介绍

真实世界资产(Real World Assets,简称RWA)的概念在加密货币市场中并非近期新引入的,至少在2018年就已存在,那时的资产代币化和证券代币发行(Security Token Offerings,简称STO)与今日的RWA概念有许多相似之处。然而,由于监管框架不成熟和缺乏显著的潜在回报优势,这些早期尝试并未发展成为成熟的市场规模。

到2022年,随着美国继续提高利率,美国国债的收益率显著超过了加密行业的稳定币借贷利率。因此,将美国国债作为RWA标的进行代币化对加密行业越来越有吸引力。像MakerDAO、Compound和Aave这样的成熟DeFi项目,以及高盛、摩根大通、西门子甚至一些政府等传统金融机构,开始探索RWA。

在过去两年中,市场上出现了少量房地产RWA项目。它们旨在以各种方式扩大房地产投资市场,多样化房地产投资产品,并降低房地产投资者的入门门槛。本研究将对这些项目进行案例分析,分析房地产RWA的设计优缺点及其潜在市场。由于这些项目主要针对北美的房地产部门,因此讨论的相关政策、规定和市场条件将主要涉及北美的房地产市场。

代币化房地产市场的方法

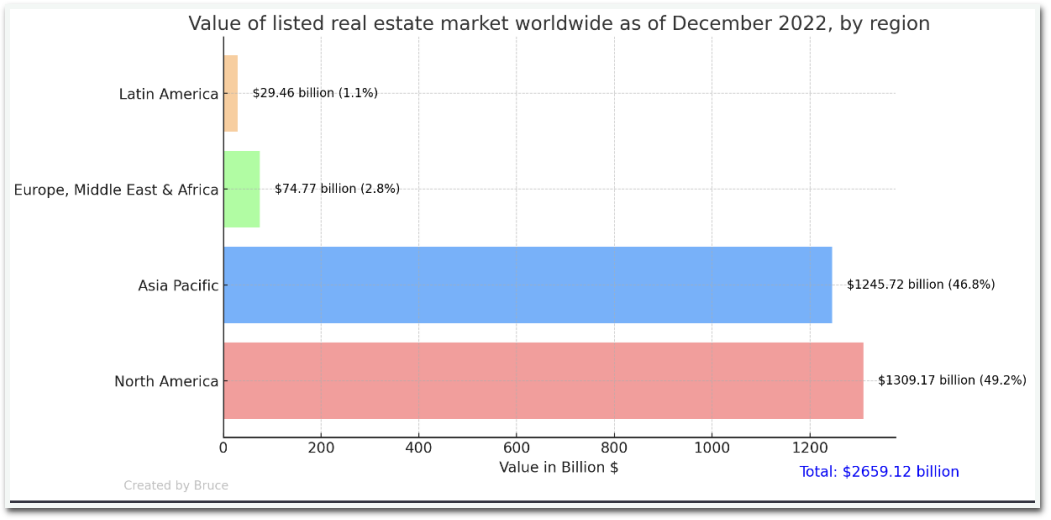

房地产市场是一个充满投资机会的庞大领域。2023年3月发布的Statista研究显示,北美上市房地产市场的价值达到了庞大的的1.3万亿美元。而全球上市房地产市场为2.66万亿美元。

代币化房地产市场的核心诉求是实现以下一个或多个目标:创建更多样化和灵活的房地产投资产品,吸引更广泛的投资者群体,以及提高房地产资产的流动性和价值。这些产品的主要表现形式通常有三种:

