Author: Azuma, Odaily Planet Daily

On the evening of April 8th, Beijing time, Solana's leading NFT trading platform, Tensor, officially launched its governance token TNSR.

On the first day of TGE, TNSR successively landed on mainstream exchanges such as Binance, OKX, Coinbase, and others. According to OKX, TNSR reached a peak of 2.6 USDT after its launch, and as of the time of writing, it is temporarily reported at 1.72 USDT.

Solana's version of Blur?

The official launch of Tensor can be traced back to July 2022.

In March 2023, Tensor completed a $3 million financing round, led by Placeholder, with participation from Solana Ventures, Alliance DAO, Big Brain Holdings, and two co-founders of Solana, Anatoly Yakovenko and Raj Gokal.

In the same month, Tensor successively launched three rounds (Seasons 1, 2, 3) of incentive activities. First, in Season 1, it distributed "treasure chest" rewards with airdrop expectations to all active NFT traders in the Solana ecosystem. Then, in Seasons 2 and 3, it provided the same "treasure chest" incentives to users who quoted, listed, and provided liquidity on the Tensor platform.

Clearly, this approach largely imitates similar projects in the Ethereum ecosystem, such as Blur. Tensor does not shy away from this fact. In an interview with Tech Crunch, Tensor's co-founder Ilja Moisejevs stated, "We and Blur are two similar but different platforms."

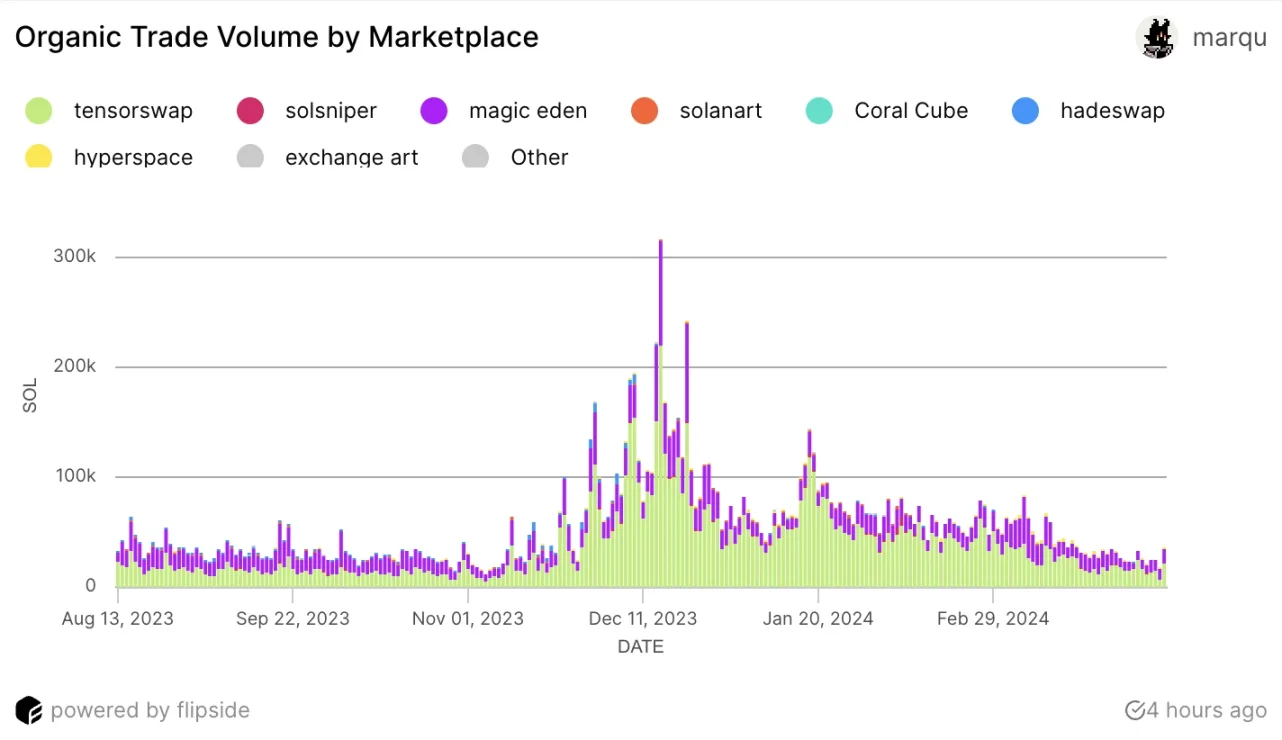

Just as Blur gradually eroded the market share of OpenSea in the Ethereum ecosystem, Tensor has also achieved a later-stage increase in trading volume within the Solana ecosystem. Flipside data shows that Tensor is now the largest NFT market in the Solana ecosystem, even holding 70% of the market share in the ecosystem for a long time.

