TL, DR:

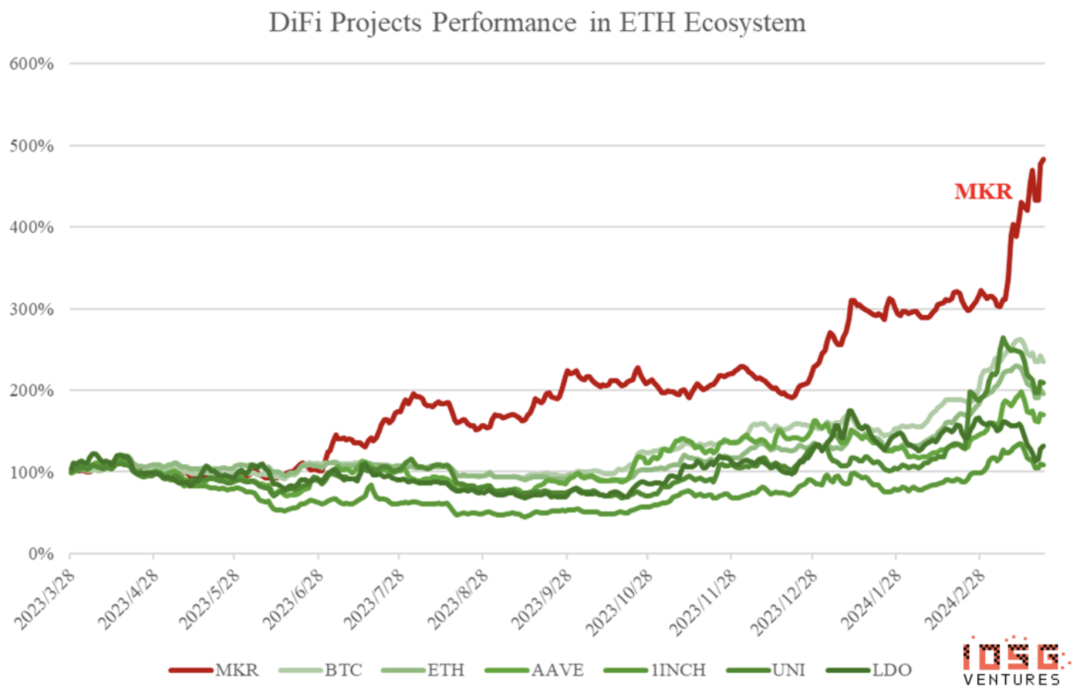

- 在过去的一年中,与 BTC、ETH 和其他 DeFi 协议相比,MakerDAO 取得了最佳表现,在普遍DeFi参与者币价涨幅在200%的情况下,MKR的币价涨幅约500%。

- MakerDAO 的成功源于其坚实的基本面和多样化的商业模式,在 RWA 和加密货币市场都表现出色。在当前传统金融宏观条件和DeFi赛道的不明朗局面,我们相信MKR在两个领域的商业布局可以让它抵御风险并且获得可观的收益。

- 积极的市场情绪和Endgame路线图预示着未来增长。而 MakerDAO Endgame: Launch Season的发布更加提振了市场情绪。

- Endgame面临的挑战包括在创新和风险之间取得平衡,确保利益相关方对其目的的理解。它带来了全新的代币经济模型、治理框架和明确的发展路线图,以改善其增长力、风险抵御能力和大众接受能力。

- 我们认为尽管简化运营,但现如今其核心业务重点基本保持不变,收入端所带来的效益短期内并不会特别显著,但是可能减少内部的沟通成本并提高每个业务的专业度和运营效率。

- 我们认为对于 MakerDAO 能否持续领导未来 DeFi的格局,Endgame的有效执行至关重要,路线图的影响和 MakerDAO 在创新上的承诺将决定其未来成功的走向。

背景

在上一个熊市中,很少加密货币表现坚挺,其中 Maker (MKR) 无疑是其中之一。在其他蓝筹资产价格波动的时候,Maker 不仅守住了自己的价值,还实现了惊人的增长,从2023年3月到10月翻了一倍。这种出色的韧性证明了它不仅能在逆境中生存,还能在艰难条件下茁壮成长。

但 Maker的魅力并不仅限于熊市。随着2024年初加密货币市场看涨,Maker 的价格从1400上涨到2000。这种势头并没有止步;在3月13日宣布大家最期待的的 Endgame 计划后,价格飙升至3000。这样的激增意味着持有 MKR 在过去一年可能带来高达5倍的回报!

