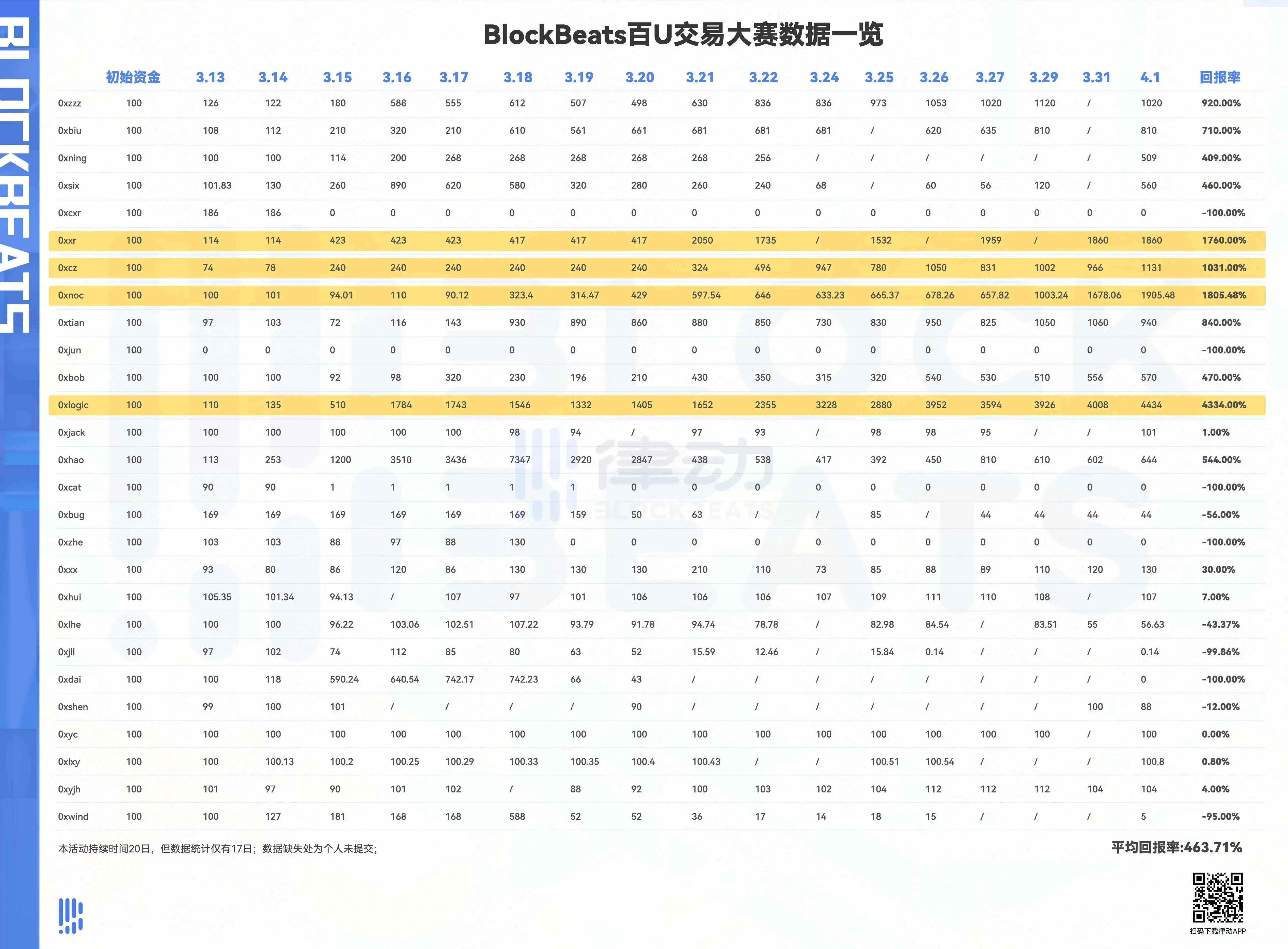

20 天最高 43 倍,平均回报率 463%。

撰文:Kaori

牛市里如果免费给你 100U,你会买什么?

