Author: FreeLabs

In the current Web3 era dominated by decentralization, the demand for decentralization and transparency is increasing. Decentralized finance (DeFi) has attracted the attention of many cryptocurrency advocates, including investment institutions, Web3 entrepreneurs, and experienced entrepreneurs and users from Web2. This has further accelerated the influx of funds and market talent. As decentralized applications cover more areas, the permanent storage of data on the chain and the transparency of open-source underlying technology, as well as the governance of economic models and protocols, have further matured and prospered the market. The DeFi sector, as the holy grail and perpetual motion machine of the industry, maximizes the circulation and returns of financial funds. The core operation mode of DeFi is its healthy economic model and reasonable equity governance, which involves the utility, returns, equity, governance, and value expiration of tokens. The most reasonable and healthy for decentralization and economic models is the combination of returns and governance. To address the governance and returns issues, Ve (custodial governance) has emerged, helping to promote the development of the new era of Web3 and decentralization. Let's analyze the practicality and potential of Ve custodial governance together!

I. What is Ve (Custodial Governance)

Ve voting custody is an economic model that integrates transaction fees (returns) and governance rights. The model was proposed by Curve Finance. Its core is a protocol that locks tokens for a predetermined period to obtain veTokens as a reward. The obtained veTokens cannot be circulated or traded. For example, $CRV holders can lock $CRV for a certain period to obtain veCRV. The lock-up period can range from 1 week to 4 years. The longer the lock-up period, the greater the reward. At the same time, the more veTokens obtained, the more voting rights (corresponding to the proportion of locked tokens). During the lock-up period, the locked tokens cannot be traded, and the tokens are linearly released during the lock-up period until the end of the lock-up period, at which point the custodial tokens decrease to 0.

The core business model is divided into two parties: users and project parties

- Users: When users participate in transactions and lock tokens, they can obtain governance rights of the protocol, including token inflation and deflation models, whether tokens will be issued in the future, liquidity pool trading parameters, the proportion of earnings for a specific liquidity pool LP, and platform trading fee sharing ratio.

- Project parties: They can increase the visibility and user base of their platform, further increase the platform's TVL data, reduce the circulation of the project platform's tokens, improve the healthy development and value appreciation of the tokens. They can also enhance the decentralization of the project, increase market recognition, and security.

In summary, ve voting custody is a way to obtain custodial tokens by locking the native token, increasing users' governance rights and revenue channels for the platform.

II. Technological Innovation and Advantages and Disadvantages of Ve Governance Custody

The core of Ve governance custody is to obtain veTokens by locking native tokens. In order to improve user retention and token liquidity, it differentiates and diversifies the benefits and rights of veToken holders, such as business sharing, governance voting rights, and liquidity pool reward enhancements. The most controversial aspect of the model is the decision-making power for listing and the allocation of liquidity incentives. While obtaining project governance rights through veTokens, users also receive stable dividend income from the platform. This has led to various projects competing and engaging in internal competition, indirectly creating a dependency and continuous demand for platforms that support the ve model. The platform can stabilize the value of the native token while also supporting the platform's market-making APY to attract more liquidity, forming a closed-loop model.

As the complex bribery ecosystem based on veCRV continues to cover and develop, we can see that the governance custody model of veTokens has achieved value innovation and market development. The innovative points can be summarized as follows:

- Providing more effective token allocation and release logic for different protocols

- Using the veNFT model to optimize the liquidity of veTokens

- Effectively incentivizing the positive development of liquidity pool trading volume

- Integrating governance and revenue structures to enhance users' rights in participating in projects and the decentralization of the projects themselves

Through the core innovative paths brought by the ve governance model, the optimization of underlying technology and solutions has been improved. At the same time, it is important to consider the specific advantages and disadvantages while improving the underlying technology.

Advantages

- Optimizing the ratio of returns and risks: veToken holders can enjoy a series of benefits such as fee sharing and increased APR, coordinating the interests of liquidity providers, traders, token holders, and protocols, reducing participation risks, and increasing user returns.

- Preserving the value of native tokens: By reducing the liquidity of native tokens, it also reduces selling pressure, contributing to the rise in the value of the project.