那么,MakerDAO 在熊市和牛市表现强劲的秘密究竟是什么?是其扎实的基本面,还是多变的叙事带来的成功?最让人感兴趣的是,MakerDAO Endgame 究竟是什么,我们又应该对未来有怎样的期待?本文旨在解释这些疑问,并揭示使 MakerDAO 在变幻莫测的加密货币市场中脱颖而出的动力。

MakerDAO:适应力极强的DeFi开拓者,加密与现实世界资产的桥梁

在快速发展的DeFi领域,MakerDAO通过巧妙应对两大关键趋势:整合真实世界资产(RWA)和质押以太坊(stETH),成功凸显出自己的独特地位。这种战略不仅增强了它在去中心化金融领域的地位,还彰显了其坚韧性和适应性。

Staked Ethereum (stETH) 整合

在加密领域,MakerDAO 通过其核心协议和子公司 Spark,锁定了约 60 万 wrapped staked ETH (wstETH)。这一重要整合使 MakerDAO 成为第三大总锁定价值(TVL)实体,达到了 116.7 亿美元(其中 Maker 锁定 86.7 亿美元,Spark 锁定 30 亿美元),仅次于 Lido 的 340 亿美元 和 Eigenlayer 的 118.01 亿美元。与专注于质押和再质押服务的 Lido 和 Eigenlayer 不同,MakerDAO 的 DeFi 业务模型超越了简单的资产质押。

通过锁定 stETH,MakerDAO 将这些资产有效地作为抵押物来铸造其本地稳定币 DAI。这一过程使 MakerDAO 能够通过对以 stETH 为抵押发放的贷款收取的稳定费用(利率)获得收入。随着以太坊收益的波动,MakerDAO 调整其风险参数和利率,以确保在收入生成的同时保持系统稳定。这一方法将以太坊的波动和收益转化为稳定的收入流,从而巩固了其作为该行业领导者的地位。

RWA策略

2023年6月,MakerDAO将美国国债整合到其投资组合中,这一举措意味着其正在通过利用RWA来使其收入来源多元化。从本质上来说,当存在一种高生产性且无风险的替代选择时,Maker的治理者不愿意让其资产负债表持有低效且“危险”的USDC。这一决定不仅将MakerDAO定位为加密货币行业中RWA领域的领导者,还显著提升了其收入。

