Spiderchain aims to combine the usability of EVM with the security of Bitcoin.

By: DeepTech TechFlow

The Bitcoin ecosystem remains a battleground.

According to a report from Galaxy, one of the most concentrated bets for crypto investors in Q1 2024 is to invest in Bitcoin L2 projects.

Yesterday, the new BTC L2 solution Spiderchain, developed by Botanix Labs, announced the completion of a $11.5 million financing round, with participation from Polychain Capital, Placeholder Capital, Valor Equity Partners, ABCDE, and others.

Official information shows that the Spiderchain network has functionality comparable to EVM and aims to combine the usability of EVM with the security of Bitcoin.

In a crowded Bitcoin L2 track and with the market gradually questioning how many of these projects can truly be considered L2, does Spiderchain, which has attracted investment from numerous VCs, really have unique advantages in its design?

We read the Spiderchain white paper and provided a quick interpretation.

Purpose of Spiderchain

There are thousands of BTC L2 solutions, but the narratives of solving problems essentially point to two core aspects:

Improving scalability and supporting smart contracts.

The former implies that Bitcoin's transaction processing capacity is limited, so there is a need to improve performance; the latter is that Bitcoin's architecture itself does not support complex smart contracts, so there is a belief that it should be capable of doing more, allowing for more Dapps to run on it.

Botanix believes that the current BTC L2 solutions all have certain issues:

State channels (such as the Lightning Network): These allow for almost instant payments through the creation of state channels, but they are mainly used for simple payments and do not support complex smart contracts.

Federated sidechains (such as the Liquid Network): These sidechains use a multisig mechanism to increase transaction speed and composability, but they rely on the trust of federation members, thus leading to a certain degree of centralization.

Batch verification (such as Optimistic Rollup and ZK-Rollup): Although these technologies provide scalable transaction processing capacity, they require changes to be made on the Bitcoin main chain (through Bitcoin Improvement Proposals, or BIPs), which are often difficult to implement.

As a result, Botanix has proposed a brand-new second-layer framework built on top of Bitcoin, aiming to solve the aforementioned issues by introducing a smart contract environment compatible with EVM while maintaining decentralization.

The expected outcome is to allow for the realization of composability and an application ecosystem similar to Ethereum on Bitcoin without sacrificing its core advantage as a decentralized digital currency.

The spider's tentacles, a sidechain composed of multisig wallets

It is necessary to maintain the security of Bitcoin itself while finding a way for the Bitcoin network to support smart contracts and other applications in some way; this "both-and" situation led Botanix to adopt a sidechain approach to independently handle smart contracts and applications.

This is where the so-called Spiderchain comes into play.

Setting aside technical details, we can use the following analogy to quickly understand Botanix's Spiderchain:

You are using a super-secure safe to store BTC, which is the Bitcoin network—very secure but with limited functionality.

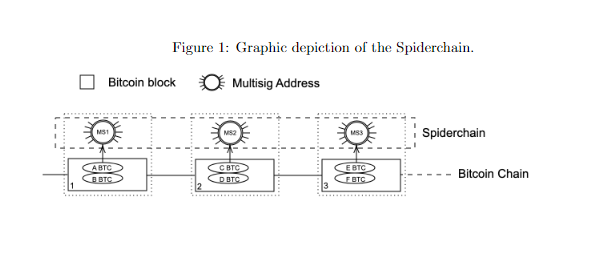

If you want BTC to support more functions, you can send it to a place called Spiderchain, which is a large chain composed of multiple small safes (multisig wallets) connected in series. Each small safe requires multiple keys (signatures) to open, and no single individual or organization can control the entire chain.

If each small safe is opened, you can then use the BTC to do more things (i.e., support Dapps and smart contracts).

