Author: Ash

Translation: Deep Tide TechFlow

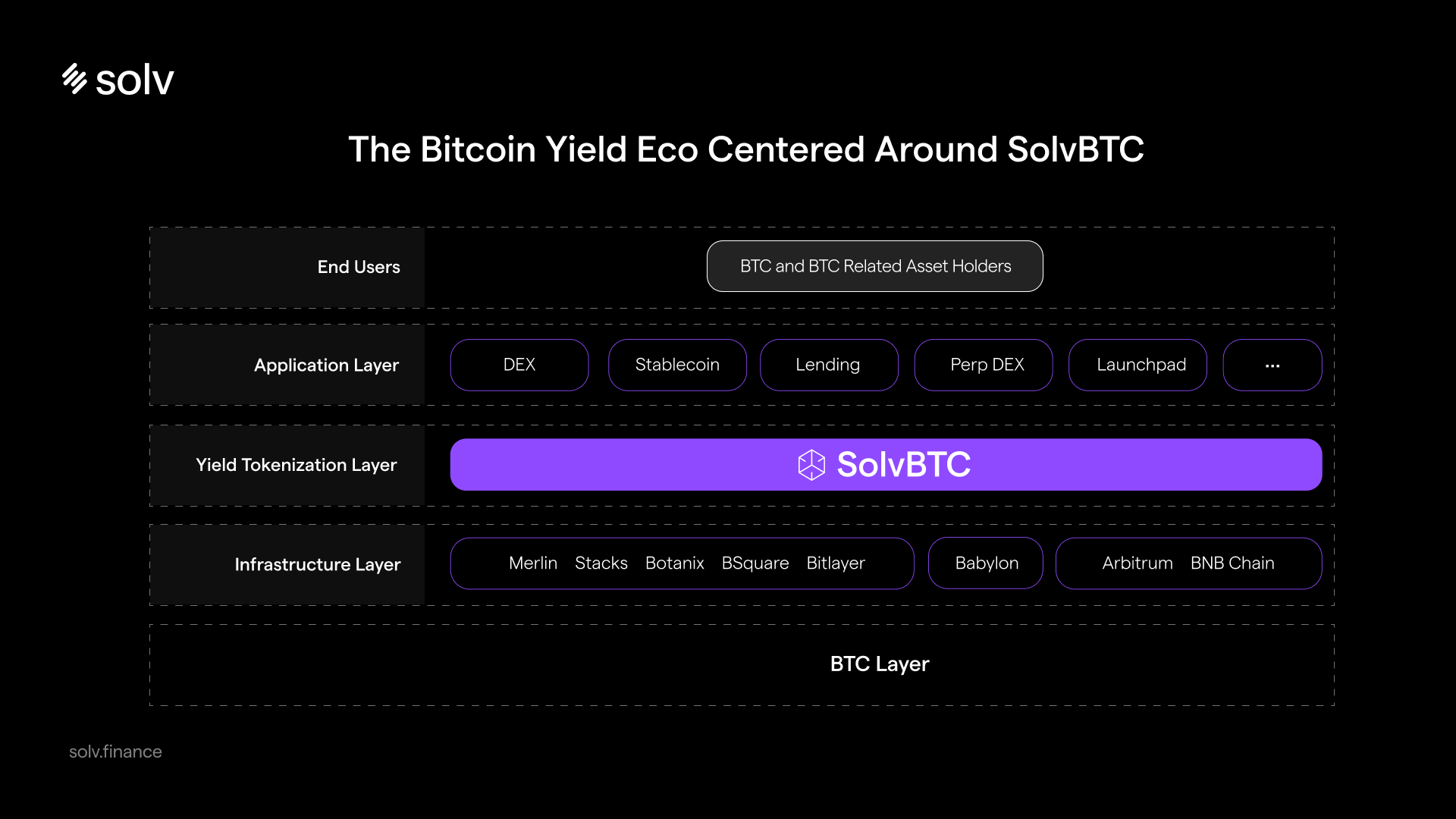

Since BRC-20 and Ordinals, I have been optimistic about the latest developments of Bitcoin in increasing practicality, rather than just as a store of value. For me, considering the scale of asset categories and the nascent nature of on-chain DeFi/NFT, it makes sense to continue to push the frontier of BTC development. Solv Protocol aligns with my overall bullish narrative in this field, as they recently launched SolvBTC: the first BTC to generate yield in history.

Key points:

- Most bitcoins remain idle because there are limited reasons for holders to transfer and utilize their bitcoin value.

- SolvBTC is the first yield-generating BTC while maintaining spot exposure.

- Yield is generated through three strategies: staking, restaking, and trading strategy yield.

- SolvBTC will be integrated across various chains and dApps, with the Solv protocol serving as a unified liquidity gateway.

Yield Generation Strategies

SolvBTC will capture Staking yield from BTC Layer2, Restaking yield, and DeFi yield from ETH Layer2, seamlessly integrating various protocol applications to provide abundant yield opportunities for bitcoin holders.

SolvBTC yield will be generated through three strategies:

- Staking yield from BTC Layer2 such as Merlin Chain, Stacks, Botanix, Bsquare, Bitlayer, etc.;

- Restaking yield from networks like Babylon;

- Trading strategy yield from Layer2 networks such as Arbitrum and BNB Chain.

I personally enjoy trying various strategies to ensure risk diversification and the best return for users.

The Advisory Committee (comprised of internal members and key external partners) will also act as a counterbalance, providing guidance to ensure transparent and trustworthy strategies.

Next Steps

Market launch and expansion of the BTCFi ecosystem

SolvBTC has been launched on Arbitrum and Merlin Chain. Currently, the Solv platform's BTC management volume has exceeded 2700 BTC, with a total TVL of over 260 million USD.

So far, other treasuries of SolvBTC have generated over 7 million USD in revenue, and I am excited to see what this will bring to SolvBTC. Furthermore, given that SolvBTC shares the same characteristics as ERC20, it can be integrated into various dApps and chains, thereby increasing liquidity and serving as a multi-chain BTCFi Lego block.

Points System

The Solv team announced that the points system will launch on April 5th, potentially rewarding early adopters of SolvBTC (Hint: the token has not yet been launched).

Funding Status

The team has raised a substantial amount of funds from investors such as Binance Labs and Laser Digital, conducting a total of 4 rounds of financing, raising a total of 11 million USD, including undisclosed strategic investment from Binance Labs.

Getting Started

For those interested, feel free to click here to start earning BTC yield.

Related Links

Twitter: https://twitter.com/SolvProtocol

Website: https://app.solv.finance/points/FCN884

Documentation: https://docs.solv.finance/solv-documentation/getting-started/overview

DeFi Llama: https://defillama.com/protocol/solv-protocol

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。