Beijing time on November 11th (November 10th Eastern Time), the U.S. Securities and Exchange Commission (SEC) approved the listing and trading of Bitcoin Exchange-Traded Fund (ETF) products, which will be listed and traded on nationally registered securities exchanges in the United States (see full text at the end of the article).

The complete list of management companies approved by the SEC to launch Bitcoin ETFs includes Ark 21 Shares, Bitwise, BlackRock, Fidelity, Franklin Templeton, Grayscale, Hashdex, Invesco, WisdomTree, Valkyrie, and VanEck.

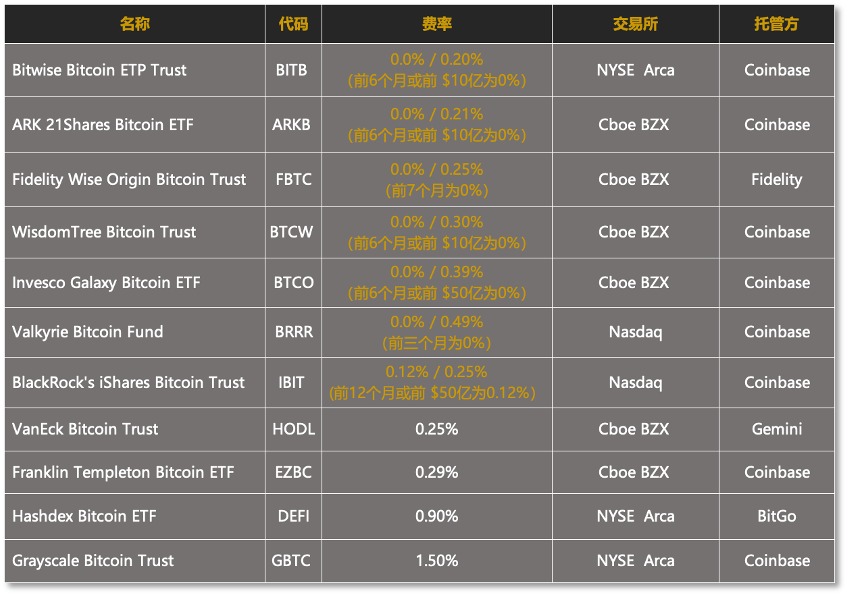

Fees and listing exchanges for the 11 approved Bitcoin ETFs

Fees and listing exchanges for the 11 approved Bitcoin ETFs

The SEC stated in the approval statement that the staff of the commission is simultaneously completing the review of registration statements for 10 spot Bitcoin ETPs, which will help create a fair competitive environment for issuers, promote fairness and competition, and benefit investors and the broader market.

According to public documents, Bitcoin ETFs will be traded on stock exchanges, including Nasdaq, the New York Stock Exchange's electronic securities exchange (NYSE Arca), and the Chicago Board Options Exchange (Cboe BZX). The first batch of ETFs holding mutual funds will enjoy special tax treatment in the United States and are expected to start trading as early as the morning of January 11th Eastern Time. At that time, BlackRock will list its iShares Bitcoin Trust (IBIT) on Nasdaq.

ETF products with both primary and secondary markets have inherent mechanisms for physical subscription and redemption. ETF investors (generally large institutional investors) generally exchange a basket of securities or commodities for ETF shares when subscribing, and exchange ETF shares for a basket of securities or commodities when redeeming. Ordinary investors do not need to hold a basket of securities or commodities and can buy and sell ETF products in the stock market in cash.

However, the Bitcoin ETFs listed in the U.S. market do not adopt a mechanism for physical subscription/redemption. During the application period, several Bitcoin ETF issuers submitted the subscription/redemption mechanism in the documents as "cash" rather than Bitcoin "physical". This mechanism will inhibit the entry of funds from the mainstream financial market into the Bitcoin market, likely to dispel the SEC's concerns about price manipulation of Bitcoin.

Nevertheless, the appearance of Bitcoin ETFs in the mainstream financial market in North America is allowing institutional and retail investors to access this trillion-dollar cryptocurrency asset market without needing to hold physical Bitcoin.

Analysts at Standard Chartered Bank previously stated that Bitcoin ETFs alone could attract $50 to $100 billion in funds this year, potentially driving the price of Bitcoin to as high as $100,000. Some analysts are more conservative, estimating that inflows over the next 5 years could approach $55 billion.

Issuers are also making every effort to enhance the attractiveness of this potential product. Documents submitted to the SEC show that several Bitcoin ETF issuers have once again lowered management fees to gain a competitive advantage after listing, including 7 companies including BlackRock adopting flexible fee standards, with fees as low as 0 for the first 6 months or the first $1 billion for Bitwise and ARK, 0% for the first 7 months for Fidelity, and BlackRock extending the period and amount to gain a fee advantage: 0.12% for the first 12 months or the first $5 billion. Grayscale, which has been applying to convert its Bitcoin Trust into a Bitcoin ETF, currently has the highest fee among all issuers, at 1.5%.

