Compilation: Biscuit, RootData

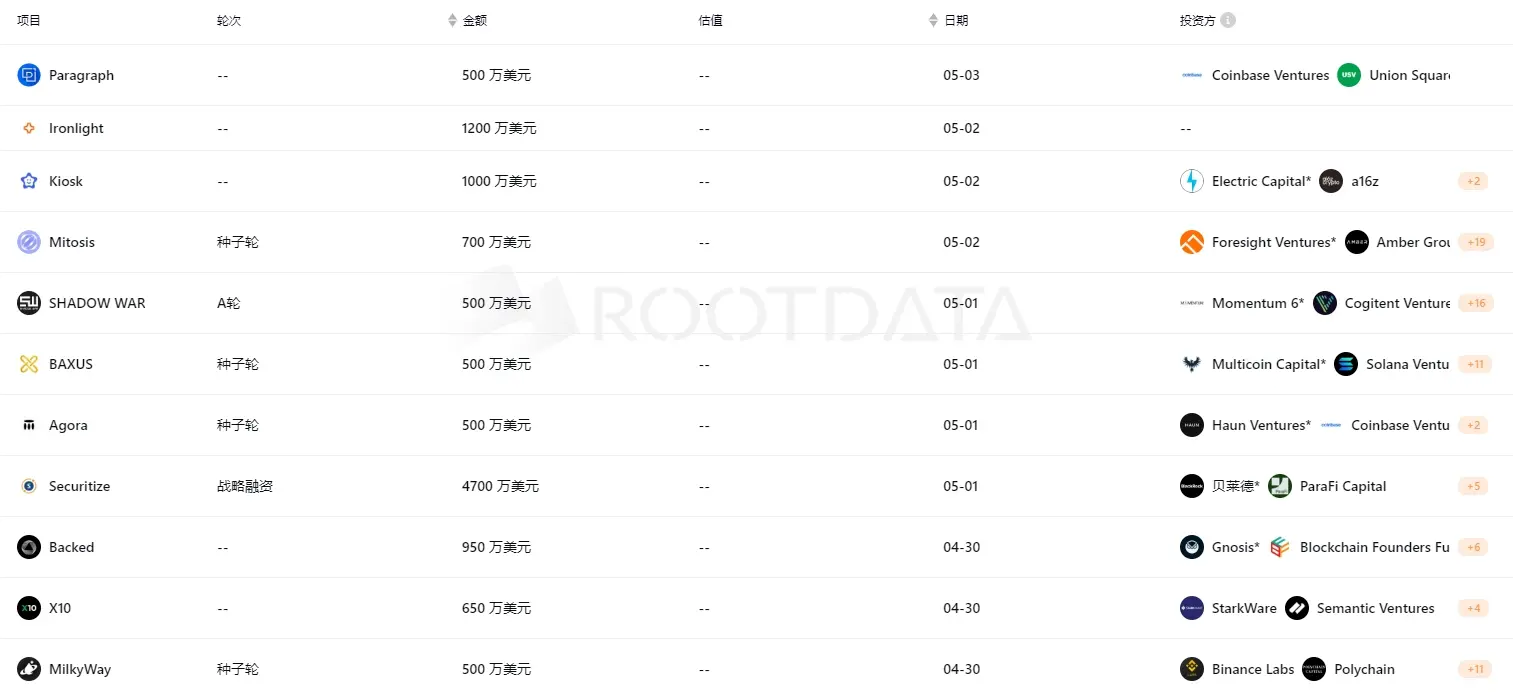

According to RootData's incomplete statistics, from April 29th to May 5th, 2024, there were a total of 28 public financing events in the blockchain and crypto industry, with a total financing of approximately 135 million US dollars.

In terms of sector distribution, the Web3 social sector has become popular, and the RWA sector financing events have surged. friend.tech released the v2 version and launched the native token FRIEND, Paragraph acquired the Web3 content publishing platform Mirror, and shifted its focus to developing a Web3 social application "Kiosk" based on Farcaster, which integrates blockchain and e-commerce. Popular financing projects in the RWA track include Backed, Balcony, Securitize, Ironlight, and more.

