Cancun upgrade may become a signal for Ethereum to start strengthening.

Author: Jerry Luo, Kernel Ventures

TLDR:

- Ethereum has completed the first three upgrade phases, solving the problems of development barriers, DoS attacks, and POS transformation. The current main upgrade goal is to reduce transaction fees and optimize user experience.

- The four proposals EIP-1553, EIP-4788, EIP-5656, and EIP-6780 respectively achieve the reduction of interaction costs between contracts, improve the efficiency of accessing the beacon chain, reduce data replication costs, and limit the role permissions of SELFDESTRUCT bytecode.

- EIP-4844 introduces blob data attached to blocks, which can greatly increase Ethereum's TPS and reduce data storage costs.

- The Cancun upgrade will bring additional benefits to Ethereum-specific DApps in the DA track, and currently, the Ethereum Foundation holds a negative attitude towards DA solutions that do not rely on Ethereum for data storage.

- With the more mature development environment of Op Layer2 and the increasing demand for Ethereum's DA layer, the Cancun upgrade may bring relatively more benefits.

- The Cancun upgrade can raise the performance ceiling of DApps, making DApps function more like apps in Web2. Games that require a large amount of storage space on Ethereum are worth paying attention to.

- The current Ethereum ecosystem is undervalued, and the Cancun upgrade may become a signal for Ethereum to start strengthening.

1. Ethereum Upgrade Road

From the false news of the Bitcoin ETF passing published by Cointelegraph on October 16 last year to the final approval of the ETF on January 11 this year, the entire cryptocurrency market has experienced a sustained rise. As the most direct beneficiary of the ETF is Bitcoin, during this period, there has been a deviation in the trends of Ethereum and Bitcoin. Bitcoin reached nearly $49,000, reclaiming two-thirds of the peak of the last bull market, while Ethereum only reached around $2,700, just surpassing half of the peak of the last bull market. However, since the landing of the Bitcoin ETF, the ETH/BTC trend has shown a significant rebound. In addition to the expected Ethereum ETF, another important reason is the long-delayed Cancun upgrade, which has recently announced public testing on the Goerli test network, releasing a signal of the upcoming upgrade. From the current situation, the timing of the Cancun upgrade will not be earlier than the first quarter of 2024. The Cancun upgrade is committed to solving the current problems of low TPS and high transaction fees on Ethereum, and is part of the Ethereum Serenity upgrade phase. Before Serenity, Ethereum has gone through three stages: Frontier, Homestead, and Metropolis. The first three stages respectively solved the development barriers, DoS attacks, and POS transformation on Ethereum. The Ethereum Roadmap clearly indicates that the current main goal is to achieve "Cheaper Transactions" and "Better User Experience".

2. Core Content of Cancun Upgrade

As a decentralized community, Ethereum's upgrade plan comes from proposals put forward by the developer community and ultimately approved by the majority of the Ethereum community. Among them, proposals approved are called ERC proposals, and those under discussion or about to be implemented on the mainnet are collectively referred to as EIP proposals. The upcoming Cancun upgrade is expected to be implemented through 5 EIP proposals, namely EIP-1153, EIP-4788, EIP-5656, EIP-6780, and EIP-4844.

2.1 Main Task: EIP-4844

- Blob: EIP-4844 introduces a new transaction type, blob, to Ethereum, a data packet of 125kb in size. Blob compresses and encodes transaction data and does not permanently store it on Ethereum in the form of CALLDATA bytecode, greatly reducing gas consumption, but cannot be directly accessed in the EVM. After the implementation of EIP-4844 in Ethereum, each transaction can carry up to two blobs, and each block can carry up to 16 blobs. However, the Ethereum community recommends that each block carry 8 blobs. When this number is exceeded, although it can still be carried, it will face continuously increasing gas fees until the limit of 16 blobs.

In addition, EIP-4844 utilizes two other core technologies, KZG polynomial commitment and temporary storage, which were analyzed in detail in our institution's previous article Kernel Ventures: A Discussion on DA and Historical Data Layer Design. In summary, EIP-4844 makes changes to the size of individual block capacity and the storage location of transaction data in Ethereum, reducing gas on the mainnet while greatly increasing the TPS.

2.2 Subsidiary Task: EIP-1153

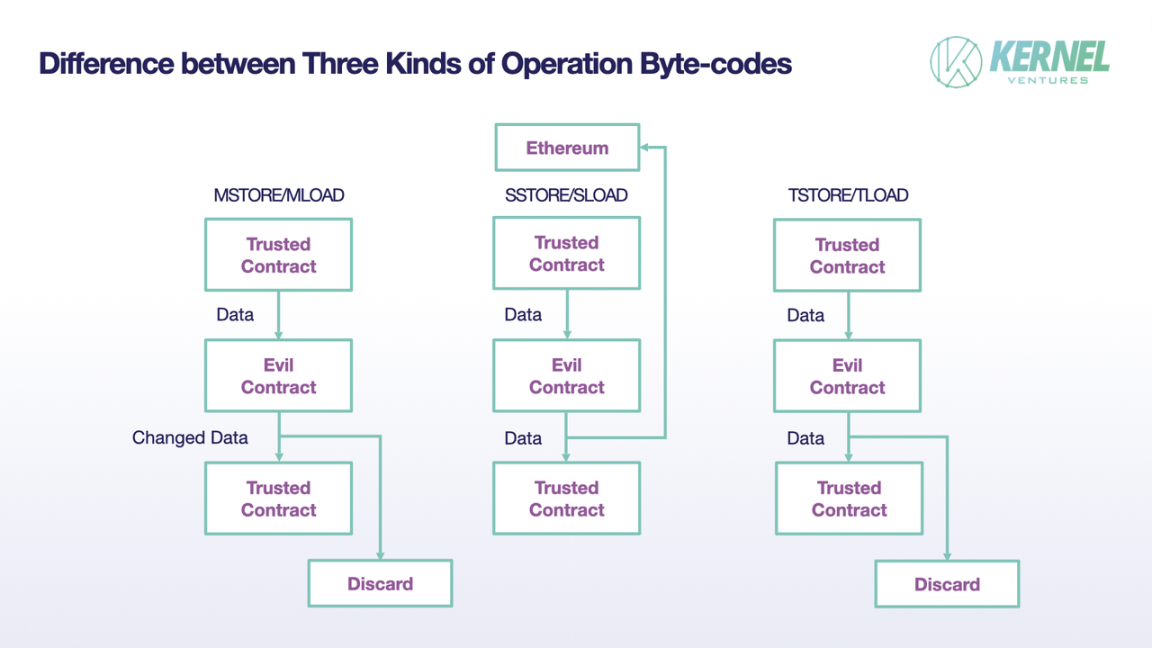

EIP-1153: The proposal aims to reduce the storage cost during contract interaction. A transaction on Ethereum can be broken down into multiple frameworks created by the CALL instruction set, which may belong to different contracts and involve the transmission of information from multiple contracts. There are two ways of transmitting state between different contracts, one is through input/output, and the other is through the CALLDATA bytecode for on-chain permanent storage. The former stores and transmits data in memory, with lower costs, but if the entire transmission process goes through any untrusted third-party contract, there will be significant security risks. However, choosing the latter will bring a considerable storage cost and burden on on-chain storage. EIP-1153 solves this problem by introducing the operation codes TSTORE and TLOAD for temporary storage. Variables stored through these two bytecodes have the same properties as variables stored through the SSTORE/SLOAD bytecodes and cannot be modified during the transmission process. However, the difference is that the data stored temporarily will not remain on the chain after the transaction ends, but will disappear like temporary variables. Through this method, the security and relatively lower storage cost of state transmission process are achieved.