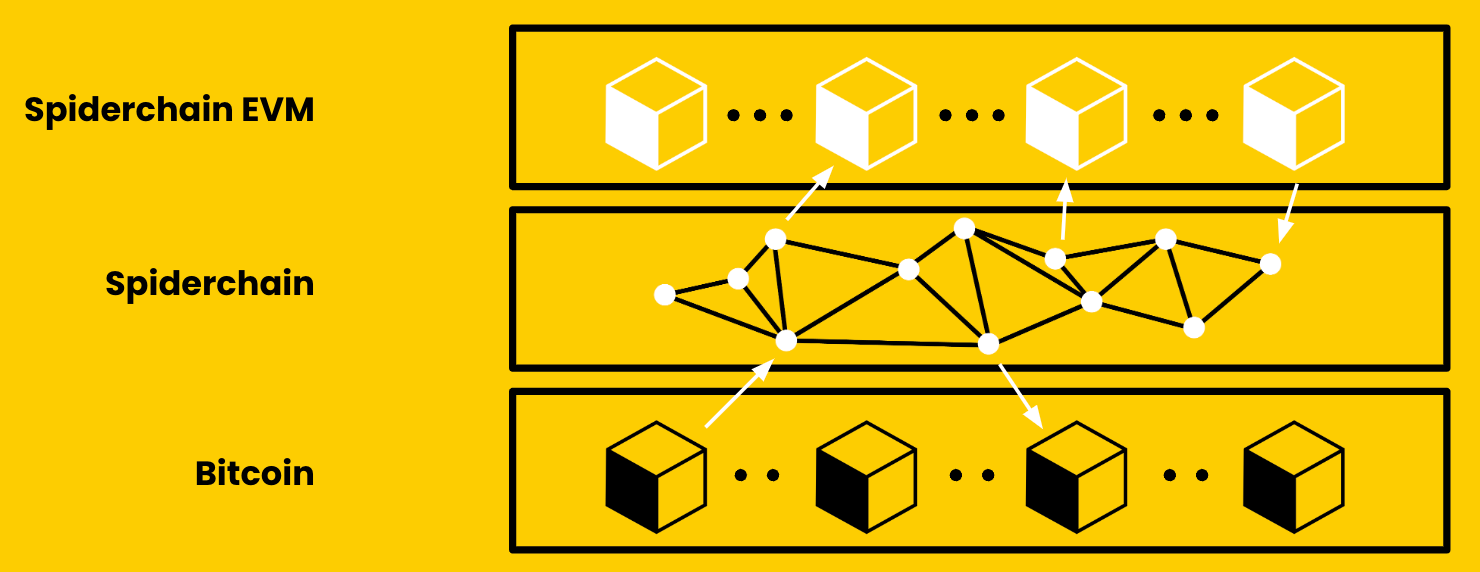

So, the idea behind Spiderchain is to provide a "sidechain" independent of the Bitcoin network, absorb assets corresponding to BTC, and then provide an EVM environment behind this chain to execute various smart contracts, allowing BTC to be used in various scenarios specified by the contracts, engaging in various DeFi activities, and so on.

From a more technical perspective, this entire process, as described in the white paper, is called the Botanix Protocol, which consists of the following technical components:

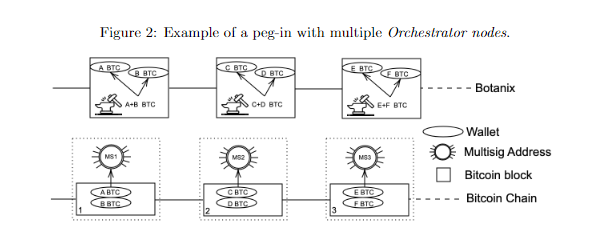

Spiderchain: A key technology in the Botanix Protocol, it is a continuous chain of multisig wallets controlled by operators known as "Orchestrator nodes." These nodes are responsible for running Bitcoin core nodes, Spiderchain, and EVM to ensure the decentralization and security of the network.

Orchestrator nodes: An important part of the network, these nodes not only run the entire protocol but also provide liquidity and are responsible for creating new blocks and verifying transactions. They participate in consensus by staking Bitcoin and may be penalized for misconduct (i.e., "slashing"). Similar to a PoS mechanism.

Synthetic BTC: Tokens used on the Botanix chain, pegged 1:1 to Bitcoin. Each synthetic BTC represents Bitcoin locked in Spiderchain.

