Cointelegraph 近期报道了 Web3 银行协议 Fiat24 与 Safepal DApp 钱包的战略合作:Fiat24 为 Safepal DApp 钱包推出了 in-DApp 的 Web3 银行网关和虚拟加密支付 Visa 卡,以增强 DApp 钱包的易用性,进一步打通与现实世界的交互。

结合我们此前的投研文章《Fiat24:架构在区块链上的 Web3 银行》,可以看到由 Web3 银行协议构建的法币协议层(Fiat Layer Protocol),正在 Blockchain Network 发挥着积极的作用:

1. 将银行业务逻辑搬到链上之后,协议层能够与 DApp/DeFi 进行无缝衔接;

2. 为用户带来基于 U 本位的 Web3 链上银行服务;

3. 为 DApp/DeFi 带来法币业务的创新逻辑。

本文将先介绍 Fiat24 与 Safepal 的本次战略合作,再来进一步阐释 Web3 银行协议如何开启 DeFi 乐高游戏的无限遐想。

(Singaporean fintech launches USDC-powered Visa card with Swiss bank Fiat24)

一、无缝嫁接 Safepal DApp 钱包

3 月 8 日,由 Binance Labs 战略投资的 Safepal DApp 钱包已经接入 Fiat24 作为其默认的法币协议层,Safepal 钱包的用户可以通过 in-DApp 的 Web3 网银入口创建 Arbitrum 上的 Fiat24 链上银行账户,实现:

1. 基于 U 本位的链上银行服务,账户自托管,所有相关交易都安全、透明地记录在链上;

2. 钱包内加密资产 Crypto 与法币 Fiat 的出入金;

3. Fiat24 链上银行账户与实体银行账户的法币转账汇款,Euro/USD 的法币互换;

4. 接入虚拟加密支付 Visa 卡后,使用加密资产在现实世界中的无缝消费支付。

(https://www.safepal.com/en/bank)

Safepal 的创始人 & CEO Veronica Wong 表示:“在 SafePal 的钱包中创建 Fiat24 链上银行账户后,用户能够将钱包中的任何加密资产兑换成 USDC 存入 Fiat24 链上银行账户,虚拟加密支付 Visa 卡还能够与 Paypal、Google Pay、Apple Pay、Samsung Pay 等第三方支付进行链接,增强用户支付的便利性。”

二、Web3 银行协议 Fiat24

Fiat24 是一家获瑞士金融市场监管局(FINMA)发牌的金融科技公司,其推出了第一个将银行逻辑完全架构在公共区块链(Arbitrum)上,完全由智能合约驱动的 Web3 银行协议,为用户创建一个链上银行账户,提供出入金、加密消费支付、储蓄、转账、换汇等一系列的Web3银行服务。

(Temperature Check - [Issue a Visa Card with Uniswap Logo ])

可以将Fiat24想象成 DApp/DeFi的法币协议层(Additional Fiat Layer forDApps)。在法币协议层,Fiat24为通过KYC的用户创建链上银行账户(Cash Account),该账户一方面能够将Web3支付服务整合其中,例如用户通过链上银行账户直接实现出入金支付以及加密消费支付;另一方面,依托金融科技牌照,链上银行账户能与瑞士国家银行、欧洲中央银行和VISA支付网络直连,能够实现法币的储蓄、换汇、商家结算等传统银行服务。

Fiat24 将银行核心运营逻辑(Core Banking System)搬到链上,是 Fintech 在区块链创新的完美实践,最大程度地融合了区块链的去中心化账本技术,在增强便利性的同时也加强了安全性,避免了单点故障的风险。

更难能可贵的是,这种创新的做法获得了瑞士监管的认可,瑞士监管基于 Technology Neutral 的监管原则,保证 Fintech 公司在满足业务基础功能的前提下进行大胆科技创新。由此,Fiat24 一方面通过区块链实现了银行的账本记账,另外一方面通过 NFT 实现链上用户身份的 KYC,以满足反洗钱的要求。

Fiat24 的区块链银行架构将传统银行金融服务和 Web3 区块链创新无缝融合,获得了诸多顶级资本的青睐,同时也获得了 Qorusand Accenture 授予的 2022 最佳新兴银行(Neobanks & Specialized Players)的殊荣。

(Qorusand Accenture Announce Winners of 2022 Banking Innovation Awards)

三、为 DApp/DeFi 带来法币业务的创新逻辑

Fiat24此前的创新在于将银行逻辑上链,并获得瑞士监管的认可。在这之后,Fiat24的创新在于为DApp/DeFi开启新的法币业务逻辑。

由于Fintech牌照的限制,Fiat24并不能够开展借贷业务,只能做吸储和支付业务。但是,这些限制反而为采用Web3银行架构的Fiat24带来巨大优势:

A.基于Debit Card的全球发卡支付。Credit Card本质上属于放贷,由于Fiat24牌照限制无法展业,并且违约催收压力巨大,一般局限于固定地域。而充值支付的Debit Card反倒能够实现全球网络的发卡支付,并且不存在违约问题。