1)碎片化的房地产所有权融资。

2)特定区域房地产市场指数产品。

3)房地产代币进行抵押借贷。

此外,房产代币化上链也有潜力增强房地产资产的透明度和治理民主性。

如果你熟悉房地产投资信托(REIT),它是一种持有能盈利的房地产并管理或借此房地产融资的公司类型。REIT提供了类似于共同基金的投资机会,使普通投资者能够访问类似分红的房地产投资收入和总回报,并帮助该地区的房地产市场增长。REIT和房地产RWA在提供碎片化房产投资机会方面有许多相似之处,他们都有效降低了投资门槛并增强了房地产资产的流动性。然而,传统REIT通常不为投资者提供管理机会或所有权,保持中心化的运营模式。尽管如此,它们在严格的监管框架内对资产的审查、运营,以及其投资结构,为房地产RWA项目提供了可以参考的框架。

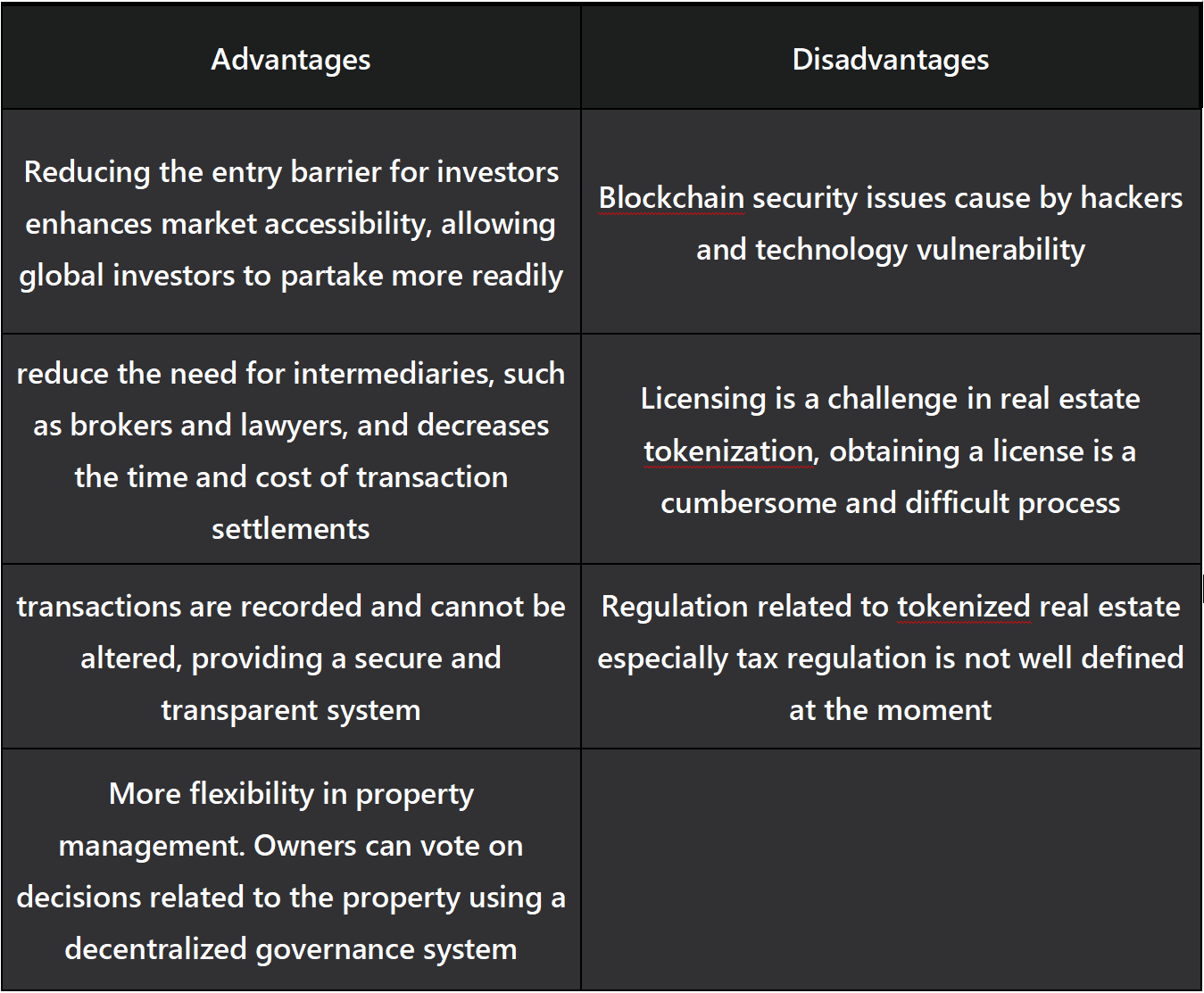

通过对过去两年关于房地产RWA项目的运营观察中,我们对它们的优点和缺点有了一些清晰的了解。

通常,房地产RWA项目具有上述优缺点。但深入研究具体案例时,发现由于管理和产品方法的不同,每个项目在运营过程中遇到的实际情况各不相同。

案例分析

在本章中,我选取了三个房地产RWA项目进行分析。每个项目采用不同的方法来代币化房地产市场,并在其各自的领域具有一定代表性。需要注意的是,这些项目仍处于早期阶段,其产品尚未经历长期和广泛的市场验证和测试。

‣RealT

RealT于2019年推出,是最早的房地产RWA项目之一,专注于通过Ethereum和Gnosis区块链(主要在Gnosis上)使美国住宅房地产代币化供散户投资。

RealT购买住宅房产,并依照美国法规将持有的房产代币化。这些房产的管理、维护和租金收集责任被委托给第三方管理机构。扣除费用后,这些房产产生的租金被分配给其代币持有者。虽然RealT负责代币化过程,但他们与持有房地产资产的公司在法律上是有隔离的。如其网站所述,如果该公司违约,代币所有者有权指定另一家公司来管理持有房产。然而,值得注意的是,该协议并没有强制要求RealT参与投资由他们推向市场的房产代币。用户持有房产代币则可以每个月从分得该房屋的租金,分得金额需要减去约2.5%的维护储备金和通常约为10%的管理费。