A Brief Analysis of TNSR Token Economic Model

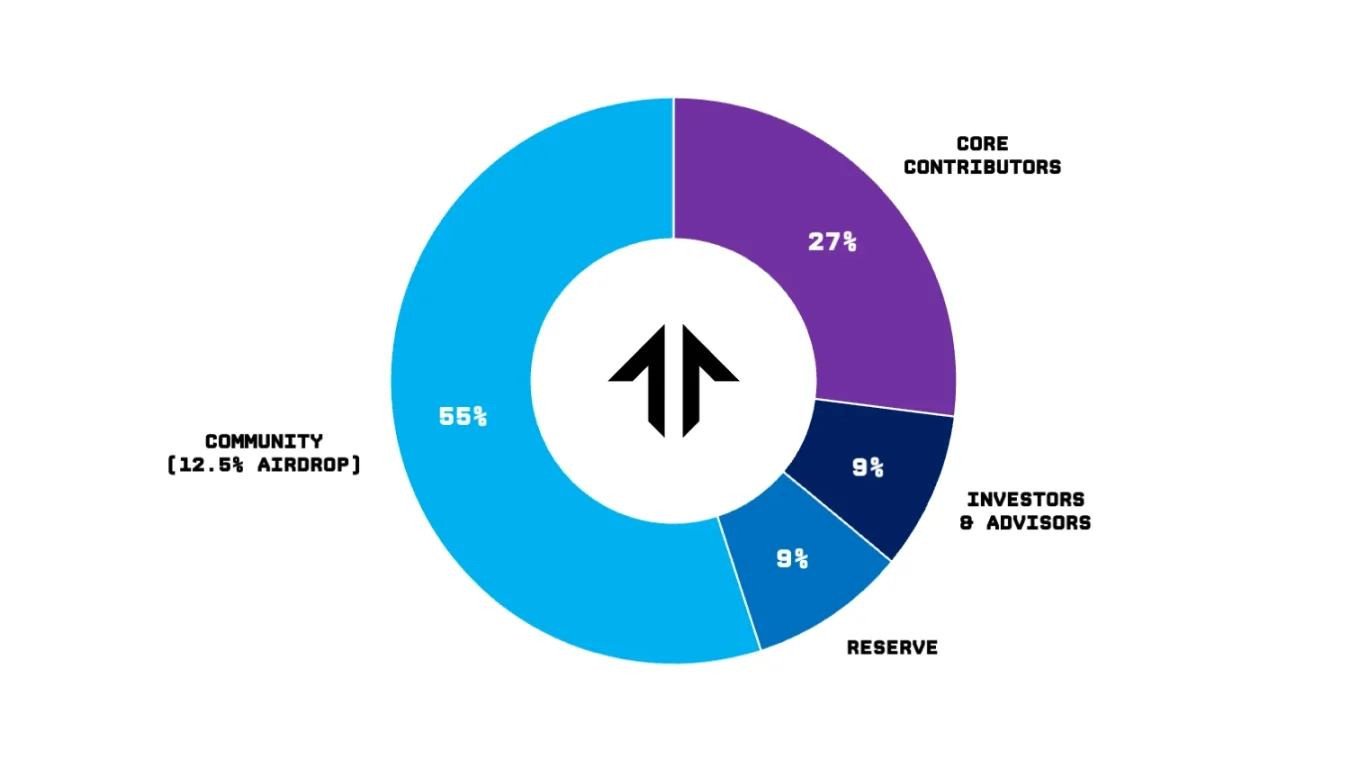

At the same time as TGE, Tensor also announced an overview of the TNSR token economic model. In short, the utility of TNSR is mainly for protocol governance. The total supply of the token is 1 billion, and the initial allocation is as follows:

- 550 million TNSR (55%) allocated to the community, with 12.5% for the initial airdrop, and the remaining 42.5% for incentive programs, liquidity supply, and activities beneficial to the Tensor ecosystem.

