撰文:Eureka Partners

Bitcoin Layer2 的展望

比特币最初被构想应用于电子支付系统,因此为了安全性和稳定性,非图灵完备的脚本语言的设计限制了比特币执行复杂计算的能力,比特币更多的是作为价值储存的数字黄金而存在的。随着以太坊,Solana 等公链上生态的大爆发,为了盘活比特币生态上沉睡的万亿美元资产,开发者们也一直在探索比特币生态上的扩容方案,但侧链、闪电网络等方案的技术局限性依然存在,因此一直不温不火。

2023 年由 Ordinals 催生的铭文潮拓展了比特币生态新的资产形态,也进一步引发了市场关于比特币可拓展性和可编程性的思考和探索。一系列新的 Layer2 解决方案如 Merlin、B² Network 也涌现出来,借助可编程性创建 Swap、借贷、流动性挖矿等一系列 DeFi 应用来拓展比特币生态中新的应用场景。

目前市场上大部分 Layer2 都是通过将流动性桥接到以太坊生态,通过与以太坊生态耦合来参与 DeFi 等链上场景。然而,很多 Layer2 的提款桥本质都是多签桥,通过多签来管理公共资产的桥接方案往往存在信任风险,无法以一种去信任的形式让用户把资产随时撤出。对于很多 BTC holder 而言,他们没有动力也不放心将 BTC 资产桥到以太坊生态上去博取未知的收益,毕竟资金的安全才是一切收益的基石。因此,理想中的比特币二层应当继承比特币的安全特性,而且能够构建一个可扩展且支持编程的链上金融基础设施。

BitLayer 作为 Layer2 里的核心支撑期望高

Bitlayer 作为 BTC Layer2 的引领者,采用了分层虚拟机技术(Layered Virtual Machine),结合了零知识证明(ZKP)和乐观验证(OP)机制,用以支持广泛的计算任务。此外,Bitlayer 通过其创新的 OP-DLC 和 BitVM 桥技术,构建了一个双通道双向锁定资产桥,继承了比特币第一层的安全性。

Bitlayer 的主要技术创新在于采用最新的 BitVM 计算范式和 OP-DLC 桥。

与其他比特币第二层解决方案相比,Bitlayer 旨在解决第二层面临的三个核心问题,并提出了相应的解决方案:

-

无需信任的双向锚定(Trustless 2-Way Peg)—— 通过结合 OP-DLC 与 BitVM 桥,提出了一种超越传统多重签名模式的新模型,实现了资产在比特币主链和 Bitlayer 之间无需信任的双向流动。

