作者:Justin Bons,Cyber Capital 创始人

编译:Frank,Foresight News

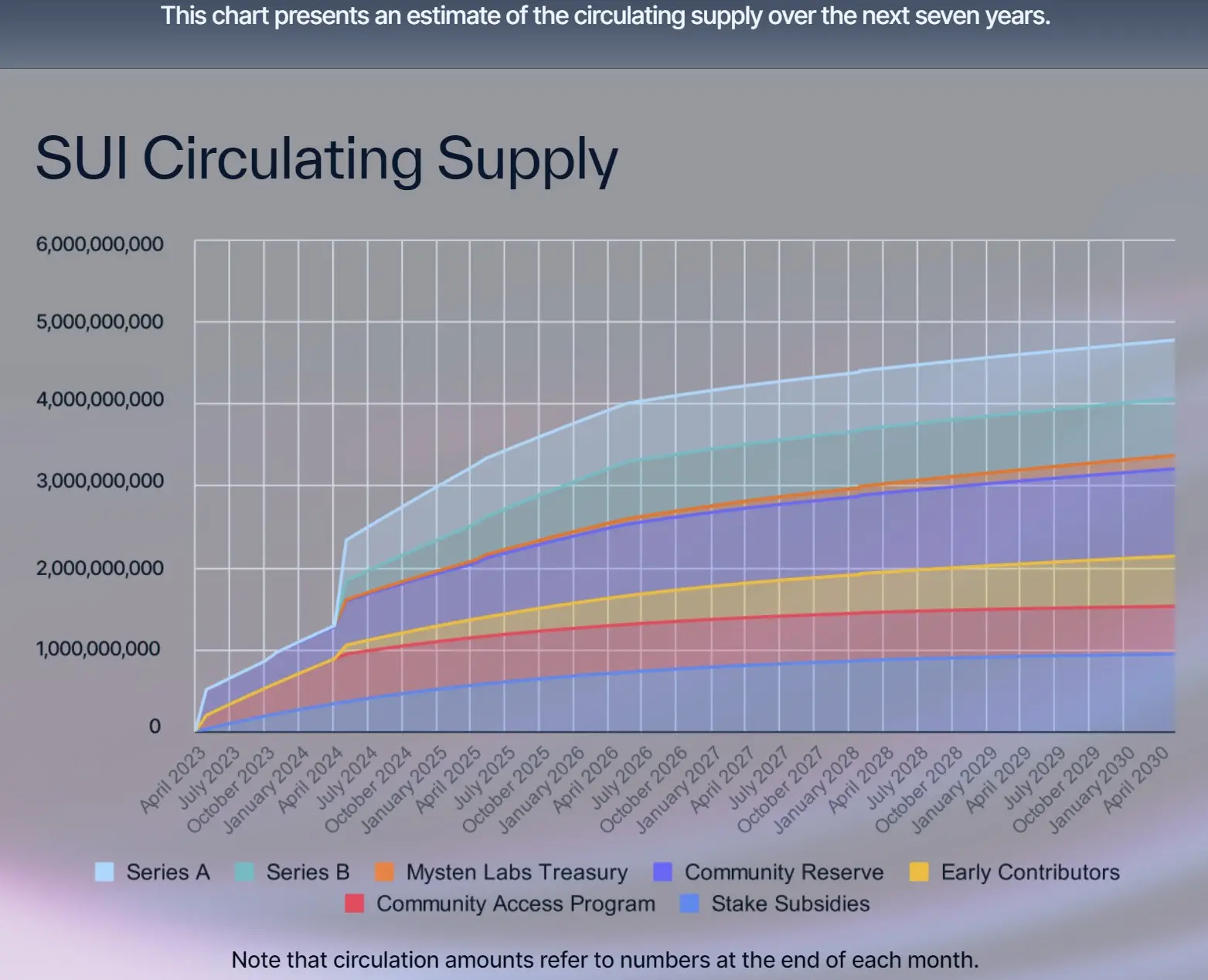