The SEC also stated in its latest statement, "Today we approved the listing and trading of certain spot Bitcoin ETP stocks, but we did not approve or endorse Bitcoin. Investors should exercise caution regarding the various risks associated with Bitcoin and products linked to its value and cryptocurrency."

Full text of SEC approval of Bitcoin Exchange-Traded Products (ETP) statement

Today, the Commission approved the listing and trading of certain spot Bitcoin Exchange-Traded Product (ETP) stocks.

I often say that the Commission acts within the scope of the law and court interpretations of the law. From Chairman Jay Clayton in 2018 to March 2023, the Commission rejected more than 20 spot Bitcoin ETP trading rule filings. One of the applications was filed by Grayscale, considering converting the Grayscale Bitcoin Trust into an ETP.

We are now faced with a series of new applications similar to those we have not approved in the past. However, the situation has changed. The U.S. Court of Appeals for the District of Columbia Circuit found that the Commission failed to fully explain its reasons for not approving the proposed listing and trading of Grayscale's ETP (Grayscale Order). Based on these circumstances and the more fully discussed circumstances in the approval order, I believe the most sustainable path forward is to approve the listing and trading of these spot Bitcoin ETP stocks.

The basis for the Commission's evaluation of any rule submitted to a national securities exchange is whether the rule complies with the Exchange Act and related regulations, including whether it is intended to protect investors and the public interest. The Commission remains neutral and does not express opinions on specific companies, investments, or the underlying assets of ETPs. If an issuer of securities and a listing exchange comply with the Securities Act, the Exchange Act, and the Commission's regulations, then the issuer must, like anyone else, have equal access to our regulated markets.

It is important to note that the Commission's action today is limited to ETPs holding a non-securities commodity—Bitcoin. This by no means indicates that the Commission is willing to approve listing standards for cryptocurrency securities. This approval also does not mean that the Commission has any opinion on the status of other cryptocurrencies under federal securities laws or the current situation of certain cryptocurrency market participants not complying with federal securities laws. As I have said in the past, without prejudging any particular cryptocurrency, the vast majority of cryptocurrencies are investment contracts and are therefore subject to federal securities laws.

Today, investors can already buy or otherwise access Bitcoin through some brokerage firms, mutual funds, national securities exchanges, peer-to-peer payment applications, non-compliant cryptocurrency trading platforms, and of course, the Grayscale Bitcoin Trust. Today's action will include certain protections for investors:

First, the initiators of Bitcoin ETPs will be required to provide comprehensive, fair, and truthful disclosures about the products. Investors in any listed Bitcoin ETP will benefit from disclosures in public registration statements and periodic filings. While these disclosures are necessary, it is important to note that today's action does not endorse the disclosed ETP arrangements, such as custody arrangements.

Second, these products will be listed and traded on nationally registered securities exchanges. These regulated exchanges must establish rules designed to prevent fraud and manipulation, and we will closely monitor these exchanges to ensure that they enforce these rules. In addition, the Commission will conduct a comprehensive investigation of any fraudulent or manipulative behavior in the securities market, including plans implemented through social media platforms. These regulated exchanges also have rules designed to address certain conflicts of interest and protect the interests of investors and the public.

In addition, existing rules and conduct standards will apply to the trading of approved ETPs. For example, this includes the best interest rule for broker-dealers recommending ETPs to retail investors and the fiduciary responsibilities of investment advisers under the Investment Advisers Act. Today's action does not approve or endorse cryptocurrency trading platforms or intermediaries, as most of them do not comply with federal securities laws and often have conflicts of interest.

Third, the staff of the Commission is simultaneously completing the review of registration statements for 10 spot Bitcoin ETPs, which will help create a fair competitive environment for issuers, promote fairness and competition, and benefit investors and the broader market.

Since 2004, our agency has accumulated rich experience in supervising spot non-securities commodity ETPs (such as commodity ETPs holding certain precious metals). This experience is very valuable for our supervision of spot Bitcoin ETP trading.

Although we remain neutral about its advantages, I want to point out that the underlying assets of metal ETPs have consumer and industrial uses, while in contrast, Bitcoin is primarily a speculative and volatile asset, and is also used for illegal activities, including ransomware, money laundering, evading sanctions, and financing terrorism.

Although we approved the listing and trading of certain spot Bitcoin ETP stocks today, we did not approve or endorse Bitcoin. Investors should exercise caution regarding the various risks associated with Bitcoin and products linked to its value and cryptocurrency.

(Statement: Readers are strictly required to comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。