In terms of fundraising and incubators, Matthew Homer, former senior cryptocurrency affairs officer of the New York Department of Financial Services, founded the cryptocurrency fund XYZ, which completed a financing of 5.1 million US dollars. Participants included Robert Leshner, founder of Compound, Kyle Samani, managing partner of Multicoin, and the Winklevoss brothers, co-founders of Gemini. Microcosm Labs launched the "Move to TON" ecological incubation fund plan, aiming to provide comprehensive support for project teams intending to enter the TON ecosystem, including providing funding ranging from 5,000 to 50,000 US dollars.

(List of projects with financing greater than 5 million US dollars last week, data source: Rootdata)

I. Infrastructure

1. Bitcoin re-collateralization protocol Chakra completes a new round of financing, with participation from StarkWare and others

The Bitcoin re-collateralization protocol Chakra, based on zero-knowledge technology, announced the completion of a new round of financing on X platform, with participation from StarkWare, Bixin Ventures, Cogitent Ventures, Trustless Labs, and others. The specific amount and valuation information has not been disclosed.

According to the Web3 asset data platform RootData, Chakra is a Bitcoin re-collateralization protocol based on ZK proof. It uses STARK to prove collateralization events on Bitcoin and verify proofs on the second layer chain. (Source link)

2. Bitcoin domain protocol TNA Protocol completes a new round of financing, with participation from MH Ventures and others

The Bitcoin domain protocol TNA Protocol completed a new round of financing, with participation from MH Ventures, Cogitent Ventures, CSP DAO, and others. This round of financing will be used for the development of TNA Core, community expansion, and token liquidity scenario expansion, aiming to promote cross-chain interoperability standards in the Bitcoin ecosystem and facilitate ecosystem expansion. (Source link)

3. Web3 startup Matera completes a 3.6 million US dollars financing round, with participation from Sidedoor Ventures and others

Web3 startup Matera announced the completion of a 3.6 million US dollars financing round, intended for building a platform that addresses the monetization challenges in the creator economy. This round of financing includes participation from Sidedoor Ventures, HighCass Crypto, Medusa Ventures, The Sandbox, Saxon Partners, and other well-known enterprises.

Matera plans to develop a blockchain infrastructure, including a DeFi platform, protocol layer, and L2 network. Currently, Matera supports creators on X, enabling them to raise funds and profit from loyal fan bases. Matera plans to quickly integrate and expand its services to other social media platforms. (Source link)

4. GPU cloud infrastructure provider CoreWeave completes an 1.1 billion US dollars Series C financing, led by Coatue

The AI-focused cloud service provider CoreWeave announced the completion of an 1.1 billion US dollars Series C financing, led by Coatue, with participation from Magnetar (the main investor in the previous round), Altimeter Capital, Fidelity Management & Research Company, and Lykos Global Management.

The new financing will be used to support the rapid growth of CoreWeave's various business areas and expand to new regions to meet the ongoing explosive demand for GPU-accelerated cloud infrastructure worldwide. Mike Intrator, co-founder and CEO of CoreWeave, stated that the continued trust of high-level investors validates CoreWeave's position as a key infrastructure provider for AI development, and confirms the huge opportunities it has in defining the next generation of cloud computing.

As enterprises increasingly recognize the potential of AI in improving efficiency, productivity, revenue expansion, cost reduction, and bringing growth and innovation at a strategic level, organizations of all sizes and industries are deploying large-scale AI solutions, driving an explosive demand for powerful, scalable infrastructure. Traditional cloud providers' general-purpose infrastructure cannot meet the large-scale parallel processing and memory requirements of AI workloads. (Source link)

5. Dynamic modular service platform Crestal completes a 2 million US dollars Pre-Seed financing round, with participation from MH Ventures and others

Dynamic Modular Service Platform Crestal Completes $2 Million Pre-Seed Financing Round

Dynamic modular service platform Crestal announced the completion of a $2 million Pre-Seed financing round, with participation from MH Ventures, Cogitent Ventures, NxGen, and others. The new funds will be used to accelerate the construction of modular services. (Source link)

II. CeFi

1. Tokenized Asset Issuer Backed Completes $9.5 Million New Financing Round

Tokenized asset issuer Backed completed a $9.5 million new financing round, led by Gnosis, with participation from Exor Seeds, Cyber Fund, Mindset Ventures, Stake Capital Ventures, Blockchain Founders Fund, Blue Bay Capital, Nonce Classic, and others. With this investment, the company aims to accelerate the entry of its private tokenized issuance and asset management company into the blockchain channel.