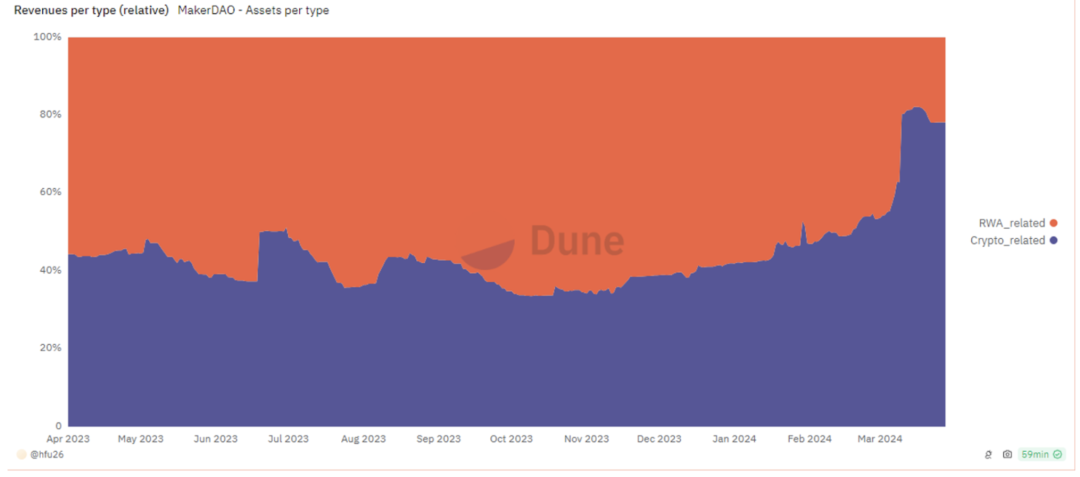

RWA 包括房地产和债券等实物资产,已成为MakerDAO收入的重要组成部分,贡献了其费用收入的约60%。美国国债的纳入被证明是一项成功的策略,增强了MakerDAO的收入稳定性,导致年收入超过1亿美元。

根据来自Steakhouse的一份报告(https://www.steakhouse.financial/projects/makerdao-financial-report-2023),2023年,约56%的收入,总计7630万 Dai,来自真实世界资产 (RWA)。进一步的分析显示,83%的真实世界资产收入集中在年后半段,与十年期联邦利率持续增长的时期相吻合。

Source: Steakhouse

MKR:全天候的加密资产

MKR因其在RWA和加密市场借贷上的战略配置,在不同的市场环境中表现出色。在高利率环境中,MKR显示出强大的适应力,从其RWA投资中受益,这与其他可能在此类宏观经济压力下遭受损失的加密货币不同。当利率下降,市场流动性增加且加密市场进入牛市,MakerDAO的策略预计将转向其在加密原生操作中的优势,特别是加密货币的借贷。

因此,MakerDAO巧妙地驾驭市场周期,专注于在牛市中的加密货币的借贷,并在熊市中优化RWA收益,确保其作为一个强大的全天候加密资产的地位。

下面的图表重新确认了Maker的资产配置策略。当美联储利率在2023年10月达到约5%的峰值时,Maker将其资产的最大部分配置在与RWA相关的资产上,从国债和其他信用相关产品中获得收益。

随着利率因美联储对控制通胀的信心增加而开始下降,Maker战略性地转向与加密相关的领域。

目前的宏观局势并不像我们可能认为的那样明朗:随着美国劳工统计局宣布的通胀数字未达到分析师的预期(2024年3月的CPI 为0.4%,预期为0.3%),对美联储降息的期望持续被推迟甚至被压制。摩根大通的CEO杰米·戴蒙甚至提到利率上升至8%以上的风险。高利率环境为RWA项目提供了更多的盈利机会。Maker很有可能再次从RWA方面获利。

Source:https://dune.com/queries/3569610/6008265

估值扩张:市场恢复以及Endgame发布后叙事演化

前面的部分强调了 MKR 坚实的商业模式和令人印象深刻的盈利能力,为理解其估值奠定了基础。然而,MKR 价格的激增并非仅仅归因于其财务表现,因为盈利预估从2023年4月的 5 亿美元被提高到 2024年3月的 15 亿美元,但价格却上涨了5倍之多。

仔细观察来自 Makerburn 的数据,揭示了故事中的另一重要部分:估值扩张。从 2023 年 6 月到 8 月,MKR 的市盈率(P/E)在 10 到 15 之间徘徊。到了 2023 年 9 月,这个数字开始攀升,到 2024年 2 月达到了 20 左右,然后在 2024年 3 月底急剧跃升至 30 以上。

那么,是什么推动了这一引人注目的估值扩张呢?

Source:https://makerburn.com/#/charts/revenue

市场环境的恢复

在我们2023年12月的文章中,我们强调了第六次加密货币牛市的开始,现在已经进行了一年多,具体详情请参见我们的分析。这一阶段促进了各种DeFi项目的活跃度,由市场活动增强和增长预期所驱动。这种预期中的互动和交易量增加不仅是投机性的;在DeFi领域各处都能观察到。如Balancer、Synthetix、Sushiswap和Curve Finance等项目正在经历倍数的显著扩张,这一趋势得到了Token Terminal数据的证实。

然而,MKR其估值扩张的非凡之旅并不仅仅是市场动态的产物,特别是其到2024年3月的市盈率估计飙升至30,。MKR Endgame于2024年3月初的全面启动标志着一个关键时刻,推动其估值达到新高,并使其增长轨迹与更广泛的市场趋势区别开来。

这促使我们更深入探讨:Endgame究竟是什么,为什么它能激发如此高的期望,并支撑MKR估值倍数的显著增加?

