原文标题:Bitcoin halvings may be bullish—but returns have shrunk every cycle

原文作者:David Canellis

原文编译:Mary Liu,比推 BitpushNews

比特币当前的上涨正值两种看涨叙事的结合:在不到八周的时间内,减半将使新增供应量减少一半,同时现货 ETF 吸筹比特币的速度已经快于开采速度。

除了现货 ETF 的新需求之外,减半通常被视为比特币价格大幅上涨的催化剂。

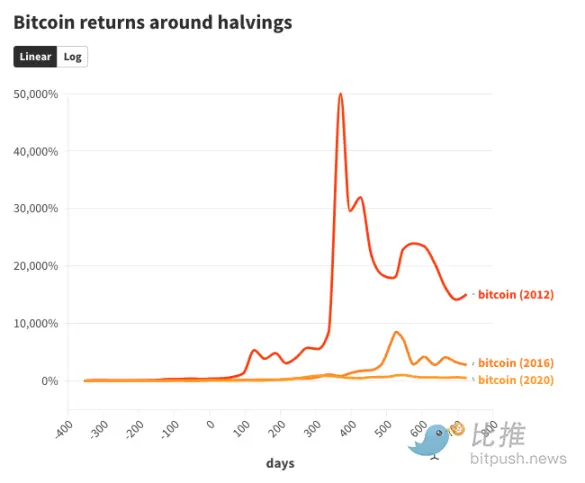

但在过去的两个周期中,受益最大的是加密货币,而不是比特币。从之前每次减半的前一年开始,比特币的峰值涨势为:

· 2012 年减半一年后增长 50,000%。

· 2016 年减半后近一年半的时间里增长了 8,500%。

· 2020 年减半一年半后 1,000%。

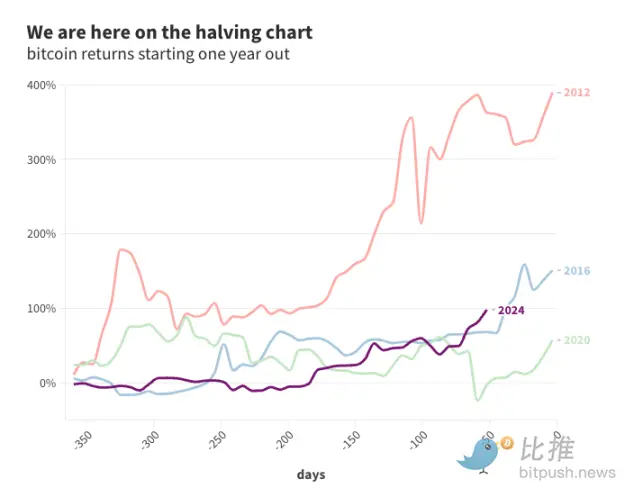

对于有数学思维的人来说,一个有趣的发现是,减半后比特币的涨幅大约是前一个周期的数字除以 6 到 8(50,000%/8,500%;8,500%/1,000%)。如果历史重现,那么这次比特币的峰值涨幅将低于 170%—而目前,它已经实现了大部分收益。

考虑到比特币的市值已经超过 1 万亿美元,所有这些都是可以理解的。比特币的价格不可能像 2012 年那样在两年内上涨 500 倍,当时其市值还不到 2 亿美元。

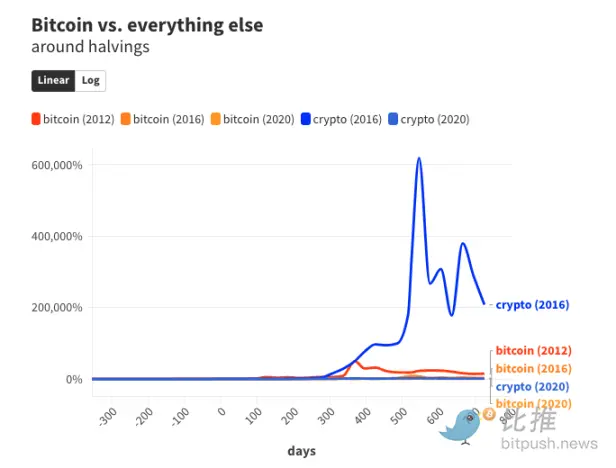

比特币(BTC)目前约占整个加密货币市场的一半,但还有数以万计的其他加密货币,总体而言,它们往往会在比特币反弹最猛烈时「搭上顺风车」。

事实上,除比特币以外的代币总是能够从比特币牛市中获得更多的收益。2016 年减半前一年,不包括比特币的加密货币总价值为 6490 万美元。

减半事件发生一年后,即 2017-2018 年牛市最高峰时,这一数字增长了 6,000 多倍,达到 4,210 亿美元,这主要归功于 XRP、以太坊和比特币现金的崛起。

