Author: @Web3Mario

Data Links:

- EtherFi Participation Address Analysis on Thegraph: https://api.thegraph.com/subgraphs/name/web3mario/etherfiairdropanalyze

- Overall Airdrop Results for All Accounts: https://cf-ipfs.com/ipfs/QmP2tgnrAyUGwRs1o6B8YGzHmnecyZrVhY5QiFCESxUsBv

Introduction: In the previous article, the author discussed how Web3 oligarchs exploit users through Loyalty Points. In this article, we will choose a practical case to further demonstrate this point.

On March 18, 2024, the leader of the Restaking track, Ether.Fi, conducted the first TGE of its ETHFI token and carried out the first round of airdrops, bringing considerable wealth effects. As of the time of writing, the price of $ETHFI has reached $5.54, and the fully diluted market value has also reached $5.5 billion. This valuation is very considerable for an early-stage project whose core business has not yet been launched, and it also reflects investors' recognition of the project's vision.

However, many users have some complaints about the results of this round of airdrops. This is because for a long time, EtherFi's promotion focus and incentive mechanism have revolved around EtherFi Loyalty Points. Naturally, users would associate the amount of airdrops received with the accumulation of Points in the past. However, after the airdrop results were announced, many users found that there seemed to be no necessary relationship between the two. Many loyal users who had accumulated a significant amount of Points received rewards similar to some "shallow participants," and it was also discovered that many whales quickly acquired a large share of the airdrop allocation due to their financial advantage.

Therefore, the author spent some time conducting a detailed analysis of the project's design thinking in this round of EtherFi airdrop activities from a data perspective, aiming to identify the biggest beneficiaries of this round of airdrops. The hope is to help readers optimize their strategies for participating in similar airdrop competitions and to look ahead to the possible design direction of the rules for the second season of EtherFi airdrops and estimate the potential returns.

Review of the First Season Airdrop of EtherFi

First, let's review the official rules of the first season airdrop of EtherFi:

- EAP: You participated in the Early Adopter Program

- ether.fan: You are the holder of ether.fan NFT

- Solo Staker: You are an ether.fi Solo Staker

- eETH / weETH: You hold eETH or weETH

- DeFi rewards: You participated in the eETH or weETH DeFi pool or vault

- Badges: You unlocked one or more ether.fi badges

- Referrals: You invited one or more new users to participate in ether.fi

There is no direct mention of Loyalty Points in the description, and the specific calculation algorithm is not very clear. However, after our analysis of the full data, we can still find certain patterns.

We obtained all the addresses of users who participated between July 10, 2023, when EtherFi deployed the Liquidity Pool smart contract, and March 18, 2024, through TheGraph (TheGraph Query Link). After that, we used a Python web crawler to capture the airdrop situation for these addresses, and the results have been uploaded to IPFS. Interested friends can analyze it on their own. The analysis results are as follows:

- Total participating addresses: 82,102, of which 71,380 received airdrops.

- Among all users who received airdrops, the average Loyalty Points per user is 536,444, and the average ETHFI airdrop per user is 702.

- On average, each user needs to accumulate 755 Loyalty Points to receive 1 $ETHFI, with a Loyalty Point to $ETHFI conversion rate of 755 Loyalty Points / ETHFI.

- The Matthew effect of the project is very obvious. Among all users who received airdrops:

- The top 20% of users in terms of Loyalty Points received 94% of the total Loyalty Points and 77.5% of the total airdrop amount.

- The top 10% of users in terms of Loyalty Points received 87.8% of the total Loyalty Points and 72.2% of the total airdrop amount.

- The top 5% of users in terms of Loyalty Points received 79.2% of the total Loyalty Points and 65.6% of the total airdrop amount.

- The project's airdrop distribution mechanism is more favorable to "shallow participants" and "heavily loyal" users (usually whale users).

First, let's take a look at the distribution of Loyalty Points obtained by users. As shown in Figure 1, the horizontal axis represents the ranking of users by Loyalty Points, and the vertical axis represents the amount of Loyalty Points held by users. We can see that the average Loyalty Points obtained by each user is 536,444, but at this point, only the top 7,588 users can meet this standard. Compared to the 82,102 participants, this is a relatively small range, which means that whales hold a large amount of Loyalty Points.