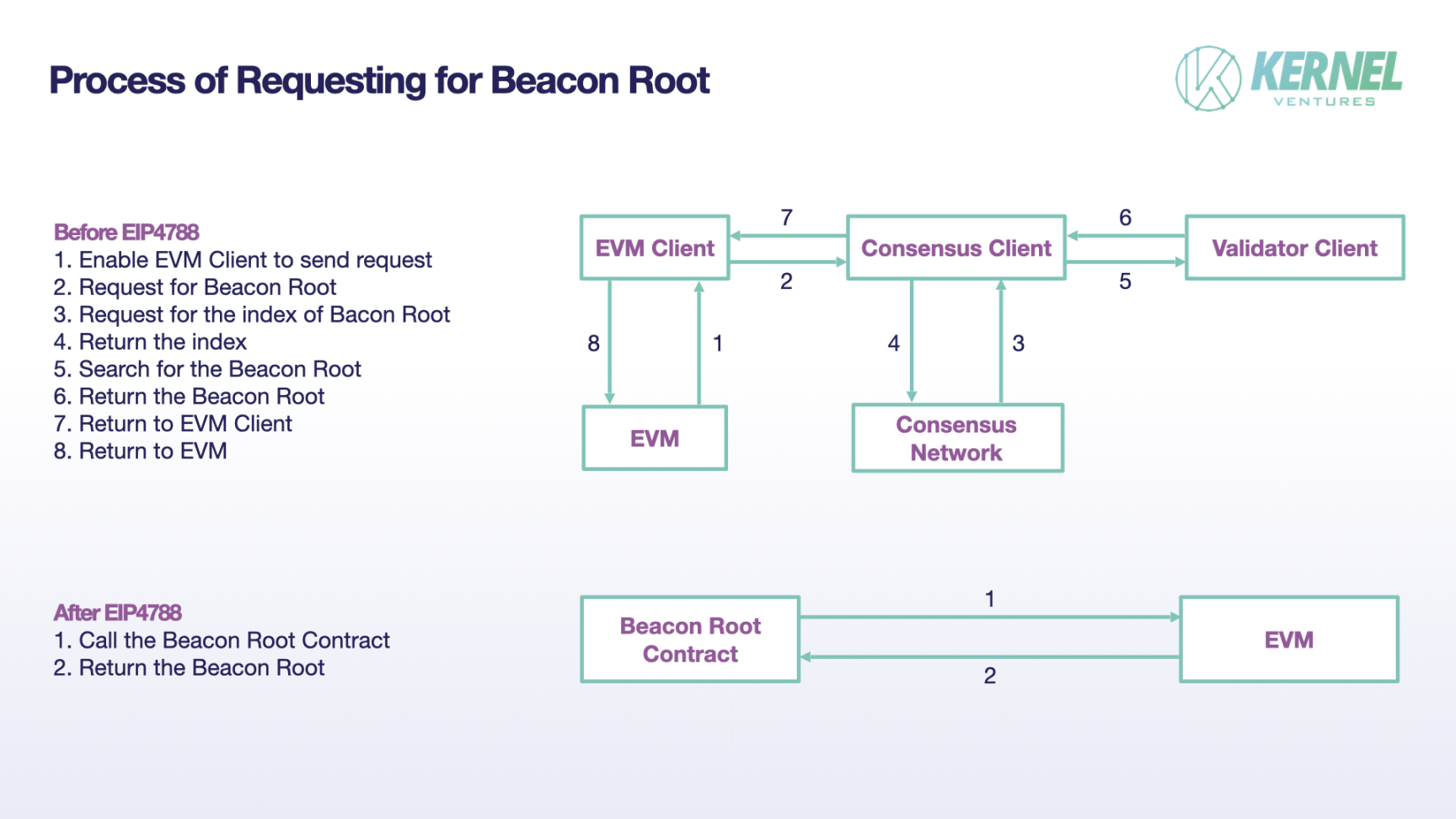

EIP-4788: In the beacon chain of Ethereum after the POS upgrade, each new execution block contains the Root of the parent beacon block. Even if some earlier Roots are lost, the Root stored by the consensus layer is reliable. Therefore, in the process of creating new blocks, we only need to keep a few of the latest Roots. However, frequent requests from the EVM to the consensus layer for data during the creation of new blocks will reduce execution efficiency and create the possibility for MEV. Therefore, EIP-4788 proposes using a dedicated Beacon Root Contract to store the latest Roots, making the Roots of the parent beacon block exposed by the EVM, greatly improving the efficiency of data retrieval.

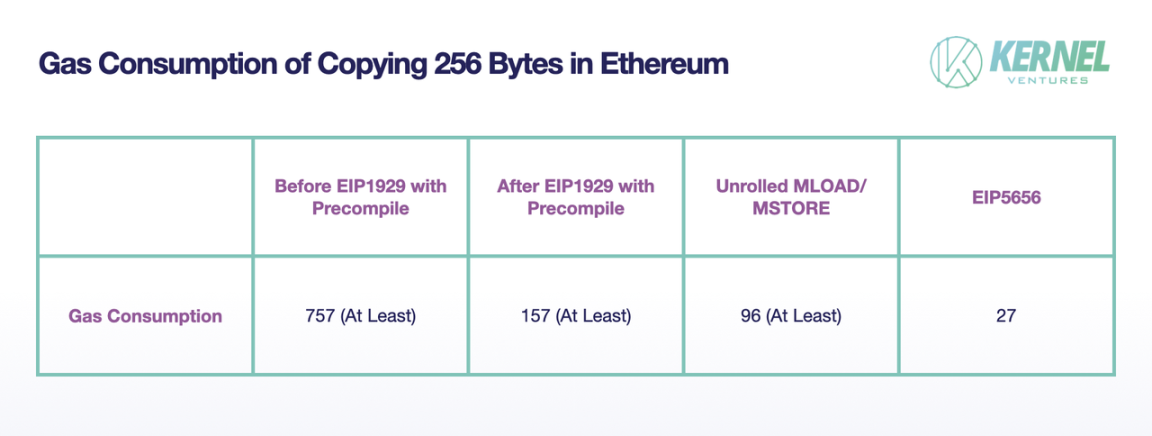

EIP-5656: Copying data in memory is a very frequent basic operation on Ethereum, but executing this operation on the EVM incurs a lot of overhead. To solve this problem, the Ethereum community proposed the MCOPY opcode in EIP-5656, which efficiently copies data on the EVM. MCOPY uses a special data structure to temporarily store the responsible data, including efficient slice access and memory object copying. Having a dedicated MCOPY instruction can also provide proactive protection, better coping with changes in gas costs for CALL instructions in future Ethereum upgrades.