Source: https://tokenterminal.com/terminal/metrics/ps-circulating

MakerDAO Endgame:运营效率、清晰度和风险隔离的最终计划

4.1 背景:MakerDAO面临的挑战

运营效率低下:尽管DAOs在加密项目中得到广泛采用,但运营效率仍存在问题。MakerDAO也曾遇到过重大挑战,包括被拒绝的旨在提高效率而采取的集中化运营提案,这些沟通上夺得障碍也使成员对投票和活动的理解变得模糊。

竞争加剧:去中心化金融(DeFi)生态系统内的竞争日益激烈,MakerDAO与Aave的公开冲突凸显了这一点。面对Aave推出其稳定币GHO,MakerDAO通过支持Spark的开发并与Morpho合作建立新的贷款池来应对。这些举措突显了DeFi中的激烈竞争格局,也渐渐引发了对MakerDAO在快速变化的市场中竞争壁垒稳固性的疑问。

风险控制的变化:最近,MakerDAO的Dai储蓄率(DSR)经历了显著波动,迅速从5%上升到16%,回调至13%后,最终在4月底调整至10%,这挑战了社区对于稳定和可预测的利息政策的预期。此外,他们将D3M的限额大幅扩展到25亿DAI,并与Morpho合作建立USDe池,反映了向更高风险容忍度的战略转变。这些举措,更接近对冲基金策略而非传统中央银行,展示了MakerDAO努力应对外部DeFi竞争者的同时,可能牺牲了基础稳定性。

为了应对这些挑战同时保持其去中心化特性,MakerDAO在2022年第三季度引入了Endgame框架,其初始阶段于2024年第一季度启动。该框架旨在提高MakerDAO的可扩展性、风险承受能力和用户参与度。

4.2 路线图中的内容

关键变更:

Maker Core 与其业务将没有直接关系,甚至 Dai 贷款也是通过 Spark(一个SubDAO)进行的。

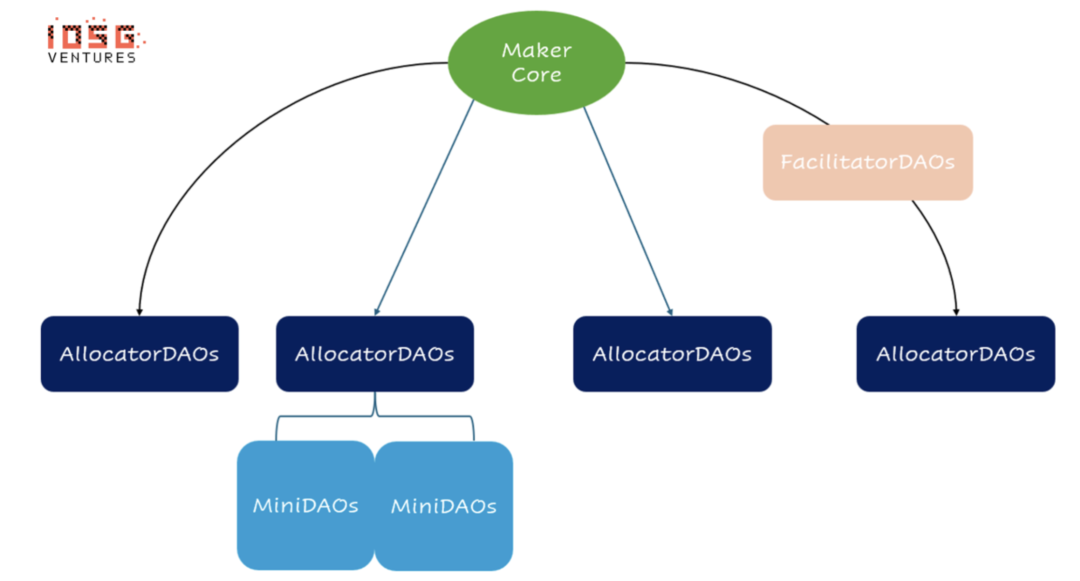

Maker的Endgame中将引入了两种类型的SubDAO:主要的SubDAO,包括 AllocatorDAO 和 FacilitatorDAO,以及被称为 MiniDAOs 的次要SubDAO。主要的SubDAO具有大量的代币供应,主要通过 Genesis farming 分配,并用于员工奖金,并且根据后期的提议而进行持续的分配。MiniDAOs 也遵循 Genesis farming 模型,但在各种farming渠道中的具体分配策略不同。

Endgame对 MKR 使用进行了关键更新:它允许购买流动性池代币以将 Maker Core 与SubDAO的利益更相关,每年都会有新的铸造以支持SubDAO和员工激励,以及一个新模块,在该模块中锁定的 MKR 使治理参与并获得奖励,提取时将会被销毁部分。

整个提案相当长,包含许多技术细节。但是,可以将改进的关键特性和考虑因素归纳为以下几类:

4.2.1 商业侧

1. 激励长期参与

MKR作为抵押品:在Sagittarius引擎中使用MKR作为抵押品是一个重大变化。它是Maker Endggame的组成部分,使MKR能够用作抵押品,激励长期质押以获得奖励和惩罚,以增强Maker生态系统内的稳定性和治理。

奖励和惩罚:与过去的模型不同,Sagittarius座引擎引入了解除质押的15%削减惩罚,促进稳定性并使持有者的利益与生态系统的可持续性保持一致。

2. 风险管理机制

硬清算比率:设定为200%,如果跌破此阈值,金库将被清算。

软清算比率:预防性的300%阈值,如果在一周内未恢复,则清算金库。

风险控制:Maker Endgame中的硬清算和软清算触发机制旨在保护所有利益相关者的利益,如MKR持有者和DAI用户,通过确保系统保持良好抵押和对市场波动的韧性。然而,引入内生抵押品带来重大风险。价格波动可能触发MKR销售压力的死亡螺旋,进一步增加其作为抵押品的波动性。

