作者:Regan Bozman

编译:深潮 TechFlow

为什么总有人说这个周期已经结束了?为什么每个人都感到痛苦?我们可以将所有问题归结为:在当前的市场结构下,散户再也赚不到真正的钱了。

关于回归本源、摆脱当前周期的一些杂谈

为什么本轮行情中没有散户的身影,答案其实很简单——这是因为「传统」加密货币市场(如 infra 代币)不再有 500 倍的价格了。现在有一个更有趣的赌场,有更好的 meme,他们唾手可得。

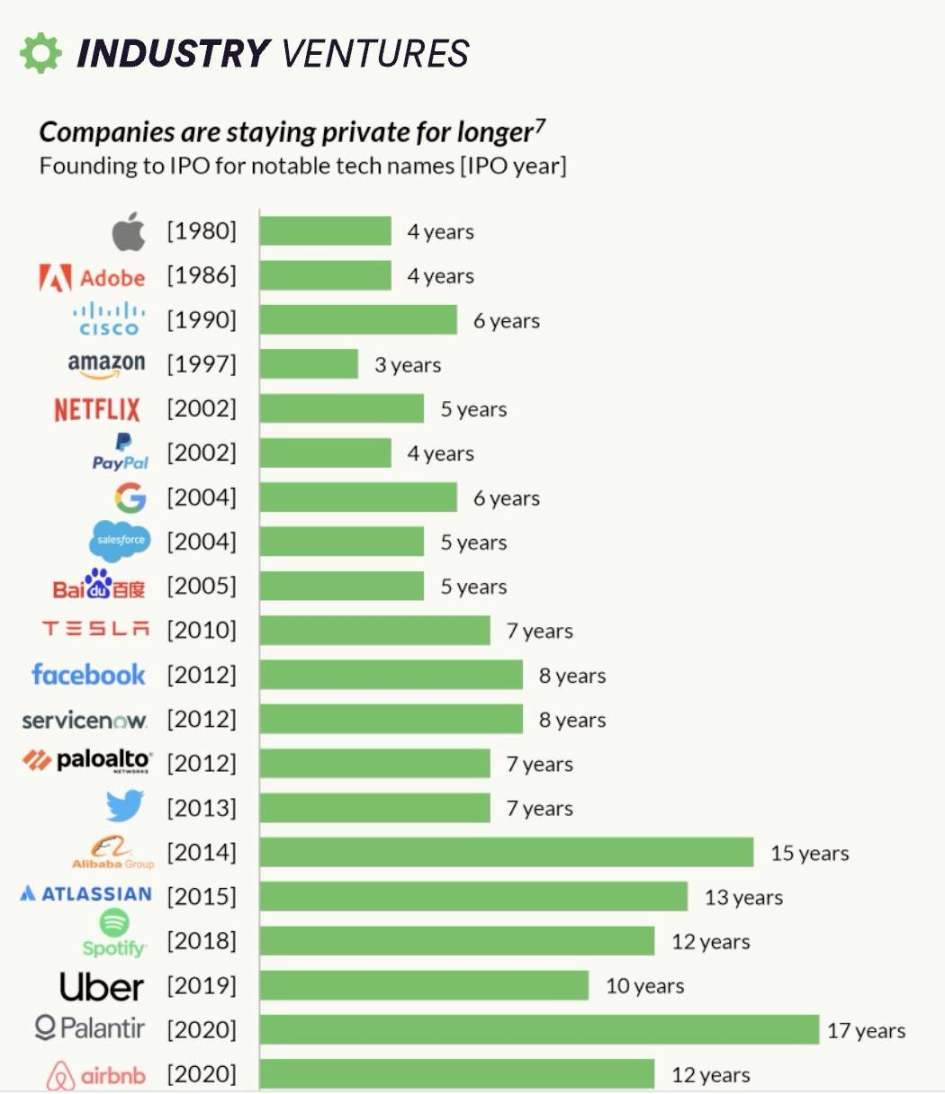

我们实际上是在重现 VC/IPO 市场中发生的事情,在这些市场中,公司保持私有化的时间更长,这意味着更多的上升空间保持「私有化」(例如风险投资基金),并且散户无法进入。

加密货币一度扭转了这种情况,并使非对称上涨空间的获取更加民主化。但现在不再如此了!L1 和 L2 从风险投资者那里筹集了更多资金。没有公开的代币销售。风险投资者赚钱。散户投资者被边缘化。也许散户投资者对这个周期的幻想破灭并不那么令人惊讶。