EIP-6780: In Ethereum, using SELFDESTRUCT can destroy a contract and clear all of its code and all states associated with the contract. However, in the upcoming Verkle Tree structure to be used in Ethereum, this will pose a significant risk. In the Ethereum using Verkle Tree to store states, clearing the storage space will be marked as previously written but empty, which will not cause observable differences in EVM execution, but compared to operations that did not occur, created and deleted contracts will generate different Verkle Commitments, leading to data verification issues in the Ethereum under the Verkle Tree structure. Therefore, in EIP-6780, SELFDESTRUCT only retains the function of returning ETH from the contract to a specified address, and the code and storage state associated with the contract will continue to be stored on Ethereum.

3. Major Tracks After the Cancun Upgrade

3.1 DA Track

3.1.1 Ecological Value Discussion

For an introduction to the principles of DA and various types of DA, refer to our previous article Kernel Ventures: A Discussion on DA and Historical Data Layer Design. For DA projects, their revenue comes from the fees paid by users for storing data on them, while their expenses come from maintaining the operation of the storage network and paying for data persistence and security. The value accumulated by the network is the difference between revenue and expenses. The main means for DA projects to increase value is to increase the utilization of network storage space and attract as many users as possible to use the network for storage. On the other hand, improvements in storage technology, such as data compression or sharded storage, can reduce network expenses, thereby achieving higher value accumulation from another perspective.

3.1.2 Subdivision of DA Track

Currently, projects providing DA services are mainly divided into three types: main chain-specific DA, modular DA, and storage public chain DA. For specific introductions and differences, see Kernel Ventures: A Discussion on DA and Historical Data Layer Design.

3.1.3 Impact of the Cancun Upgrade on DA Projects

- User Demand: After the Cancun upgrade, the historical transaction data on Ethereum will increase several times faster than before. This historical data will also bring greater storage demand, but since the current Ethereum after the Cancun upgrade has not improved storage performance, the main chain's DA layer has adopted a simple periodic cleaning approach for this part of the data, naturally shifting the storage market to various DA projects, thereby bringing greater user demand.

- Development Direction: The increase in historical data on Ethereum after the Cancun upgrade will prompt various DA project parties to improve their efficiency and interoperability with Ethereum to better seize this part of the market. It can be foreseen that various cross-chain storage bridge technologies will become the focus of development for storage public chain DA and modular DA. For main chain-specific DA on Ethereum, it also needs to consider how to further enhance its compatibility with the mainnet and minimize transmission costs and transmission risks.

3.1.4 Different Opportunities for DA Tracks After the Cancun Upgrade

The Cancun upgrade brings faster data growth to Ethereum but does not change the way data is stored synchronously across the network, forcing the main chain to periodically clean up a large amount of historical data and delegate the long-term storage of transaction data. However, there is still demand for this historical data in processes such as airdrops by project parties and data analysis by on-chain analysis institutions. The underlying data value will attract different DA project parties to compete, and the key to the market share direction lies in the data security and storage costs of DA projects.

- Main Chain-Specific DA: Currently, main chain DA projects such as EthStorage mainly source the storage market from large memory data such as images and music from NFT projects on Ethereum. Main chain DA, due to its high compatibility with Ethereum on node clusters, can achieve secure data interaction with the Ethereum mainnet at low cost. At the same time, it stores index data on the Ethereum mainnet smart contract and does not completely detach the DA layer from Ethereum, thereby gaining strong support from the Ethereum Foundation. For the storage market brought by Ethereum, main chain-specific DA has a natural advantage over other DAs.

- Storage Public Chain DA and Modular DA: These non-main chain DA projects are relatively difficult to gain a competitive advantage in historical data storage performance in the Cancun upgrade compared to specific DA projects on Ethereum. However, the current specific DA projects on Ethereum are still in the testing phase and have not been fully implemented, while the Cancun upgrade is imminent. If specific DA projects cannot provide an implemented storage solution before the Cancun upgrade, the exploration of this round of data value may still be dominated by modular DA.

3.1.5 Opportunities for DA After the Cancun Upgrade

- EthStorage: Projects like EthStorage will be the biggest beneficiaries of the Cancun upgrade, so it is worth paying close attention to the EthStorage project before and after the Cancun upgrade. In addition, after the news of the Cancun upgrade possibly taking place in February this year, the official promotion of EthStorage has been active, releasing its new official website and annual report, showing a very proactive approach.

Let’s celebrate the reveal of our new website! Please visit http://EthStorage.io to see the brand new design!

Meet the Frontier of Scalability

Real-time Cost Comparison with Ethereum

How EthStorage Works

Core Features of EthStorage

Applications Enabled by EthStorage

However, compared to the content of the latest official website and the 2022 version, apart from the cooler front-end effects and more detailed introductions, there have not been many innovations in service functions. The main focus remains on storage and Web3Q domain services. If interested, you can click the link below to claim test tokens W3Q on the Galileo Chain network to experience the services of EthStorage. To participate in claiming tokens, you need to have a W3Q domain or an account with a mainnet balance of over 0.1 ETH. Judging from the recent water output from the faucet, despite some promotion, there is currently not a very large level of participation. However, considering that EthStorage recently received a $7 million seed round of financing in July and there is no clear source of this funding, it is also possible that the project team is quietly brewing the advancement of certain infrastructure, waiting for the early release of the Cancun upgrade to attract maximum attention.

Celestia: Celestia is the leading project in the current modular DA track. Compared to Ethereum-specific DA projects still in development, Celestia began to make a name for itself and received its first round of financing during the last bull market. After more than two years of development, Celestia has perfected its Rollup model, token model, and has undergone extensive testing on the testnet, finally completing its mainnet launch and first batch of airdrops on October 31, 2023. Its token price has been on the rise since its opening, and recently the price even broke through $20. Based on the current circulating supply of 150 million TIA, the project's market value has reached around $30 billion. However, considering the limited service group of blockchain historical storage, the market value of TIA has far exceeded that of the more profitable traditional storage public chain Arweave and is approaching the market value of Filecoin. Although there is still some room for growth in the bull market, the current market value of TIA is somewhat overvalued. However, with the support of star projects and the lingering enthusiasm for airdrops, if the Cancun upgrade can be pushed as scheduled in the first quarter of this year, Celestia is still a project worth paying attention to. However, one risk worth noting is that the Ethereum Foundation has repeatedly emphasized in discussions involving Celestia that projects that are not part of the Ethereum DA layer will not be considered Layer2, showing an exclusionary attitude towards non-Ethereum-native storage projects like Celestia. The possible stance of the Ethereum Foundation before and after the Cancun upgrade may also bring uncertainty to the price trend of Celestia.

