The Hong Kong Monetary Authority officially released the "Legislative Proposal Consultation Document for the Implementation of the Regulatory System for Stablecoin Issuers in Hong Kong" in December 2023, and launched the stablecoin issuer "sandbox" system in March 2024 [1]. The digital stablecoin of the Hong Kong dollar is on the verge of meeting the world. At this critical moment in history, it is essential to deeply explore a crucial question: Can the digital stablecoin of the Hong Kong dollar become a dominant currency on the blockchain? And how should we proceed?

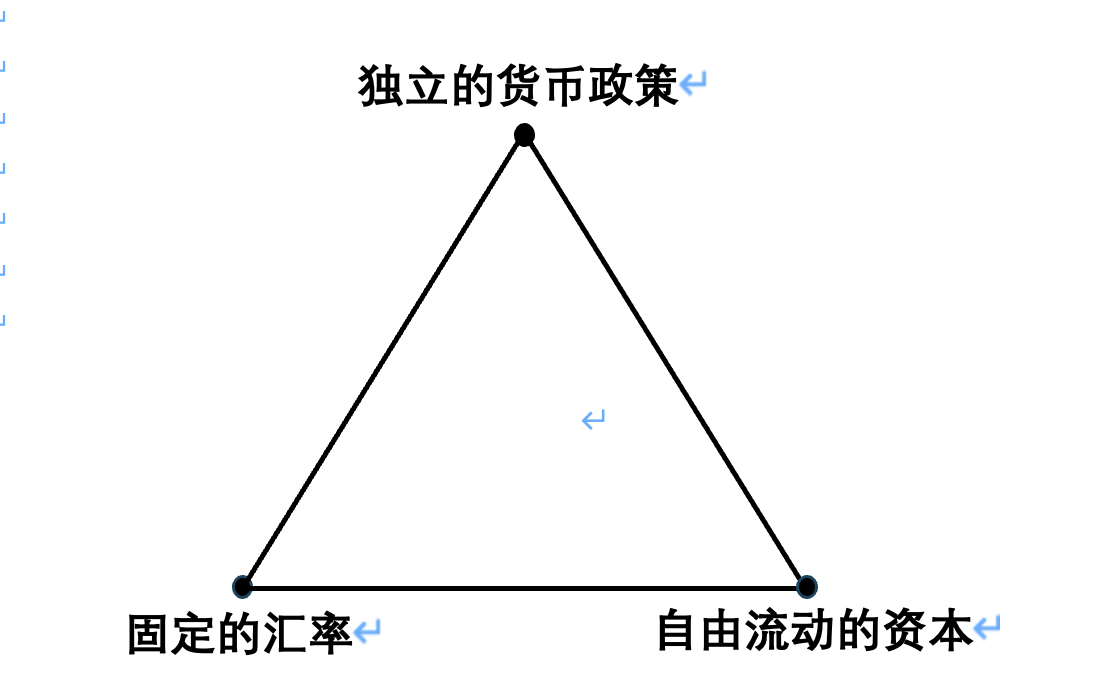

The Traditional "Impossible Trinity" No Longer Holds

In the world of Web 3.0 blockchain, the traditional "impossible trinity" no longer exists. This is a disruptive change and the starting point for considering new issues. The "Mundell-Fleming Trilemma" of the open economy is a famous proposition in international economics, independently proposed by the renowned economists John Fleming and Robert Mundell in the 1960s; later, the American economist Paul Krugman also expounded on it [2]. According to the content of the "impossible trinity," the three vertices of the triangle correspond to three objectives, namely: (1) completely independent monetary policy; (2) completely fixed exchange rates; (3) completely free capital mobility. The "impossible trinity" states that a country can only choose two of the three objectives at most, and cannot achieve all three.

The creation of fiat currency, formulation and transmission of monetary policy, design and implementation of financial regulation, parity relationship between traditional financial market interest rates and exchange rates, and the pricing and circulation of various complex financial products in countries around the world are all based on this "impossible trinity." It can be said that the "impossible trinity" is the core "algorithm" of the operation of the world financial system since the Bretton Woods system.