According to the Web3 asset data platform RootData, Backed is the infrastructure for the on-chain capital market, connecting real-world assets to the blockchain. Backed issues ERC-20 tokens that track the value of real-world assets, such as stocks or ETFs. The tokens can be freely transferred across wallets, fully collateralized by the underlying assets, and issued in accordance with Swiss DLT legislation.

2. Hybrid Crypto Exchange X10 Completes $6.5 Million Financing, Tioga Capital and Others Participate

Hybrid cryptocurrency exchange X10 announced the completion of a $6.5 million financing, with investors including Tioga Capital, Semantic Ventures, Cherry Ventures, Starkware, Cyber Fund, as well as executives from Revolut and Lido founder Konstantin Lomashuk.

Founded by former Revolut crypto business executive Ruslan Fakhrutdinov, X10 aims to combine the advantages of centralized exchanges (CeFi) and decentralized finance (DeFi) to provide users with a Revolut-like experience and self-custody of funds. The new financing will be used to build a brand new crypto exchange, providing a high-quality user experience while enabling self-custody of funds. (Source link)

3. Crypto Trading Ecosystem LazyBear Completes $4 Million Strategic Financing, DWF Labs and Others Participate

Cryptocurrency trading ecosystem LazyBear announced the completion of a $4 million USDT strategic financing, with participation from Gogeko Labs, DWF Labs, Shadow Labs, Salad Labs, Bees Network, REI Network, IBIT, Crypto Bullish, SYNBO Protocol, Bazaars, Sypool, Bitcoin Gbox, GemX Crypto, Wikibit, and others.

LazyBear is a cryptocurrency trading ecosystem aimed at retail traders, dedicated to providing users with a low-fee, inclusive, and enjoyable trading experience. (Source link)

III. DeFi

1. Celestia Staking Protocol MilkyWay Completes $5 Million Financing, Co-led by Binance Labs and Polychain Capital

Celestia's ecological liquidity staking protocol MilkyWay completed a $5 million financing, co-led by Binance Labs and Polychain Capital, with participation from Hack VC, Crypto.com Capital, and LongHash Ventures. The structure of this round of financing includes future equity simple agreements for equity (SAFE) and token warrants, as well as future token simple agreements for future tokens (SAFT) for participating investors.

According to the Web3 asset data platform RootData, MilkyWay is a liquidity staking solution in the Celestia ecosystem, initially deployed and operated on Osmosis, with long-term plans to migrate to Celestia's rollkit for native milkTIA issuance. When users stake TIA tokens in MilkyWay, they receive an on-chain representation of the staked TIA, called milkTIA. This allows Celestia token holders to access liquidity for their staked assets, enabling trading or using them as collateral for various DeFi products. (Source link)

2. RWA Tokenization Platform Securitize Completes $47 Million Strategic Financing, Led by BlackRock

RWA tokenization platform Securitize completed a $47 million strategic financing, led by BlackRock, with participation from Hamilton Lane, ParaFi Capital, Tradeweb Markets, Aptos Labs, Circle, Paxos, and others. The funds from this round of financing will be used to accelerate product development and further strengthen its partnerships in the financial services ecosystem.

As part of the investment, Joseph Chalom, Global Head of Strategic Ecosystem Collaboration at BlackRock, has been appointed as a member of the Securitize board. (Source link)

3. OKX Ventures Announces Lead Investment in Multi-Chain Liquidity Re-Collateralization Protocol BedRock

OKX Ventures announced the lead investment in the multi-chain liquidity re-collateralization protocol Bedrock. Bedrock provides institutional-grade services to users, with a total re-collateralization value of over $200 million to date, and will further innovate by building the first liquidity-re-collateralized Bitcoin (uniBTC) on Babylon.