3.2 Layer2 Track

3.2.1 Ecological Value Discussion

Due to the increasing number of users and ongoing development projects on Ethereum, the low TPS of Ethereum has become a major obstacle to further development of its ecosystem. At the same time, the high transaction fees on Ethereum make it difficult to widely promote projects involving complex interactions. However, many projects have already landed on Ethereum, and there are huge costs and risks associated with migration. Additionally, apart from the Bitcoin public chain, which focuses on payments, it is difficult to find a public chain with the same level of security as Ethereum. The emergence of Layer2 is an attempt to solve the above problems. It processes and computes transactions entirely on another public chain (Layer2), packages the data, verifies it through smart contracts bridging with Layer1, and changes the state on the mainnet. Layer2 focuses on transaction processing and verification, while Ethereum serves as the DA layer for storing compressed transaction data, resulting in faster speed and lower computational costs. If users want to execute transactions using Layer2, they need to purchase the corresponding tokens in advance and pay the network operator. The network operator of Layer2 also needs to pay for the security of data stored on Ethereum, and the revenue of Layer2 is the difference between the fees paid by users for data security on Layer2 and the fees paid by Layer2 for data security on Layer1. Therefore, for Layer2 on Ethereum, the following two improvements can bring more revenue. From an open-source perspective, the more active the Ethereum ecosystem and the more projects there are, the more users and project parties will have a need to reduce gas fees and accelerate transactions, thereby bringing a larger user base to the Layer2 ecosystem. Under the premise of unchanged profit per transaction, more transactions will bring more revenue to the network operator of Layer2. From a cost-saving perspective, if the storage cost of Ethereum itself decreases, the storage fees for the DA layer that Layer2 projects need to pay will decrease. Under the premise of unchanged transaction volume, the network operator of Layer2 can also obtain more revenue.

3.2.2 Subdivision of Layer2 Track

Around 2018, Ethereum's Layer2 solutions presented a situation of diversity, including sidechains, Rollup, state channels, and Plasma, totaling four types of solutions. However, state channels have gradually been marginalized from the Layer2 solutions due to the risk of unavailable data during off-chain channel transmission and a large number of griefing attacks. Plasma is relatively niche, and the total value locked (TVL) cannot enter the top 10 in Layer2, so it is not discussed much. Finally, for the sidechain form of Layer2 solutions, it completely does not use Ethereum as the DA layer, and has gradually been excluded from the definition of Layer2. This article only discusses the current mainstream Layer2 solution Rollup, and analyzes its subdivision tracks ZKRollup and OpRollup.

Optimistic Rollup

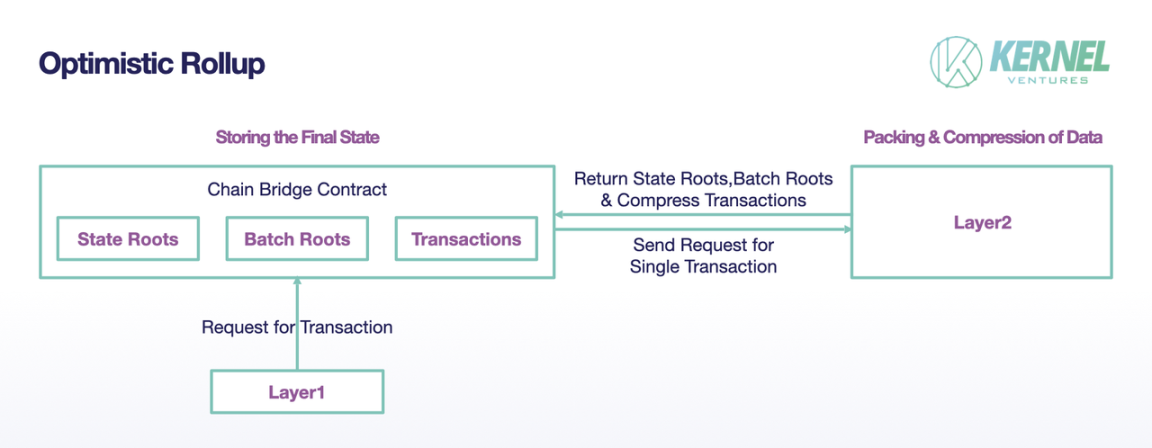

Implementation principle: During the initialization phase, the Optimistic Rollup chain needs to deploy a chain bridge contract on the Ethereum mainnet to interact with the Ethereum mainnet. Op Layer2 will batch package user transaction data and send it to Ethereum, including the latest state root of Layer2 accounts, batch roots, and compressed transaction data. Currently, this data is stored in the chain bridge contract in the form of Calldata, which has reduced gas compared to permanent storage in MPT, but it still incurs significant data costs and also poses obstacles to potential performance improvements for Op Layer2 (Optimistic Rollup Layer2).

