"《On the threshold of liberty》 — — Rene Magritte"

Preface:

The US GDP for the first quarter was lower than expected, and the core PCE exceeded expectations, indicating a slowdown in economic growth and inflationary pressure. The market predicts that there may be only one interest rate cut in 2024, and the entire market has entered a period of weak adjustment.

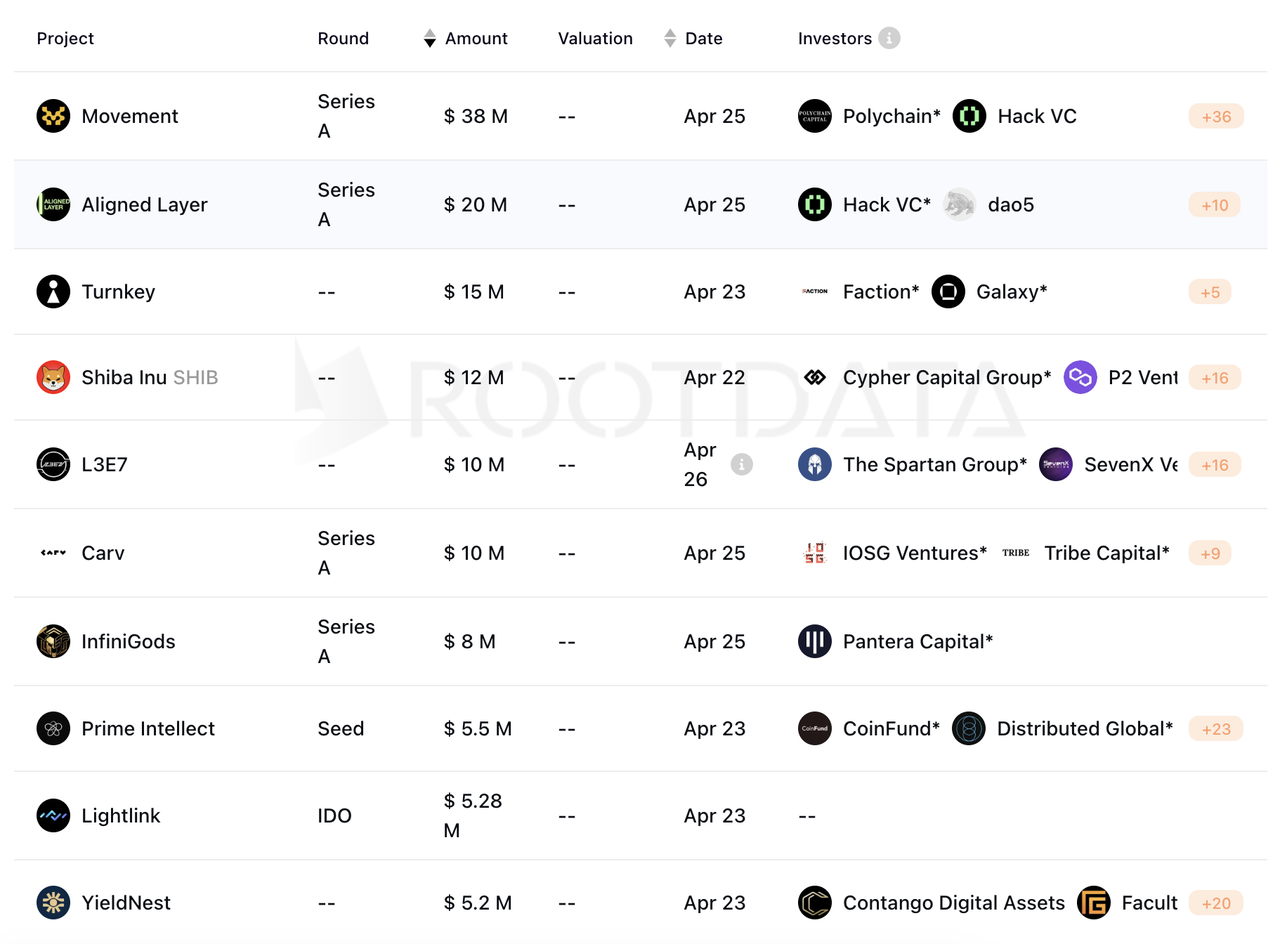

1. Investment and Financing Observations

Last week, there were a total of 32 investment and financing events in the cryptocurrency market, a decrease of 5.8% compared to the previous week, with a total fund size of 206 million US dollars, an increase of 43% compared to the previous week:

In the DeFi sector, 3 investment and financing events were announced (-72%), with the liquidity re-staking protocol YieldNest announcing the completion of a new round of financing of $5.2 million on the X platform;

In the blockchain gaming sector, 9 investment and financing events were announced (+200%), including 3D LBS game L3E7 of Web3, which completed nearly $10 million in Series A financing, with Spartan Group and SevenX Ventures as the lead investors;

In the infrastructure and tools sector, 9 investment and financing events were announced (+12.5%), including the Ethereum L2 blockchain Movement Labs announcing the completion of a $38 million Series A financing, with Polychain Capital as the lead investor;

In the DePIN sector, 3 investment and financing events were announced (+50%), with Natix Network, a decentralized infrastructure network focused on map data, completing a strategic financing of $4.6 million, with Borderless Capital as the lead investor;

In the AI-related field, 4 investment and financing events were announced (+400%), with Prime Intellect raising $5.5 million in seed funding, jointly led by Distributed Global and Coinfund;

In other Web3/cryptocurrency sectors, 3 financing events were announced (-66.6%), including the completion of a $6 million financing for the all-in-one Web3 search engine Adot;

From a week-on-week perspective, the number of cryptocurrency market investment and financing events declined slightly last week, but the total fund size increased significantly. Market enthusiasm began to focus on infrastructure and the DeFi sector. In terms of VC, the main focus was on blockchain gaming and infrastructure for Hack VC, IOSG Ventures, and Coinbase Ventures.

About Movement

Movement is a modular framework for building and deploying Move-based infrastructure, applications, and blockchains in any distributed environment. The framework is compatible with Solidity, connects EVM and Move liquidity, and allows builders to customize modular and interoperable application chains out of the box.

About Aligned Layer

Aligned Layer is a ZK verification layer developed on EigenLayer. As an Eigen Layer AVS, it promises to provide cost-effective verification and multi-functional proof systems for L2 and bridges, meeting critical needs in the blockchain ecosystem. The project is developed by Yet Another Company.

About Roam

Roam is a decentralized global WiFi network that provides public access to enterprise-grade WiFi roaming. Compared to cellular services, it ensures uninterrupted, low-cost access to Web3 and the Metaverse. This investment will further promote Roam's ecosystem in the DeWi sector and the construction of global WiFi roaming network nodes.