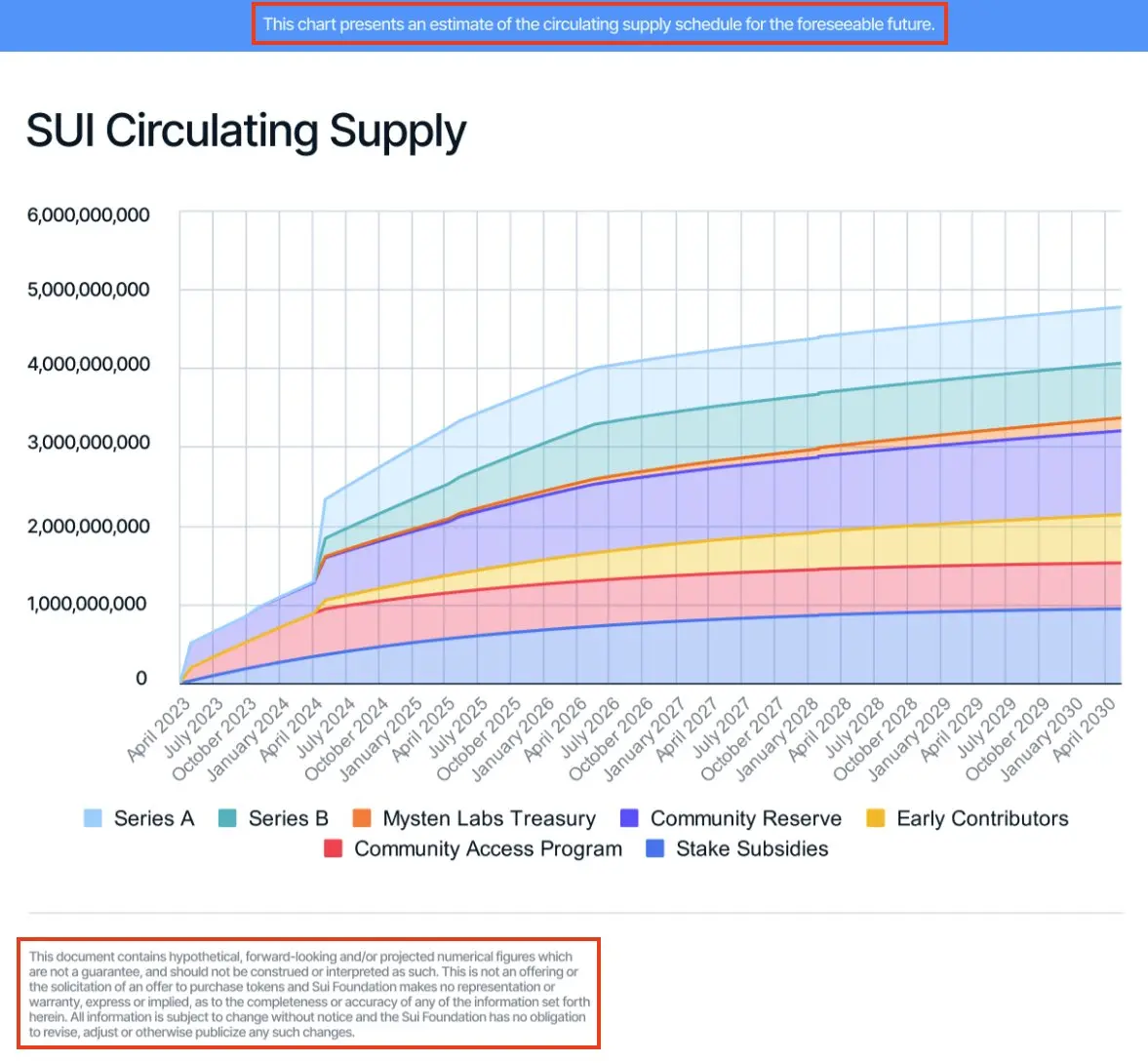

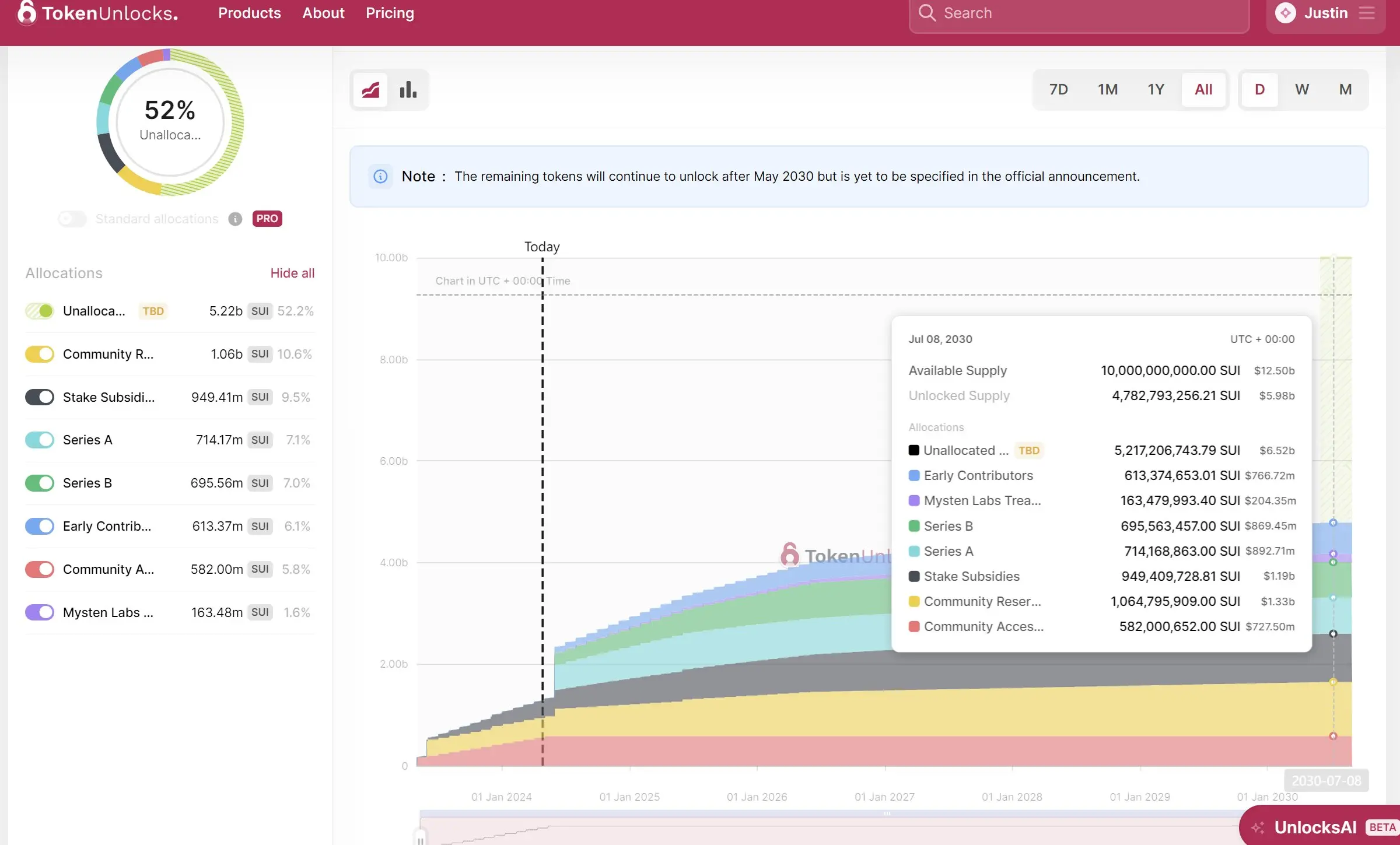

Sui 的设计很棒,除了其代币经济学: SUI 声称拥有 100 亿枚的总供应上限,其中 52% 在 2030 年之前将「未分配」( unallocated )。