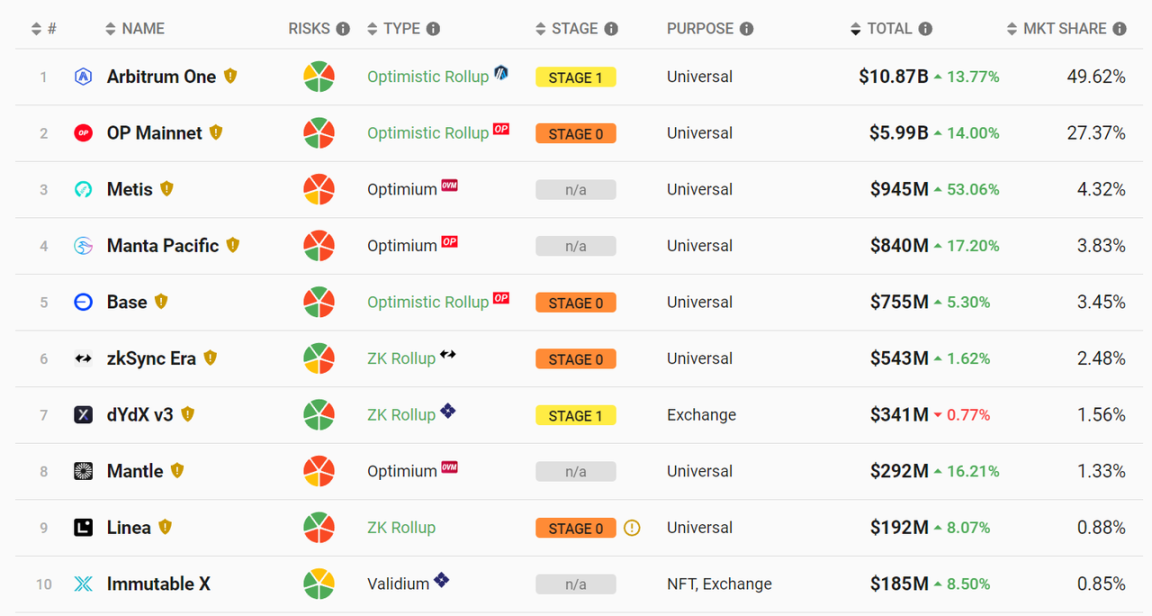

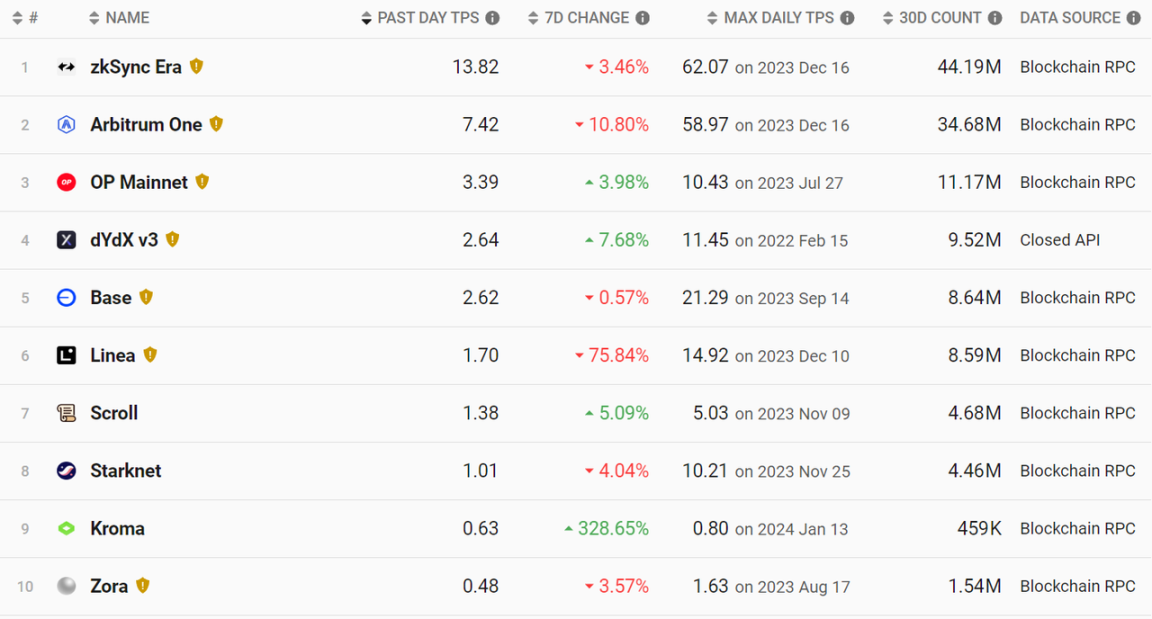

Current status: Op Layer2 is currently the largest ecosystem of Layer2, and the total value locked (TVL) of the top five public chains all come from the Optimistic Rollup ecosystem. The combined TVL of the two public chains, Optimism and Arbitrum, exceeds $16 billion.

The main reason why the Op Rollup ecosystem is able to take the lead position today is its developer-friendly environment. It completed the first round of Layer2 release and mainnet launch ahead of ZK Rollup, attracting a large number of DApp developers who were suffering from Ethereum transaction fees and low TPS limitations, leading to the migration of DApp development from Layer1 to Layer2. At the same time, Op Layer2 has higher compatibility with EVM at the underlying level, clearing obstacles for the migration of Ethereum mainnet projects and enabling the deployment of various DApps such as Uniswap, Sushiswap, and Curve on Layer2 in the fastest time. It has even attracted projects like Wordcoin to migrate from the Polygon mainnet. Currently, Op Layer2 includes leading DeFi projects like Uniswap V3, native DeFi projects with TVL exceeding $100 million like GMX, and SocialFi projects like Friend.tech with transaction fees exceeding 20 million. It has not only accumulated a large number of projects but also driven breakthroughs in the quality of the entire ecosystem in various tracks. However, in the long run, ZK Layer2 (ZK Rollup Layer2) has a higher TPS limit and lower gas consumption per transaction. As the ZK Rollup technology gradually improves, Op Layer2 will face fierce competition from ZK Layer2.

ZK Rollup (Zeroknowledge Rollup)

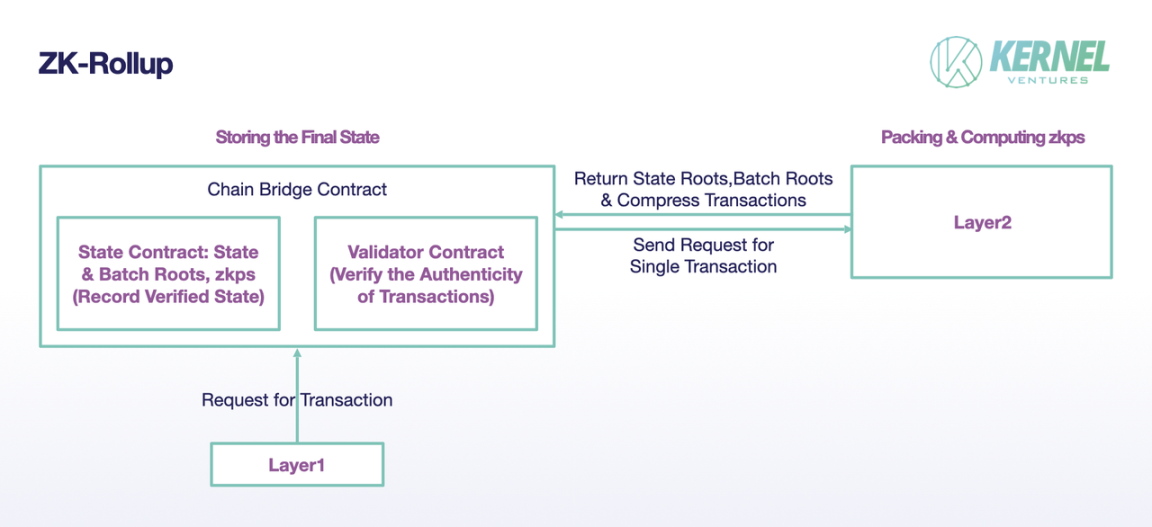

Implementation principle: The transaction data in ZK Layer2 is processed in a similar way to Op Layer2, packaged on Layer2, and stored in the Calldata of the smart contract on Layer1. However, in ZK Layer2, there is an additional step of generating ZKp for the transaction data on Layer2, and it does not need to return compressed transaction data to the network, only the transaction root, batch root, and ZKp for verifying the legitimacy of the corresponding transaction. The data returned to Layer1 through ZK Rollup does not require any waiting period and can be updated in real-time on the mainnet after verification.