对于那些希望将加密资产投入日常使用的用户来说,Fiat24这种为DApp/DeFi提供出入金及加密支付解决方案的革命性能力是一种对传统支付体系的革新。

B.无缝嫁接DApp/DeFi。由于牌照限制无法开展借贷业务,但是并不妨碍Fiat24银行协议本身(Fiat Layer Protocol)能够直接自由嫁接在DApp/DeFi上,通过DeFi智能合约实现链上的借贷业务。

这里的重点在于:其作为协议能够为DeFi带来法币的业务逻辑。以最常见的金融活动为例:

1.抵押借贷:Bob提供加密资产ETH作为抵押品在DeFi平台上借稳定币,DeFi协议可以直接调用Fiat24银行协议来做USD法币的出借;

2.投资/质押生息:Alice提供加密资产ETH去做质押生息,DeFi协议可以直接调用Fiat24银行协议来做法币生息资产的发放,这真的能够躺赢?

3. 投资理财:Will 提供加密资产 ETH 直接投资 DeFi 协议的代币化证券 Coinbase,那么 DeFi 协议可以直接调用 Fiat24 银行协议,用法币去纳斯达克买股票。

(X@Fiat24)

将法币的逻辑加入DeFi的想象空间可以很大!同样,作为协议本身(Fiat Layer Protocol)能够直接自由嫁接在DApp/DeFi上的能力,亦能够帮助Fiat24丝滑接入Blockchain Network,并带来巨大生态价值。

试想一下,中心化的Metamask钱包接入中心化的出入金Moonpay,需要签订多少合同,需要经过多少部门讨论,需要多少领导签字?再试想一下,中心化的出入金Moonpay如何与去中心化的DeFi协议签订合同?DeFi协议根本就没有法人主体,根本就没有公章。

而Fiat24银行协议与DeFi Protocol就不存在一点障碍,没有一点摩擦,just by one Click!

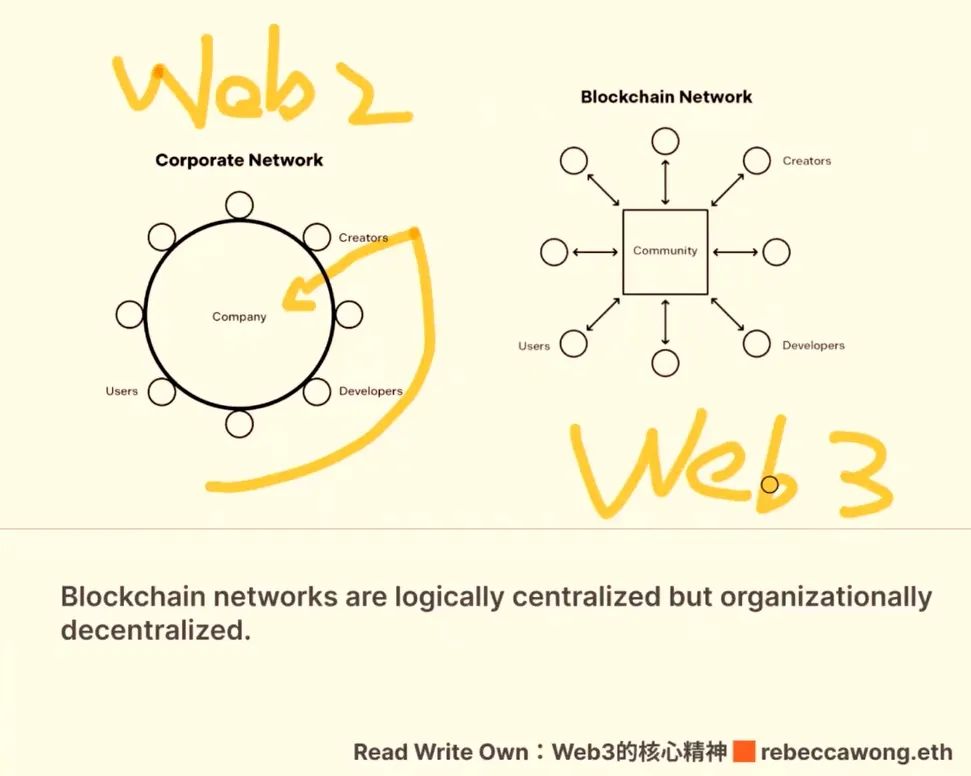

大家都没有法律上的强绑定,而是通过智能合约来一起做乐高游戏,这才是Web3的精髓。

四、写在最后

现在有两波人在做Web3 Banking/Payment的业务,一波是传统跨境支付的人,他们依然沿袭着传统跨境支付的思路,Crypto只是多了一个币种,他们通过渠道手续费、会员费用订阅费赚钱,做的是现金流的生意;另外一波是Web3 Native的人,他们不太会去动现金流生意的脑筋,而是会直接用区块链去改造旧体制,释放新的活力,并且去拥抱社区生态,去做一些Blockchain Network的事,做的是生态的生意。

到底谁能笑到最后我们不得而知,但是我愿意去相信、去参与、去创造Blockchain Network的变革力量!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。