When Bitcoin, with a market value of 1 trillion US dollars, can rise by 50% within a month, Markus Thielen's market analysis report has been widely spread in the community. Of course, what people are more familiar with is his title as an analyst at Matrixport, and he also works as a researcher at 10X Research. Markus's Bitcoin report has been quite accurate in predicting the price of Bitcoin in the past few months. Both the rise and fall seem to be within his calculations. Even recently, Markus's analysis indicated a risk of decline for Bitcoin, and the market responded with a decline, which made Markus quite famous.

Markus Thielen

When Bitcoin has already reached $60,000, which is less than 10% away from the previous high of $69,000, BlockBeats had a chat with Markus. The most important information for everyone is that this exceptionally accurate analyst believes that Bitcoin can reach $125,000 this year. Of course, in addition to the price, Markus also talked about the impact of ETFs and his views on the market.

BlockBeats: Okay, first, can you briefly share your experience, and how did you join Matrixport as a Bitcoin analyst?

Markus: Several years ago, I was the head of the quantitative and derivatives strategy department at Morgan Stanley, basically becoming an investment portfolio manager, working for large banks and large hedge funds, and also setting up my own hedge fund in Hong Kong. I also served as the Chief Investment Officer of a cryptocurrency asset management company. The experience from these jobs led me to Matrixport.

BlockBeats: So you have been trading Bitcoin for many years?

Markus: Yes, I first paid attention to Bitcoin in 2013. We tried to set up some trading platform arbitrage as a side business in 2015, but full-time trading started a few years ago. When the market capitalization became quite high, Bitcoin really became a macro asset, which is why we were able to make accurate predictions. Quantitative analysis, macro, and liquidity analysis, these components make up the foundation of the market and the basis for predictions.

BlockBeats: I see, let's talk about Bitcoin directly. In November last year, you said Bitcoin might rise to $57,000. Has the current situation exceeded your expectations?

Markus: First, in October 2022, we said that Bitcoin might reach $63,000 by March this year, entering the halving period. Our views and analysis are actually supported by data, we don't just throw out price targets casually, there's always a quantitative method behind it. When we said in November last year that Bitcoin might reach $57,000, to be honest, it has indeed exceeded expectations.

In October 2022, about 15 months ago, we were already looking at the $60,000 level. But the reality is, when you see the previous cycle symmetry, you will find that the bull market has only gone halfway. When you understand how the previous bull market evolved, you won't be surprised by Bitcoin's sudden 10% rise overnight. For example, some analysis we did this morning (February 29) also makes it difficult for us to be bearish here, because it will continue to rise.

BlockBeats: Do you think this bull market has only gone halfway?

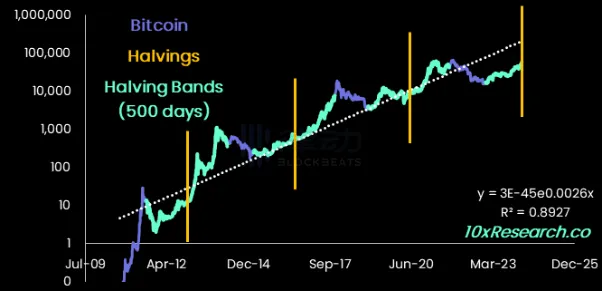

Markus: According to the data we are running, it looks like we are only halfway through this bull market. This does not mean that we will rise by 150% or 160%. But when you see the previous cycles, I can show you a chart (see the figure below), if you buy 500 days before the halving, it's actually the bottom. Then in the next 500 days, which is 18 months, it's the second stage of the rebound.

When we did the analysis in October 2022, this chart indicated that we were at the bottom. Many Bitcoin holders now say that you should buy Bitcoin after the halving because it often rises after the halving, but our view has always been that you should buy Bitcoin 14 to 15 months before the halving, because that is likely the low point. So yes, we are still only halfway through the bull market.

BlockBeats: I can't imagine how high Bitcoin can rise now.

Markus: There are two pieces of data, we don't just throw out numbers, I don't rely on speculative trading. But in the past three presidential elections, which coincides with the halving cycle, so in 2012, 2016, and 2020, Bitcoin's average return in those years was 192%, and Bitcoin rose by over 100% each year. So based on 192%, we start at $40,000 this year, and Bitcoin can reach $125,000 by the end of the year. We saw an indicator in July last year that when Bitcoin sets a new high within a year, there will be a 300% rebound, so this data also leads to $125,000. We judged accurately last year, and this year might be more conservative, Bitcoin may reach $125,000 by the end of this year or next year.

BlockBeats: $125,000, that's crazy. So what is the biggest reason Bitcoin can reach this level, is it ETF? I feel like we all underestimate the impact of ETF.

