2024注定是加密行业叙事中浓墨重彩的一年。新年伊始,美国SEC通过了11支比特币ETF的申请。随着贝莱德、富达资本等资管巨头的合规入场,比特币价格也一路高歌猛进,成功突破57000美元。

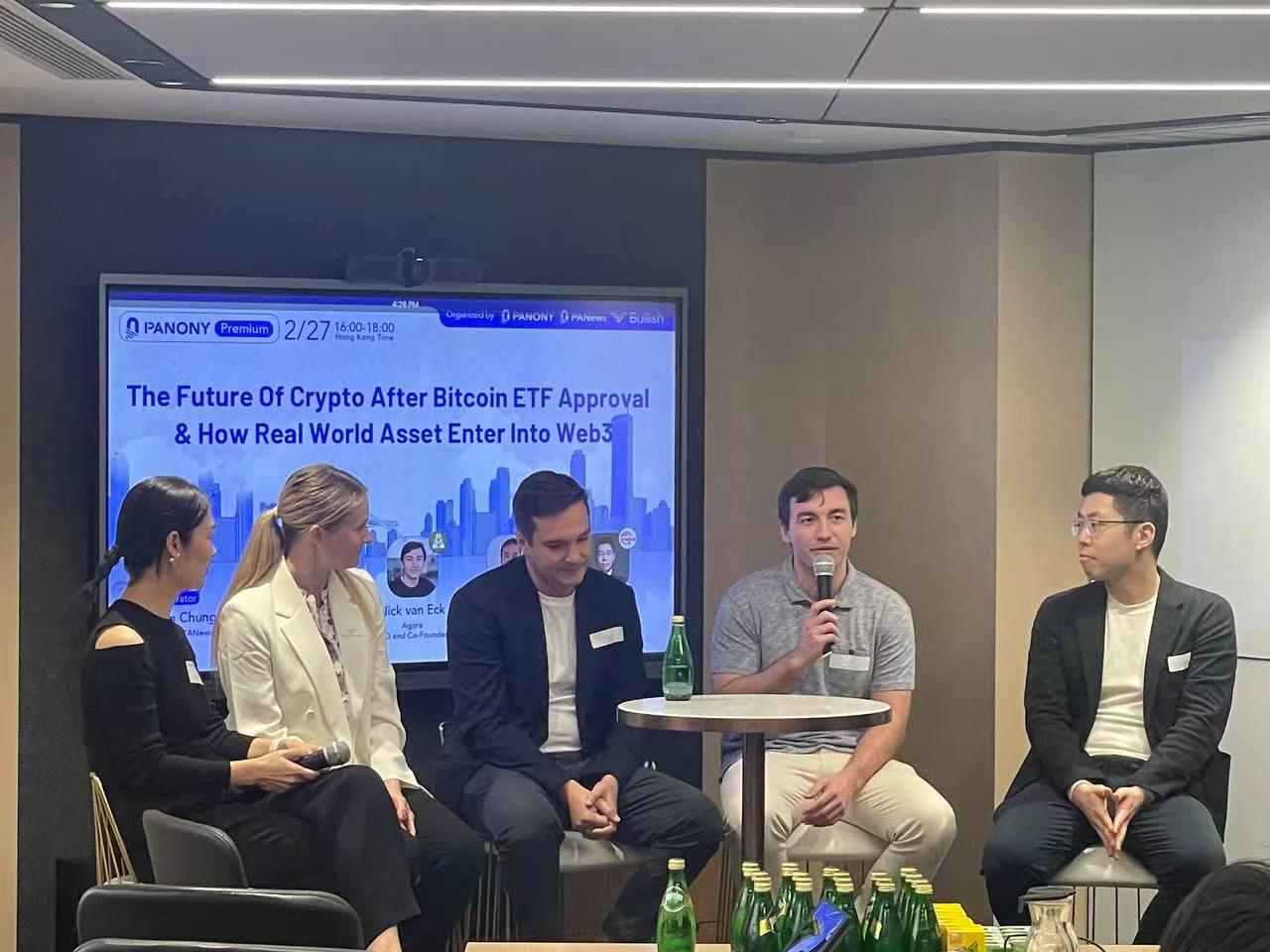

2月27日下午,在另一个加密合规热土香港,一场由PANONY & PANews与Bullish联合主办的圆桌论坛成功举办。围绕着“比特币ETF获批后的加密货币未来以及现实世界资产如何进入Web3”这一主题,Bullish合规部总监Priscilla Adams、Agora首席执行官和联合创始人Nick van Eck、Clearpool首席执行官和联合创始人Jakob Kronbichler、亚洲RWA工作组创始人Thomas Zhu,以及PANews&PANONY的合伙人Yolanda Chung展开了讨论。