4.2.2 运营侧

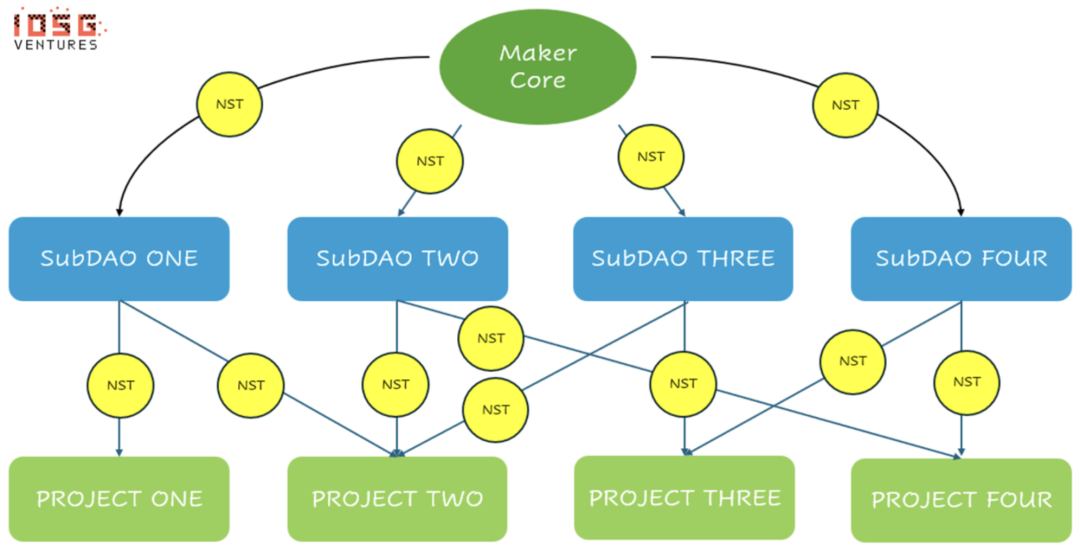

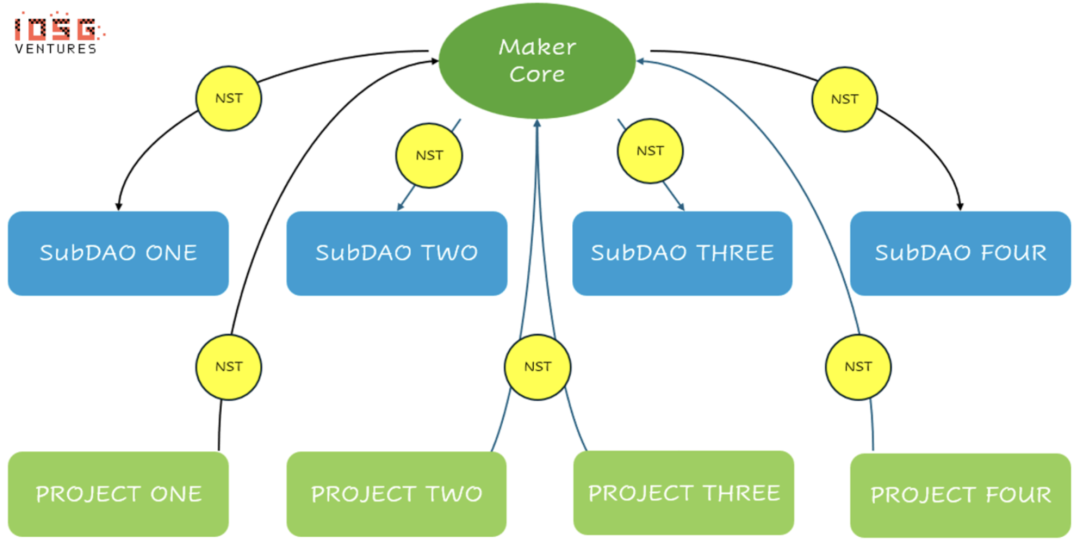

1. SubDAO

与Maker的关系:SubDAO是Maker生态系统内部的自治组织,每个都有自己的治理代币和关注领域。例如,Spark SubDAO专注于贷款和DeFi产品,与Maker的基础设施一起大规模运营。

与MakerCore的关系:MakerCore与SubDAO之间的关系已经改变,MakerCore从前端维护中退出,专注于通过这些SubDAO分配DAI。MakerDAO为SubDAO分配信用额度,使它们能够拥有足够的流动性。MakerCore设置风险参数,包括可接受的抵押品类型和超额抵押要求,确保DAI的稳定性。作为这些服务的交换,MakerDAO从SubDAO管理的DAI中赚取存款费,创建了一个同时有强流动性和收入的共生系统。

价值分配:通过指定的通胀机制,价值在SubDAOs和MakerDAO之间共享,将一部分新MKR分配给SubDAO。这些SubDAO承诺再投资于MKR和DAI,增强市场流动性和生态系统的货币价值。这种分配取决于MKR/DAI流动性池代币的质押量,协调Maker及其SubDAO的激励。

新稳定币(NST)的分配

利润的传递和分配

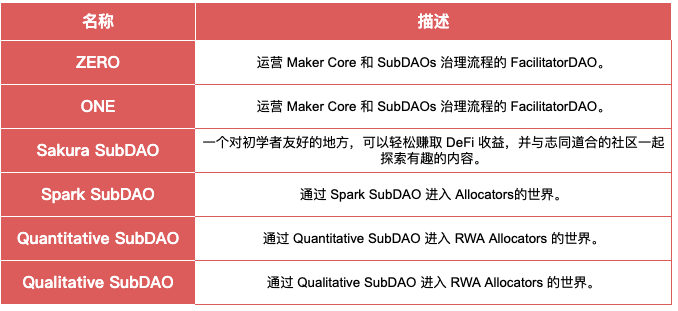

2. SubDAO类别

AllocatorDAOs:

- 能够直接从Maker生成DAI。

- 在Maker核心审批后,有权在DeFi生态系统中分配DAI。

- 为新参与者进入Maker生态系统提供入口。

- 有能力创建miniDAO,以增加自主性和灵活性。

MiniDAOs:

- 一种实验性概念,迄今为止没有实际例子。

- 旨在在需要时为AllocatorDAO提供更独立结构的选项。

FacilitatorDAOs:

- 负责组织和管理不同DAO及Maker核心的内部机制。

- 处理包括社区管理、产品开发和法律合规等各个方面。

不同DAO的结构

SubDAO的列表

4.2.3 风险隔离:

MakerDAO 的Endgame通过一个明确定义的运营和治理结构来管理风险,该结构维持了 Maker 生态系统内部的一致性。这个结构概述了 MKR 持有者、Maker Core 和 SubDAOs 的角色,专注于资本流动和资产配置的管理。MKR 持有者,特别是Aligned Delegates,在设定治理实践方面至关重要,这些实践确保了整个生态系统中决策的统一性和一致性。

Maker Core 通过在既定的风险参数内将资本引导至Allocator Vaults来实施这些治理决策。这个过程有助于通过确保资本管理不会过度集中,并且通过与Arrangers的合作进行资本分散管制,从而减轻财务风险。

通过引入 SubDAO 治理代币,MKR 处于一个更安全的位置,它只需要在 SubDAO 治理代币本身无法解决的重大动荡情况下进行干预(例如,巨大的脱钩)。而 SubDAO 成为了实际业务和 Maker Core 之间的防火墙。

Source: Steakhouse

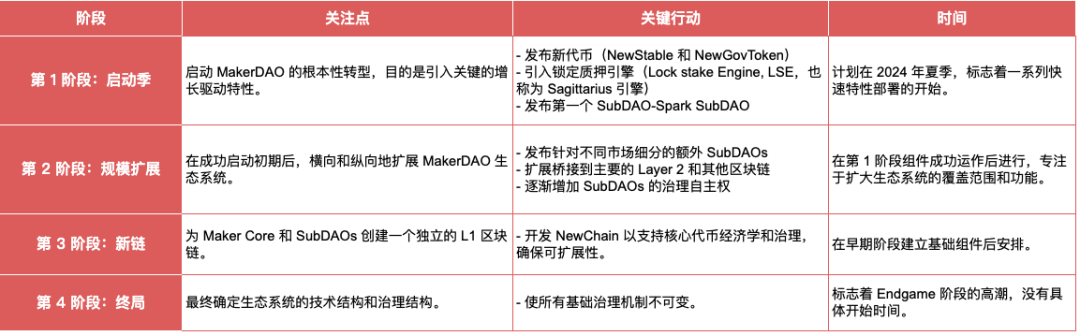

4.3 不同阶段:

这样的叙事无疑是前所未有的宏大,而这一过程也将分为四个阶段进行。

要言不烦:究竟是新时代的开始,还是新瓶装旧酒?

代币经济学: MKR 代币经济学的转变需要更仔细的审查。计划将 MKR 作为抵押品,并允许治理参与通过零利率贷款交易 ETH,引入了风险因素。此外,提议的年通胀率大约为 6%,可能会对代币的价值产生不可预见的后果。

是更简单还是更复杂: 尽管 MakerDAO 终极战略的详细规划展示了一个经过深思熟虑的进化计划,但它也呈现出一个显著的缺点。虽然转向 Maker Core 是有远见的,但似乎过分强调长期目标而忽视了立即的实际行动,导致战略计划和当前实施之间存在差距。此外,治理结构的变化引入了另一层复杂性,让参与者质疑这种新方法是否简化了系统,或者以另一种方式使系统变得更加复杂。