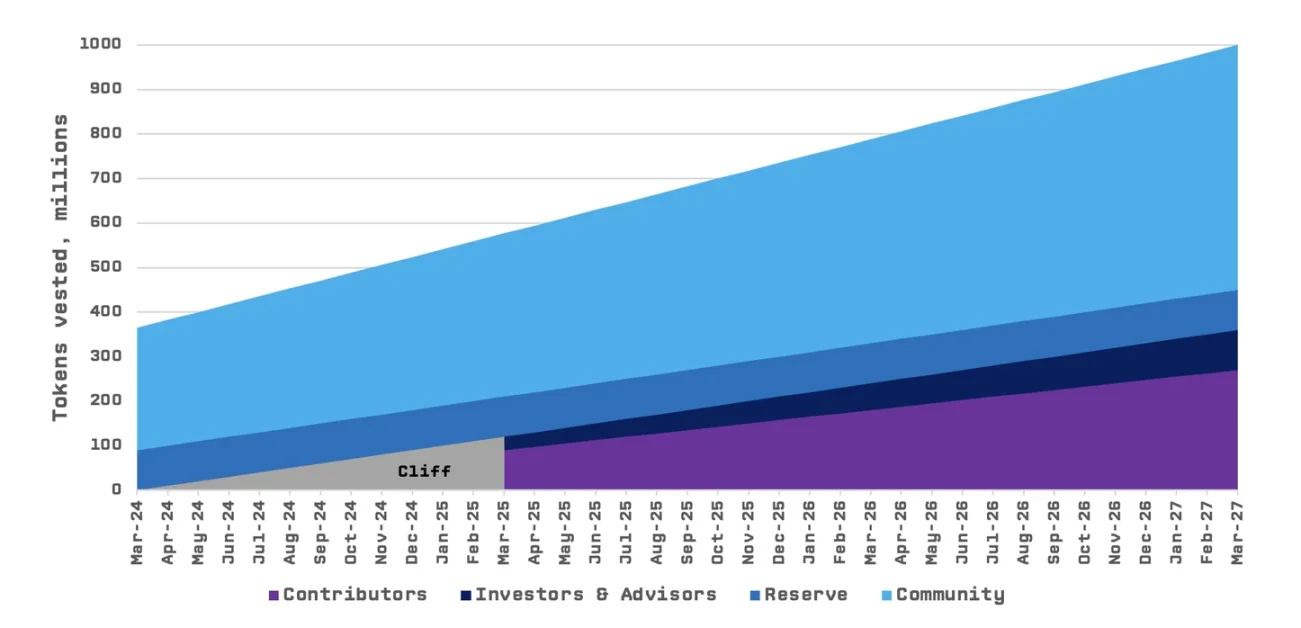

- 270 million TNSR (27%) allocated to core contributors, with this portion being locked for one year and then released linearly over the next three years.

- 90 million TNSR (9%) allocated to investors and advisors, with this portion being locked for one year and then released linearly over the next three years.

- 90 million TNSR (9%) reserved for future fundraising and development.

Odaily Note: TNSR allocation overview

Odaily Note: TNSR allocation overview

Odaily Note: TNSR unlocking and circulation situation

Odaily Note: TNSR unlocking and circulation situation

Regarding the specific design of the airdrop, Tensor did not provide much information, only mentioning that "users who help develop the Tensor protocol and holders of Tensorians are eligible for the airdrop," and "the amount of airdrop that users can receive is directly proportional to their use of the Tensor protocol in Seasons 1, 2, 3."

During the 180 days of the airdrop, eligible addresses can apply for the airdrop rewards at any time on the Tensor Foundation's official website. According to community feedback, the minimum airdrop from Tensor this time will be 420 TNSR, which means even small holders will have at least a few hundred dollars in substantial income.

Can TNSR continue the wealth creation miracle?

With the rising popularity of the Solana ecosystem and the high market expectations for projects within this ecosystem, several leading Solana ecosystem projects that have launched coins in the past few months have achieved excellent secondary market performance.

Among them, Jito (JTO) in the LSD track and Jupiter (JUP) in the DeFi track, although still have a certain gap in terms of fully diluted valuation (FDV) compared to leading projects in the Ethereum ecosystem, have both surpassed in FDV. The specific comparison is as follows:

Odaily Note: TNSR's MC data is from Coinmarketcap, and other data is from CoinGecko.

Odaily Note: TNSR's MC data is from Coinmarketcap, and other data is from CoinGecko.

As shown in the above figure, as another leading project in the Solana ecosystem, TNSR's opening performance has basically continued the trend of "relatively low MC and relatively high FDV" seen in JTO and JUP. If we apply the convention of "FDV can surpass leading projects in Ethereum" to JTO and JUP, it seems that TNSR still has some upward potential.

It should be emphasized that this should not be seen as an investment basis. Firstly, because this convention does not have a clear logical support, and secondly, because NFTs are not the current narrative hot spot, which also makes the future trend of TNSR more uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。