Two-way peg: This mechanism allows for the transfer of Bitcoin between the Botanix chain and the Bitcoin chain. Users can transfer Bitcoin to the Botanix chain through a process called "peg-in" and transfer it back through "peg-out."

From the above explanation, it seems that we can also infer why it is called Spiderchain:

In this system, multisig wallets act as nodes on the spider web, and transactions or operations require signatures from multiple Orchestrator nodes, similar to the multi-point support structure of a spider web, with each node contributing to the stability and security of the entire network.

The edge nodes in the image represent multisig wallets, with multiple Orchestrator nodes extending inward, and the wallets must be collectively unlocked for the BTC mapped to this chain to be used.

Separation of Bitcoin assets and the chain

The existence of Spiderchain allows BTC to be separated from the original chain and used for more operations on the Spiderchain.

We can use a simple example to understand the entry, exit, and use of BTC assets.

- Entry (Peg-in process): User Alice wants to transfer Bitcoin to the Botanix chain.

Alice sends Bitcoin to a new multisig address generated by the current Orchestrator node.

After the transaction is confirmed, the Orchestrator node mints the same amount of synthetic BTC on the Botanix chain for Alice.

Alice can now use these synthetic BTC for transactions and execute smart contracts on the Botanix chain.

- Usage (Running smart contracts): Alice uses her synthetic BTC to interact with smart contracts, such as participating in decentralized finance (DeFi) platforms.

Alice initiates a transaction, calling a function of the smart contract.

The transaction is verified and included in a new block on the Botanix chain by the Orchestrator node.

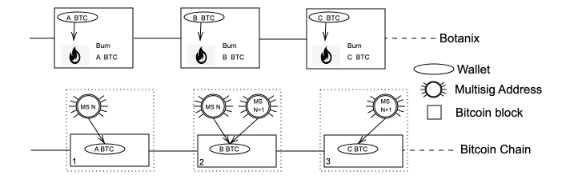

- Exit (Peg-out process): Alice decides to exchange her synthetic BTC back to Bitcoin.

Alice sends her synthetic BTC to an Orchestrator node.

The Orchestrator node destroys the corresponding amount of synthetic BTC and triggers a process to send the same amount of Bitcoin from the multisig wallet to Alice's Bitcoin address.

With this design, Botanix achieves decentralization through multisig and random selection of Orchestrator nodes, while supporting EVM, allowing any DApps that can run on Ethereum to run on Botanix, while maintaining the security and decentralization features of Bitcoin.

As for the security of the Spiderchain itself, the white paper discusses the system's structural design, consensus mechanism, and various methods to ensure the overall network's security and resistance to attacks:

For example, in terms of node design, Orchestrator nodes need to stake Bitcoin to participate in the consensus process, providing economic incentives for running nodes and increasing the cost of malicious behavior.

In terms of overall security, Spiderchain has designed a mechanism to enhance its forward security, ensuring that even if a node becomes compromised in the future, it will not compromise the past records of the entire system. This is achieved by continuously updating the group of nodes participating in consensus, ensuring that no single node or small group can control the network in the long term.

In terms of resistance to Sybil attacks, requiring nodes to stake Bitcoin before participating in consensus and punishing malicious behavior can significantly increase the cost of attacks.

Finally, Botanix has planned a phased development to prevent uncontrollable risk growth from taking overly large steps, transitioning from a small-scale network controlled by the founding team and trusted partners to a fully decentralized and community-driven network.

It is important to note that the token of Spiderchain is Bitcoin. The project aims to use BTC as the base settlement layer to build the future programmability of Bitcoin. All fees collected and paid on the Spiderchain EVM are settled in Bitcoin (BTC).

Additionally, the Spiderchain EVM utilizes Bitcoin's main chain upgrade for second-layer design, eliminating the need for any additional BIPs (Bitcoin Improvement Proposals), which lowers the adoption barrier for the project.

The Spiderchain testnet is already live, and interested users can click here to perform various operations such as claiming rewards, cross-chain transactions, and swaps. With investment from top VCs in Europe and the United States, the project still has certain reward expectations, so early participation to await blessings or rewards could be a good choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。