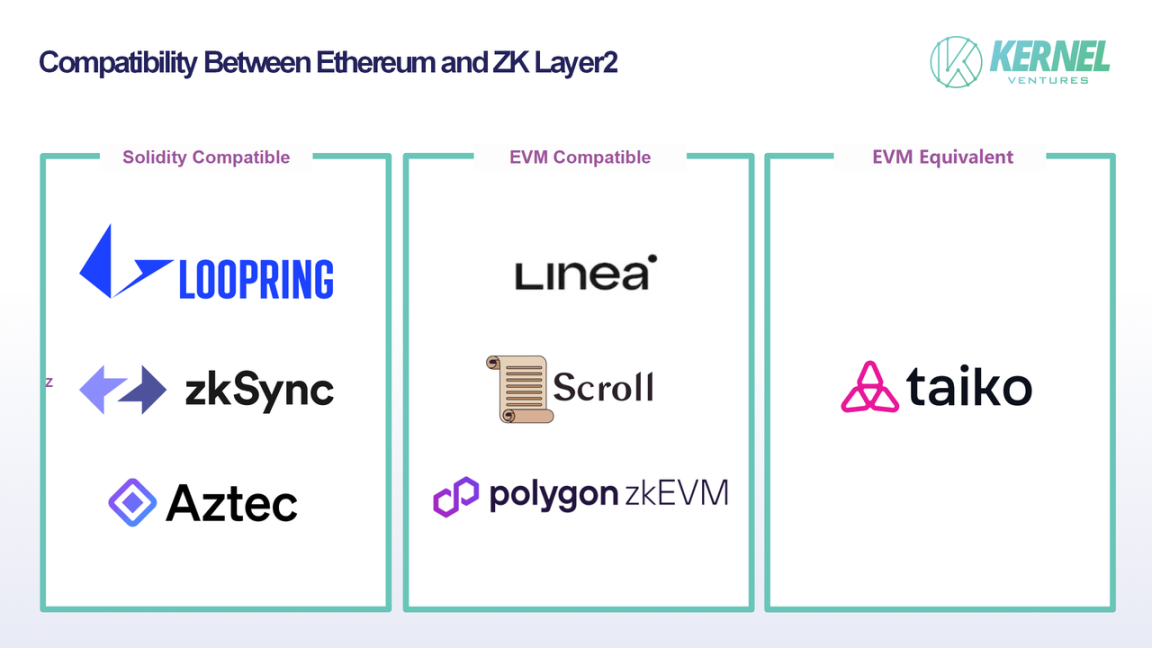

Current status: ZK Layer2 has developed into the second-largest Layer2 ecosystem, following closely behind Op Layer2. Among the top 10 TVL-ranked Layer2, 4 are from the ZK series, but overall, there is a phenomenon of quantity without strength. Many believe that ZK Layer2 has great development prospects but has not been able to fully develop. This is primarily because the early release of Op Layer2 has attracted many developers to land their projects on it. If project migration does not provide enough advantages, project teams are unlikely to migrate projects that are already generating stable income on Op Layer2. Additionally, many ZK Layer2 projects are still working on compatibility with Ethereum at the underlying level. For example, the star project Linea in the ZK series currently cannot be compatible with many EVM opcodes, creating development barriers for EVM developers. Another star project, zkSync, currently cannot even achieve compatibility with the EVM underlying layer and can only be compatible with some Ethereum development tools.

The compatibility with Ethereum also brings great difficulty to the migration of native projects. Due to the lack of complete interoperability of bytecode, project teams need to make changes to the underlying contracts to adapt to zkEVM, which poses many difficulties and risks, greatly slowing down the migration process of native Ethereum projects. Currently, most projects on ZK Layer2 are native projects, with a focus on relatively low development difficulty DeFi projects like Zigzag and SyncSwap. The total quantity and diversity of projects on ZK Layer2 are waiting for further development. However, the advantage of ZK Layer2 lies in its technological advancement. If it can achieve compatibility between zkEVM and EVM and improve the ZKp generation algorithm, it will have a better performance limit compared to Op Layer2. This is also why, even in the current Op Layer2-dominated market, there are still new ZK Layer2 projects emerging. In a situation where the Op Layer2 track has been almost fully divided, the most suitable way for newcomers is to propose a better solution to attract users to migrate from the existing network. However, even if one day ZK Layer2 achieves technological perfection, if Op Layer2 has already formed a comprehensive ecosystem with many projects landing, it will be an unknown whether users and developers are willing to take on the huge risk of migration. In addition, Op Layer2 is continuously improving at this stage to consolidate its ecosystem position, including Optimism open-sourcing Op Stack to assist other Op Layer2 developers in rapid development and improvements to the challenge method such as binary challenge. While ZK Layer2 is in the process of improvement, Op Layer2 has not slowed down its development. Therefore, the important task for ZK Layer2 at this stage is to focus on perfecting cryptographic algorithms and compatibility with EVM to prevent the formation of dependency on the Op Layer2 ecosystem by users.

3.2.3 Impact of the Cancun Upgrade on Layer2

Transaction speed: After the Cancun upgrade, a block can carry up to 20 times more data through blob while maintaining the same block generation speed. Therefore, theoretically, Layer2 using Layer1 as the DA layer and settlement layer can achieve up to 20 times the TPS increase compared to before. Even with a conservative estimate of a 10x growth, the transaction speed of any of the major Layer2 star projects will exceed the historical highest transaction speed of the Ethereum mainnet.

Transaction fees: One of the important reasons why Layer2 networks cannot reduce their costs is the data security fees provided to Layer1. Based on current prices, the storage cost of 1KB Calldata on the Ethereum smart contract is close to $3. However, with the Cancun upgrade, the transaction data packaged by Layer2 is stored in the form of blobs on the Ethereum consensus layer, and storing 1GB of data for a month costs only about $0.1, significantly reducing the operating costs of Layer2. For the revenue generated from this open-source, Layer2 operators will definitely pass on some benefits to users to attract more users and reduce the transaction costs of Layer2.

Scalability: The impact of the Cancun upgrade on Layer2 mainly comes from its temporary storage solution and the addition of the blob data type. Temporary storage will regularly delete old states on the mainnet that are not useful for current verification, reducing the storage pressure on nodes and speeding up the network synchronization and node access speed between Layer1 and Layer2. The blob, with its large external space and flexible adjustment mechanism based on gas prices, can better adapt to changes in network transaction volume. When the transaction volume is too high, the number of blobs carried in a block can be increased, and when the transaction volume decreases, it can be reduced accordingly.

3.2.4 Different Tracks of Layer2 under the Cancun Upgrade

The arrival of the Cancun upgrade will be beneficial for the entire Layer2 ecosystem. The core change in the Cancun upgrade is the reduction of data storage costs on Ethereum and the increase in the size of individual blocks, which naturally leads to a corresponding increase in TPS for Layer2 using Ethereum as the DA layer and a reduction in storage fees paid to Layer1. However, due to the different usage levels of the two types of Rollups on the Ethereum DA layer, the degree of benefits for Op Layer2 and ZK Layer2 will differ.

Op Layer2: Due to the need to leave compressed complete transaction data on Ethereum for recording, Op Layer2 requires more transaction fees to be paid to Ethereum compared to ZK Layer2. Therefore, with the reduction in gas consumption through EIP-4844, Op Layer2 can relatively achieve a larger reduction in transaction fees, thereby narrowing the disadvantage in transaction fee difference compared to ZK Layer2. Additionally, the reduction in Ethereum gas fees will inevitably attract more participants and developers. More projects and capital are likely to prefer entering Op Layer2, especially the strong-performing Arbitrum. This may bring about a new round of development dominated by Op Layer2 in the Layer2 ecosystem, especially for SocialFi and GameFi projects that are affected by high transaction fees and struggle to provide a quality user experience. This stage of Layer2 may see the emergence of many high-quality projects that can provide a user experience close to Web2. If this round of development dominance is taken over by Op, it will further widen the gap with the overall ZK Layer2 ecosystem, making it more difficult for ZK Layer2 to catch up in the future.

ZK Layer2: Compared to Op Layer2, the benefits of gas reduction for ZK Layer2, which does not need to store specific transaction information on the chain, will be smaller. Although ZK Layer2 is still in the development process and does not have a large ecosystem like Op Layer2, there is more intense competition in development on Op Layer2. For new developers attracted by the Cancun upgrade, competing with mature Op Layer2 developers may not be a wise choice. If ZK Layer2 can improve the developer support facilities at this stage and provide a better development environment for developers, considering the better prospects and intense market competition of ZK Layer2, new developers may choose to enter the ZK Layer2 track. This process may actually accelerate the catching up of ZK Layer2, achieving a surpassing of Op Layer2 before it establishes a dominant advantage.