2. Industry Data

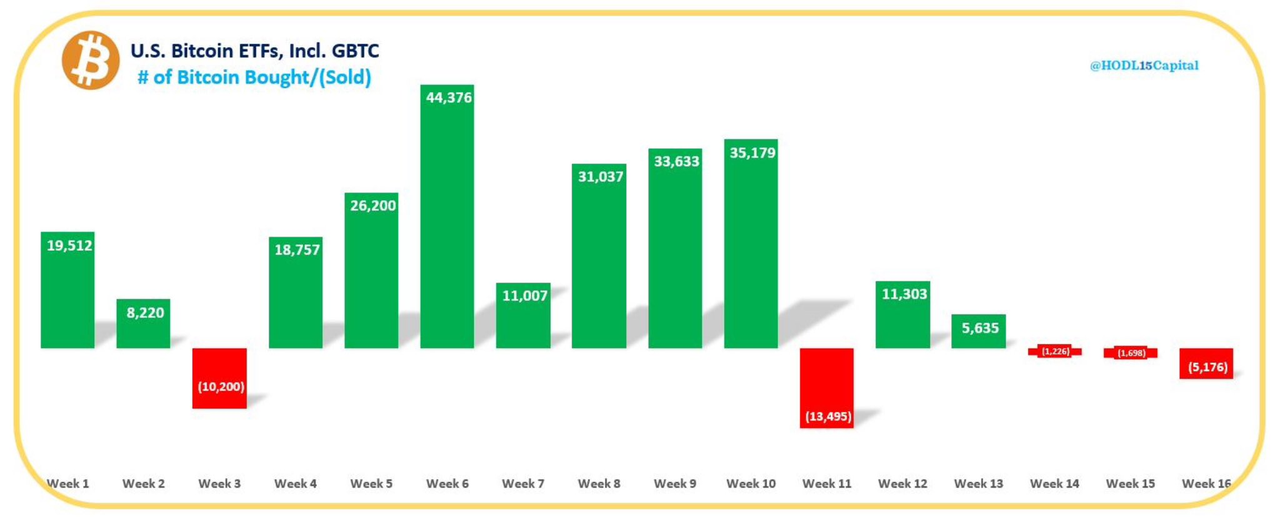

BTC Spot ETF Has Seen Net Outflows for 3 Consecutive Weeks

HODL15Capital data: The US Bitcoin spot ETF saw a net outflow of 5,176 BTC in the 16th week, marking the third consecutive week of net outflows. On April 26th, according to on-chain analyst @EmberCN (余烬), the overall net outflow of the US BTC spot ETF amounted to $83.61 million, indicating that after the US stock market opens on April 29th (Monday), the custodial addresses of these ETFs will see a total net outflow of approximately 1,310 BTC.

After reaching a historical high on March 15th, BTC has experienced two significant price declines, which are typically seen as signals of exhausted upward momentum in the market. Currently, its price is at a short-term high in a downward trend, with a high probability of entering a path towards $52,000 in the future. However, there are many factors influencing the trend of BTC, and careful judgment and continued tracking are needed.

According to analysis by 10X Research: BTC currently faces a certain downside risk, possibly further declining to the expected range of $52,000 to $55,000. This risk assessment comes from multiple market structure data, including the reduction in BTC miner income, which to some extent reflects potential issues with BTC's fair value.

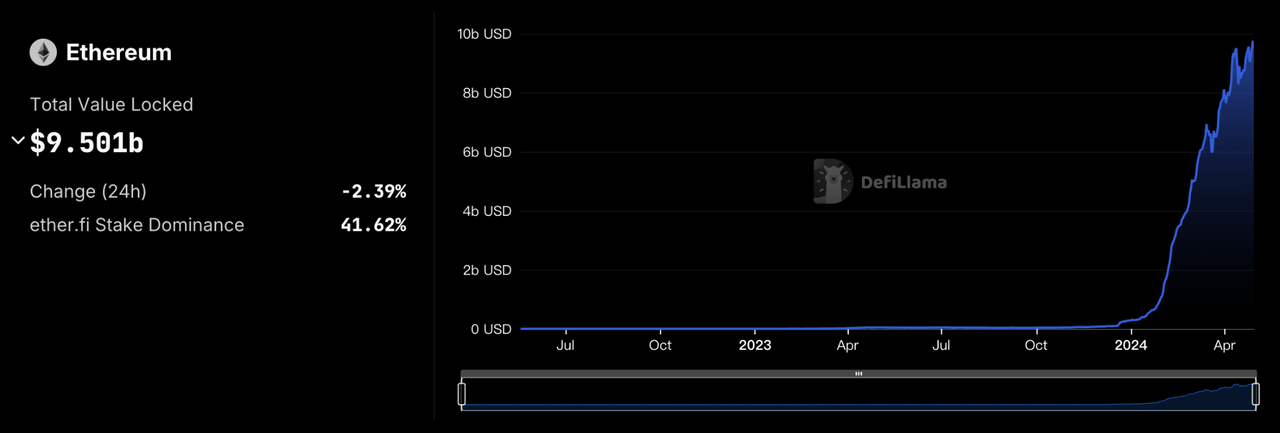

TVL of ETH Re-Staking Protocols Surpasses $9.5 Billion

According to DeFiLlama data, the total value locked (TVL) of Ethereum liquidity re-staking protocols has surged past $9.501 billion. The top five protocols by TVL are:

ether.fi Stake TVL: $3.95 billion, with a 7-day increase of 5.11%;

