USDe's TVL in this cycle may exceed 10 billion US dollars.

Author: Chetanya, Researcher at The Spartan Group;

Translation: Golden Finance xiaozou

Ethena Labs is the fastest-growing participant in the high-profit stablecoin field - as evidenced by the surge in revenue from Tether and Maker.

I am a loyal supporter of stablecoins supported by illegal currencies, and projects that can solve the dilemma of stablecoins will have huge market opportunities.

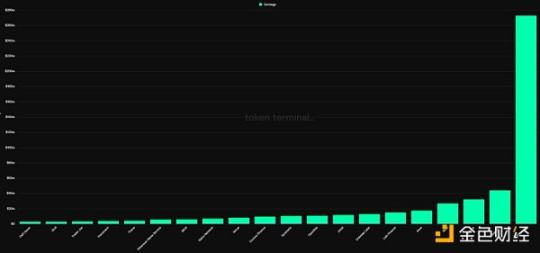

USDe's TVL has soared to 2.3 billion US dollars. Ethena has quickly become the highest-yielding DeFi protocol, second only to ETH and MKR.

Interestingly, after the recent leverage craze, its TVL elasticity, and the perfect management of the protocol's redemption and USEe linkage surprised me. This will boost market confidence in the product and attract a large number of USDe holders when the market rebounds.

1. Bullish on USDe

sUSDe provides a scalable way to achieve double-digit market-neutral returns, making it an effective alternative to USDT/USDC. As Anchor protocol showed in the last cycle (ATH TVL: 18 billion US dollars), there is a great demand for stable returns. I hope that traders, exchanges, funds, etc., will hold a portion of USDe stablecoins while gradually deploying funds.

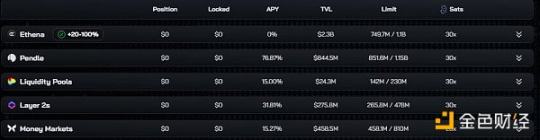

Seraphim and his team have rapidly integrated USDe into major DeFi protocols, including Frax Finance, Pendle, Morpho Labs, etc., showing early signs of DeFi expansion for USDe. With the upcoming CeFi integration (Bybit being the first), USDe is likely to become one of the largest stablecoins.

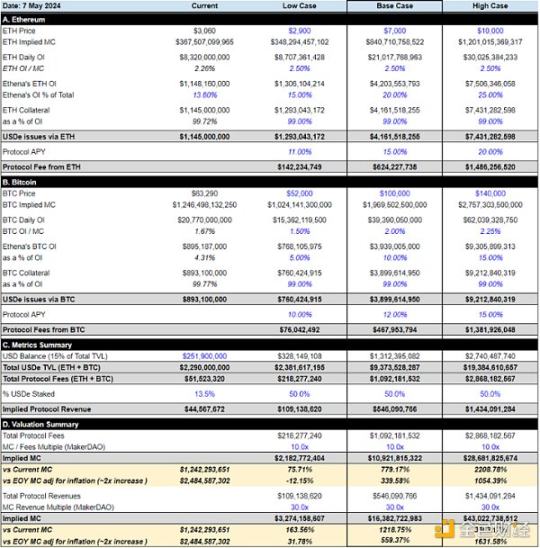

The growth of BTC and SOL collateral may not have been taken into account. This could significantly expand TAM and push USDe's TVL in this cycle to exceed 10 billion US dollars.

2. Valuation

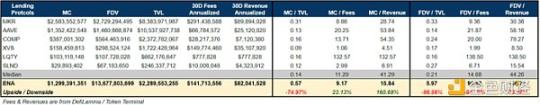

When comparing ENA with lending protocols and stablecoin protocols in terms of TVL, fees, and revenue metrics, ENA seems to be overvalued in a fully diluted scenario. However, in terms of market cap (MC), the valuation seems reasonable.

I believe MC is a more appropriate metric at least in the short term, as the first major unlock will begin in early 2025. Until then, the float range will be maintained at around 10-20%.

3. Data Forecast

Fundamentally, I expect ENA's TVL to grow to around 10 billion US dollars. This will enable it to earn over 1 billion US dollars in fees and generate over 500 million US dollars in revenue based on the utilization of USDe (or sUSDe exchange rate). The upside potential for ENA could be 5-10 times, meaning the market cap will reach 5-10 billion US dollars.

These forecasts are premised on the prosperity of this cycle being no less than the previous cycle.

4. Risks

Ethena's design risks have been well managed. However, a more pressing issue is how they will manage TVL once the points/Shards program ends. They are able to generate high protocol income and provide exceptionally high exchange rates to sUSDe holders, largely due to the low collateralization rate of USDe (currently about 13.5%). Essentially, current USDe holders are encouraged not to collateralize in order to earn more "points/Shards".

After the points program ends, USDe holders will not accumulate any value, meaning there will be no natural demand for USDe. I expect some of the income to be shared with USDe holders, or the sUSDe/USDe exchange rate will approach 100%, reducing protocol income and therefore ENA's utility.

But I believe Ethena's founders and team will have some strategies to address this issue in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。