Next, let's take a look at the distribution of the amount of airdrops received by users. As shown in Figure 2, the horizontal axis represents the ranking of users by Loyalty Points, and the vertical axis represents the amount of $ETHFI airdrops received by users. We can see that the average amount of airdrops received by each user is 636. At this point, approximately the top 6,500 users can meet this standard. Compared to the distribution of Loyalty Points, the distribution of airdrop amounts is more concentrated among users with higher rankings.

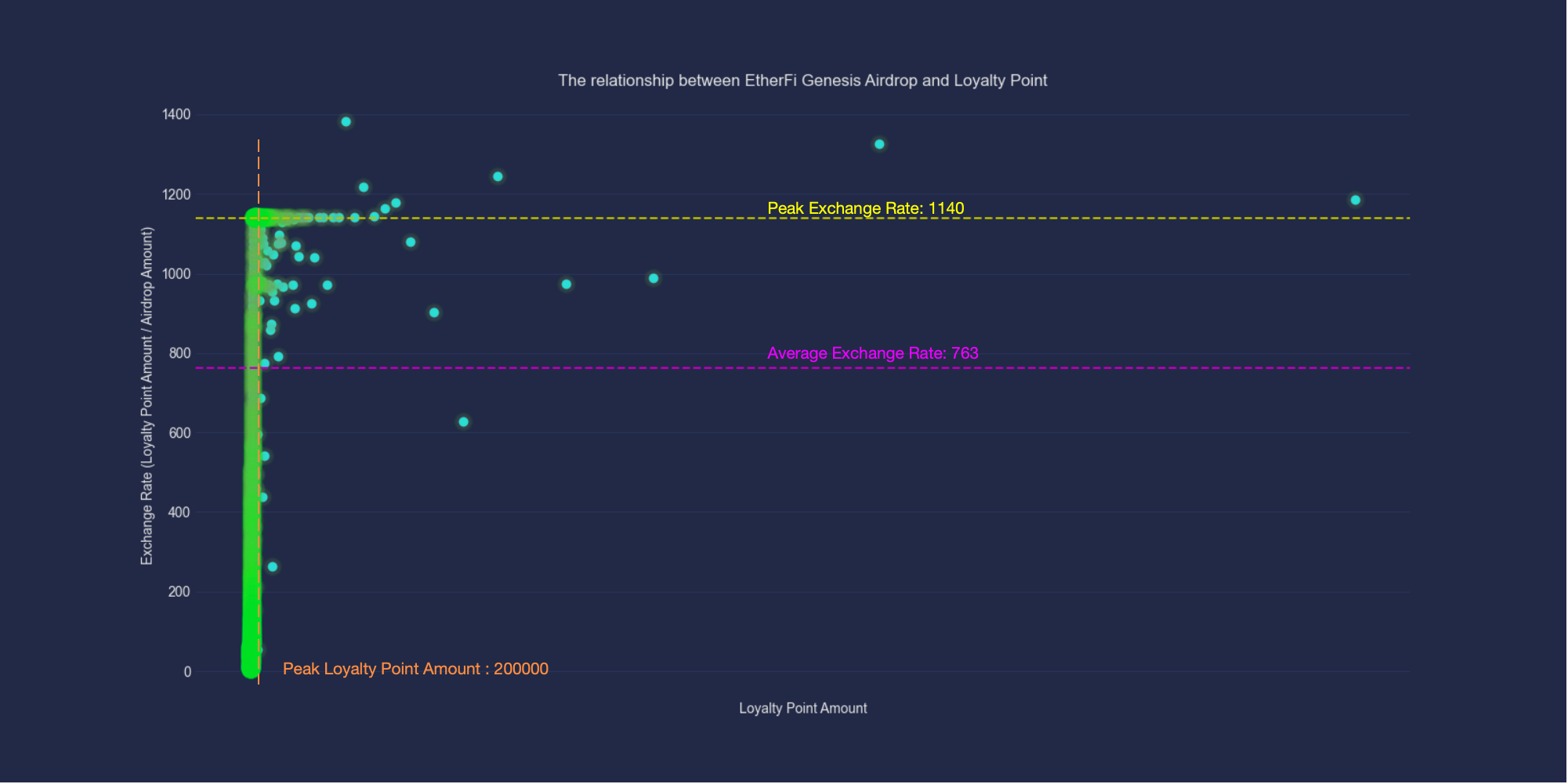

Finally, let's explore the scatter plot of users' Loyalty Points and the number of airdrops, as shown in Figure 3. The horizontal axis represents the amount of Loyalty Points held by users, and the vertical axis represents the user's $ETHFI airdrop conversion rate, i.e., how many Loyalty Points are required to receive 1 $ETHFI airdrop. We can observe that the relationship between Loyalty Points and the airdrop conversion rate exhibits an approximate segmented function. In the first segment of the function, the user's airdrop acquisition rate is roughly proportional to the Loyalty Points held. The more Loyalty Points held, the higher the corresponding airdrop conversion rate, indicating that it becomes more difficult to receive 1 $ETHFI airdrop for each additional Loyalty Point held. When a user's Loyalty Points exceed approximately 200,000, the entire segmented function enters the second segment. At this point, the user's airdrop conversion rate reaches a peak of approximately 1140, indicating that beyond this stage, holding more Loyalty Points does not further increase the difficulty of receiving airdrops, which is more favorable for whales.