Renzo TVL: $2.423 billion, with a 7-day decrease of -2.75%;

Puffer Finance TVL: $1.38 billion, with a 7-day increase of 4.08%;

Kelp DAO TVL: $835 million, with a 7-day increase of 3.98%;

Swell Liquid Restaking TVL: $385 million, with a 7-day increase of 3.22%;

The rebound in TVL of liquidity re-staking reflects the heat in the re-staking sector and also indirectly indicates people's cautious attitude towards the current market situation. More people believe that liquidity re-staking is currently the best way to preserve and increase value, and the weakening trend of USD inflows further confirms this sentiment.

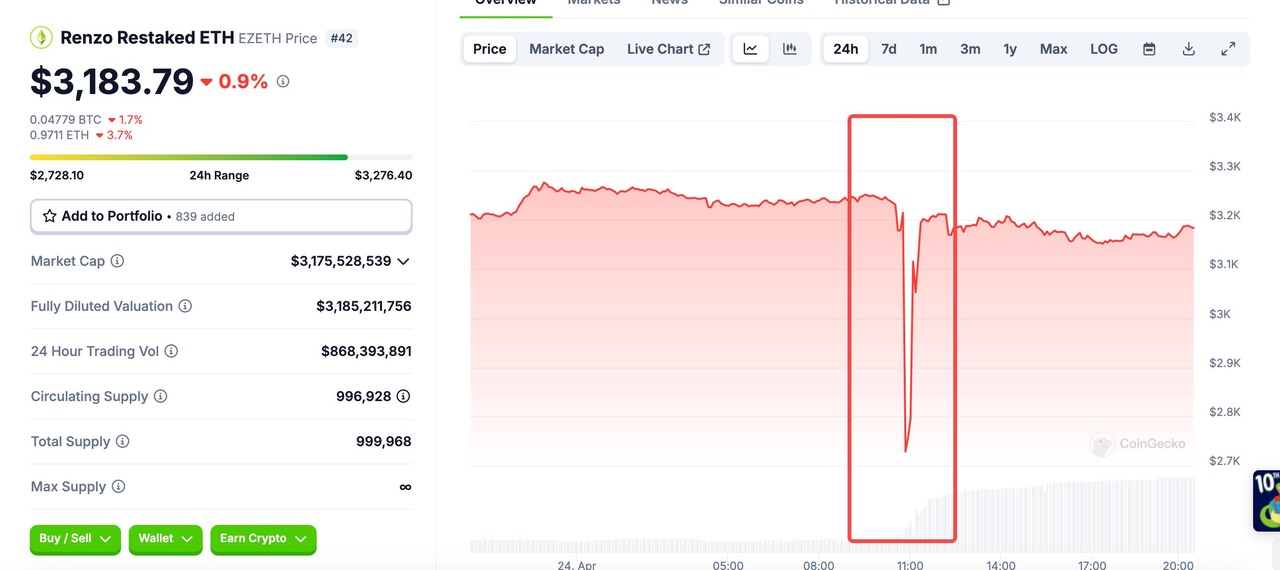

ezETH and ETH Prices Significantly Deviate

April 24th, Renzo's announcement of the token economics being too "centralized" sparked strong dissatisfaction in the community. As a result, ezETH was heavily sold off, causing it to deviate significantly from its anchor, dropping to as low as 0.8510 ETH. Many people took advantage of this opportunity to buy the dip successfully. During the deviation period, a whale used 2400 ETH to buy 2499 ezETH, worth $6.98 million, and made a net profit of 99 ETH. Many others also shared their successful bargain-hunting results. Currently, ezETH has largely recovered and has risen to 1:0.9875 ETH.

The Renzo incident highlighted the vulnerability of the current Restaking sector, especially as various Restaking projects are still in the early stages, and their models and security need time to be verified. This is especially true in the case of continued leveraged stacking, where potential risks need to be closely monitored by participants.