三月的某天,工作群里传出一张「嘲讽」律动小编没多少钱的截图(是的老板,确实没钱),便有了律动的第一届百 U 交易大赛,本打工人斗胆问了一句图中的话,怀着愉悦的心情报名了此次交易大赛。

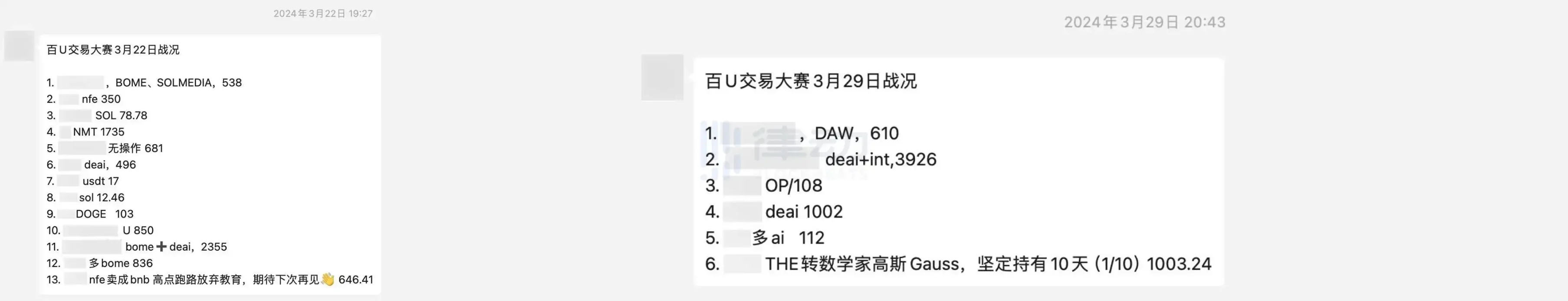

牛市里最不缺的就是焦虑,百 U 战神、喊单老师们只晒收益率不说仓位的行为令人深恶痛绝,但这次百 U 交易比赛,老板要求全程跟踪报道,不得弄虚作假,持续 20 天便有了这一篇或许会稍微缓解一些你的焦虑的文章。下图是本次比赛结果的总数据,有 4 人有超 10 倍以上的收益,占比超 50% 的人是负收益,但平均回报率达到了 463%。

市场的神奇之处在于,就算给一群人相同的起点,但每个人还是会拿到不同的剧本。有人第一天就爆仓归零,有人稳扎稳打靠现货跑赢全场。拿着这免费得来的 100U,很多人的第一个念头是拿着不动,因为这样很有可能跑赢大部分人取得胜利,显然结局不是如此;也有一些人的第一个念头是开合约,一天十倍,三周逆风翻盘,但合约党不是这场比赛的最大赢家。

Meme 狂潮正当时

交易比赛刚开始的那段时间,大盘持续下跌,但整个市场都沉浸在 meme 的氛围中。

0xcxr 在第一天靠合约交易排名第一,但转头迎来爆仓龟苓膏,这位选手最惨的是倒在 meme 狂潮来袭之前。3 月 14 日,交易大赛第二天,BOME 横空出世。0xlogic(也是本次比赛的战神)最早在群里发布了 BOME 的合约,随后,BOME 在大盘震荡的行情中从籍籍无名的 meme 摇身蜕变为上线 Binance 的正规军,三天走完一个项目的终局。

很多选手赶上了这一波,让投资回报开始出现差距。问及 0xcxr 为什么没有在 3 月 14 日将合约里的钱提取出来买 BOME,得到的答案是嫌麻烦,「meme 总是一阵一阵的,把握不住」,第二天整个市场再次震荡下跌时,0xcxr 的合约却迎来爆仓。但也是在这一天,0xhao 靠着在公布当天战绩之前买入 BOME 获得了超 250% 的回报。

BOME 持续发力,部分选手的资产更是较初始资金翻了 35 倍。在当时预售打款的热潮下,Slerf 又以十分 drama 的开局方式迎来了 meme 第二波高潮,让一些群友再次致富。