- Governance and returns: Governance rights are linked to revenue distribution, enhancing the motivation for users to hold tokens and participate in governance. Long-term staking users have greater governance weight, increasing the motivation to make better governance decisions. The current governance weight based on time and quantity seems quite reasonable.

- Degree of decentralization incentives: The current DAO governance has low attractiveness for users, who only focus on the issue of return ratios. In ve governance, the focus is on enhancing user governance rights, which can affect individual return ratios, and also avoids malicious proposals and decisions.

Disadvantages

- Hard lock-up: Locking tokens is a way to participate and earn returns, but the rigid lock-up may deter many users. Locking tokens represents a fixed restriction and uncertainty for the future, creating a barrier.

- Nested governance: Although governance rights are distributed to users, there is a risk of malicious users using multiple accounts and voting rights to concentrate governance rights over time.

- Bribery issues: New liquidity pool funds and liquidity are limited, and new projects can incentivize voting through bribery or promotional activities, leading to market disarray. Malicious projects can also affect the security of locked funds.

Through the above advantages and disadvantages, we find that although projects or models with many innovations and advantages will have risks. When investing, it is necessary to analyze and investigate from multiple aspects and calculate the specific profit and loss ratios. In any case, the industry continues to develop and iterate, and new models and technologies are positive improvements for the industry.

III. Competitive Landscape and Differentiation of Ve Governance Custody

The ve governance custody model accelerates the development of protocols, and its core is its economic model. It optimizes the existing economic model. From the perspective of the business logic of different projects, the DeFi economic model can be divided into three main categories: DEX, lending, and derivatives. According to the characteristics of the incentive layers of the economic model, it can be divided into four modes: governance mode, staking/cash flow mode, voting custody (including ve and ve(3,3) modes), and ES mining mode. Let's specifically look at the competitive landscape of ve governance custody for different economic models.

- Governance mode: Tokens only have governance functions for the protocol. For example, early $UNI represents governance rights over the protocol. Uniswap DAO is the decision-making body of Uniswap, where $UNI holders initiate proposals and vote to make decisions that affect the protocol. Main governance content includes managing the $UNI community treasury, adjusting the fee rate, etc.

- Staking/cash flow mode: Tokens can bring continuous cash flow. For example, 1inch, PancakeSwap, etc., quickly attract liquidity by distributing their tokens to early LPs and traders. Uniswap and the recent update that rewards protocol income in proportion to stakers.

Ve voting custody: Mainly divided into ve mode and ve(3,3) mode.

ve Mode: The core mechanism of ve is for users to obtain veTokens by locking tokens. VeToken is a non-transferable and non-circulating governance token, and the longer the lock-up period, the more veTokens can be obtained. Based on the veToken weight, users can obtain corresponding voting rights. The voting rights can determine the allocation of newly issued token rewards to liquidity pools, thereby substantially impacting users' actual returns and enhancing their incentive to hold tokens.