良好的监管可以作为市场的创造者

时下最热的话题之一便是比特币ETF的通过给行业带来的变化。针对这个话题,Bullish的合规部总监Priscilla Adams表示,“比特币ETF为行业带来了积极势头。良好的监管可以作为市场的创造者。” Priscilla Adams提出,在此前的加密货币冬天,整个行业缺乏信任和监管,对于ETF的通过,他认为有很多理由感到兴奋。

亚洲RWA工作组创始人Thomas Zhu提出, 比特币现货交易所为其他数字资产树立了先例,并可能为加密资产与现实世界资产的进一步整合铺平道路,增强流动性,创建一个更强大和互联的金融生态系统。

Clearpool首席执行官和联合创始人Jakob Kronbichler在提到这个话题时则表示,从DeFi的角度来看,随着机构的入场,比特币ETF的通过可能为Defi带来更多的交易量。

更高的移动支付渗透率有利于亚洲地区RWA的发展

在这一轮牛市的诸多热点赛道中,RWA(真实世界资产)被认为是可以将更多传统资产带入Web3.0世界的一种重要方式。亚洲RWA工作组是一个跨行业自律组织,致力于推动实物资产(RWA)代币化的生态系统建设。

Thomas Zhu表示,“RWA代表了传统金融与DeFi之间的重要进展,有可能释放流动性并为投资和资产管理创造新机会。比特币现货ETF的批准可能对RWA领域产生重大影响。它标志着监管机构对加密货币资产的接受,并提供了代表数字资产的传统金融产品,从而增加了加密货币对主流投资者的合法性和访问性。这可能导致对该行业的兴趣和投资增加,进而加速RWA项目的发展和采用。

在论坛中,Thomas Zhu也分享了在亚洲和西方国家进行RWA的区别,他提出亚洲和西方国家在进行RWA时,要考虑几个关键因素的区别,分别是:监管环境、市场动态、技术应用、投资者配置、经济重点和法律制度。他表示,亚洲国家,特别是韩国和中国等国家,往往更快地采用新技术。与一些西方国家相比,这些地区可能有更高的移动和数字支付渗透率,这可能使代币化资产的概念更容易被接受。

Jakob Kronbichler提到,Clearpool的新产品Credit Vaults即将推出,他表示这个产品将赋予借款人灵活性,吸引新的贷款人以更高的利率,并开启新的借款人类型和贷款机会。Jakob Kronbichler认为RWA带来的链上信贷是激动人心的,但有点小把戏,RWA可能导致DeFi中再也没有好的收益率了。就他个人而言,他认为机构在Defi中的采用以及原生资产的Defi和有权限批准的Defi是值得关注的赛道。

在现场Nick van Eck分享了Agora的一些近况,他表示Agora的第一个产品是一个完全抵押、自由交易的美元稳定币,将在未来几个月内推出。此外,Agora正在推出一种下一代支付和运营平台。Nick van Eck透露,该稳定币的抵押物将由一家拥有近1000亿美元资产管理规模的蓝筹传统资产管理公司管理。

关于PANONY:

PANONY是一家深耕加密和区块链产业的孵化、投资、咨询公司。PANONY拥有经验丰富的行业老兵和业内顶尖专家组成的管理和咨询团队,致力于为企业赋能本土化市场认知,提供链接全球资源的专业路径。服务客户包括200多家区块链初创公司,如 Highstreet、Render Network (RNDR)、Linear Finance、Polygon Network 等,覆盖Web3.0和区块链的所有领域;以及世界500强企业公司亚马逊、上汽集团等,帮助大型企业开拓Web3.0业务思路。

关于Bullish

Bullish交易所于2021年11月启动,在亚太、欧洲、非洲和拉丁美洲的50多个精选司法管辖区内可用。Bullish交易所由Bullish (GI) Limited运营,并受直布罗陀金融服务委员会(GFSC)(DLT许可证:FSC1038FSA)的监管。专注于为机构数字资产领域开发产品和服务,重新设计了传统交易所,以惠及资产持有者、赋能交易者并增加市场透明度。得益于集团充裕的资金支持,在一个合规且受监管的框架内,Bullish的中心化交易所结合了高性能的中央限价订单簿(CLOB)和专有的自动化做市技术,提供深度流动性和紧凑的价差。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。