在经历了六年的停顿之后,支付巨头Stripe决定重返加密货币支付领域,首先支持的是基于Solana、以太坊和Polygon的USDC稳定币。这一变化标志着自2018年因比特币价格过度波动而停止支持加密支付以来,Stripe首次重新接纳加密货币。

2022年,Stripe曾尝试通过支持USDC进行支出支付重返加密市场,虽然当时未直接接受支付,但已有大客户开始使用这一服务。这次更新的决定显示了Stripe对于探索和适应不断变化的数字支付环境的持续承诺。下文我们一起探讨Stripe的前世今生。

初识Stripe:全球支付领域巨头,为用户提供极致的转账体验

作为全球金融科技的巨擘,Stripe不仅仅是支付服务的提供者,它重新构筑了互联网的财务基础设施。通过一系列模块化解决方案,Stripe为从小型初创企业到跨国集团的商业活动提供动力,无论是在线上还是线下。Stripe通过其全面集成的支付和金融产品套件,实现了支付流程的全球化,并为各种商业模式的发展和创新提供动力。

Stripe的支付服务不仅提高了授权率和结账转化率,还通过多样化的本地支付渠道满足了各地市场的特定需求。它的服务组合中包含了自动化税务处理工具、欺诈预防系统、以及为商户定制的线下支付终端解决方案。在计费方面,Stripe优化了周期性收入的管理,通过其发票系统和收入认证工具,降低了客户流失率并提高了财务运营的效率。

Stripe Connect更是将支付功能整合到客户的平台中,为交易市场带来端到端的支付体验,这包括了即时支付出款和提供个性化支付界面的服务。Stripe的银行即服务产品,如商务卡的发行和管理,无需额外的设置费用,提供了灵活的融资选择。

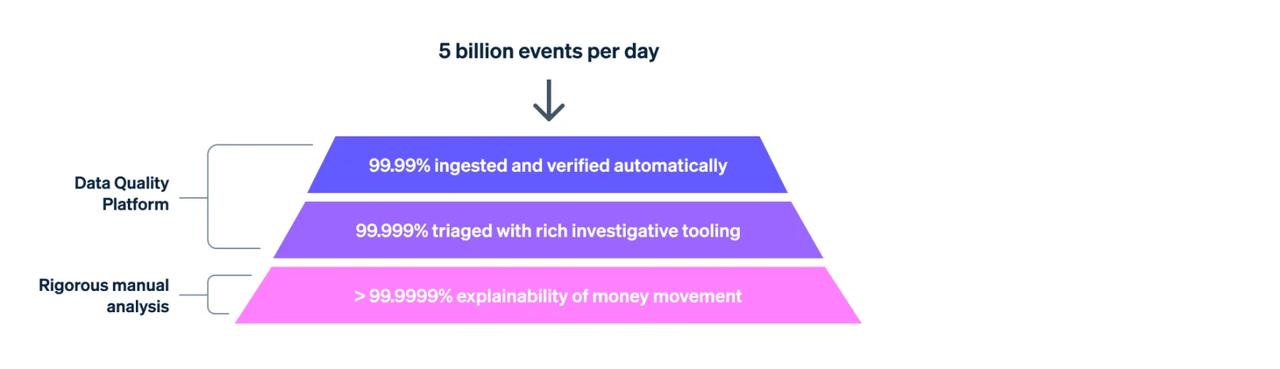

在全球范围内,Stripe将资金转移的便捷性比肩数据的流通,其庞大的网络覆盖全球,每年处理着数千亿美元的交易。Stripe的开发者友好特性体现在其强大的API,它简化了全球经济中的网关和支付轨道,使开发团队能够在一个平台上高效地构建所需的所有业务功能。

曲曲折折、坎坷不断:回顾Stripe踏足加密资产世界的这6年

六年之后,Stripe 再次踏入加密货币的世界,这一次,它以接受 USDC 稳定币为第一步。然而,这并不是 Stripe 第一次涉足加密货币的领域。回顾历史,我们能够看到 Stripe 对加密货币早期尝试与当前发展的联系和差异。

2014年,Stripe首次涉足加密货币领域,开始对比特币进行测试。当时,有合作伙伴指出:“由于比特币的本质,Stripe的支持至关重要:它并不具备一般货币所期望的所有特性。 ”这迎来了Stripe对加密货币潜力的认可和探索。

然而,到了 2018 年,Stripe 取消了对所有加密货币的支持,称其为“非常出色且不稳定”。公司过去在声明中指出:“两年里,随着区块链的规模限制,比特币已经演变成为一种资产,而不是一种交换手段。”这一决定表明了Stripe对比特支付币的不信任,并反映了其对加密货币未来发展的观点。

然而,2022年到来,Stripe再次引人注目。它不仅与以太坊扩展方案Polygon合作,在Twitter上尝试行接受加密货币支付,最初仅支持Polygon上的USDC。这是对加密货币支付的再次尝试,也是Stripe持续发展的一部分,以适应不断变化的支付市场。

2022年,Stripe进一步巩固了在加密货币领域的地位。其宣布支持加密货币和NFT的法币支付,并与FTX、FTX US、Blockchain.com、Nifty Gateway以及Just Mining达成合作,推出了加密业务套件。这不仅为企业提供了接受法币支付加密货币的新接口,还为数字钱包、KYC解决方案以及欺诈性交易检测等提供了全方位的支持。

时光飞逝,来到2024年,Stripe再次引领加密货币圈的潮流。它开始接受USDC稳定币支付,为用户提供了更便捷、快速且稳定的支付选择。这一举措推动了Stripe对加密货币支付的重大决策,也反映了其对加密货币未来的信心和期待。

Stripe的加密货币之旅充满了曲折,但也充满了挑战与机遇。从比特币的初步尝试到现在USDC的接纳,Stripe不断探索和创新,致力于为用户提供更好的支付体验。随着加密货币的发展市场的不断发展,我们可以期待Stripe在未来为加密货币支付领域带来更多的惊喜与可能性。

Web3金融业务将进入稳态,Stripe后市走向值得关注

在经历了一系列挑战之后,现在是时候使用Stripe的劫后余生了。曾经赞扬硅谷独角兽的它,在疫情期间面对表演产生了爆发性的肢体和生长波形,但在逆境和管理对比时也遇到了一些困难。然而,要评判Stripe的未来走向并不容易,因为这家公司仍然拥有许多优势和潜力,但也面临着前所未有的挑战。

首先,Stripe在全球支付领域拥有强大的地位和影响力,其产品更新和创新能力使其保持在行业的前沿。例如,通过推出新的支付方式选择和支付方式规则引擎,Stripe为用户提供了更多灵活的支付解决方案,进一步拓展了其市场。此外,Stripe Connect的嵌入式支付与金融服务为用户提供了更多的定制选项和工具,进一步增强了其竞争优势。

然而,去年的Stripe也面临着一些挑战。过度的扩张和管理失误导致了财务状况的恶化和员工流失的加剧,使得公司的估值受到质疑。此外,面对资本市场的冷淡反应,Stripe推迟上市的计划,进一步增加了其未来的不确定性。

Stripe在其2024年年度大会上分享了一系列重要的产品更新,内容涵盖了全球支付、嵌入式财务与支付金融、以及嵌入式财务与支付收入与自动化等领域,但其劫后余生能否如愿以偿,却是一个未知数。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。