At XT.COM Finance, safeguarding user funds is the top priority.

Maximizing returns is the ultimate goal for all players in the cryptocurrency market. Some investors like to trade frequently, attempting to gain higher returns through short-term fluctuations, but ultimately end up selling off their chips and significantly reducing their returns.

An effective strategy in a bull market is actually to hold onto assets and wait for them to appreciate, setting a target price and reducing the frequency of trading. During the long waiting process, players can earn additional static income through various financial products.

Currently, both centralized and decentralized platforms have launched corresponding cryptocurrency financial products, but there are also many pitfalls that have caused significant losses for investors. Therefore, it is best for users to choose platforms with large scale, high security, wide brand recognition, and a variety of financial products and yields, such as Binance, OKX, and XT.COM.

Finance link: https://www.xt.com/en/finance/simple-earn

I. Fund security is the top priority

"You pursue its returns, it pursues your principal." Many investors often joke about this, conveying concerns about the security of financial products. Especially after the high-yield fund-raising explosion at FTX in 2022, investors seem to have developed a stress response to financial management.

However, accidents like FTX's are just isolated cases that cannot be completely avoided in any market, and the demand for cryptocurrency financial products has always existed. According to datos.com statistics, the global cryptocurrency financial market had reached $292 billion as early as 2021, with an annual growth rate of 20%.

"Prevention is better than cure. In the context of continuous growth in demand, cryptocurrency financial products should pay more attention to the security protection on the supply side, ensuring the safety of users' assets and reducing or even eliminating various systemic risks faced by users," said Albin Warin, CEO of XT.COM. He emphasized that the focus on risk reduction needs to be addressed from both subjective and objective perspectives.

Subjectively, it is necessary to establish a user-centric philosophy. "At XT.COM Finance, we prioritize safeguarding user funds as the top priority." This cannot be achieved without the support of a professional asset management team.

Taking XT.COM Finance as an example, team members are all graduates of world-renowned universities (Stanford University, National University of Singapore, Tsinghua University, and Carnegie Mellon University), and have rich work experience in Web3 exchanges, traditional private equity firms, and the internet industry, making it one of the largest digital currency capital management teams in the industry. They focus on quantitative development and asset management in the digital currency market, providing users with customized and comprehensive strategies, including spot-futures arbitrage, CTA trend/reverse, CeFi-DeFi on-chain hedging, and AI high-frequency quantitative strategies.

XT Finance mainly consists of two types of financial products: zero-risk and high-yield financial products.

Zero-risk finance: current finance, fixed-term finance.

The income from current/fixed-term finance in XT Finance comes from the cryptocurrency lending market. The income for financial users is the interest paid by borrowers in the lending market. Each borrower needs to pledge a certain amount of digital assets at a certain collateralization ratio to borrow, and then pay interest to the lender.

Therefore, purchasing zero-risk financial products ensures the principal, with zero risk and stable returns. XT Finance ensures dedicated use of funds, records of every lending fund, and a sound collateralized lending risk control system to ensure that financial users enjoy stable returns with zero risk.

High-yield finance: VIP exclusive finance, wealth management.

For users who prefer high returns, XT Finance also offers corresponding financial products. Unlike the income from regular financial products, the income from VIP exclusive finance and wealth management products comes from quantitative strategy returns.

Quantitative returns are higher, and they are jointly safeguarded by the excellent XT strategy team and more than 50 cooperative partners. After 5 years of research and technological accumulation, they also ensure the safety of users' principal and basic return rates. Based on this, they pursue higher returns as market conditions change.

Objectively, it is necessary to establish a professional risk control management mechanism, from selecting high-quality assets, risk monitoring, to multi-strategy risk hedging, to achieve transparent financial processes and controllable risks. In this regard, XT.COM Finance has long established a comprehensive professional risk control system that has been tested in the market for 5 years. Specifically, it includes the following steps:

Carefully select trading assets: Only select highly liquid and well-structured cryptocurrency assets to avoid severe fluctuations and market manipulation.

Strict position control: Control the position of each strategy below a specific threshold to avoid excessive fluctuations in profitability due to rapid market changes.

Comprehensive hedging: All positions are fully hedged, unaffected by macro market or cryptocurrency price changes.

Low leverage: Leverage is controlled to be below 2 times, or non-leveraged hedging strategies are used, with real-time monitoring of margin ratios and MMR to strictly control liquidation risks.

Taking the "VIP Exclusive Finance" provided by XT as an example, users' assets are held on the XT.COM platform, but the asset management strategy is provided by 50 top global suppliers, all of whom have undergone rigorous screening processes by XT platform and have a successful record of more than 2 years of long-term cooperation and risk verification. According to the official website, the yield range of BTC exclusive finance is 7%-18%, which is also the highest in the industry for BTC financial products.