-

第一层验证(Layer 1 Verification) —— 通过 BitVM 继承比特币的安全性。

-

图灵完备性(Turing-Completeness)—— 支持多种虚拟机,实现了 100% 与以太坊虚拟机(EVM)兼容的环境。

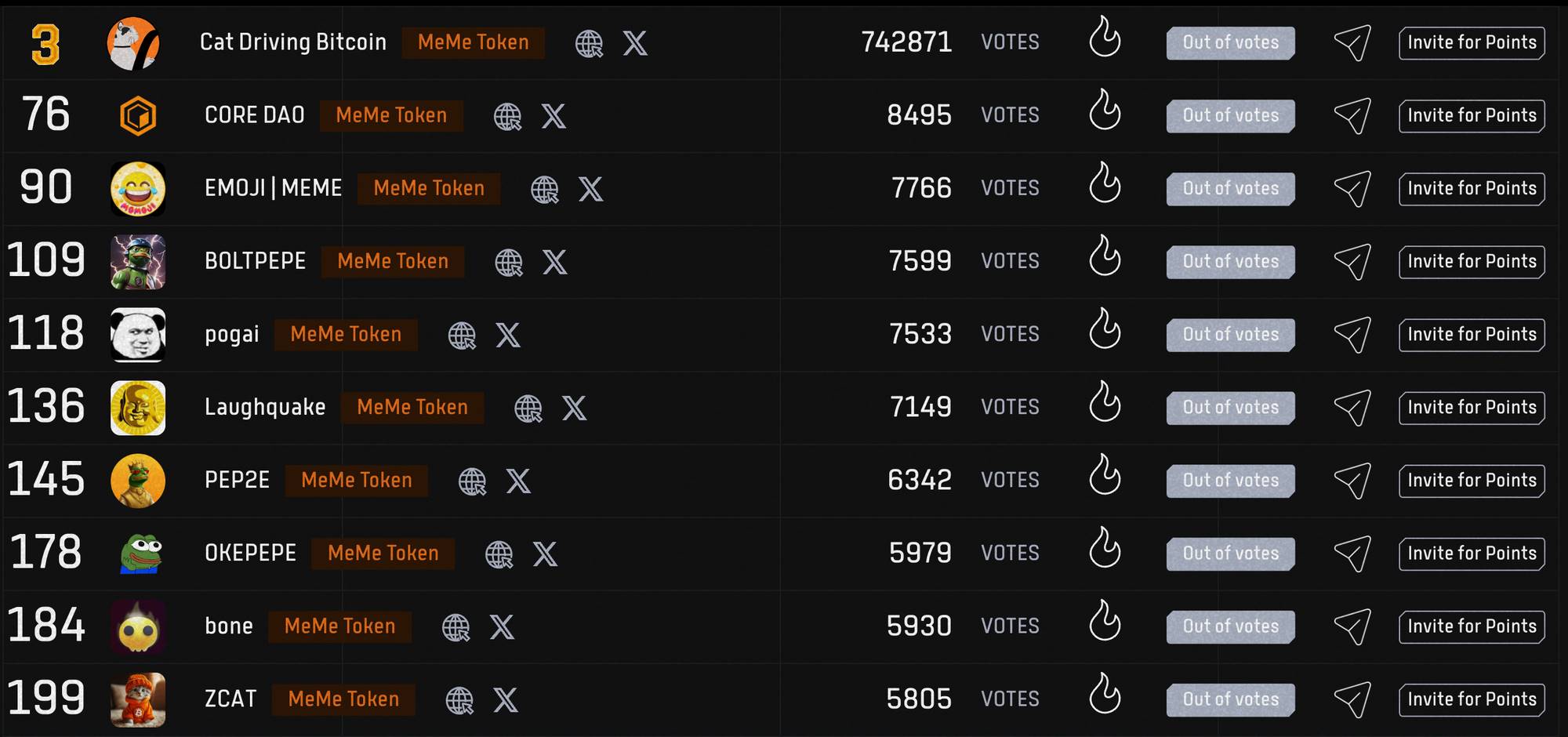

代币空投(Ready Player One)

除了底层技术,链上生态的繁荣度也对于一条链的发展而言至关重要。为了鼓励 DEX、Wallet、NFT Marketplace、Lending、LSD、Bridge、Stablecoin 等类型项目在 Bitlayer 上建设,3 月 29 日 Bitlayer 官方公布了系列生态激励计划,首期活动 Ready Player One 将向生态构建者和项目方发放价值 5000 万美元的公链代币奖励。 据官方数据显示,截止到目前,Ready Player One 已经吸引了超过 800 个项目报名,在 5 月 10 日投票结束前,用户可以积极参与投票,赚取「头号玩家」活动积分。同时,报名的项目团队可以积累人气积分,这将有助于在 Bitlayer 官方排行榜排名中占据有利位置以争取更多的开发者空投奖励和 grants。