OKX Ventures founder Dora Yue stated, "With the rapid development of DeFi, the total on-chain collateral value has exceeded $93.4 billion, with 48% coming from the liquidity re-collateralization sector. The investment in Bedrock aims to accelerate the liquidity re-collateralization solution. We hope to provide the community with diversified and secure asset management options. We look forward to the gradual maturation and systematization of DeFi use cases, promoting the sustainable development of the Web3 industry."

4. Modular Liquidity Protocol Mitosis Completes $7 Million Financing, Led by Foresight Ventures and Amber Group

The modular liquidity protocol Mitosis announced the completion of a $7 million financing round, led by Amber Group and Foresight Ventures, with participation from Big Brain Holdings, Folius Ventures, Citizen X, GSR, Cogitent Ventures, No Limit Holdings, Digital Asset Capital Management, Pivot Global, Everstake, as well as angel investors from Zellic, XAI, ether.fi, Hyperlane, Osmosis, DefiLlama, Injective, Keplr, Puffer, Curve, and Interchain.

Mitosis's Expedition event Epoch 2 will start on May 2 at 23:00 Beijing time, following the opening of Epoch 1 on April 25 at 23:00.

Mitosis is a liquidity protocol for the modular era, aiming to redefine cross-chain liquidity. By providing liquidity to cross-chain LPing, it makes cross-chain LPing more attractive. Mitosis LPs receive derivative tokens that can be exchanged 1:1 with their locked assets. LPs can use these derivative tokens to participate in various DeFi applications on supported Ethereum L1 and L2 Rollup, essentially allowing LPs to earn additional income on their cross-chain assets on a fee-sharing basis. (Source link)

5. RWA Marketplace Ironlight Completes $12 Million Financing, Investor Information Not Disclosed

RWA marketplace Ironlight announced the completion of a $12 million financing round, with specific investor information not disclosed. Ironlight, founded by Rob McGrath and Matt Celebuski, aims to tokenize traditionally illiquid private securities such as real estate, natural resources, fine art, public infrastructure, and private equity. Its goal is to become an SEC-regulated marketplace for tokenized real-world assets (RWA) and will initiate the registration process in the future. (Source link)

6. Cross-Chain DeFi Protocol EYWA Completes $7 Million Seed Financing, Led by Curve Founder

Cross-chain DeFi protocol EYWA completed a $7 million seed financing round, led by Curve Finance founder Michael Egorov, with participation from Fenbushi Capital, GBV Capital, Big Brain Holdings, Marshland Capital, and Mulana Capital.

EYWA and Curve are jointly developing a trustless bridge. (Source link)

7. RWA Blockchain Platform Balcony Completes Pre-Seed Financing, Avalanche Blizzard Fund Participates

The U.S.-based blockchain infrastructure company Balcony announced the completion of pre-seed financing, with participation from Avalanche Blizzard Fund. Specific amount and valuation information has not been disclosed. The new financing will be used to expand operations and development work.

Balcony is dedicated to building an RWA blockchain platform for institutions and government agencies, providing on-chain transaction and asset settlement services, primarily applied in the real estate sector. (Source link)

8. DeFi Protocol Amphor Completes $4 Million Seed Financing

DeFi protocol Amphor, incubated by hedge fund MEV Capital, announced the completion of a $4 million seed financing round, with participation from over 80 angel investors in the crypto industry. The project aims to simplify ordinary investors' participation in DeFi with algorithmic and on-chain technology solutions, with specific valuation data not disclosed. (Source link)

IV. Gaming

1. Blockchain Game Developer Overworld Receives Investment from DWF Ventures

DWF Ventures announced an investment in blockchain game developer Overworld, which is set to launch the main world arena. Additionally, Overworld recently announced plans to release another NFT series.

According to the Web3 asset data platform RootData, blockchain game developer Overworld completed a $10 million seed financing round in February this year, led by Hashed, TheSpartanGroup, SanctorCapital, and GalaxyInteractive, with participation from Hashkey, BigBrainHoldings, and ForesightVentures. (Source link)

2. Full-Chain Game Studio Blade Games Completes $2.4 Million Seed Financing, Led by PTC Crypto and IOSG Ventures

Full-chain game studio and infrastructure provider Blade Games completed a $2.4 million seed financing round, led by PTC Crypto and IOSG Ventures, with participation from Bonfire Union Ventures, Animoca Ventures, Mantle, ForesightX, Formless Capital, Public Works, Puzzle Ventures, and K300 Ventures.