"Asset risk management may sound simple, but we have also encountered many pitfalls behind it. In this regard, we can say that we are more forward-looking and have taken a big step ahead compared to other competing products," Albin Warin shared XT.COM Finance's past experiences and hardships. "For a simple comparison, the 2022 FTX explosion had a wide impact, and many so-called big-name financial platforms were affected or even bankrupted, but XT.COM Finance has been able to stand alone. Doesn't this prove the completeness and maturity of our system?"

II. Industry-leading yield rates

Security is the primary prerequisite for user selection, and while safeguarding the principal, users have never stopped pursuing high yield rates.

Currently, with the market heating up again, some users are choosing decentralized financial products. These products are characterized by high transparency, but the entry barriers are high, especially those based on the Ethereum mainnet, with high gas fees, usually costing tens of dollars in fees, which discourages ordinary retail investors. These products also have significant issues, such as uneven returns, large differences in returns between different protocols, some even reaching more than tenfold. In addition, ordinary retail investors are susceptible to phishing attacks and asset losses when interacting with these financial products, and sometimes the project party actively rugs. In summary, DeFi finance is like a dark forest and is not suitable for ordinary users.

The emergence of centralized financial platforms represented by XT.COM Finance has effectively bridged the gap in the market and met the financial needs of ordinary users. Users can participate with zero threshold and without any fees, greatly facilitating user participation. In addition, the diversification of financial income sources has also become an important guarantee. "The income from our (XT.COM Finance) financial products comes from stable lending markets and certified on-chain node returns," said Albin Warin.

For example, after users deposit stablecoin assets into XT.COM Finance, a professional asset management team will invest the assets in on-chain protocols for interest. At this point, the asset management team will select the protocol with the highest, most stable, and safest yield in the entire DeFi lending market, and technical personnel will also review the relevant protocol code to prevent vulnerabilities. All the complex work is left to professionals, and users only need to click a button to transfer assets in and out at the appropriate time to seamlessly earn returns.

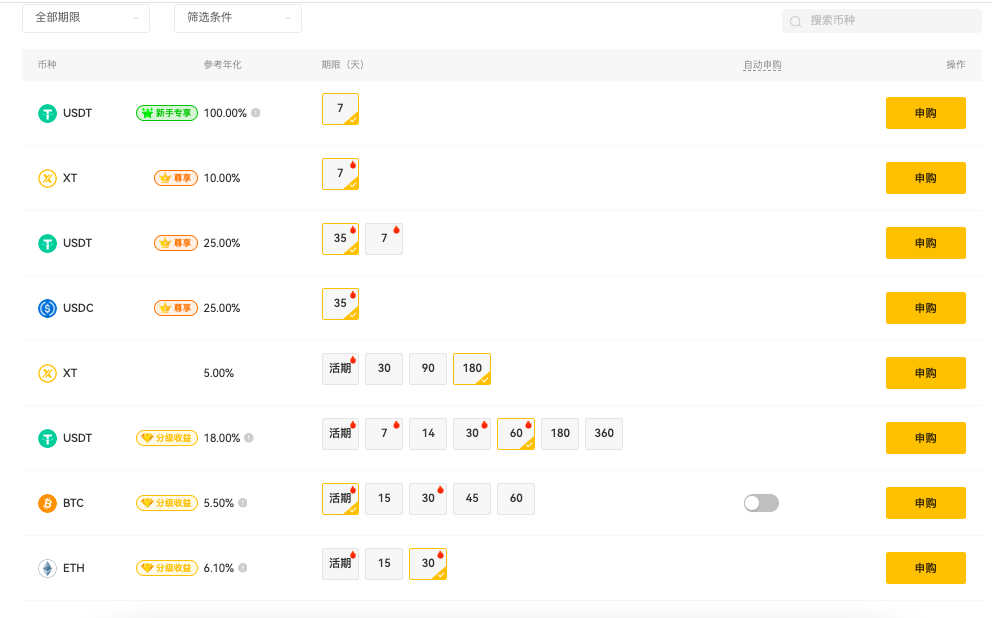

Under this combination of measures, the returns of XT.COM Finance have also become industry leaders. For example, with USDT, users can choose current finance (withdraw at any time), fixed-term finance (with higher returns), and VIP exclusive finance, with annualized returns fluctuating between 15% and 40%; even if the market experiences a downturn, as long as the market trading volume is high, the team can still ensure that users' financial returns will not significantly shrink through low-risk arbitrage strategies. In comparison, the current annualized returns for USDT in Binance and OKX are only 6%, far lower than XT.COM Finance.

(Partial financial tokens)

In addition to traditional financial methods such as direct deposits and loans, XT.COM Finance also focuses on providing Staking financial services. Currently, some POS networks support participants to maintain and make decisions on the network by staking tokens and provide token rewards. However, there are significant barriers: users need reward nodes, rent servers, and need to stake a certain amount—especially ETH staking starts at 32, which blocks the vast majority of users.