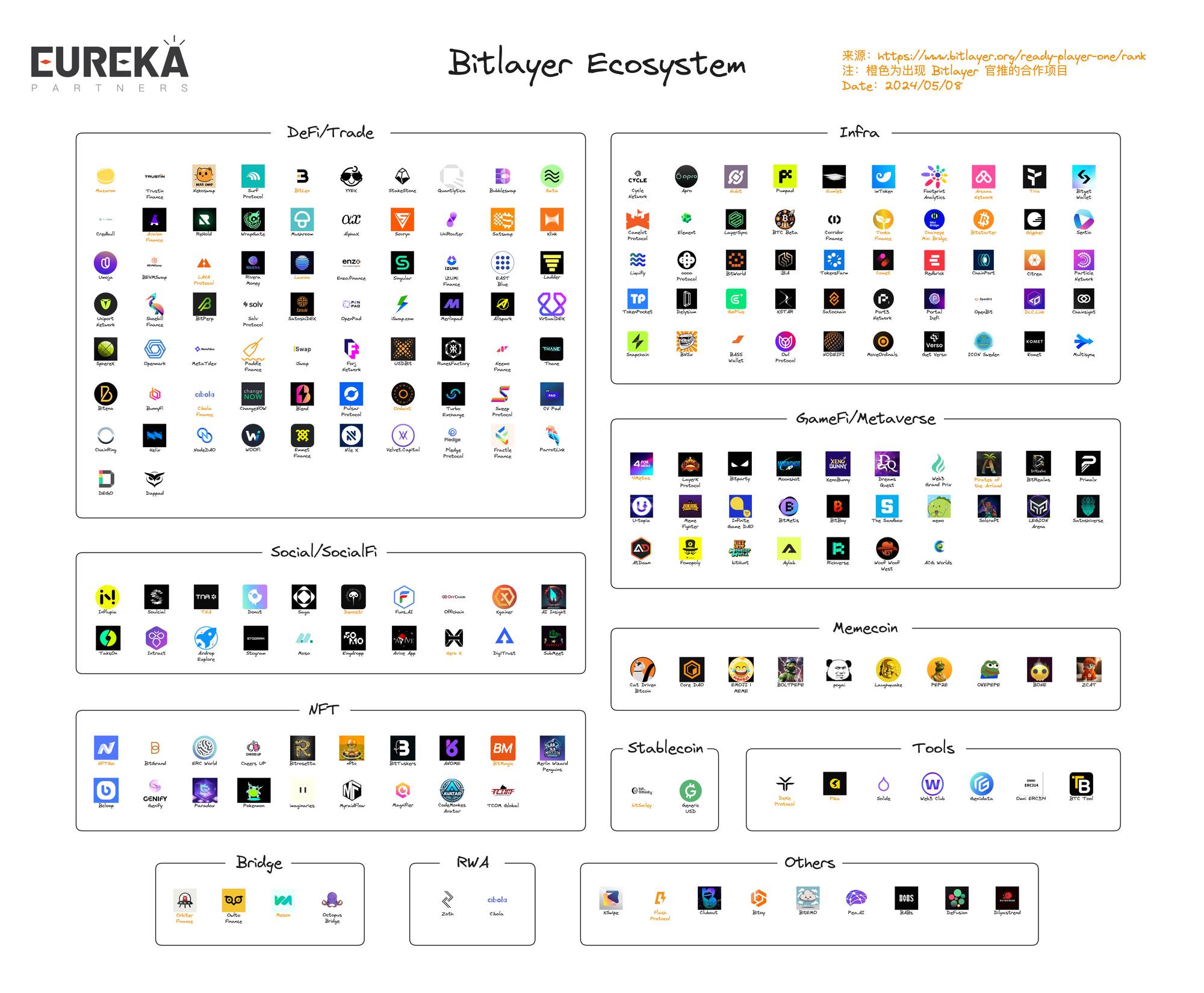

Bitlayer 生态原生项目一览

原生定义:仅面向 BitLayer 的,跨链和多链项目不包含在内;榜单内前 30 名

Pumpad

Pumpad 是 Bitlayer 原生的 Launchpad 项目,据官方称,Pumpad 是 BTC 生态系统的一站式 Launchpad 根据 IPOS 标准发行 VGA 资产。资产发行后,Pumpad 可以帮助发行方自动添加 DEX 的流动性,并部署自动做市商协议。可以说,Pumpad 是一个为项目方提供全周期服务的发行平台,而不仅仅是提供 IDO 服务。