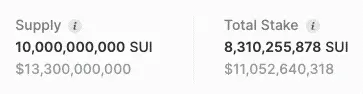

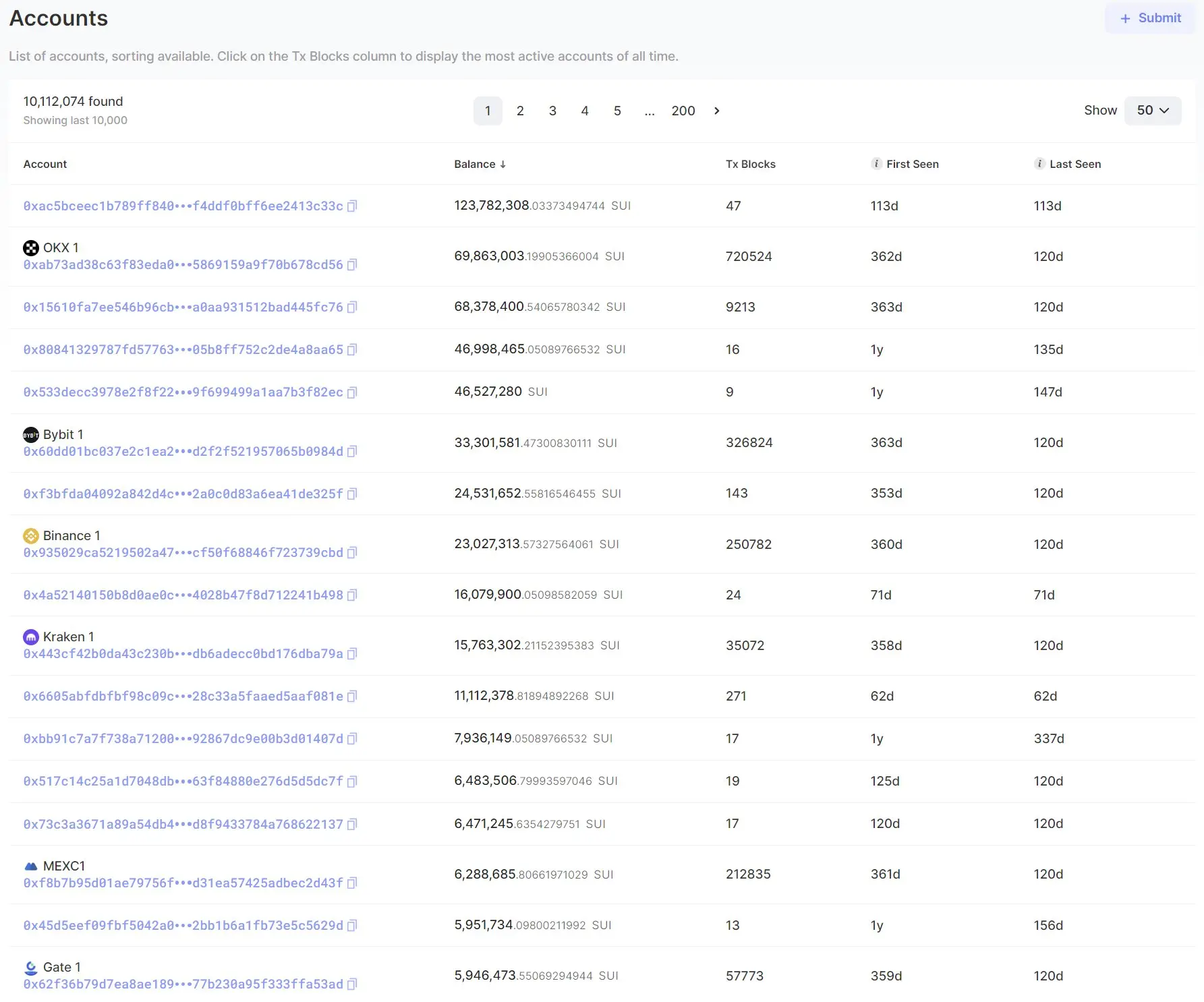

但问题是,目前已有超过 80 亿枚 SUI 被质押,且超过 84% 的质押供应由创始团队持有。所以某种程度上,SUI 无疑是中心化的,即创始人控制了大部分供应,同时没有任何锁定期和法律保证。

也就是说法律漏洞保护了他们,这就是为什么 Sui 基金会发布的流动供应图表是一个谎言——这意味着所谓质押的 SUI 根本没有锁定期!