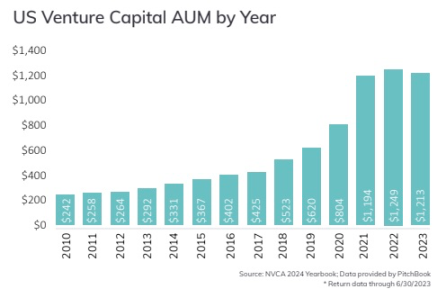

公司愿意保持私有化更长时间的一个重要原因是,风险投资者现在的资金比十年前多了五倍。公司现在可以在私人市场筹集 10 亿美元以上的资金,并且不必处理公开市场的额外开销。

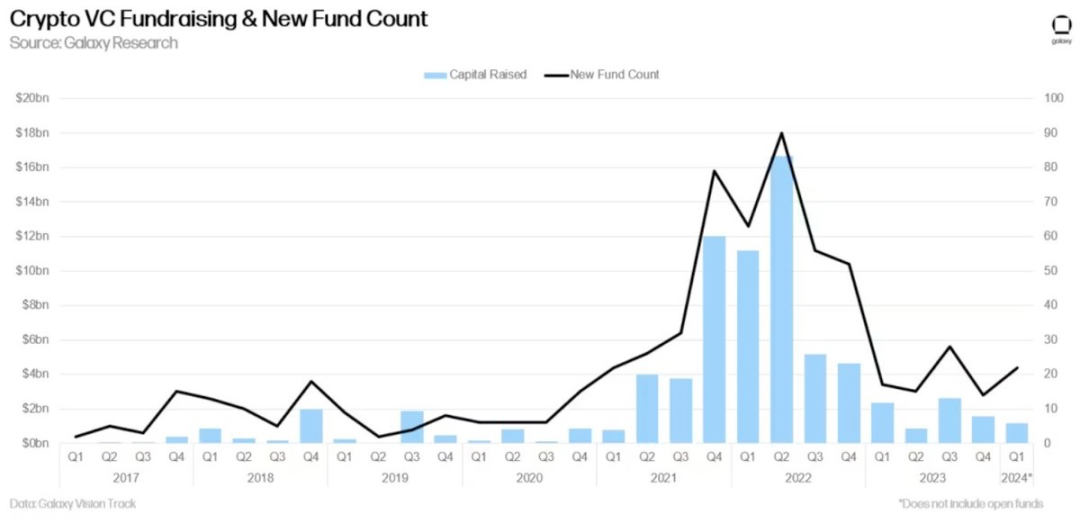

毫不奇怪,加密风险投资也出现了同样的趋势——现在比五年前有更多的资金流入加密风险投资基金。

加密货币应该解决这个问题!

ICO 旨在使资本形成民主化,并进一步获得风险回报。他们绝对成功地做到了这一点。

以 2014 年 ICO 时的 30 美分的价格购买以太坊,到今天价格涨到 3,000 美元,这意味着在 10 年时间里获得了 10,000 倍的回报,绝对能够击败同期内的任何风险投资。任何地球上的人都可以参与,这太棒了。

现在这个行业明显增长了,所以入门价格自然而然地攀升,但这些机会并没有消失。2020 年的 $SOL 推出价格为 0.22 美元,而今价格为 140 美元,这意味着 4 年内获得了 636 倍的回报,这也可能击败了过去五年中几乎所有的风险投资回报。