Justin Sun's Frequent Increase in ETH Holdings

On April 25th, Justin Sun purchased 21,547 ETH ($67.5 million). On April 28th, one of the suspected addresses belonging to Justin Sun increased its ETH holdings by 6743 ETH ($22.3 million). The address currently holds a total of 14,146 ETH, with a total value of $46.76 million. The average cost of ETH for this address is $3205. Since December 2023, Justin Sun has been continuously accumulating a large amount of ETH through purchases on centralized exchanges and on-chain methods.

Justin Sun's continued accumulation of ETH reflects his support and recognition of ETH's long-term position in the industry. It also suggests that he may believe the current ETH price is undervalued and will have a stronger performance in the future market.

According to @EmberCN (余烬) data:

Justin Sun currently holds approximately $4.165 billion in token assets through multiple Tron and Ethereum addresses, mainly including: 598,900 ETH ($1.902 billion), 5.364 billion TRX ($602 million), 458 million USDD, 315 million TUSD, 300 million USDT, and 1.589 quadrillion BTT ($2.09 billion), among others.

Binance's 11.05% Investment Projects Launched on Launchpool

RootData: Since November 2021, Binance has launched a total of 30 Launchpool projects, with Binance Labs investing in 21 of them, accounting for 11.05% of the 190 investment portfolios of the institution. The average percentage of projects launched on Binance Launchpool by other investment institutions or individuals does not exceed 2%.

Binance's high percentage has been controversial in the past, with some believing it lacks the fairness it should have. However, in the recent 8 Launchpool projects, only 2 received investments from Binance Labs, indicating that Launchpool seems to be becoming more fair, giving more projects the opportunity to receive investment.

More Binance Launchpool data:

Among the 30 Binance Launchpool projects, projects in which Coinbase Ventures, OKX Ventures, Polychain, Dragonfly, and GSR participated in investments all exceeded 5;

Among the 288 investors surveyed, the average percentage of their investment projects launched on Binance Launchpool did not exceed 2%, while the percentages for Gemini Frontier Fund, Draper Dragon, Lightspeed Venture, and Folius Ventures exceeded 5;

For individual investors, the investment rate of Synthetix founder Kain Warwick reached 8.77%. This was followed by the investment rate of EthHub co-founder Anthony Sassal, which reached 8.57%.

