Multiple institutions submit updated documents, market sentiment is high, and options trading volume has surged.

Author: Loopy Lu, Odaily Star Daily

This evening, as the United States enters the working hours of January 8th, there have been significant developments in the Bitcoin spot ETF. Bitcoin quickly rose slightly back above $45,000, and the market has seen fluctuations again.

Currently, there is less than 48 hours until the final result of the ETF is obtained. At the time of the ETF's approval, regardless of the rise or fall, the market consensus is that there will be huge fluctuations. The Bitcoin spot ETF is just one step away.

Odaily Star Daily has compiled the latest developments today as follows:

### Today's ETF Application Dynamics

Hashdex May Not Be the First to Pass

Previously reported, the SEC had required all Bitcoin ETF issuers to submit updated documents to the SEC by 8:00 am Eastern Time. The deadline has passed.

In addition to Hashdex, Grayscale, Ark/21 Shares, Blackrock, BitWise, VanEck, WisdomTree, Invesco, Fidelity, Valkyrie, Franklin, and other ETF applicants have all submitted updated versions of the S-1 document (Grayscale's case is an S-3 document).

Hashdex's most recent document submission was on December 26, 2023, missing the final deadline for this document update.

Voting is Imminent, When Will It Land?

The first stage of approving the Bitcoin spot ETF is for the SEC to sign the 19b-4 document. Then the SEC needs to approve the issuer's S-1 application, and if both are approved, technically, the ETF can start trading on the next working day.

Currently, the issuer's final document modification has been completed, and the next stage is for the SEC commissioners to vote on it.

Analyst Eric Balchunas of Bloomberg stated that there are no specific arrangements on the SEC's public agenda before January 11, but the SEC can make decisions using its authorized policies.

This means that we still do not know the specific time for the most important agenda of "voting."

ETF Fee Price War Begins?

In a series of documents, several ETFs such as BlackRock, WisdomTree, and VanEck have disclosed their fees. The fees of each company are quite interesting. (See the previous image for details)

Previously, Grayscale set the fee rate at 2%. According to Grayscale's latest submission of the Bitcoin spot ETF S-3 update document, its fee rate has been reduced to 1.5%. However, compared to competitors, Grayscale is still the most expensive ETF. However, there are clauses regarding fee exemptions. In addition, the fee rate for Grayscale's spot Bitcoin ETF has not been finalized, and Grayscale may further reduce its ETF fee rate.

Taking the most attention-grabbing BlackRock as an example, BlackRock has adjusted the ETF fee to 0.3% in the latest document. Bloomberg analyst Balchunas believes that this is lower than the previous forecast, which will make it more difficult for other competitors to compete.

ARK also decisively lowered its price at the right time.

In November 2023, ARK's initial submission to the SEC showed that its ETF fee was as high as 0.8%. 20 minutes after BlackRock submitted the ETF update document, ARK's updated document showed that the fee had been reduced to 0.25%. This move may have kicked off a price war.

After this round of significant fee adjustments, the fee competition landscape has changed.

Taking Fidelity as an example, its fee rate is 0.39%. In the initial version of the documents submitted by various issuers, this fee level was supposed to be the cheapest, but it has suddenly risen to a medium level.