同样,在加密货币的上一个周期(2019 年至 2021 年)中,比特币以外的加密货币在 2020 年减半前一年的估值为 716 亿美元。

一年半后,当比特币接近历史高位时,所有其他加密货币的价值为 1.7 万亿美元—- 增长超过 2,000%,超过了比特币 1,000% 的增长率。

四年周期并非比特币独有

本文再次强调,三次减半的样本量太小,无法得出任何有意义的分析。

如此小的样本量意味着减半以外的因素也可能在形成看似规律的比特币四年市场周期中发挥作用。

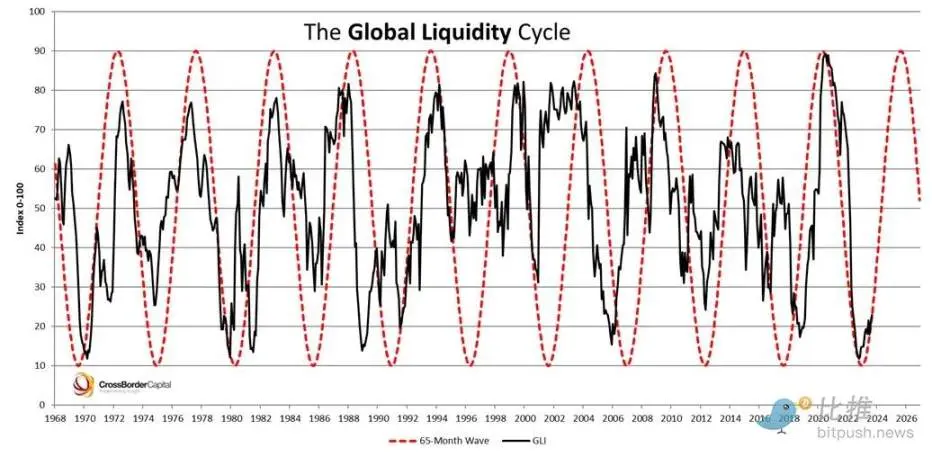

全球流动性周期追踪全球经济中流动的现金量,它与比特币上涨的相关性可能比减半还要紧密。

事实证明,全球流动性也以四年为周期运行。

与减半一样,证明全球流动性浪潮导致比特币爆炸性增长实际上仍然是不科学的,这很可能是两者的混合效应:随着全球流动性加深,供应减少,溢出到加密货币等投机资产类别,从而推高需求。

不包括上周现货 ETF 净流出的一天,美国实物支持的比特币基金平均每个交易日共购买了近 6,350 枚比特币(3.62 亿美元)。

比特币矿工平均每天挖掘 147 个区块,每个区块都会获得 6.25 BTC(356,600 美元)的奖励,这是网络分配新币的方式。

因此,矿工每天从区块链中提取的比特币不到 920 枚(5250 万美元)。以贝莱德 (BlackRock)、富达 (Fidelity) 和 Ark/21Shares 为首的比特币基金代表股东购买了近六倍的资金。

比特币市场的许多方面都超过了比特币的供应量。今年平均每天约有 35,000 BTC(20 亿美元)流入加密货币交易所,这表明潜在的比特币销量比每天开采量高出 37 倍。

即使考虑到比特币最近的价格上涨,如果只有一小部分发送到交易所的比特币矿工最终被出售,那么假设有足够的供应来满足需求,而价格不会立即呈抛物线式上涨。

尽管如此,随着减半即将到来——预计在 4 月 19 日或 20 日——很容易看出他们如何吸引了整个市场的想象力。Bitwise、Bitfinex 和 CoinShares 等加密原生公司已经尝试揭开它们的神秘面纱,摩根大通和渣打银行等金融机构也是如此。

在实际层面上,比特币减半将从根本上彻底改变比特币挖矿的经济性,CoinShares 预计,如果比特币没有保持在 40,000 美元以上(到目前为止,情况还不错),几家主要运营商将陷入困境。

渣打银行近年来以其大胆的加密价格预测而闻名,与此同时,该行仍维持在今年年底前每枚加密货币价格达到 10 万美元的目标,部分原因是减半可能会在多大程度上使供需向后者倾斜。

人们很容易绘制出之前减半后的比特币价格走势图(只有 3 次减半,分别是 2012 年、2016 年和 2020 年)。毕竟,比特币最大的牛市在减半后的一年到一年半之间达到了顶峰。

除了证明「过去的表现并不能保证未来的结果」之外,每个人都在猜测为什么这次会有所不同。

无论减半对价格有(或没有)什么影响,回顾数据显示,尽管每四年都会进行大规模资本注入,但比特币市场的周期效应正在随着时间的推移而减弱。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。