The Hong Kong region is a real case of the effectiveness of the "impossible trinity." The Hong Kong region adopts the "linked exchange rate" system under the Currency Issuance Bureau, with the Hong Kong dollar pegged to the US dollar at a fixed exchange rate of 7.8 Hong Kong dollars to 1 US dollar (allowing a 0.64% float, i.e., allowing 7.75 to 7.85 Hong Kong dollars to 1 US dollar), while Hong Kong allows free capital mobility. Under the framework of the "impossible trinity," the Hong Kong region maintains two "vertices" of the "triangle," namely a stable exchange rate and complete capital mobility, but loses the independence of monetary policy, another "vertex." Hong Kong has spent more than 40 years establishing the global credibility of the Hong Kong dollar, and the linked exchange rate of the Hong Kong dollar has become a stabilizing force for the economy and finance in the Hong Kong region.

However, in the world of Web 3.0 blockchain, this "impossible trinity" no longer exists. Once digital currencies are on the chain, they participate in full competition with all digital currencies, conducting exchange transactions 24/7. Peer-to-peer exchanges on the blockchain can be fast, efficient, and unimpeded, and are basically unaffected by the degree of openness of the capital account in the country. Of course, there is also an "impossible trinity" on the blockchain, proposed by Ethereum founder Vitalik Buterin, namely "the blockchain network cannot simultaneously achieve security, decentralization, and scalability." This "impossible trinity" of the blockchain will guide the structure and algorithms of different blockchains, and is also the common logic of competition among various public chains and applications, thus deeply affecting the ecological environment for the participation of the digital stablecoin of the Hong Kong dollar in the crypto competition.

On-Chain vs. Off-Chain Currency Competition

Let's shift our focus to a more micro perspective. With no physical limitations, the competition of digital currencies will be based on network ecology, application scenarios, and incentive mechanisms.

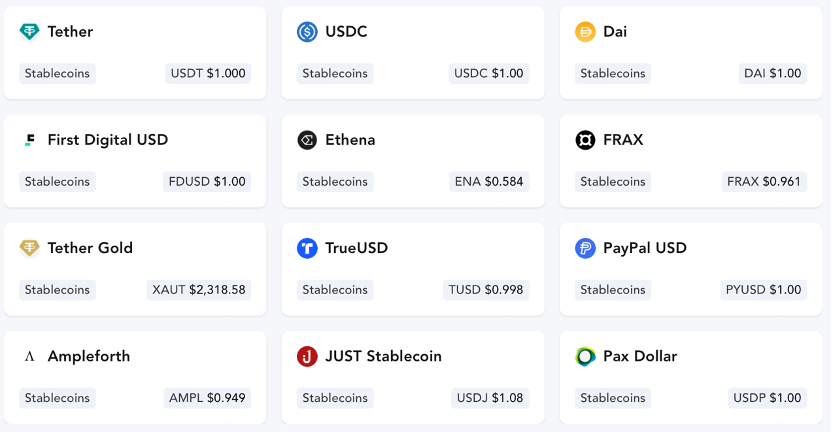

There are many types of stablecoins already issued on the chain. Currently, the most commonly used is USDT, issued by Tether in 2014, with a market value of 113 billion US dollars, accounting for about 60% of the stablecoin market share. However, Tether does not disclose its audit reports, and its off-chain reserve assets are not transparent. The market is quite concerned about the stability of its currency value and the potential impact on traditional finance off the chain. The second-ranked stablecoin is USDC, which was listed and issued in May 2018, with a current market value of 32 billion US dollars. Its parent company, CIRCLE FINANCE, is a publicly listed payment company on the New York Stock Exchange, and the off-chain reserve asset situation of USDC will be disclosed in quarterly audit reports. The third-ranked stablecoin is DAI, issued by MakerDAO, an algorithmic stablecoin (its reserve assets are other digital assets on the chain, such as BTC, ETH, etc.), with a current market value of 5.3 billion. The DAI stablecoin single-collateral Sai system was launched in 2017, and DAI is currently the largest market value-based algorithmic stablecoin.

Figure: Some of the on-chain circulating digital stablecoins

In the Web 3.0 world on the chain, the "FIT21" bill, defining Bitcoin as a digital commodity, has been passed by the U.S. House of Representatives. There is no clear definition for other digital currencies, so the regulatory authority and applicable rules for digital stablecoins have not been clearly defined. Digital stablecoins are a type of digital currency and serve as a medium for on-chain and off-chain connectivity. Currently, the USDT and USDC corresponding off-chain reserve assets held in U.S. Treasury bonds account for approximately 10% of the total size of U.S. Treasury bonds, which is one of the reasons the United States openly embraces Crypto. If Crypto receives reasonable regulation in the future, Crypto will form a positive cycle with the off-chain return mechanism of the U.S. dollar, further consolidating the international status of the U.S. dollar.