但 0xlogic 却没有买 SLERF,「我觉得这叙事不咋地,BOME 永远只有一个,这个项目存在法律争议,注定上不了 tier 1」,只认龙头的他没有选择将 BOME 获利资金转入 SLERF。与此同时,3 月 18 日晚间,0xhao 的资产因为 SLERF 已经涨至最高 8000u,群友顶礼膜拜。

「价值币都是想象的价值,有意思才是核心,比特币本身就是 meme,所谓价值币都是自己赚钱了开始吹牛逼」,0xhao 对于 meme 的理解不同于 0xlogic,0xlogic 坚定持有 BOME 直至其寻找到下一个 Alpha 标的,但 0xhao 换仓买入 SLERF 后又接连冲了其它 meme 币。

不幸的是其资产在这个阶段遭遇了大幅回撤,「能在几天之内 80 倍肯定不是交易技术上有什么优势,完全是市场牛逼和好运气。8000 刀跌回 600 才是交易技巧的完美展现」,0xhao 回顾那几天的心路历程,说道「高吸低抛几次才知道自己心态这么差劲」。

但他选择拥抱 meme 并不后悔,为什么这轮牛市都喜欢玩 meme?为什么 meme 会这么火爆?事实就是因为玩 meme 才会暴富。在这个观点的基础上,0xhao 坦言「庆幸这仅是 8000 刀,而不是更大的仓位,心理素质一直是我的短板,上一波牛市有几笔操作都是因为心态导致动作变形。」

敬畏市场,是拿到剧本的人必须遵守的准则。但每个人又面临着不同的抉择,0xlogic 的选择是只拿龙头,「我的习惯是在底部建仓后就一动不动,从不波段。当然遇到特别牛逼的项目,比如 BOME,也可以在走势符合期待的情况下持续加仓」。BOME 并没有出现如同 SLERF 那般大起大落的盘面,因此 0xlogic 的仓位受影响较小。

随着 meme 币告一段落,0xlogic 将目光转向了 AI 赛道,DEAI 便是其在 BOME 之后选择的「一动不动」标的。也正是因为 DEAI 让其余额稳步攀升,直到交易比赛结束 0xlogic 获得冠军。不管是 meme 还是价值币,「等待」+「拿住」是其获胜的法门。

「如果我开了合约」

流传在社交平台中的交易心路有各种不同的风格,不过总会都有一条「不要碰合约」。

而看到代币价格的走势曲线,很难有人不会去设想「如果我在这里开了合约...」,这次,免费拥有的百 U 可以让这个「如果」成真了。

不必等待未知的 meme,0xdai 选择了合约,将命运掌握在自己手里。交易大赛开始之前,0xdai 已经对 WLD 观察许久,并有了几次成功下场的经验。百 U 基金给 0xdai 了高倍勇气,在 WLD 出现一周震荡下跌行情中,0xdai 通过 75 倍合约波段多空 WLD,让她的百 U 基金在 4 天时间里翻了 7 倍。

meme 不常有,而波动恒有,合约让 0xdai 从最多 20% 的涨幅里吃到了超 700% 的收益。如果说最初选择合约而非 meme 还有一层对 gas 费的心疼,这次精准多空 WLD 让 0xdai 对合约技术的信心极大增长,回头来看,似乎每一步都了然于胸。

0xdai 见好就收,休息一天后,瞄准了大饼比特币。

按 0xdai 的分析,大饼的波动预测要比山寨币来的更可靠一些。毕竟牛市之下,无论多少跌幅都是「回调」。「我想着 BTC 涨这么好,说不定可以结束短频快操作,来个长期收益」,于是在 0xdai 选择在 66,000 美元处开多比特币,而比特币当日跌破 63,000 美元,10% 的跌幅一把结束了 0xdai 的合约梦。「我的感受就是,大风刮来的钱被大风刮走了。」

频现神仙操作、最终一朝归零,0xdai 的故事是许多玩合约人常有的经历。不过,在本次交易大赛中,也有几个在合约中全身而退的选手,演绎了「合约赚钱靠运气,守住盈利靠能力」的合约交易经验。