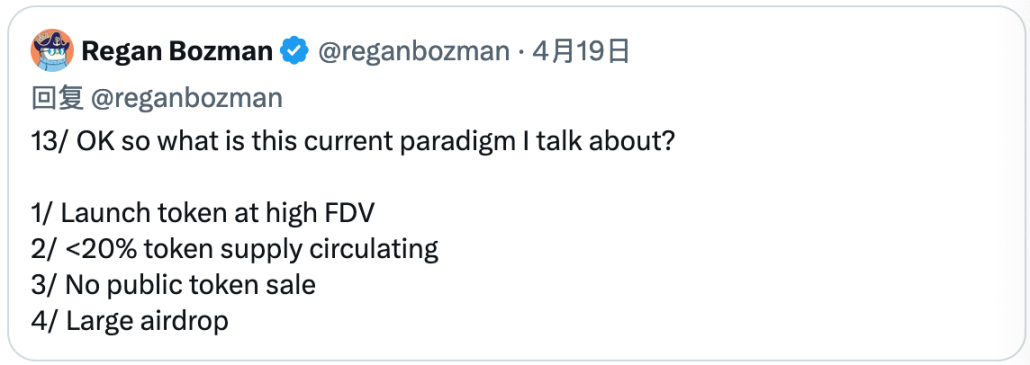

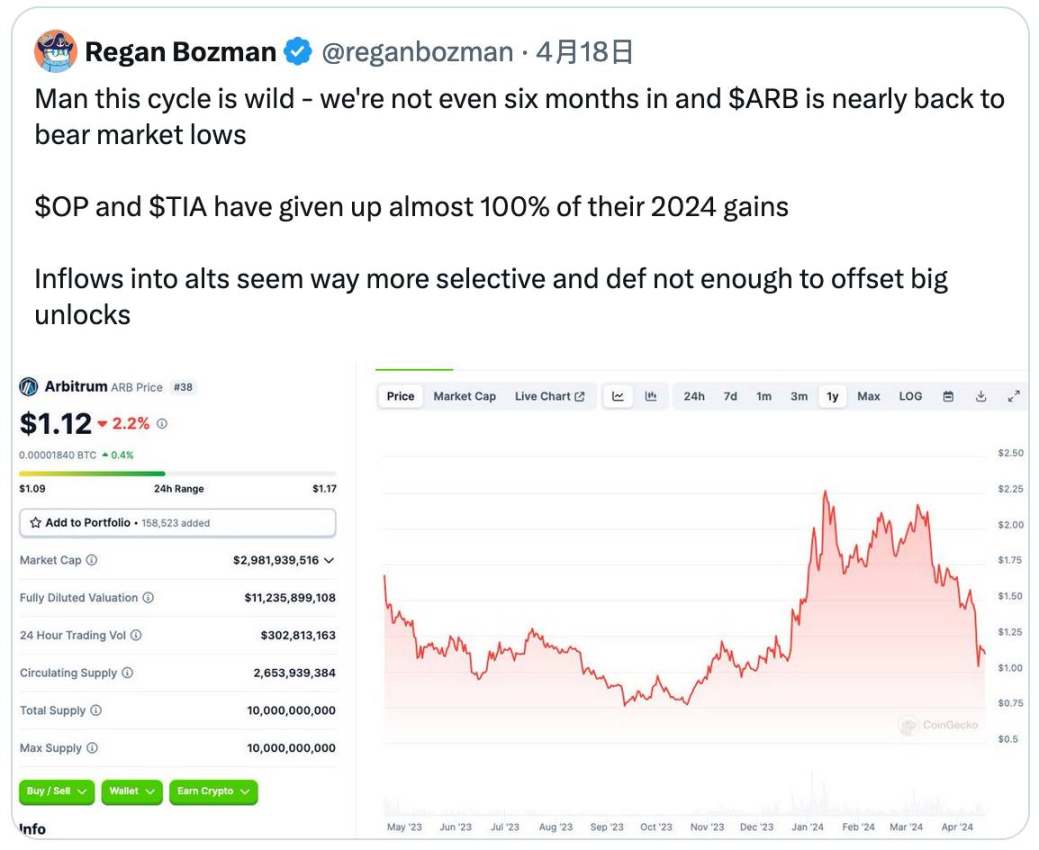

在这个周期中,我们已经远离了这种市场结构。现在几乎没有散户投资者有机会在代币发行前购买代币,或者在公开市场以低价购买代币。

空投确实是一种改进,与现有的风险投资范式相比,早期用户可以获得一些财务上的收益。但它们在财务上并不如代币销售,从定义上讲,你只能从空投中赚到这么多钱。

我们已经从一个有无上限的上涨空间市场转变为一个有上限的市场——这是一个巨大的变化。在 SOL 的 ICO 中投入的 1,000 美元现在变成了 636,000 美元;

而在 Eigen 中投入的 1,000 美元只能变成约 1,030 美元……即使它涨了 10 倍,也只有 1,300 美元。上一个周期中,你掌握自己的命运;而在这个周期中,你在等待 Eigen 爸爸的施舍。