### Surge in Options Trading Volume, ETF Guessing Begins

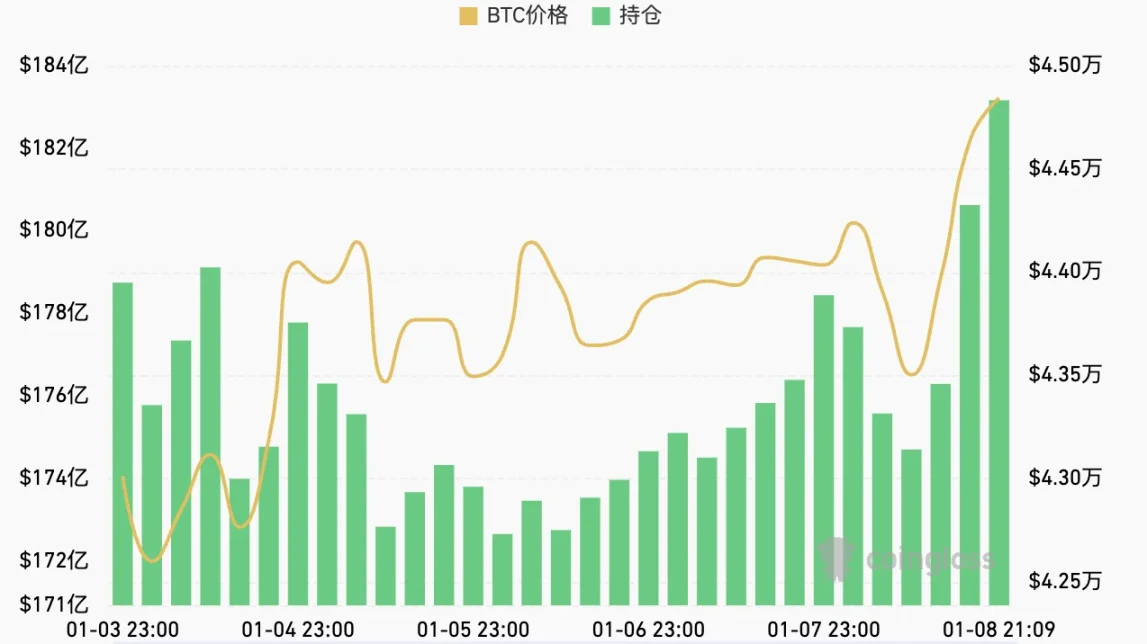

Coinglass data shows that in the past 24 hours, the entire network has liquidated $231 million, with $25.96 million in BTC and $24.24 million in ETH. Long positions were liquidated at $173 million, and short positions at $58.12 million.

Currently, the open interest is gradually increasing. The total BTC open interest in the network is 428,400 BTC, worth approximately $19.254 billion. CME has the highest open interest, with 122,400 BTC, equivalent to $5.492 billion. Binance has an open interest of 97,600 BTC, worth approximately $4.385 billion. Bybit has an open interest of 76,200 BTC, worth approximately $3.420 billion.

Adam, a macro researcher at Greeks.live, stated that the review results of the Bitcoin spot ETF are about to be finalized, and the market generally believes that it will be approved smoothly.

Adam further stated that stimulated by the continuous appearance of positive news, the current BTC has returned to a short-term high of $45,000. The at-the-money option IV expiring on the 12th is already as high as 110%, and the IV expiring on the 11th is as high as 120%. After today's settlement, the IV has risen by nearly 20%.

Options trading volume has also surged.

Deribit data shows that the most traded BTC options today are the options expiring on January 12, which may be related to the expected approval of the spot Bitcoin ETF. The trading volume (nominal value) for put options is $165.7 million and for call options is $157.7 million, indicating active market activity.

Although no one can know the final result of the ETF, and this event is almost unpredictable, various analysts, investors, and other major participants in the market have given their own predictions.

James Seyffart, an ETF analyst at Bloomberg, stated that the current probability of approval for the spot Bitcoin ETF may have exceeded 90%; another Bloomberg ETF analyst, Eric Balchunas, stated that he believes the current probability of approval for the spot Bitcoin ETF may have reached 95%, but extreme situations cannot be completely ruled out.

BlackRock has given some kind of "official forecast" for its ETF. According to Fox Business Channel, BlackRock expects its spot Bitcoin ETF to be approved by the SEC next Wednesday.

In the world of blockchain, predictions are also in full swing. In the prediction market Polymarket's "Will Bitcoin be approved before January 15th" topic, 85% of the funds have flowed to the "yes" option, with only 15% choosing "no." There are already over $3.3 million participating in the prediction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。