Now, let's turn our attention back to off-chain. In the off-chain world of paper currency, how do we define international currency? According to Kenen (1983) and Krugman (1984), similar to the functions of domestic currency, international currency also has three functions: medium of exchange, unit of account, and store of value. For different users, it can be further divided into six functions: (1) as a medium of exchange, it represents trade settlement and financial transactions for the private sector, and serves as a tool currency for foreign exchange intervention for the government (public) sector. (2) As a unit of account, it represents the pricing unit for trade and finance for the private sector, and for the government (public) sector, it plays the role of a "anchor" currency pegged to the domestic currency. (3) As a store of value, it is used as an investment asset and foreign exchange savings for the private sector, and is foreign exchange reserves for the government (public) sector. Each of these six functions can be associated with other functions to a certain extent (Cohen, 1971) [3]. The five currencies included in the IMF's SDR currency basket are the U.S. dollar, euro, Chinese renminbi, Japanese yen, and British pound. According to the results of the IMF's 2022 valuation review, the U.S. dollar accounts for 43.38% of the SDR weight, and the Chinese renminbi accounts for 12.28%.

Table: Attributes of International Currency [4]

Currency Functions

Government (Public) Sector

Private Sector

Store of Value

Foreign Exchange Reserves

Foreign Exchange Savings

Medium of Exchange

Tool Currency for Foreign Exchange Intervention

Trade Settlement and Financial Transactions

Unit of Account

"Anchor" Currency Pegged to the Domestic Currency

Pricing Unit for Trade and Finance

Table: Composition and Weight of the SDR Basket after the 2022 Valuation Review

Currency

2002 SDR Weight (%)

U.S. Dollar (US Dollar)

43.38

Euro (Euro)

29.31

Chinese Renminbi (Chinese Renminbi)

12.28

Japanese Yen (Japanese Yen)

7.59

British Pound (Pound Sterling)

7.44

Source: International Monetary Fund

Here is the translation of the provided text:

We return to the question we raised at the beginning: Can the digital Hong Kong dollar stablecoin become a dominant currency on the chain? One possible design for the digital Hong Kong dollar stablecoin is to exchange it 1:1 with the Hong Kong dollar banknotes. Due to the Hong Kong dollar's linked exchange rate system with the US dollar, the on-chain digital Hong Kong dollar stablecoin maintains a 7.8:1 anchoring relationship with the off-chain US dollar. Of course, other possible designs include pegging the Hong Kong dollar digital stablecoin to a currency basket including the US dollar, Chinese yuan, and others. However, this approach would need to address arbitrage issues between on-chain and off-chain assets, as the Hong Kong dollar cash is anchored to the US dollar. If the digital Hong Kong dollar stablecoin is not anchored to the US dollar, there would be price differentials and arbitrage issues between on-chain and off-chain Hong Kong dollars.

The Hong Kong region has always been an important gateway for China's external connections and is the largest offshore center for the Chinese yuan. It has built a bridge for the vast amount of high-quality Chinese assets to connect with the world. Capital flows from around the world to the Hong Kong region, exchanging their local currency for Hong Kong dollars to gain high returns from Chinese assets. This narrative of Hong Kong's 40 years of reform and opening up reflects its core competitiveness in three aspects: financial center, entrepôt trade, and shopping paradise, which collectively create the fundamental strength of the Hong Kong economy and the linked exchange rate of the Hong Kong dollar. However, in the world of blockchain, due to the absence of the classic "impossible trinity," there is no control over capital flows between currencies, and there is no "center" to intervene in exchange rates. Therefore, we must raise the following four questions: 1) If mainland capital cannot legally and compliantly exchange for the digital Hong Kong dollar stablecoin, what are the advantages of the digital Hong Kong dollar stablecoin? 2) If mainland capital is allowed to legally and compliantly freely exchange for the digital Hong Kong dollar stablecoin, how can capital outflows from the mainland be controlled, as this would lead to more serious financial instability? 3) The 1:1 exchange of the digital Hong Kong dollar stablecoin and the Hong Kong dollar implies an additional condition, namely the absolute stability of the Hong Kong linked exchange rate. Is it necessary to effectively hedge this additional condition at the beginning of the stablecoin system design? 4) How will the digital Hong Kong dollar stablecoin compete with other stablecoins, such as USDT and USDC?