所有法律文件都证实了这一点,因为这允许 Sui 团队可以随时随地其这部分 SUI 做任何想做的事。

鉴于这些事实,他们的大部分沟通都极具欺骗性,呈现出一种明显的缺乏披露加上谎言和肆无忌惮的贪婪。

我们此前曾要求 SUI 公开他们的地址,但他们拒绝了。同时他们确实透露了这些 SUI 由托管机构持有,具体来说是 BitGo 、 Anchorage 和 Coinbase Prime 。

然而,这暗示着确实有人对整个「未分配」的 SUI 供应拥有法律所有权。这些托管机构必须与法律实体合作,就像 Cyber Capital 和 BitGo 的合作一样。

简言之,他们并不强制执行归属期,而是使中心化机构能够安全地持有其加密货币,由于这些机构使用多种质押服务,因此混淆了中心化问题。

也就是说我们甚至不知道是基金会还是营利性机构 Mysten Labs 控制了这部分质押的 SUI ,背后甚至可能是一些随机的个人——如果没有核心团队的进一步披露,我们真的无法得知详情。

对于一个筹集了超过 3.3 亿美元的项目来说,这是完全不可接受的。

此外,总供应量的 100 亿枚中,1.6 亿枚分配给了营利性机构 Mysten Labs ,6 亿枚分配给了「早期贡献者」,而接近 15 亿枚直接流向了风险投资公司......

再加上超过 10 亿枚的「质押补贴」——这些补贴最终会回到创始团队手中,因为他们实际上控制了大部分的质押份额。

与此同时, SUI 根本没有进行公开销售(也就是说 100% 预挖),这也是过去几年加密经济学的一个趋势, SUI 是最糟糕的例子之一,尤其考虑到「未分配」的那部分供应量。

这就是我撰写这篇文章的原因,我们必须为了整个行业的利益提高标准,毕竟用「过分」形容 Sui 的代币分配简直是太轻描淡写了。

到目前为止, Sui 仍然拒绝披露其大部分代币供应的信息,这给我们带来了极高的风险,因为 Sui 的领导层实际上控制着网络共识。

他们不仅可以操控共识,而且如果他们决定抛售,还能一夜之间促使整个市场崩溃。不过,从博弈论的角度来看,他们更有可能选择通过逐渐抛售的方式来慢慢榨干散户投资者的利益。

这或许可以解释为什么 SUI 拥有「供应上限」,但它显然不是一个着眼于未来的项目。

既然我都要批评了,那就顺便提出个解决方案吧,很简单:销毁「未分配」的 SUI 供应量:

这是一个激进的解决方案,相当于销毁一半以上的供应,价值超过 10 亿美元,听起来简直疯狂,但这也将释放出令人难以置信的利好信号!

另一个解决方案是将对该部分供应量的控制权移交给一个由 Sui 链上治理系统控制的金库地址,优势在于这部分资金仍然可以发挥作用,为 Sui 带来越多的竞争优势。

Sui 的技术本身极具潜力,其面向对象的模型允许更多的控制和局部分片;对于状态膨胀问题, Sui 也提出了一个新颖的解决方案——由于对象需要用户锁定 SUI ,当对象被销毁时, SUI 会被释放, 这与并行处理结合实现了高度的可扩展性。

在加密货币领域,很少有事情是绝对的,没有什么是完美无瑕的, Sui 是一个无许可的公共区块链,却拥有掠夺性的代币分配方式,好坏并存,令人震惊的是, SUI 的代币分配让 SOL 看起来都像圣人, ETH 俨然是天使了。

面对这样的情况,我们难免会感到矛盾。不过, SUI 仍然有机会走上正确的道路,他们只需要放弃对「未分配」供应的控制权,将它们销毁!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。