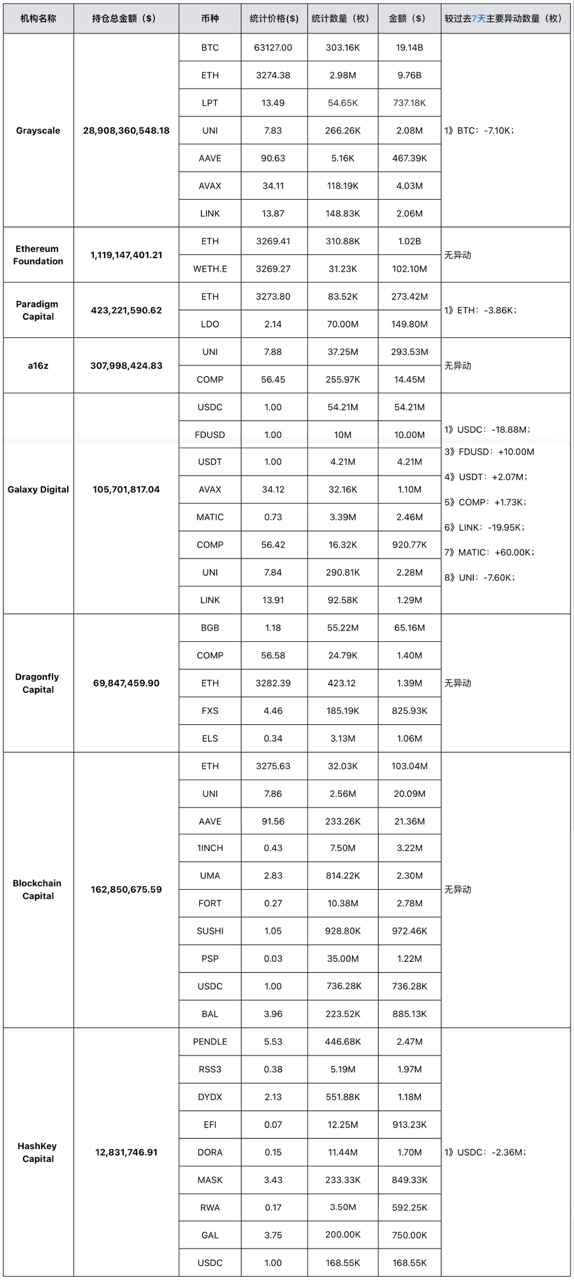

3. VC Holdings

Note: The above data is from https://platform.arkhamintelligence.com/, as of April 29, 2024, 10:00 (UTC+8).

4. Focus This Week

April 29th

- Bitlayer's $50 million developer airdrop registration is open until April 29th.

- The deadline for submitting withdrawal requests for BlockFi's initial bankruptcy assets is April 29th at 7:59.

- The full-chain AI game ecosystem Cellula will announce the BNB Chain user award addresses for participating in Cellula mining to obtain energy on April 29th.

- Web3 social platform friend.tech will release version 2 on April 29th.

April 30th

- The Hong Kong Stock Exchange will begin trading JPMorgan's Bitcoin and Ethereum spot ETFs.

- CZ Zhao Changpeng's sentencing hearing.

- The OP_CAT protocol is expected to go live on the Bitcoin testnet Signet on April 30th.

- The Illuvium Private Beta 4 for blockchain game Illuvium will run from April 30th to May 28th, 2024.

May 1st

- US April ADP employment figures.

- US April ISM Manufacturing PMI.

- Japanese financial giant SBI Holdings will issue NFTs for the 2025 World Expo on the XRP Ledger.

- Theta Network plans to launch the first phase of its EdgeCloud cloud computing platform on May 1st.

- The Farcaster developer conference FarCon 2024 will be held in Venice Beach, Los Angeles, USA from May 1st to 5th.

May 2nd

- US Federal Reserve interest rate decision.

- Powell's monetary policy press conference.

- US weekly initial jobless claims.

- Pragma Sydney will be held in Sydney, Australia on May 2nd, 2024.

- Shiba Inu's L2 solution Shibarium network will undergo a hard fork on May 2nd to improve network speed and reduce costs.

May 3rd

- US April unemployment rate.

- US April non-farm payroll data.

- Social platform UXLINK announces the upcoming first season airdrop, expected to cover 10% of active users.

- ETHGlobal Sydney will be held in Sydney, Australia from May 3rd to 5th.

May 5th

- The Avail token airdrop verification date continues until May 5th, planning to distribute a total of 600 million AVAIL tokens to 354,605 wallet addresses.

5. Conclusion

Last week, the cryptocurrency market saw a decline in the number of investment and financing events due to the impact of the slowdown in US first-quarter GDP growth and the core PCE index exceeding expectations. However, the total fund size increased significantly, indicating continued optimism in the capital market for infrastructure and the DeFi sector. Additionally, the BTC spot ETF showed net outflows for three consecutive weeks, indicating a lack of upward momentum in the market and a high probability of entering a downward path towards $52,000.

This week, the market trend continues to show a downward trend, especially with the frequent actions of the SEC, including issuing a Wells notice to Consensys, accusing MetaMask of operating without a license, and attempting to classify Ethereum as a security. The market is likely to continue to experience the "cicada effect." However, the progress and plans of projects such as TON, PYUSD, Renzo, and Avail have not been affected, especially as the progress of modular blockchain projects is rapidly driving implementation.

In addition, Justin Sun's frequent increase in ETH holdings, James Fickel's purchase of ETH, and borrowing WBTC from Aave to go long on ETH/BTC may reflect optimism about ETH's future performance in the industry and could even bring a resurgence to the entire market. It is recommended that investors closely monitor these developments.

Finally, tomorrow CZ will have his final sentencing hearing. We wish for everything to go as everyone hopes, and for good people to have a safe and peaceful life!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。