3.2.5 Opportunities for Layer2 under the Cancun Upgrade

DYDX: Although DYDX is a DEX deployed on Ethereum, its functionality and principles are quite different from traditional DEXs on Ethereum like Uniswap. It uses an order book instead of the AMM trading model used by mainstream DEXs, allowing users to have a smoother trading experience and creating favorable conditions for leveraged trading. Additionally, it utilizes second-layer solutions like StarkEx to achieve scalability and process transactions, packing them off-chain and returning them to the chain. Through the underlying principles of Layer2, DYDX enables users to have transaction costs much lower than traditional DEXs, with fees of only around $0.005 per transaction. With the intense volatility of Ethereum and related tokens during the Cancun upgrade, there is almost certainly an increase in high-risk investments such as leveraged trading. With the Cancun upgrade, the transaction fees on DYDX will surpass those of CEX even for small transactions, while also providing higher fairness and security, thus providing an excellent trading environment for high-risk investments and leverage enthusiasts. From this perspective, the Cancun upgrade will bring a very good opportunity for DYDX.

Rollup Node: For new block verification, the data that is regularly cleared in the Cancun upgrade no longer has meaning, but it does not mean that this cleared data is worthless. For example, projects that are about to airdrop tokens need complete historical data to ensure the security of each token to be airdropped, and some on-chain analysis institutions often need complete historical data to trace the flow of funds. At this time, one option is to query historical data from the Rollup operator on Layer2, and in this process, the Rollup operator can charge for data retrieval. Therefore, against the backdrop of the Cancun upgrade, effectively improving the data storage and retrieval mechanism on Rollup and developing related projects in advance will greatly increase the possibility of project survival and further development.

3.3 DApp Track

3.3.1 Discussion on Ecosystem Value

Similar to applications in Web2, the role of DApps is to provide a service to users on Ethereum. For example, Uniswap provides real-time exchange of different ERC20 tokens for users; Aave offers over-collateralized lending and flash loan services to users; and Mirror provides decentralized content creation opportunities for creators. However, unlike in Web2, where applications mainly profit by attracting more users to their platform through low-cost and high-quality services and then monetizing through advertising, DApps maintain zero invasion of user attention throughout the process and do not provide any recommendations to users. Instead, they charge corresponding fees for each interaction with users after providing a service. Therefore, the value of DApps mainly comes from the frequency of user usage of DApp services and the depth of interaction in each interaction process. If a DApp wants to increase its value, it needs to provide services that are superior to those of similar DApps, thereby making more developers inclined to use it over other DApps for operations.

3.3.2 Subdivision of DApp Track

Currently, Ethereum DApps are mainly focused on DeFi, GameFi, and SocialFi. There were some early Gamble projects, but due to the limitations of Ethereum transaction speed and the release of more suitable public chains like EOS, Gamble projects on Ethereum have gradually declined. These three types of DApps provide financial, gaming, and social services, respectively, and capture value from them.

Implementation principle: Essentially, DeFi is a single or series of smart contracts on Ethereum. During the deployment phase of DeFi, relevant contracts (such as currency contracts, exchange contracts, etc.) need to be deployed on the Ethereum mainnet, and the contracts interact with Ethereum through interfaces to implement DeFi functional modules. When users interact, they call the contract interface to perform operations such as depositing, withdrawing, and exchanging. The DeFi smart contract will package the transaction data, interact with Ethereum through the contract's script interface, and record state changes on the Ethereum blockchain. During this process, the DeFi contract will charge a certain fee as a reward for liquidity providers and for its own profit.

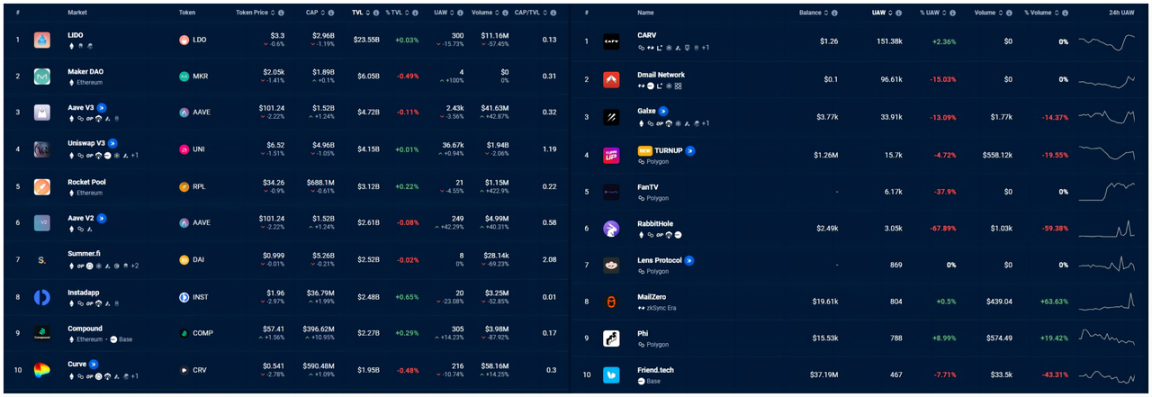

Current situation: Currently, DeFi holds an absolute advantage in DApps on Ethereum, occupying positions in the top 10 DApps in terms of contract assets on Ethereum, apart from cross-chain and Layer2 projects. As of now, the cumulative number of users in DeFi on Ethereum has exceeded 40 million. Although the monthly active user count experienced a peak of nearly 8 million in November 2021, it has since fallen due to the bear market. However, with the market rebounding, the current monthly user count has also risen to about half of the peak, awaiting the next bull market for another surge. Additionally, the types of DeFi are becoming more diverse and comprehensive, from the early coin trading and collateralized lending to the current leveraged trading, periodic purchases, NFT finance, flash loans, and more. Financial methods that can be implemented in Web2 are gradually being realized in DeFi, and functionalities such as flash loans that cannot be implemented in Web2 are also being realized in DeFi.

SocialFi

Implementation principle: Similar to traditional social platforms, SocialFi also supports individuals to create content and publish it through the platform for dissemination, attracting followers to their accounts. For users, they can access the content they need and obtain the services they require through the platform. The difference is that the content published by users, the interaction records between content creators and followers, and the information of the accounts are all decentralized and recorded through blockchain smart contracts, returning ownership of the information to each individual account. For the SocialFi platform, the more people willing to create and share content through its platform, the more revenue it can generate by providing these services. The fees users pay for interacting on the SocialFi platform, minus the storage costs for account and transaction data, constitute the profit of the SocialFi project.

Current situation: Although the UAW (User Active Wallet) of leading SocialFi projects may seem comparable to DeFi, this often comes from the expected airdrops of certain projects and lacks sustainability. For example, the UAW volume of friend.tech after the hype was even less than 1,000, and the comparison between the top 5 DeFi and SocialFi projects clearly shows this. The fundamental reason is that the high service fees and inefficiency of SocialFi make it unable to fulfill its social attributes and simply become a speculative platform.

