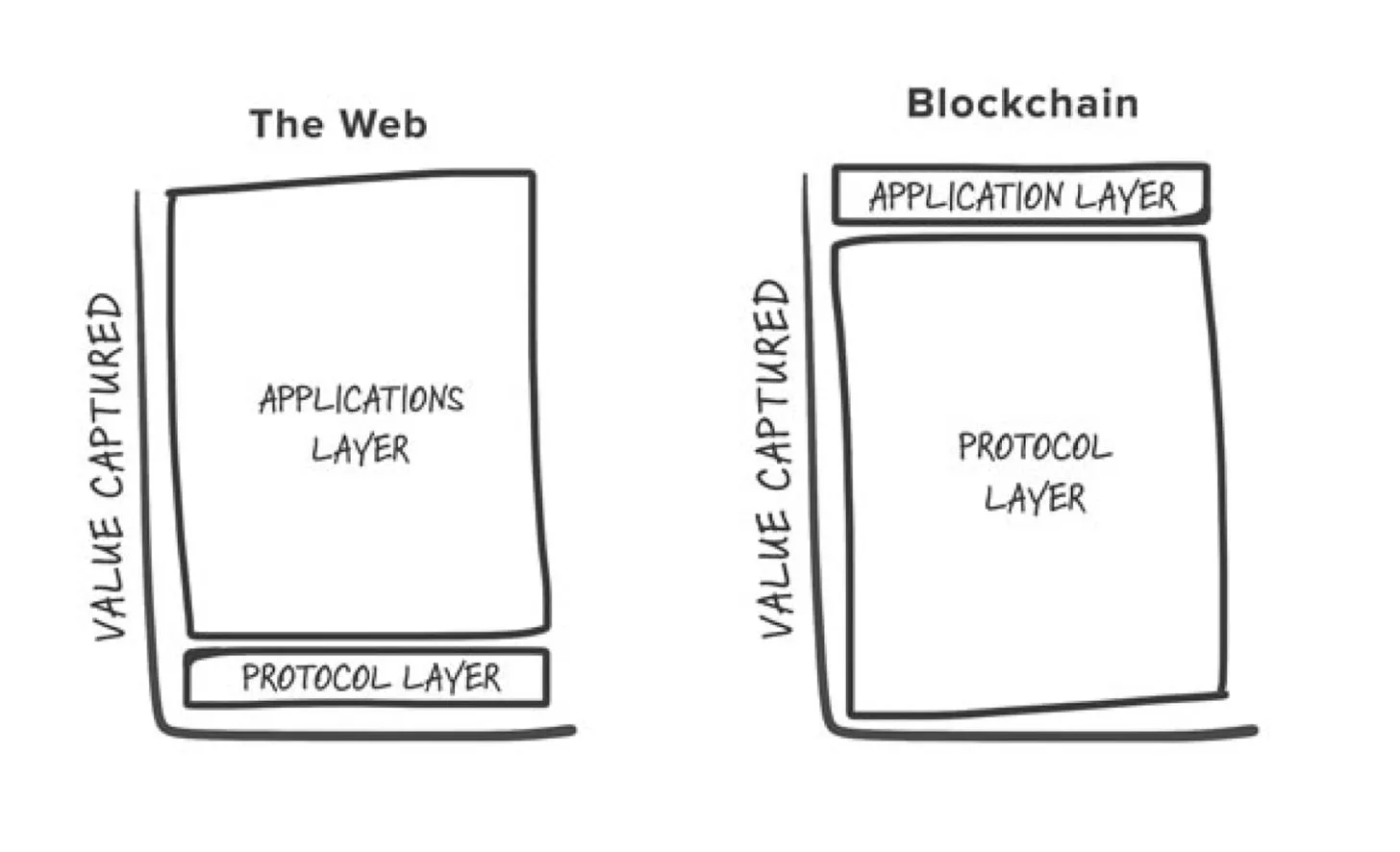

Joel Monegro famously proposed the concept of "fat protocols" in 2016, where in blockchain networks, most of the value accrues at the protocol layer rather than the application layer:

In our view, the modularization of the protocol layer reduces the share of value capture at the "protocol layer," leaving more flexibility for applications. This allows applications to select and combine modular components of the protocol layer as needed, ultimately creating a better experience for users (while also being more profitable). Users are now essentially paying fees to the application through increasingly abstracted front-ends of the protocol layer.

Interestingly, the modularization of infrastructure means that many of the problems faced by Ethereum application developers today are often more cultural than technical. For these developers, the ecosystem they choose to build in is crucial for their brand, community, and long-term development. Sometimes, these applications are referred to as "projects built on [insert your favorite L2 here]," and if the L2 cannot be sustained, it weakens the value of their own products and brands. Building on Solana is unified, as everyone defaults to building on the same platform, while Ethereum presents a critical question to developers: where should I build? Since most chains abstract protocols are not ready, "ubiquitous deployment" is not a real option. When the ecosystem becomes more important than the application itself, it can lead to a parasitic relationship between the application and the ecosystem, both vying for the same limited attention.

The initial cause of all this may be that Ethereum actually did not do any marketing, forcing L2s to create their own brands and styles. This trusted neutral approach has led to a rich and diverse L2 ecosystem, but of course, it has also led to fragmentation. Vitalik emphasized this in a recent article, comparing L2 to an extension of Ethereum's own culture: "For a subculture, Layer 2 is the ultimate arena of action." These subcultures may actually be the best breeding ground for emerging applications: active user engagement, tight-knit communities, and prolific developers. Additionally, the culture of the underlying L2 can support its applications and enhance its culture. Of course, from the infrastructure perspective, many L2s on Ethereum are maturing, allowing more applications to exist and scale.

Conclusion

So far, we have experienced enough cycles to know that infrastructure drives the development of applications, and applications in turn promote the improvement of infrastructure, and this virtuous cycle continues. The emerging technologies we often complain about are actually driving products with low-cost chains, better distribution, and higher-quality user experiences, ultimately promoting adoption. We still have a lot of work to do, but it is worth acknowledging that despite the collapses of companies like FTX, regulatory resistance, and extreme market volatility, we have still achieved a lot. Our industry is still small, and the development stage is still early, so the work we do should be mutually beneficial. It's time to embrace true ambition again, as they say, patience is a virtue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。