But through XT.COM Finance, users are spared from various troubles, without the need to set up nodes or safeguard keys themselves. They only need to hold a small amount of tokens to participate in staking services, without high token staking requirements. XT Staking maximizes on-chain returns for users, eliminates intermediaries from profiting from the spread, and only uses on-chain official or recognized blockchain staking nodes, or self-built nodes. This is to provide users with the most direct, secure, and pure on-chain node returns.

"By staking through our platform, the on-chain network returns are directly given to staking users, with zero intermediary fees, maximizing returns for XT users," said Albin Warin. Currently, the staking yields provided by XT.COM Finance are industry-leading— as of April 10, 2024, the annualized staking rate for ETH is 4.1%, AVAX staking yield is 7.01%, and SOL staking yield is 7%. XT Staking service: https://www.xt.com/en/finance/staking

III. Rich variety, diverse choices

In the financial arena, XT continues to innovate and launch a variety of financial products, including financial products, structured finance, staking mining, wealth management, cloud mining, and lending markets.

In the words of Albin Warin, "Whether you are a conservative investor seeking stable returns or an aggressive investor willing to take on additional risks for higher returns, XT Finance has the right products for you. Whether you are a novice in cryptocurrency or a seasoned investor, XT Finance can make your investment journey easy and enjoyable."

Here, the focus is on the pioneering structured product "Shark Fin" in XT.COM Finance, which has also been imitated by other trading platforms. Shark Fin finance is a structured financial product with a guaranteed minimum return and high floating returns, with three highlights: guaranteed principal; industry-leading guaranteed return rate; and the ability to pursue greater floating returns when the market is good.

The income behind Shark Fin comes from a financial product highly integrated with the options market, with a simple investment method. The guaranteed return rate is 7%, and if the market fluctuates upwards, it can also generate very high floating returns— with a floating return rate of up to 12% or more. By accurately judging the price fluctuation range, it can create returns far higher than the market average, suitable for conservative investors who prefer low-risk investments.

Another structured financial product, "Dual Currency Finance," is also an important option for many cryptocurrency players. Dual Currency Finance is a structured financial product involving two cryptocurrencies in the options market, with a high yield rate. Users subscribe to the product based on the investment currency, settlement currency, yield rate, subscription amount, target price, and settlement date. When the settlement date arrives, the final return and settlement currency will be determined by the settlement price and reference price. Dual Currency Finance is divided into "low buy" and "high sell" product types, helping investors ignore short-term market fluctuations and ensuring they earn the highest floating return rate across the network.

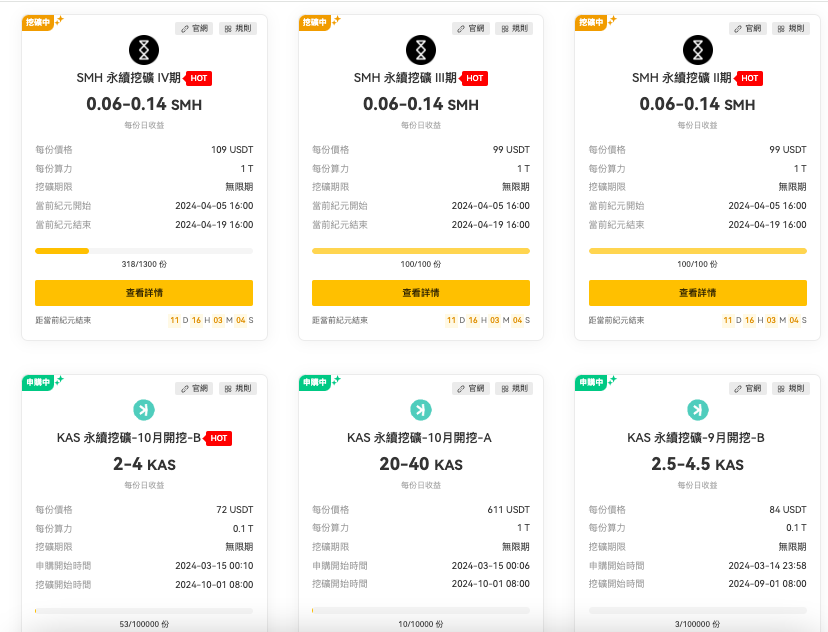

Finally, it is worth mentioning the latest cloud mining products launched on the platform—KAS perpetual mining futures and SMH perpetual mining. In simple terms, users can participate in mining small coins without having to purchase mining machines, find cheap electricity prices, or handle various logistical tasks.

Moreover, through XT cloud mining (such as KAS cloud mining), it is 20%-60% cheaper than directly purchasing mining machines on the market. At the same time, the electricity cost is very competitive compared to the industry average. Users only need to invest once to mine permanently. After the breakeven period, there will still be profit output, without worrying about the depreciation of mining machines.

Interested friends can click on the official website for details: https://www.xtcore.plus/zh-HK/finance/cloud-mining.

Now, inviting friends to subscribe to cloud mining can also enjoy a 10% commission reward.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。