Using the self-developed zk game engine of Blade Games, games can run game logic in zkVM and push state differences as zkSNARK proofs to the chain, then verify on L2. The zk game engine can currently process up to 12-15 frames per second and is about to update batch proof functionality. The engine currently supports all game studios to develop survival, tower defense, RPG, and roguelike card-building games.

Blade Games' self-developed game Dune Factory started internal testing on May 1 and announced the internal testing rules and rewards on April 29. The game is scheduled for public testing at the end of May. (Source link)

3. Web3 Game Studio Games for a Living (GFAL) Raises $3.2 Million in Seed Financing, with Participation from Supercell, Mitch Lasky, and Others

Web3 game development studio Games for a Living (GFAL) raised $3.2 million in seed financing, with participation from Supercell, Mitch Lasky, and others. Additionally, GFAL has been trialing the launch of its mobile game Elemental Raiders and plans to conduct several soft launches in the fourth quarter of 2024, transitioning to a full version in 2025.

According to the RootData page, Games for a Living (GFAL) is headquartered in Barcelona and is a pioneering electronic game development and publishing studio. The team's leadership has held positions at leading companies in the industry such as King Entertainment, Activision Blizzard, Electronic Arts, Netflix, and Digital Chocolate. GFAL successfully launched the GFAL token in the first quarter of 2023, raising $4.4 million. (Source link)

4. Web3 Game Shadow War Completes $5 Million Financing, Led by Momentum 6

Swedish game studio Patriots Division has raised $5 million for its Web3 game Shadow War in seed and Series A financing rounds, with Series A financing led by Momentum 6, and participation from iAngels, Cointelligence Fund, Xborg, Andromeda VC, Cogitent Ventures, and Cluster Capital.

Shadow War is a sci-fi 5v5 third-person action game inspired by popular games like Overwatch and League of Legends, emphasizing a fusion of futurism, fantasy, action, and competition. It emphasizes melee combat and tactical strategy, aiming to reward skill-based players while avoiding pay-to-win elements that hinder competitive integrity. (Source link)

V. NFT

1. LayerZero Ecosystem Full-Chain NFT Protocol Holograph Completes $3 Million New Financing Round, Led by Mechanism Capital and Selini Capital

LayerZero ecosystem full-chain NFT protocol Holograph announced the completion of a $3 million new strategic financing round, led by Mechanism Capital and Selini Capital, with participation from Northrock Capital's Hal Press, Arca, Courtside Ventures, and Hartmann Capital. The project's total funding has now reached $11 million.

Holograph's full-chain technology allows the creation of NFT assets that can be used on multiple Ethereum-compatible blockchains. The new funds aim to accelerate its expansion into the growing blockchain gaming market, with a focus on supporting Ethereum-compatible network tokens, including Optimism, Arbitrum, Avalanche, BNB Chain, Base, Mantle, Zora, and Linea.

According to the Web3 asset data platform RootData, Holograph is a full-chain tokenization protocol that enables asset issuers to mint native composable full-chain tokens. Holograph works by burning tokens on the source chain, sending messages to the target chain through a message protocol, and then re-sending the same amount of tokens to the same contract address. This unifies liquidity, eliminates slippage, and maintains interchangeability between blockchains. (Source link)

2. NFT Integration Protocol STYLE Protocol, Focused on Gaming, Completes $2.5 Million Seed Financing, with Participation from GBV Capital and Others

NFT integration protocol STYLE Protocol, focused on gaming, announced the completion of a $2.5 million seed financing round, with participation from Morningstar Ventures, Dutch Crypto Investors, GBV Capital, Protocol Labs, Alpha Ventures, and a group of founders from crypto projects. The protocol aims to unleash the potential of NFTs by seamlessly integrating NFTs into any game or metaverse, enabling the conversion of 2D images or NFTs into 3D assets for gaming, currently supporting Ethereum, Polygon, Binance Smart Chain, and Solana blockchains.

