AI is important, but not the most important.

Author: Mu Mu

AI is rising, and Gauth, an educational product under ByteDance, is soaring overseas.

According to the Qimai ranking, as of April 15, 2024, Gauth's iOS mobile version ranked fourth in the education category in the United States. On April 8, the app had reached the runner-up position, second only to the language learning app Dolingo.

According to Data.ai, Gauth has reached 147,400 downloads, with 449,000 active users. The website gave this app a Mobile Performance Score (MPS) of 98 out of 100.

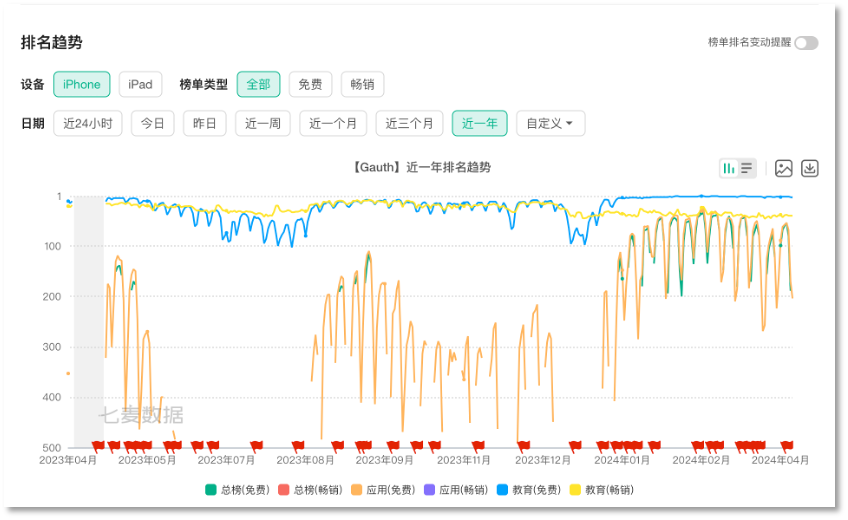

As a math subject educational product launched between 2020 and 2021, Gauth did not stand out in the education app rankings until the beginning of this year. According to Qimai data, within three months, Gauth's global downloads increased 14 times, and daily active users grew 1.4 times.

Gauth is an AI-driven learning tool that provides step-by-step solutions for problems in subjects such as math, chemistry, biology, and physics. According to evaluations, Gauth's math problem-solving level matches that of ninth-grade students in the United States, and its language and comprehensive abilities are comparable to those of excellent test-takers in the United States SAT exam.

Sitting on the crest of the wave, Gauth has taken off, but in seizing the "cake" of the overseas market, AI is just one of its "tricks."

AI Drives Traffic for Educational Resources through Photo-solving

Gauth's explosive growth began at the beginning of this year. According to Qimai data, starting from January 2024, Gauth has emerged as a rising star in the education app market in the United States and globally, with a total user base exceeding 200 million. It briefly ranked second in the free education app rankings in the U.S.

Gauth's ranking performance over the past year according to Qimai data

According to Data.ai, Gauth's daily active users (DAU) in the U.S. surged from 506,000 in January to a peak of 1.39 million, and globally, the DAU reached 2.065 million, more than 1.4 times the growth at the beginning of the year. At the same time, the daily download volume soared to 14 times its original amount in early April.

It can be said that Gauth not only performs strongly in the U.S. market but also stands out in the international market. Why has it become so popular?

In fact, Gauth was officially launched in December 2020, then known as Gauthmath, operated by GAUTHTECH PTE. LTD. registered in Singapore, with LEMON INC. as a shareholder, a subsidiary of ByteDance. Even now, online advertisements for AI project interns recruited by ByteDance for Gauthmath can still be found (the position is currently offline).

This learning tool had two main selling points from the beginning: overseas and AI.

When it first launched, Gauth did not attract much attention. At that time, educational apps with features like photo-solving were not uncommon in the domestic market, and many tech companies specializing in the education industry were also promoting similar products. This may be one of the reasons why Gauth did not gain traction in the domestic market and chose to go overseas. However, even in the overseas market, it did not gain much attention in the rankings of educational apps.

In 2023, generative AI, driven by ChatGPT, became extremely popular. Gauth, which already incorporated AI features, found a "fulcrum" and began its counterattack.

Users can take a photo of a problem with their phone, and Gauth can analyze the problem and provide detailed step-by-step solutions and problem-solving strategies within a few seconds with the help of AI. According to the official website, Gauth covers multiple subjects such as math, statistics, physics, chemistry, history, and even reaches the level of the U.S. SAT exam in language and comprehensive abilities.