之前几乎不碰合约的 0xcz,拿到 100U 后选择「直接开空比特币」,「我赢了就赢麻,输了就当给你们助兴了」。

0xcz 是唯一一个只对 BTC 进行合约交易操作的人。0xcz 的比特币空单埋伏成功后,尽管市场上对比特币回调预期仍在,他却在翻倍后选择止盈。平仓合约后,比特币连续下跌两日,他也没有再次入场。操作合约的人总会设想,如果当时拿住将会如何如何,但 0xcz 想得很清楚,「我觉得那个盈利对我来说已经够了,只关心我的钱有没有增长」。

平仓之后几天里,0xcz 没有再进行任何操作。投资取向从 meme 转到 AI 的 0xlogic 在群里发布了一个 AI 项目 DEAI 正在进行 LBP 的消息,0xcz 选择用这些资金参与其中。然后就是平淡而幸福的时间了,踩中 AI 风口,这个项目的热度不错,一周过后,他的资金突破 1000 U。

能够守住合约盈利的,除了 0xcz 这样的谨慎知足派,还有 0xnoc 这样的灵活应变派。

合约 /meme/ 价值币?能赚就好

0xnoc,以 1905.48U 的成绩斩获本次交易比赛的第二名。常对于 0xnoc 来说,合约已经是他必备的交易策略,「不玩合约什么时候翻身啊兄弟」。最初,0xnoc 的 100U 跳转在不同代币的合约之间,但即使是选对了方向的合约策略,在做好风险控制的情况下,盈利情况还是难以比过爆发的 meme。

赛程过去 1/3,错过了 BOME 的 0xnoc 开始吐槽「费劲开什么合约呀」。随后 SLERF 出现在消息流中,0xnoc 迅速买入,并称「价值投资一场空!」SLERF 之后,0xnoc 的 100U 终于翻了三倍。

0xnoc 明白 SLERF 的增长预期不会超过 BOME,所以他并没有期望在 SLERF 上找回错过的遗憾,一日三倍止盈,0xnoc 又回到了合约上。

紧接着,meme 热度不在,大盘的不确定性愈发增加。「当土狗收入可以把本金翻到不错盈利的时候,就不能再乱冲了,该守江山了」。0xnoc 将资产全部换成了 BNB。而看 0xlogic 分享了新的「财富密码」时,0xnoc 又紧跟其上。捕捉讯息迅速入场、及时止盈转换目标,在换过数个标的后,他的百 U 三倍之后再得翻倍。

「百币丛中过」后,0xnoc 是少有几个资产稳定增长、没有大幅回落的选手之一。但快速止盈换战场也并不是 0xnoc 的真正交易法则,灵活与清醒才能成为赢家。「脑子里想到『买点这个行不行的时候』,手一定要开始操作,别犹豫」。

赛程尾声,0xnoc 也有了看好的标的,这次他选择拿久一些。

最后一行为 0xnoc 交易记录

结语

再次回到一开始的那个问题,如果免费给你 100U,你会怎么操作?

「加密领域不缺机会」,这是很多人都曾听过的话。但有人赚钱就有人亏钱,在 Web3 快速发展的几年里,从小本金走向财富自由的故事常有发生,高位跌落、一夜归零的案例也并不少见。黑暗森林里,如何才能把握风声?

在持续了不到一个月的交易比赛中,选手们的平均回报率超过 4 倍。当然,操作 100U 与操作 100 万 U 的心态大为不同,但不同本金的人都能在这些选手中找到自己的影子。乍看起来,短期内的高额回报依赖于选手各自的运气,但能够接住「风刮来的钱」、并将其越滚越大的人,其交易原则都有相似之处。

「与不确定性对赌」是每一笔交易都绕不过的考虑。这次涌现出的高倍盈利操作,大都是首先押中了共识聚集的热门板块,如 meme、AI 以及热门公链,并做好了仓位管理和心态建设,依据获得的信息选择及时止盈撤出或是钻石手拿住。

在资产增值的路上,有效信息和稳定的交易心态是比本金更加重要的动力。紧跟市场消息、把握资金流向,顺势而为。正如盈利 43 倍、获得本次交易大赛冠军的 0xlogic,在被问到心路历程时回答的那样,「居安修身以俟命」。做好能做的一切,然后等风来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。