GameFi

Implementation principle: The implementation of GameFi is broadly similar to SocialFi, but the application is focused on gaming. Currently, the mainstream profit model for GameFi projects is through the sale of in-game items.

Current situation: In order to generate more profit, project owners must attract more people to participate in the game. At present, there are only two main factors that can attract users to participate in games: the fun of the game, driving users to purchase items for game participation or a better gaming experience, and the expectation of profitability, where users believe they can sell these items at a higher price in the future. The first model is similar to Steam, where project owners receive real money while users enjoy the game. In the second model, if the profit of users and project owners comes from the continuous influx of new users, and once the new funds cannot offset the project's issuance of items, the project will quickly fall into a cycle of selling, decreasing market expectations, and continuous selling, making it difficult to sustain profits and having Ponzi-like properties. Due to the limitations of blockchain transaction fees and speed, GameFi at present mostly cannot meet the user experience requirements of the first model and is more inclined towards the second model.

3.3.3 Impact of the Cancun Upgrade on DApps

Performance optimization: After the Cancun upgrade, a single block can carry more transaction data, allowing DApps to achieve more state changes. Based on the average expansion of 8 blobs, the processing speed of DApps after the Cancun upgrade can reach ten times that of the original.

Cost reduction: Data storage costs are a fixed expense for DApp projects. Whether on Layer1 or Layer2, DApps directly or indirectly use Ethereum to record the state of accounts within the DApp. After the Cancun upgrade, each transaction in DApps can be stored in the form of Blob data, significantly reducing the operating costs of DApps.

Function expansion: Constrained by the high storage costs on Ethereum, project owners deliberately reduce the data uploaded to the chain during DApp development. This has led to many experiences that users can enjoy in Web2 not being transferable to DApps. For example, SocialFi cannot support the demand for video creation on platforms like Twitter, or even if it can, it cannot provide the same level of security for data as Ethereum. The interaction options in GameFi games are often basic and uninteresting because every state change requires recording on the chain. Through the Cancun upgrade, project owners have more opportunities to attempt in the above-mentioned areas.

3.3.4 Different Tracks of DApps under the Cancun Upgrade

DeFi: The impact of the storage cost reduction on DeFi after the Cancun upgrade is relatively small because DeFi only needs to record the state of user assets in the contracts, such as whether they are staked, borrowed, or in other states, requiring much less data storage compared to the other two types of DApps. However, the increase in Ethereum TPS brought about by the Cancun upgrade can greatly promote arbitrage activities in DeFi with high transaction frequency and leveraged businesses that need to open and close positions within a short period. Additionally, the accumulated improvement in storage cost reduction, which is not evident in single token exchanges, can save a significant amount of fees in leveraged and arbitrage trading.

SocialFi: The performance improvement brought about by the Cancun upgrade has the most direct impact on SocialFi. Through the Cancun upgrade, the smart contracts of SocialFi can handle and store a large amount of data, providing a user experience closer to Web2. Additionally, basic user interactions such as content creation, comments, and likes on SocialFi can also have lower costs, attracting long-term participants with genuine social orientation.

GameFi: For asset-on-chain games during the previous bull market, the impact is similar to DeFi, with a relatively small reduction in storage costs. However, the increase in TPS provides conditions for high-frequency interactions in games, improving the real-time interaction of complex interactive features in games. The impact on full-chain games is more direct. As all the logic, states, and data of the game are stored on the chain, the Cancun upgrade will significantly reduce the operating and user interaction costs of the game. Additionally, the initial deployment costs of the game will also greatly decrease, lowering the barrier to game development and prompting the emergence of more full-chain games in the future.

3.3.5 Opportunities for DApps under the Cancun Upgrade

Dark Forest: Since the third quarter of 2023, perhaps due to skepticism about the lack of decentralization in traditional asset-on-chain games, or simply because of the weak narrative of traditional GameFi, fully on-chain games have started to gain popularity. However, for fully on-chain games on Ethereum, the transaction speed of 15 TPS and the storage cost of 16 gas per byte in the CALLDATA field significantly limit their development potential. The implementation of the Cancun upgrade can greatly improve both of these issues, especially in combination with the continuous development of related projects in the second half of 2023, which could bring significant benefits to this track. Considering the network effect, Dark Forest is one of the few fully on-chain games that has emerged from the previous bull market, with a well-established community and has not issued its own token yet. If the project team has this idea before and after the Cancun upgrade, it should have a good trend.

4. Summary

The implementation of the Cancun upgrade will bring higher TPS and lower storage costs to Ethereum, but it also brings a surge in storage pressure. The tracks that will be greatly affected are DA and Layer2. For the DA track, the surge in storage pressure will bring huge benefits to Ethereum-specific DAs, and related projects such as EthStorage are worth paying attention to. In contrast, projects that do not use Ethereum's DA in the underlying data storage have not received support from the Ethereum development community. Although there are also opportunities, caution is needed when dealing with specific projects. Since most ZK-based Layer2s have not yet introduced tokens, and with the recent strength of Arbitrium in anticipation of the Cancun upgrade, if Arbitrium does not experience a major setback, Arb and its ecosystem-related projects will have an advantage over other Layer2s in the Cancun upgrade. Due to the influx of speculators, the DYDX project may also have certain opportunities at the nodes of the Cancun upgrade. Finally, Rollup has a natural advantage in storing historical transaction data for Layer2. When it comes to providing historical data access services, Rollup on Layer2 will also be a good choice.

Looking at the longer term, the Cancun upgrade creates conditions for the development and performance of various DApps, and in the future, we will inevitably see Web3 projects gradually approaching Web2 in terms of interaction functionality and real-time performance, bringing Ethereum closer to the goal of becoming a world computer. Any pragmatic development project is worth long-term investment. In the recent surge in the market, Ethereum has been relatively weak compared to Bitcoin. While Bitcoin has recovered to nearly two-thirds of its previous bull market high, Ethereum has not yet recovered half of its previous high. The arrival of the Cancun upgrade may change this trend and bring a round of catch-up for Ethereum. After all, as one of the few public chains that can maintain profitability and has token deflation, its current value is indeed undervalued.

References

eips.ethereums-core: https://eips.ethereum.org/core

EthStorage Official Website: https://eth-store.w3eth.io/#/

EIP-1153: Transient storage opcodes: https://eips.ethereum.org/EIPS/eip-1153

EIP-4788: Beacon block root in the EVM: https://eips.ethereum.org/EIPS/eip-4788

EIP-5656: MCOPY - Memory copying instruction: https://eips.ethereum.org/EIPS/eip-5656

EIP-6780: SELFDESTRUCT only in same transaction: https://eips.ethereum.org/EIPS/eip-6780

How do zk rollups work: https://ethereum.org/zh/developers/docs/scaling/zk-rollups#how-do-zk-rollups-work

OPTIMISTIC ROLLUPS: https://ethereum.org/developers/docs/scaling/optimistic-rollups

zk, zkVM, zkEVM and their future: https://foresightnews.pro/article/detail/11802

Rebuilding and breakthrough, exploring the present and future of fully on-chain games: https://foresightnews.pro/article/detail/39608

Analyzing the economic model behind Axie Infinity: https://www.tuoluo.cn/article/detail-10066131.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。