金融虚无主义意味着承认这些市场一直都是关乎金钱的。是的,这些钱资助了科技发展,但正是这些资金推动了整个行业。如果削弱了金钱部分,整个行业将会崩溃。

我们可以做几件事情来改善当前的发行结构。关键在于为早期用户和社区创造无上限的上涨空间。

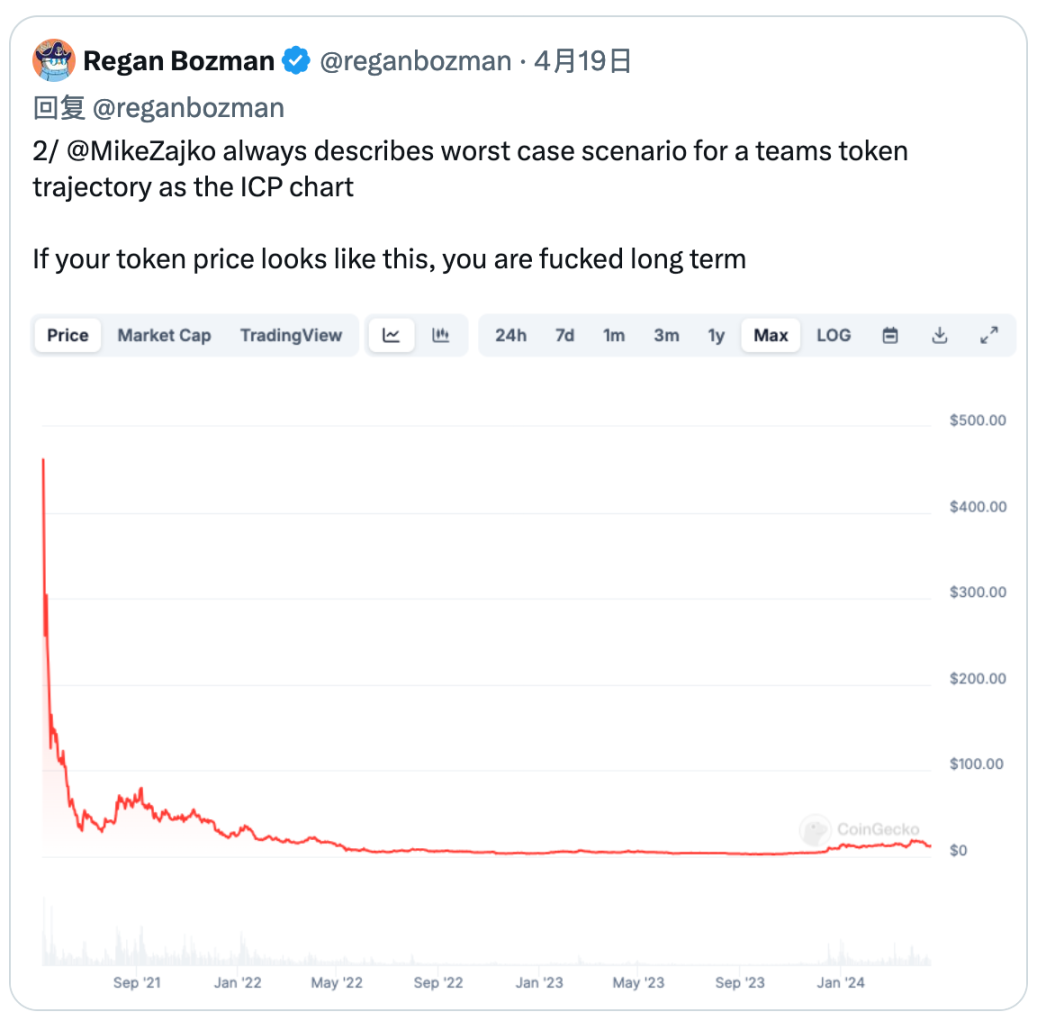

也就是说,市场中存在更大的结构性问题,L1 和 L2 的大规模筹资,导致在上线前估值达到数十亿美元。这带来了两个问题:(A)大量卖方压力;(B)上线时发行价的下限。

我认为,本周期大多数山寨币所面临的结构性问题之一是,风险投资的抛售压力没有被散户流入所抵消。如果在上线前筹集了 5 亿美元,那么将会产生 5 亿美元的卖出压力(如果代币价格上涨,潜在压力甚至更大)。

在高估值的情况下私下筹集资金,意味着你会试图以更高的估值出货。这可能导致行情只能向下的情况。

风险投资者和散户投资者之间的关系不需要是敌对的。$SOL 上的每个人都赚到了钱。

但是,如果你试图将过多的风险投资资金塞进流动性不强的市场,这就变得更加困难了。如果你剥夺了最重要的市场参与者的无上限上涨空间,那几乎是不可能的。

我们可以指责和争论有关 meme 币,但这完全忽略了问题的本质。meme 币不是问题所在——我们当前的市场结构才是问题所在。让我们回到我们的民主根基,解决当前市场的问题。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。