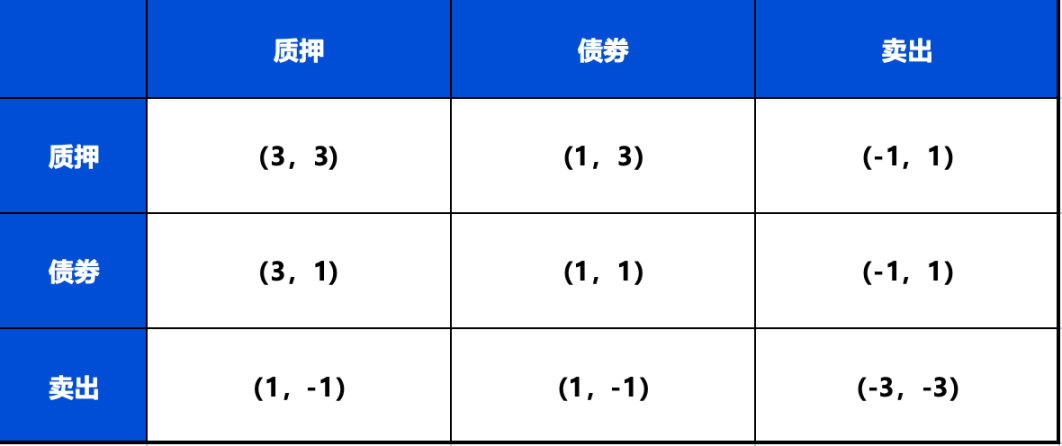

ve(3,3) Mode: The VE(3,3) model combines Curve's ve model and OlympusDAO's (3,3) game model. (3,3) refers to the game results for investors under different behavioral choices. The simplest Olympus model involves two investors who can choose staking, bonding, or selling. When both investors choose staking, the joint returns will reach the maximum (3,3), better incentivizing cooperation and staking.

Additionally, the Ve(3,3) model cycle can be divided into three steps:

- Step one: LP invests in token market liquidity enhancement. LP puts tokens into the liquidity pool, lubricating the entire market, increasing market trading volume, and increasing the workload for protocols serving the market, indicating higher coin prices in an active market.

- Step two: Increased trading volume promotes veToken voter returns. The increase in liquidity leads to a surge in trading volume, meaning a simultaneous increase in transaction fees within the limited trading "computing power," resulting in veToken voters receiving more transaction fee cuts.

- Step three: High-quality markets attract more external investors, completing a positive cycle for the market. In a good market environment, more external investors are attracted, choosing to exchange their tokens for locked tokens, further supporting the market price. Additionally, since LP returns are strongly correlated with coin prices, the higher the coin price, the higher the LP returns, leading to more tokens being put into the liquidity pool, starting a second cycle.

ES Mining Mode: The core is to reduce the cost of protocol subsidies by lowering the unlocking threshold and enhancing its attractiveness and inclusiveness by incentivizing real user participation. The supply of esTokens will be adjusted according to rules; for example, when the token price rises, the protocol will increase token supply to stabilize the price, and when the token price falls, the protocol will reduce token supply to increase the price. In the ES mode, users can earn high returns and rewards through staking or locking tokens, but due to the existence of an unlocking threshold, users cannot immediately realize returns, making it difficult to accurately calculate real returns, adding complexity and unpredictability. Compared to the ve model, the ES mode has an advantage in terms of the cost of protocol subsidies, as its designed unlocking threshold reduces subsidy costs. This makes the ES mode more realistic in the game of distributing real returns, as it incentivizes real user participation, where users cannot receive returns if they cancel, but will receive esToken rewards if they continue staking. Rewards are controlled by the spot ratio and unlocking period of staking or locking, with tokens being unlocked in a curved manner.

After understanding the different DeFi economic models mentioned above, it is evident that continuous optimization in different models amplifies user incentives and liquidity issues, reflecting that the core elements in DeFi are users and liquidity. When delving into the details of economic models, the most easily accepted by users are the ordinary governance model or staking/cash flow model, significantly reducing user capital risks and providing immediate access and cancellation. Compared to the ES governance model, the ve model is more attractive, as it provides more detailed returns. If a project is viewed favorably in the long term, the ve model is undoubtedly the most suitable solution.

IV. Application Scenarios of Ve Governance Custody

1. Curve

Website: Curve

Twitter: @CurveFinance

Curve is a decentralized liquidity pool exchange on Ethereum, specializing in the exchange of stablecoins and pegged assets, and providing highly efficient stablecoin trading. It has the largest market size in asset trading and liquidity market business.

Its core business is to provide decentralized exchange (DEX) services based on the AMM (Automated Market Maker) model, with stablecoins, wrapped assets (such as wbtc/renbtc), and LSD assets (such as stETH) being its main trading categories, primarily serving the bill market. Another area is liquidity procurement, distribution, and management, which is the main business that sets Curve apart from Uniswap.

Its core feature is its ve economic model, where users obtain non-transferable and non-circulating governance tokens veToken by locking tokens. The longer the lock-up period, the more veTokens can be obtained. Based on the veToken weight, users can obtain corresponding returns and other rights (locking 1 CRV for 1 year can yield 0.25 veCRV, and locking for 4 years can yield 1 veCRV). The protocol uses the ve economic model to coordinate business and participant demands. In terms of business, it can coordinate multiple business demands such as trading, liquidity procurement and distribution, governance, market value management, and expanding ecological cooperation. In terms of investors and participants, the protocol coordinates the interests of trading users, market-making users, liquidity procurement users, and token holders.