品牌重塑后业务本质未变: 尽管运营结构发生了变化,但 MakerDAO 本质上仍然坚持其熟悉的加密借贷业务领域,特别是扩展到 Spark 协议。同样,在RWA方面,其业务短期内并未改变。这引发了关于为了业务创新的疑虑,因为该计划没有详细说明未来的项目。它将很大一部分路线图留给了人们想象,表明战略重点在于完善现有运营,而不是探索未知的商业途径。至少在当前阶段,其业务仍然集中在 DeFi 借贷/借款和 RWA 上。因此,我们无法判断这个终极计划的推出是否只是品牌重塑,还是真正带来了更多价值。

是风险更高了还是更安全了: SubDAOs 成为了 Maker Core 和实际业务之间的防火墙。但同时,Maker 采取了更冒险的举措。市场对 MakerDAO 的看法已经从将其视为一个稳定的中央银行转变为一个为了保持竞争力而越来越多地承担风险的实体。这种观念上的转变,反映了对 DAI 风险的重新评估,导致了 MKR 的重新定价,使其与更广泛的市场趋势保持一致。这种转变强调了 MakerDAO 在创新和维护基础稳定性之间面临的微妙平衡。

结论

MakerDAO 过去一年出色的表现证明了其稳健的全天候商业模式,该模式擅长应对波动性较大的加密市场。它在高利率时期利用RWA的策略转变,以及在市场上涨期间专注于加密市场的聚焦,突显了其超越其他蓝筹代币的商业敏锐度。凭借无与伦比的创收能力——每年大约产生 2.3 亿美元的收入——MakerDAO 在 DeFi 领域处于金融效率的顶峰。

由积极的市场情绪推动,而引发的 MakerDAO 估值扩张,突显了其市盈率(P/E)增长的潜力。MakerDAO Endgame路线图的提议进一步推动了这一势头,预示着一个更加光明的未来。

然而,Endgame的愿景并非没有挑战。成功关键在于找到创新与严谨风险管理之间的微妙平衡,尤其是当 MKR 步入抵押品角色时。实施这样一个宏伟计划的复杂性要求出色的沟通,以确保利益相关者的认同。

虽然Endgame引入了一种简化的运营模式,但它并没有偏离 MakerDAO 的核心本质。当然,考虑到其商业模式无疑是最好的之一,商业上的转型可能并不必要。它旨在增强和扩大已建立的商业框架,而不是在短期内探索新的风险投资。

展望未来,MakerDAO 能否缓解这些担忧并展示Endgame的实际效益将是关键。有效的执行可能进一步巩固其在 DeFi 领域的领导地位,呈现出一个更加强大、以用户为中心的平台,准备应对加密世界的动态变化。

Endgame成功的最终衡量标准将是其影响——它能否实现承诺,丰富利益相关者收益,并维护 MakerDAO 作为去中心化金融领域韧性和创新的灯塔的地位?至少现在看来,这个计划的推出对其百利无一害,每个角色的分工更加明确,增加各个区域的专业性,也同时隔离了一些风险。也许这只是序幕的结束,大型 DeFi 项目之间的竞争将更加激烈。只有时间会告诉我们答案,但前面的旅程无疑是充满希望的。

Reference:

“CPI Home : U.S. Bureau of Labor Statistics.” Accessed April 25, 2024. https://www.bls.gov/cpi/.

“MakerDAO Endgame.” Accessed April 25, 2024. https://start.makerdao.com/.

“Overview | Maker Endgame Documentation,” August 4, 2023. https://endgame.makerdao.com/endgame/overview.

“Steakhouse Financial.” Accessed April 25, 2024. https://www.steakhouse.financial/projects/makerdao-financial-report-2023.

The Maker Forum. “MakerDAO Endgame: Launch Season - General Discussion,” March 12, 2024. http://forum.makerdao.com/t/makerdao-endgame-launch-season/23857.

“US 10-Year Treasury Yield and Bitcoin Price Show Significant Negative Correlation | Binance News on Binance Square.” Accessed April 25, 2024. https://www.binance.com/en/square/post/2024-04-02-us-10-year-treasury-yield-and-bitcoin-price-show-significant-negative-correlation-6216009372625.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。