在定位上,Pumpad 提出了两个概念:

1️⃣ IPOS:Initial Pump Offering Standard 指的是一套 IDO 全周期的服务套餐,包含 IDO 的机制、市值管理等,为求让项目方以最小的运维成本去经营发币前后的事务。

2️⃣ VGA:Value-Growing Asset Building 指的是在 Pumpad 上发行的资产都将遵循 IPOS,以确保项目方无法跑路、撤资,并且通过该模式赚取一定的佣金收入。

目前上述两个概念暂时没有一些具体的细节。此外,Pumpad 提出的 Pump Point 用于激励忠诚、活跃用户,未来可能会用于 Pumpad 自己平台代币的空投或者优先发射。

具体来看,Pumpad 有两个主营业务:

1️⃣Launchpad:Pumpad 的 Launchpad 将支持各种发行方法,包括超额认购抽签、加权分配和先到先得等 IDO 方式。

2️⃣ Airdrop:Pumpad 的 Airdrop 模块是让用户领取空投激励的平台,并且项目方可以定制空投活动,以激励不同类型的用户。

截止 5 月 10 号,Bitlayer Dapp Leaderboard 上的排名为 19,并在该赛道中排名第一,其他的 Launchpad 暂没看到有 Bitlayer 进行关注、转推,意味着 Pumpad 的「正统性」比较强。目前平台第一个合作的项目是 $CBD,也是下文会提到的 MEME,「No.1 MEME+No.1 Launchpad」强强联手,双方流量可能可以实现「左脚踩右脚上天」。

官推:https://twitter.com/pumpad_io

Macaron

Macaron 是 Bitlayer 上的首个原生 DEX。Macaron 为用户提供了一系列工具,包括流动性 Farming、质押激励、Trade-to-earn、空投等以增厚用户收益。

在 Bitlayer 的技术和生态支持下,Macaron 团队一直致力于打造优秀的产品,使 Macaron DEX 更安全、更便宜、更快速。作为 Bitlayer 的原生 DEX,Macaron 将作为 Bitlayer 生态资产以及主流 BTC 资产的交易平台,并具有以下优势:

1️⃣ 行业领先的安全性:利用多签协议等技术确保资金安全,Macaron 可为用户提供全天候保护。

2️⃣ 先进的 AMM 算法:Macaron 独创的 AMM 算法,确保资产交易以闪电般的速度高效进行,在提供高流动性的同时,最大限度地减少滑点,优化收益率。

3️⃣ 流动性提供者奖励:当用户提供流动性时,Macaron 将为其提供奖励。奖励将根据收取的费用进行计算和分配。Macaron 奖励能够帮助团队不断改进交易体验的流动性提供者。

4️⃣ 交易收益:Macaron 的 Trade-to-earn 奖励计划引入了革命性的交易激励方式。Macaron 治理代币中一定比例的代币会以奖励的方式分配给用户。

5️⃣ 低 Gas 费:得益于 Bitlayer 卓越的底层功能,Macaron 作为原生的 DEX,可实现低手续费、闪电般快速确认和无缝交易等高性能。

6️⃣ 无缝用户体验:Macaron DEX 先进的 AMM 算法和卓越的功能确保用户可以像体验真正的顶级 CEX 一样,享受无缝交易、流动性质押等用户体验。

Macaron 为用户提供一揽子的激励计划,主要包括积分系统、Macaron NFT 以及基于 Macaron 原生 DeFi 收益,即交易收益、LP 激励、质押奖励等等。积分系统主要由社交积分和 DeFi 积分两部分构成,两种积分的获取方式以及未来兑换成为主网 token 的比例是不同的。而 Macaron NFT 是平台推出的一款 PFP NFT,它的权益包括未来空投、治理权益等一系列赋能权益。DeFi 原生收益则包括在 Macaron 进行交易、质押、添加流动性等获得稳定的资产生息。具体可通过 Macaron 的官方社媒,掌握更多 Macaron 活动信息。