For Gauth, AI is not only about basic technical capabilities but also a trend it can leverage. However, for users, Gauth is not just about AI. This tool also connects professional tutoring teams, including teachers with many years of experience, college and graduate students, and has built a global community for students to discuss problems.

If you were to test it yourself, you would find that AI is a technology that can answer the majority of academic questions, but there are always some profound and tricky questions that even AI cannot complete. Some testers uploaded questions from the Chinese college entrance examination and found that Gauth could recognize and provide step-by-step answers in Chinese, but the answers were incorrect.

Math problems have always been a challenge for various natural language models to tackle. Gauth, as an application, inevitably encounters such bugs. However, it has supplemented this shortcoming with "people" such as expert teams and communities, laying the groundwork for its commercialization.

The Gauth app can be downloaded for free, but certain features, especially those involving "real expert teams" for teacher problem-solving, require a paid subscription, which is included in the Gauth Plus membership. In addition to unlocking all answers, it also provides a 24/7 teacher Q&A service.

In the U.S. market, Gauth Plus subscription fees are divided into three tiers: $11.99 per month (approximately 86.78 RMB), $21.99 per quarter (approximately 159.15 RMB), and $99.99 per year (approximately 723.66 RMB).

In Gauth's commercialization, AI is not only a technological capability but also a traffic signboard. Combining AI technology with real human teaching resources and enriching user experience also explains the value of "AI-driven tools" beyond AI.

When AI Goes Overseas, Does It Always Enter Blue Oceans?

With the global popularity of AI, domestic application-oriented enterprises have begun to seek overseas markets during the conceptual stage of technology, aiming to lay out in the overseas market as early as possible. This seems to be the tempered experience that Chinese companies, adept at product development, have gained in the wave of mobile internet development.

Starting from 2010, under the wave of mobile internet, Chinese enterprises have been more inclined to go overseas with applications. Games were the pioneers in this field, with miHoYo being a representative; then, cross-border e-commerce emerged, and applications took the form of platforms to go overseas, providing a wide range of goods, with TikTok being a standout; later on, brand globalization also gained a foothold, and Chinese people felt a sense of familiarity when they saw Miniso in Southeast Asia.

Now, this trend of going overseas has also reached the AI track, with many domestic AI products thriving in overseas markets, such as Heygen, Opus Clip, Meshy, and PixVerse.

Baidu has launched AI camera Meira, AI chat SynClub, and AI social app WiseAI for the overseas market. Last year, HeyGen, which was popular overseas, had one of its co-founders who was a former product designer at ByteDance, Liang Wang. Many individual entrepreneurs and teams have brought products to the overseas market, such as TheB.AI and FlowGPT, both of which are native AI platforms that were independently developed in the early stages.

The reasons for the fierce competition among domestic AI players to go overseas are threefold: first, overseas users have a higher willingness to pay; second, the English processing level and openness of large language models in China need to be improved. Products going overseas mainly access APIs of large models such as GPT, Claude, and Bard, enter from vertically segmented scenes, and then package functional scenarios to quickly produce small products.

However, refusing to be part of the domestic competition and directly entering the overseas market also presents both opportunities and challenges.

As the heat of AI going overseas rises, the competition becomes fierce, and not all products can achieve successful commercialization. Even for major companies, without a rich accumulation of user resources overseas, it is difficult to achieve good results quickly.

Although Baidu has launched Meira, SynClub, and WiseAI, the market response has not been optimistic. SynClub's app ranking is outside the top 100, and the download volume is only in the thousands. Currently, the outstanding Gauth has seen a surge in daily active users, while the daily active users of the language learning app Dolingo have reached tens of millions.

Taking Dolingo as an example, its Max version has only recently added AI-based role-playing and intelligent correction, which occurred after the rise of AI. In the fourth quarter of 2023, Dolingo's revenue was $151 million, a 45% year-on-year increase; net profit was $11.1 million, a turnaround from losses, with a 187% increase in net profit. This is the third consecutive quarter that Dolingo has achieved profitability. Its ability to stand firm in the education app rankings is largely not dependent on AI but more on years of market accumulation.

Dolingo CEO Luis von Ahn has stated that AI education should focus more on the development of application layers and C-end user experience. Let AI become the "door opener" for education, rather than letting education companies get lost in the halo of technology, neglecting the product itself because of model competition.

Indeed, AI technology has brought unprecedented opportunities for products going overseas, but the focus of product development is still on the product itself, rather than simply adding "AI." In a homogenized large model market, the key to successful overseas expansion lies in how to leverage AI technology to create good products. The rise of Gauth has already sent a positive signal to the market and demonstrated what an AI product should look like: integrating into application scenarios and returning to user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。