Markus: Asians may not understand or really be unaware that many asset management companies in the United States are using ETFs to make their asset allocation decisions. Asians like to buy specific stocks, such as individual stocks like Chinese banks. In contrast, in the United States, investors like to buy a whole basket when they like a bank, and that's the real meaning of ETF.

These asset management companies manage a large amount of funds, not managing a thousand dollars, but on the scale of billions. They won't say they invested a million in JPMorgan, they will only say it's a billion-dollar bank index. These people can access ETFs, and the numbers are truly astronomical. We have been trying to indicate since July last year that if these ETFs are approved, the entry of these billions of dollars will have a huge impact.

The market has been comparing the changes in Tether's market value with the price of Bitcoin. For example, the minting of $10 billion USDT should theoretically mean that $10 billion in fiat currency enters the cryptocurrency. But now this money can flow into these Bitcoin ETFs instead of through USDT, so we are seeing a surge now.

BlockBeats: So ETF is the biggest reason for the current surge?

Markus: It's ETF, but ETF represents the institutionalization of Bitcoin. I have traded gold, interest rates, and foreign exchange. When some uncertainty occurs, you buy gold because it's a safe haven. But Bitcoin is a better safe haven. First, it reacts much more strongly to changes in US interest rates. It reacts much more strongly to wars, for example, when Bitcoin rose more strongly than gold during the Russia-Ukraine conflict. You know, when there was a banking crisis in the United States, like we saw in March last year, Bitcoin rose from $20,000 to $28,000 in two weeks. Bitcoin is becoming a better macro asset than gold.

Now there are two of the largest gold ETFs, with assets under management of $80 billion, and one of them, with a scale of $55 billion, has seen outflows of $2.7 billion. I suspect that this outflow of funds has been transferred to Bitcoin, and I believe this is a shift in allocation from gold to Bitcoin. So we may not see registered investment advisors or institutions personally buying Bitcoin now, we may only see people who own gold shifting their allocations to digital gold.

BlockBeats: Do you think a black swan event will still occur?

Markus: It's unlikely, we are in a bull market, and it seems unlikely from a regulatory and Bitcoin network perspective. The only possible black swan event would be if someone could access Satoshi Nakamoto's wallet.

BlockBeats: Many people are curious about how you analyze the market. Do you use any tools or models?

Markus: Yes, we have a lot of tools running every day. Over the past few years, every day, whether it's a weekend or a holiday, I wake up and save data just so we can understand what's happening and see if there are any changes in supply and demand. At the same time, we run a lot of quantitative models, for example, when Bitcoin was at $48,000 two weeks ago, the market's conclusion was to take profits because it was overbought. But in reality, our backtesting gave a completely opposite conclusion. In October 2022, everyone was talking about US regulation, bear market, bankruptcy, and Bitcoin was priced at $20,000, but we proposed $63,000. It seemed strange at the time, but it was what the data told us.

BlockBeats: Have you ever had a situation where the data told you it would rise, but you thought it should fall?

Markus: In my experience, the data is often correct. And the most painful moments are when you see that your model is correct, but you didn't follow what the model said.

For example, last night I thought I should take some profits, but then I suddenly saw that trading activity in Korea had increased a lot in the past 24 hours. A few months ago, on Upbit, the trading volume was less than $1 billion. But in the past 24 hours, the trading volume exceeded $7 billion. So the Asian trading time is no longer in a sideways trend.

BlockBeats: More and more people are reading your reports, it seems that your reports are increasingly influencing the market. Do you feel more pressure?

Markus: Yes. Providing good analysis for our readers and subscribers, providing high-quality reports. The more attention you get, the more people follow you, the greater the pressure. Especially when we have been accurate so many times, of course, we are afraid of being inaccurate. But I still believe in my data model.

BlockBeats: Besides ETFs and the inflow of funds from gold, are there any other reasons that could drive up the price of Bitcoin?

Markus: Honestly, I don't see any other reasons now. This bull market is very different. The previous bull market was the DeFi summer, and altcoins were the main focus, but this time it is more or less focused on Bitcoin.

BlockBeats: So it might just be a Bitcoin bull market, not an altcoin bull market.

Markus: Yes.

BlockBeats: But many people would think that the funds profiting from Bitcoin could flow into other altcoins.

Markus: Those who buy ETFs don't see it that way. Bitcoin's dominance is around 52%, if there really is a rebound in altcoins, Bitcoin's dominance would have to drop to below 50%, and I don't see the altcoin narrative, there was a narrative during the DeFi summer. But I haven't seen it now.

BlockBeats: How long do you think this bull market will last?

Markus: I think it will last until February or September next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。