According to the Web3 asset data platform RootData, STYLE Protocol is a decentralized infrastructure that enables permission and interoperability of assets and NFTs in any virtual environment. The $STYLE token unlocks the availability of custom avatars and in-game assets in the virtual world. (Source link)

VI. Other

1. Cryptocurrency Accounting Firm Harris and Trotter Digital Assets Completes $10 Million Strategic Financing, Led by Orbs

London-based global cryptocurrency accounting firm Harris and Trotter Digital Assets announced the completion of a $10 million strategic financing round to address accounting issues faced by all Web3 projects. The financing was led by Orbs, with participation from Kingsway Capital, RE7 Capital, and other prominent individuals in the Web3 community. The valuation of Harris and Trotter Digital Assets reached $85 million through equity pricing in this round.

The executive team of Harris and Trotter Digital Assets has previously worked at major accounting firms such as PwC, KPMG, Deloitte, EY, and BDO, with a team of over 45 people. CEO Nicholas Newman stated that digital assets are a rapidly evolving technical field, and the demand can only be met by professional service companies with similar technical capabilities. This strategic investment aligns the company with the biggest drivers and leaders in the industry, further enhancing its technical capabilities when launching increasingly growing SAAS products and services.

This investment will further drive the rapid growth of Harris and Trotter Digital Assets, expanding on its existing base of approximately 500 native crypto clients. Ran Hammer, VP of Business Development at Orbs, stated that Harris and Trotter Digital Assets combines expertise with blockchain technology, and the team now aims to operate at the forefront of fintech, providing tools such as proof of reserves. (Source link)

2. Web3 Content Distribution Protocol Metale Protocol Completes $2 Million Financing, with Participation from Waterdrip Capital and Others

Web3 content distribution protocol Metale Protocol recently announced an additional $2 million in financing, with participation from Waterdrip Capital, Aipollo Investment, and Ultiverse, bringing its total seed funding to $4 million.

The new funds will be allocated to its ecosystem's content creation fund to stimulate more content creation activities and drive the protocol's platform for on-chain issuance and distribution of content assets.

Previously in September 2023, decentralized reading app Read2N announced a rebranding and name change to Metale Protocol. (Source link)

3. Web3 Wine Market Baxus Completes $5 Million Financing, Led by Multicoin Capital

Web3 wine market Baxus completed a $5 million financing round, led by Multicoin Capital, with participation from Solana Ventures, Narwhal Ventures, FJ Labs, and a group of angel investors.

BAXUS aims to connect buyers and sellers by integrating the market into one application, addressing market inefficiencies. Its Web3 market is built on Solana, allowing buyers to transact using credit cards, ACH, wire transfers, or cryptocurrencies including USDC. It launched a beta version last summer and has facilitated $8 million in transactions to date. (Source link)

4. Crypto Voting Service Platform Agora Completes $5 Million Financing, Led by Haun Ventures

Crypto voting service platform Agora announced the completion of a $5 million seed financing round, led by Haun Ventures, with participation from Coinbase Ventures, Seed Club Ventures, and Consensys Ventures.

Agora aims to create a new governance software standard for protocols to organize their voting systems more efficiently. Uniswap, Optimism, and Nouns are among its early clients. (Source link)

5. Web3 Content Publishing Platform Paragraph Completes $5 Million Financing, with Participation from Coinbase Ventures

In addition to acquiring the Ethereum-based blogging platform Mirror, Web3 content publishing platform Paragraph raised $5 million in new financing, with participation from Union Square Ventures and Coinbase Ventures. Paragraph founder Colin Armstrong will serve as CEO, and Mirror founder Denis Nazarov will serve in an advisory role. (Source link)

6. Web3 Comprehensive Network Security Service Provider Resonance Security Completes $1.5 Million Pre-Seed Financing, Led by Arca

Web3 comprehensive network security service provider Resonance Security completed a $1.5 million pre-seed financing round, with joint leadership from Arca, Fabric VC, and Blockchain Founders Fund. The new financing will be used to further accelerate expansion.

Resonance Security combines its expertise with a full suite of security solutions, including smart contract, blockchain and code audits, penetration testing, CI/CD and cloud security, AI threat modeling, an extensive library of network security products, built-in network security applications, notification and guidance systems, fully supported network security gateways, and network security education. (Source link)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。