Original | Odaily Planet Daily

Author | jk

With the launch of the US spot Ethereum ETF, the cryptocurrency investment market has once again ushered in new changes. In the past week, the performance of the US spot Ethereum ETFs has been different. This batch of new ETFs saw a net inflow of over $1 billion in the first week, while Grayscale's ETHE saw a net outflow of $1.5 billion.

In this article, Odaily Planet Daily will analyze the performance of these new ETFs in detail, explore the key factors affecting market trends, and look ahead to possible development trends in the future.

Spot Ethereum ETF

After obtaining approval from the US Securities and Exchange Commission in May, the spot Ethereum ETFs from eight issuers were officially launched last Tuesday. As of July 29th local time in the US, the total trading volume of spot Ethereum reached $4.83 billion.

Since the launch of spot Ethereum a week ago, among the new eight ETFs, the one with the highest trading volume has always been BlackRock's ETHA, with a trading volume of $1.104 billion and a net inflow of $500 million, maintaining a market share of around 21%. Fidelity's FETH had a net inflow of $244.2 million, but its market share dropped from around 12% at the time of launch last Tuesday to 5% today. Due to the lowest management fee, Grayscale's Mini Trust (ETH) saw its market share increase from 5% to 13.6%.

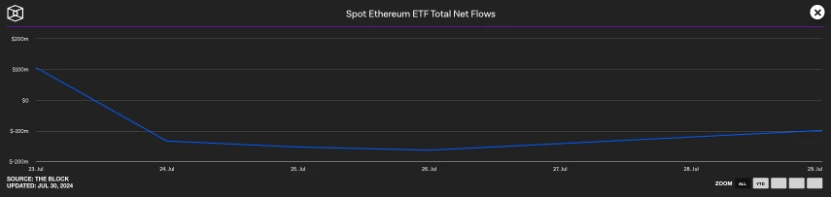

In contrast, Grayscale's ETHE saw a net outflow of over $1.5 billion due to the same reasons as GBTC (which has always traded at a discount and had high management fees), resulting in an overall net outflow of $341.8 million for the US spot Ethereum ETFs.

Net inflow and outflow of spot Ethereum overall, source: The Block

Comparison with Bitcoin ETF

In terms of trading volume, it is obvious that the spot Bitcoin and Ethereum ETFs cannot be compared (the spot Bitcoin ETF had a trading volume of $4.5 billion on the first day of its launch, which is almost the trading volume of spot Ethereum ETFs for a week). However, according to The Block's analysis, excluding ETHE, the net inflow of the Ethereum ETF is about 40% of the net inflow of the Bitcoin ETF in January (excluding GBTC), i.e., $1.17 billion compared to $2.89 billion.

The spot Ethereum ETF also quickly surpassed the trading volume of existing Ethereum futures ETF products, occupying 99.3% of the market share as of last Friday, according to The Block's data.

In contrast, the spot Bitcoin ETF accounts for 92.75% of the trading volume market share of Bitcoin futures ETFs.

Similar to GBTC: Will Grayscale Dump?

The Grayscale Ethereum Trust Fund was initially launched in 2017 and began trading in mid-2019 with the code ETHE. This situation continued until July 23rd, when ETHE became one of the newly approved spot Ethereum ETFs. The fees for converting ETHE are much higher, at 2.5%, similar to Grayscale's GBTC Trust Fund converting to Bitcoin spot ETF. Some investors who had previously bought trust shares at a significant discount during the bear market (trust shares cannot be redeemed) wanted to sell and cash out after the conversion to ETF; while other investors sold due to the high management fees and chose other new ETFs.

The fees for the spot Ethereum ETFs of other issuers are between 0.19% and 0.25% after reduction. However, in Grayscale's dual ETF strategy, its other Grayscale Mini Trust Ethereum ETF product (ETH) has the lowest fee, at only 0.15%. This product also saw a net inflow last week, totaling $164 million, and its market share has increased from 5% to 13.6%. However, due to the huge net outflow of ETHE and the decline in the price of Ethereum since the ETF was launched, its managed assets have decreased to about $7.5 billion (2.28 million Ethereum).

According to The Block, Bloomberg ETF analyst James Seyffart said, "For me, the main difference is the huge net outflow of ETHE. I don't think GBTC had this situation on the first day because there was still a significant discount when it was launched."

"'The new eight' Ethereum ETFs are not as strong as 'the new nine' Bitcoin ETFs in offsetting Grayscale's net outflow, but the good news is that their net inflow/trading volume is still very healthy. The unlocking strength of ETHE is much faster than GBTC = good prospects, but the next few days may be difficult," added Bloomberg ETF analyst Eric Balchunas.

ETH price. Source: Coinmarketcap

The price of Ethereum has not changed dramatically in the past week, dropping from over $3400 to around $3100, then rising to around $3300. This also indicates that the so-called dumping of Ethereum did not actually occur, or the selling pressure was effectively absorbed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。