截止 5 月 10 号,Bitlayer Dapp Leaderboard 上的排名第 2,仅次于稳定币 bitSmiley。推特上已经有 49.2k 关注者,热度较高。

官推:https://twitter.com/macarondex

Cat Driving Bitcoin ($CBD)

Cat Driving Bitcoin($CBD) 是 Bitlayer 链上原生的 MEME 代币,项目视觉以猫猫 + 开车元素为主,也贴合 Bitlayer 整体元素。据官方称, $CBD 旨在通过建设 MEME CBD —— 一个繁荣、现代、高楼林立的比特币世界来颠覆 meme 经济。$CBD 致力于成为 BitLayer 上最大的社区资产,推动比特币成为地球上最好的人类资产。现已被 Bitlayer 和 Marcaron 官推关注。

截止 5 月 10 号,Bitlayer Dapp Leaderboard 上 的排名为 3,属于是 MEME 赛道里的第一名。结合之前 $BONE 的数据来看,在 MEME 赛道打榜排名第 9,且 $BONE 官推有 bitSmiley 和 Bitlayer 关注,现已累计到 12.2k 粉丝,在上币后 24 小时内涨幅 10 倍。相比之下,$CBD 的潜力不可低估。

在代币模型中,有别于 $BONE 大部分代币空投给 bitSmiley 测试网用户,$CBD 更倾向于普天同庆式的空投模式:70% 用于空投,20% 用于流动性,10% 国库。

根据目前资料来看,$CBD 会空投给 4 类用户:

1️⃣ Bitlayer 头盔 NFT 持有者,并且完成过一些跨链交互

2️⃣ 持有 BTC 相关资产,并且最近执行过 BTC 交易

3️⃣ 参与社区生态中,比如投票、共建等

4️⃣ 持有 Bitlayer 生态其他资产

值得注意的是 $CBD 空投渠道并不是由项目方自己进行空投,而是在 Pumpad 上进行。另外,根据上述规则来看,Bitlayer 头盔 NFT 持有人是目前参与规则最明晰的。其他更多空投规则可以持续关注官方社媒的更新。

官推:https://twitter.com/catdrivebitcoin

TrustIn Finance

TrustIn Finance 是 Bitlayer 上原生的无权限借贷协议,由基于 BitVM 构建的比特币安全等效的 Layer2 解决方案驱动。

TrustIn Finance 采用了如下设计:

1️⃣ 浮动利率:在 TrustIn Finance 中,贷款人和借款人的利率是根据市场上的资金使用情况确定的。这最大限度地保证了参与者能够获得最理想的利率,同时也保障了流动资金池内资金的安全。

2️⃣ 风险隔离:为简化协议并提高安全性,TrustIn Finance 根据不同的基础资产隔离资产池,以防止大量违约使协议不堪重负,并减轻潜在的不可控后果。

3️⃣ 储备金:储备金是 TrustIn Finance 引入的另一项重要安全措施,旨在解决协议中潜在的债务损失问题。TrustIn Finance 根据准备金系数分配部分借款利息作为准备金,进一步保障协议内资产的安全。

4️⃣ 早期出资者激励机制:TrustIn Finance 的目标是与每位参与者共同成长,并致力于激励所有贡献者。具体激励机制有待官方进一步通知。

TrustIn Finance 预计将在近期公布积分激励计划,用户可以通过存入或接触资产获得积分。积分将作为 TrustIn Finance 治理代币空投的重要参考依据,空投并且按照一定比例分发给左右拥有积分的用户。具体可通过 TrustIn Finance 的官方社媒,掌握更多信息。