Yield Farming for Digital Stablecoins

The competition among on-chain stablecoins is achieved through the wealth effect. Various on-chain smart contracts provide users with generous participation rewards. Investors can earn high yields (over 20% is common) by depositing stablecoins, providing liquidity to stablecoin pools, and engaging in other activities. This principle is similar to the initial issuance of ride-hailing vouchers by Didi Chuxing and discount coupons by Luckin Coffee, mainly to boost popularity through high subsidies.

Here is an example of risk-free yield farming: Recently, there has been high demand for risk-free arbitrage of the USDT and USDC stablecoins on the SUI public chain. The Meta team of the Facebook Libra project evolved into the Meta system of the blockchain, and then some team members formed a new development team to develop the current SUI public chain. The Scallop smart contract on the SUI chain provides lending services for the stablecoins USDT and USDC, creating a high-yield risk-free arbitrage opportunity. Users can collateralize USDT on the Scallop smart contract (at a collateralization rate of 85%) and then borrow USDC (with a borrowing cost of 21.13%, a reward return of 28.32%, and a profit of 7.19%). Furthermore, users can use the borrowed USDT for a second collateralization, and then borrow USDC again; this process can be repeated until the available collateral approaches zero. After summing the returns from each layer of arbitrage, the annualized return can reach approximately 40% (as of June). Smart contracts like Scallop's Yield Farming will greatly drive the use of digital stablecoins such as USDT and USDC, creating a positive spiral for smart contract protocols and digital stablecoins.

Figure: Investment returns in the Scallop protocol on June 22

Returning to the digital Hong Kong dollar stablecoin, once it is on the chain, it will participate in the competition among stablecoins. In addition to the macro requirements mentioned above, the success of the digital Hong Kong dollar stablecoin also requires providing Yield Farming opportunities for investors. The advantage of the Hong Kong Web 3.0 ecosystem lies in its vast Chinese customer base and development team. The success of the digital Hong Kong dollar stablecoin requires a strong and diverse blockchain application ecosystem, public chains, layer 2 network applications, smart contracts, DeFi, DePin, etc. These infrastructure and applications should ideally be in a Chinese environment, or at least provide a more comfortable and user-friendly experience for Chinese users. The establishment of this ecosystem will involve two main issues: (1) regulatory issues—Hong Kong must provide a clear answer to the world regarding the extent to which it will embrace crypto; (2) technological issues—Hong Kong must attract developers, programmers, and crypto experts from the Web 3.0 world. This will be a process of balancing regulation and innovation, and it will not be easy.

Finally, we raise a more important question, a binary choice: the digital Hong Kong dollar stablecoin "must" become an internationally dominant digital currency, it must! Over the past few decades, Hong Kong's core competitiveness has been reflected in three aspects: financial center, entrepôt trade, and shopping paradise, which collectively create the fundamental strength of the Hong Kong economy and the linked exchange rate of the Hong Kong dollar. Web 3.0 is undoubtedly a technological revolution, and Hong Kong must ride the wave of the blockchain revolution. This is a competition for survival, a binary choice of 1 and 0.

[1] "Sandbox" is a new regulatory term in the field of financial technology. The original meaning of "sandbox" is a place where children play with sand, allowing people to play and be creative within a limited and safe environment. In the field of financial technology, "sandbox" mainly refers to regulatory authorities allowing financial institutions to test new services and products in a controlled and small-scale environment before their launch, to collect data and user feedback, thereby accelerating the launch of related products and services and ensuring compliance with regulatory requirements.

[2] After studying the international economic situation in the 1950s, Robert Mundell proposed a view supporting the fixed exchange rate system. In the 1960s, the Mundell-Fleming model proposed by Mundell and John Fleming analyzed the IS-LM model in an open economy, making it a classic analysis of using monetary policy under a fixed exchange rate. In 1999, American economist Paul Krugman drew a triangle based on the above principles, which he called the "eternal triangle," clearly demonstrating the underlying principles of the "Mundell triangle."

[4] This table was originally drawn by Cohen (1971) and later modified by Kenen (1983) and Frankel (1992), among others.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。