It also optimizes based on the AMM mechanism, using a trading mechanism between constant sum (x+y=const) and constant product (Uniswap xy=const) functions. Specifically, the mechanism creates a relatively flat curve near the balance point, similar to a constant sum function to maintain price stability, while making both ends more inclined, similar to a constant product function, so that liquidity can be provided at every point on the curve. This achieves low slippage, low transaction fees, and low impermanent loss risk, meeting the demand for large stablecoin trading.

In summary, Curve, as the protocol that proposed the ve governance model, has a diversified business system and product architecture, including stablecoins, ve governance model, Swap, multi-chain support, and is one of the top projects in the DeFi sector, with a current TVL of $2.7 billion, possessing significant attractiveness for both project parties and users, and continues to provide platform returns, still in a state of continuous growth, and is worth long-term attention.

2. Velodrome

Website: Velodrome

Twitter: VelodromeFi

Velodrome is an AMM-style native DEX on Optimism, launched by the team behind veDAO and inspired by Andre Cronje's Solidly. Its token design combines the veToken model and Solidly's (3,3) mechanism.

The platform's trading fee rate is 0.02%. Its veVELO protocol is not only in the form of NFT, but also has voting governance functions. Voters holding veVELO can receive all fees and bribes from the liquidity pool they vote for, and also receive anti-dilution Rebase every week. The token model mainly operates through the native tokens VELO and veVELO for utility and governance. VELO is mainly used to reward liquidity providers, while VELO token holders can choose to lock tokens to obtain veVELO. This locking relationship is linear, for example, locking 100 VELO for 4 years can yield 100 veVELO, while locking for 1 year can yield 25 veVELO. veVELO holders can also vote to determine which liquidity pools can receive VELO rewards and receive transaction fees and bribes from the pool trading pairs they voted for as a reward.

Additionally, individuals holding a certain proportion of veVELO can initiate a vote to add tokens for others to vote on. The team has set up a mechanism where 7 members of the Velodrome team and a referee committee from the Optimism community have the right to disable malicious voting or veto whitelist requests, ensuring the stability and security of the system.

In summary, as a leading native DEX on Optimism, the project has a TVL of $139 million and has performed well. Its token model uses the ve(3,3) governance model, attracting attention and recognition from market users, and has consistently held the top position among Optimism DEXs. Its token model and economic system have also brought new perspectives and considerations to the entire field.

3. Chronos

Website: Chronos

Twitter: @ChronosfiS

Chronos is a decentralized exchange (DEX) based on Arbitrum, aiming to provide more stable and sustainable liquidity through the maNFT LP model and ve(3,3), with the potential to become the primary liquidity layer for Arbitrum.

Its core mechanism introduces the concept of Maturity-Adjusted (MaNFT), which rewards additional $CHR to LPs who provide long-term liquidity to further promote the advantages of ve(3,3) and stabilize the value of TVL. It also makes TVL more stable. MANFT is a special type of fNFT that tracks the time period of the provided tokens and self-staked LP tokens. Over time, maNFT can increase $CHR output, reaching up to a 2x increase after 6 weeks. Additionally, the platform has changed the lock-up period to only 6 months (0.25 veCHR) and 2 years (1 veCHR). It has also issued chrNFT. There are 5555 chrNFTs, and users staking chrNFT can receive 10%-20% of the trading fees from the liquidity pool. The sales revenue of chrNFT will be used for the protocol treasury, CHR liquidity, and future protocol development.

The mechanism benefits from continuous and predictable liquidity, and liquidity providers need to carefully balance between short-term incentives and long-term profit potential. The project can also directly purchase mature LP positions from the secondary market—maNFT to increase the protocol's liquidity.

As time passes, liquidity providers will benefit from the increase in return multiples and may be able to sell mature liquidity positions at a premium in the secondary market.

For veCHR holders, their returns from bribes will increase. Due to the high opportunity cost of LP liquidity in the short term, project teams hoping to obtain initial liquidity need to invest more funds in bribes, further directing more incentives to their liquidity pools to attract LP.