截止 5 月 10 号,TrustIn Finance 在 Bitlayer Dapp Leaderboard 上排名第 6,得票数与 Nekoswap 接近。推特上有 38.1k 关注者。

官推:https://twitter.com/TrustIn_Finance

Nekoswap

Nekoswap 是 Bitlayer 上首个原生去中心化符文和代币跨链交易所。

NekoRunes 将成为 Neko swap 上的第一个符文资产代币。NekoSats 承诺 Fair launch,除了项目方持有 2% 的 $RNeko,其他所有代币都会被空投并加入流动性池。其次 Neko 会尝试用映射的方式解决 Layer 1 和 Layer 2 符文资产的流通问题,如果技术时间成本较高的话也会采用其他方式实现权益变现。在代币持有者权利上,Nekoswap 做出了包括 Nekosats 持有者将永久分享 Nekoswap 的交易费分红收益等在内的一系列承诺。

Nekoswap 的工作正在紧密进行中,目前尚没有官网或官网文档。Nekoswap 致力于成为一个完全由社区驱动、公平、透明和去中心化的交易所,包括 Swap、流动性池、Farm、Launchpad、符文交易等功能。未来对于公链的接入、部署、开发,项目方表示都会参考社区意见,通过投票、AMA 等方式决定开发方向。具体可通过 Nekoswap 的官方社媒,掌握更多信息。

截止 5 月 10 号,Nekoswap 在 Bitlayer Dapp Leaderboard 上排名第 4,推特上有 23k 关注者。

官推:https://twitter.com/NekoSwap

生态项目拼图

Bitlayer 于 3 月 29 日开启了生态激励计划,宣布将花费 5000w 美金来激励各大早期建设者和贡献者。而截止文章截稿时(5 月 10 号)总计超过 280 个项目在 Bitlayer 上面进行部署。

可以看到,Bitlayer 的生态正在迅速扩张,越来越多的项目不断涌入 Bitlayer 中。这使得 Bitlayer 在目前激烈的 BTC Layer2 竞争中有着极大的优势。

比特币二层 Endgame 在哪

在目前激烈的 Bitcoin Layer2 赛道竞争中,我们总结出三种核心的方案:rollup 系(重视 Layer1 可验证),侧链系(重视方案成熟度),客户端验证(重视 Layer1 原生 DA )。无疑市场目前仍旧没有决出胜者,但是我们认为比特币最大的价值是其 Layer1 的安全性。因此 Layer2 能否继承安全性十分关键。虽然客户端验证能够很大程度确保所有的账本记录在 Layer1 发生,但用户对客户端的信任成本是内生的,因而不可避免。而 rollup 系尽可能在确保 Layer1 可验证性的情况下,通过多种模块化方案确保用户的信任成本受控。因此从这个价值体系出发,我们认为 rollup 系终究跑赢其余两者。

而 rollup 系当中当属 Bitlayer 考虑的比较周全,Bitlayer 通过 BitVM 的方案着重突出了 Bitcoin 的可验证性,并在原本 DLC 桥中加入了 fraud proof 以确保预言机受信。尽管当前跨链桥方案仍需对预言机有着外部信任,但在安全性上几近等效于「rollup」应有的原生桥。

此外,Bitlayer 生态的繁荣度在 Leadboard 的代币预期下推至顶峰。目前已有大量原生项目加入生态建设中,包括 DEX、无权限借贷协议、MEME 等。截止目前,Bitlayer 的生态已经吸引了超过 280 个项目入驻。

在现阶段牛市初期,Eureka Parnters 仍乐观谨慎的态度看待整体 Bitcoin Layer2 发展。虽然当前市场行情疲弱,但我们相信在流动性充足时,市场热度仍会反映在比特币生态中,包括比特币相关资产以及 Layer2,届时 Bitlayer 绝对是一个不容错过的生态。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。