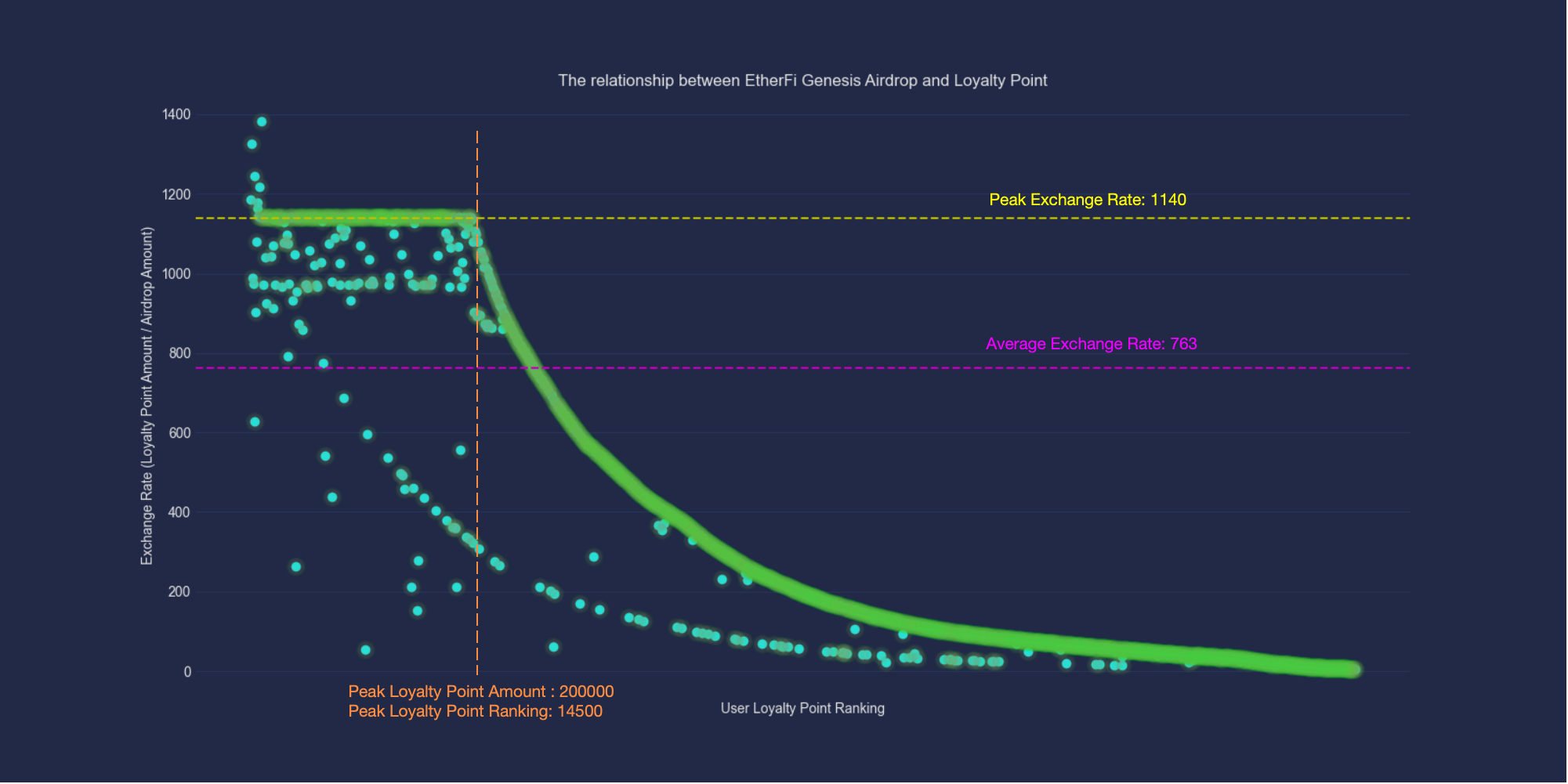

To better reflect this relationship, as shown in Figure 4, we have transformed the horizontal axis to represent the ranking of users by Loyalty Points. From left to right, the higher the user's ranking, the fewer Loyalty Points they hold. The vertical axis represents the user's $ETHFI airdrop conversion rate, and at this point, the relationship becomes more apparent. The segmented function reaches a critical point when a user's Loyalty Points ranking is around 14,500.

Looking Ahead to the Second Season Airdrop of EtherFi

Next, let's look ahead to the second season airdrop of EtherFi, which has already disclosed the relevant details of Season 2: StakeRank:

- StakeRank is a level system with 8 levels or "ranks"

- Users will advance 1 level for every 100 hours of staking ETH on ether.fi

- Each level has progressively higher loyalty point rate boosts

- Your staked balance needs to be above 0.1 eETH to continue ranking up

- Users who participated in the first season will start from Rank II

- The range of rank advancement is 1x - 2x (subject to change)

- Ether.Fan NFT holders are automatically upgraded to Rank III

- Each NFT holder is only eligible once

- In the transition to the second season, the protocol aims to recognize participants from the first season without disproportionately allocating the second season's airdrop to them. To achieve this goal, everyone's loyalty point accumulation rate will be increased by 10x. Although this will dilute the old points, they are still valid, but subject to the following conditions.

- All eETH and weETH, whether held or in DeFi positions, including Liquid, will be treated equally by StakeRank.

- If by the end of the second season, 70% of your total points come from your accumulated points in S1, then you are not eligible. However, the basic loyalty point rate in S2 will increase by 10x. Staking in S2 means that your new point balance should significantly exceed the amount collected in S1. This means that stakers from the first season have been recognized. The second season will recognize stakers who are active in the second season.

The overall plan is designed around the ranking of Loyalty Points, with different tiers and different boosting effects set for each level. The most important aspect is the guidance on the final realization of the second season's airdrop, which significantly dilutes the impact of previously accumulated Points on the final airdrop. This means that users who have accumulated a significant amount of Points will have a greatly reduced advantage in the Season 2 airdrop, and loyal users will have to start over. More importantly, EtherFi has chosen to use relatively vague descriptions to indicate the relationship between the final airdrop amount and Loyalty Points. This introduces a significant amount of uncertainty. Considering that in the design of the first season's airdrop, the team seemed to favor shallow participants and whale users, this seems to provide some guidance for user participation in the second season's airdrop activities. But don't forget, the first season's airdrop has already distributed 6% of the total issuance of ETHFI, and only 5% of the airdrop total remains for the second season.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。