In summary, Chronos is based on the core foundation of the Arbitrum ecosystem, with innovative project mechanisms. It also uses the ve(3,3) model, adding a NFT staking process, using users as trading circulation. However, the project's market recognition is average and needs continuous development. Adding new dynamics and user incentives to the ve model will effectively drive development.

4. Thena

Website: Thena

Twitter: @ThenaFi_

Thena is a native liquidity layer on the BNB Chain, creating a simpler process for the launch of new and existing protocols through capital-efficient liquidity guidance.

Its product supports multiple types of platforms, including Swap, perpetual contracts, cross-chain, fiat token purchase, and staking. The staking incentive measures are determined by weighted voting, with the platform dividing the period into weekly periods. Individuals who convert $THE to veTHE tokens can vote on the output level. The output amount is distributed proportionally at the end of each period. The weighted voting mechanism consists of a bribery market, where the protocol can bribe to obtain support for its measured veTHE votes. At the end of the period, those who voted in favor can claim the related bribes.

Additionally, improvements have been made based on the Solidy bribery model, allowing voters to appropriately compensate liquidity providers for impermanent loss. When aligned with the core goals of the protocol, additional fee generation can be added, further incentivizing voter behavior. An NFT system has also been introduced, where NFT stakers can receive 10%-20% of the trading fees.

In summary, Thena is deployed on the BNB Chain, with a current TVL of $42.7 million. Its model still references Curve and has optimized reward releases, with rewards being claimed in the n+2 week for the n week, requiring re-voting each week to mitigate selling pressure. Additionally, it is expected to increase returns when selected by the protocol. The project is currently progressing slowly and needs to continue operations and development, making it worth long-term attention.

5. Pearl

Website: Pearl

Twitter: @PearlFi_

Pearl is a ve(3,3) decentralized exchange based on Polygon, with deep liquidity for tokenized RWA and high-quality digital assets. Driven by the bribery model, supported by USDR, which is the stablecoin required for paired measurement tokens, Pearl collects native revenue from USDR and redirects it to the bribery pool.

Its core mechanism incentivizes through the Solidy bribery model. Users can obtain vePearl by locking the platform's native token, pearl, and during this process, voters can bribe and receive the stablecoin USDR. The stablecoin algorithm is Tangible, a real estate-backed basic stablecoin generated from a basket of tokenized income. Pearl collaborates with Tangible, using their stablecoin $USDR to allow automatic bribery from USDR using the Solidy model. USDR is backed by tokenized real estate, providing an 8% annual interest rate from rental income. The core mechanism incentivizes LP with unlocked governance tokens, distributes transaction fees to veToken holders, and allows the protocol to release unequal distributions to pools and allows protocol bribery locked token holders to vote.

Summary: Built on the Polygon Chain, it connects RWA assets through collaboration with Tangible, enabling bribery funding while also obtaining real estate income rates. Currently, it achieves certain innovation through the combination with RWA, but the implementation of RWA requires a long period of time to drive forward. From another perspective, the platform's core remains focused on providing efficient utility and rewards, as well as continuous liquidity development through holding and locking governance tokens.

V. Summary and Future Outlook

With the continuous growth of the market volume and the maturation of technology, the decentralized finance era is accelerating. The DeFi economy is increasingly demonstrating substantial utility and a healthy ecosystem. The ve governance custody model mentioned in this article effectively aligns the interests of all parties through locking and profit sharing, motivating participants to contribute to the long-term healthy development of projects by identifying real existing issues. The innovation of ve governance protocols has provided practical utility to the market and contributed iterative solutions from different dimensions. Different protocols have made optimizations and improvements to their mechanisms, boosting the confidence of core developers and practitioners in the industry and stimulating innovative intentions.

From the cryptocurrency industry, it is evident that the ve voting custody model is moving in the right direction. As market participants become increasingly wise to the impact of token design and the risks of holding illiquid positions, further improvements to the ve governance model, such as addressing malicious governance and hard lockups, can break users' aversion to locking and integrate lending and derivative structures to achieve diversified utility for vetokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。