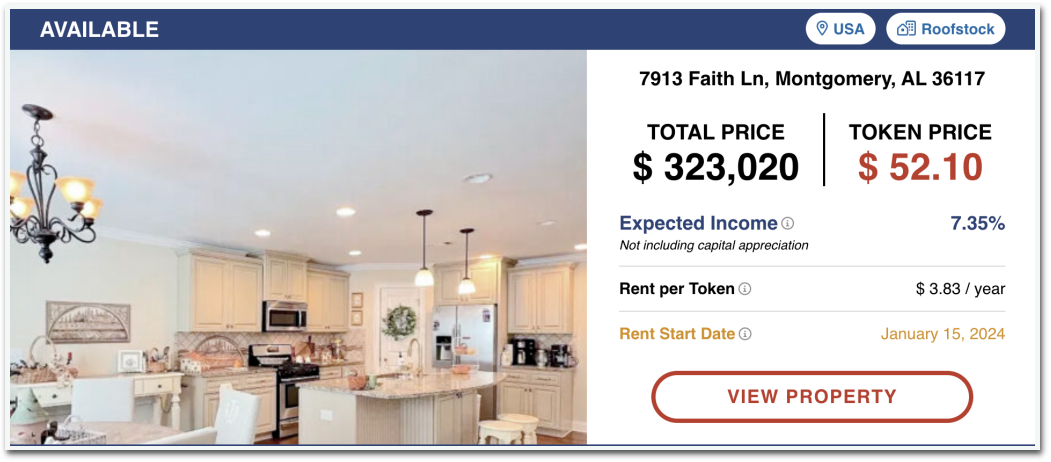

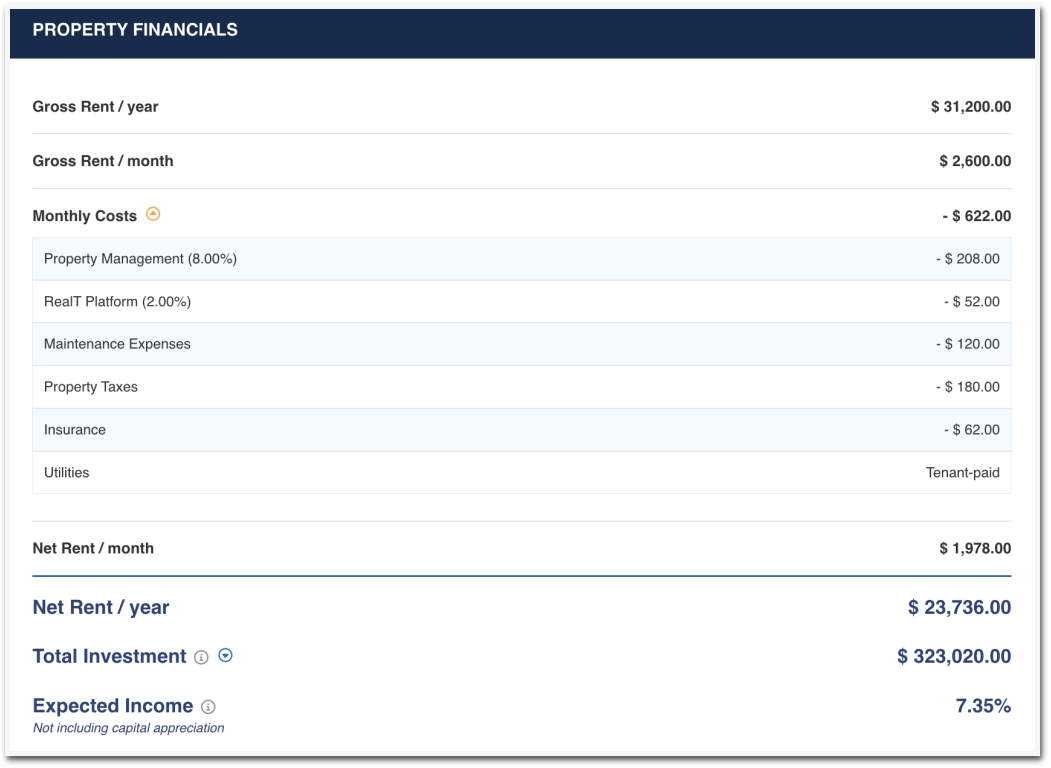

以蒙哥马利的这处房产为例,房地产代币的总价值为323,020美元,每个代币的价格为52.10美元,共发行了6,200个代币。该房产每月产生2,600美元的租金收入。扣除总计622美元的运营和管理费用后,每月净利润为1,978美元,年度总额为23,736美元。因此,每个代币获得3.83美元的分配,导致年利润率为7.35%。

对于这个房产,RealT向市场提供了100%的代币,这意味着RealT不需要与客户共同投资,并维持一个近乎无风险的模型来运营。管理机构从租金中取得8%,并从维护费用中取得剩余部分,投资平台仅为代币化房产、选择管理机构和监督管理而收取2%的费用。通过这种方法,RealT团队可以节省大量的管理时间,专注于寻找合格的房产并将它们代币化到市场上。

但是,虽然分散所有权有助于在投资者之间分摊风险,它也引入了挑战。当投资者的投资占比太小,以至于公司管理成本过高而变得不可持续。Laurens Swinkels的报告解释了房地产代币持有者和RealT之间的利益冲突。RealT选择管理机构来管理其拥有的房产;如果RealT对房产有大量所有权,他们会努力降低管理成本;因为管理不善将对他们产生负面影响较大。然而,如果RealT的持股比例太大,首先这将减少代币的流动性,其次房产小股东们将不会履行监督责任。所有的代币持有者都期望大股东能够监督被雇用的管理机构是否高效尽职。另一方面,如果RealT的持股极小,RealT可能缺乏足够的动力来尽职挑选管理机构并积极参与监督,对众多的散户投资者来说,有效地监督管理机构将变得十分困难。

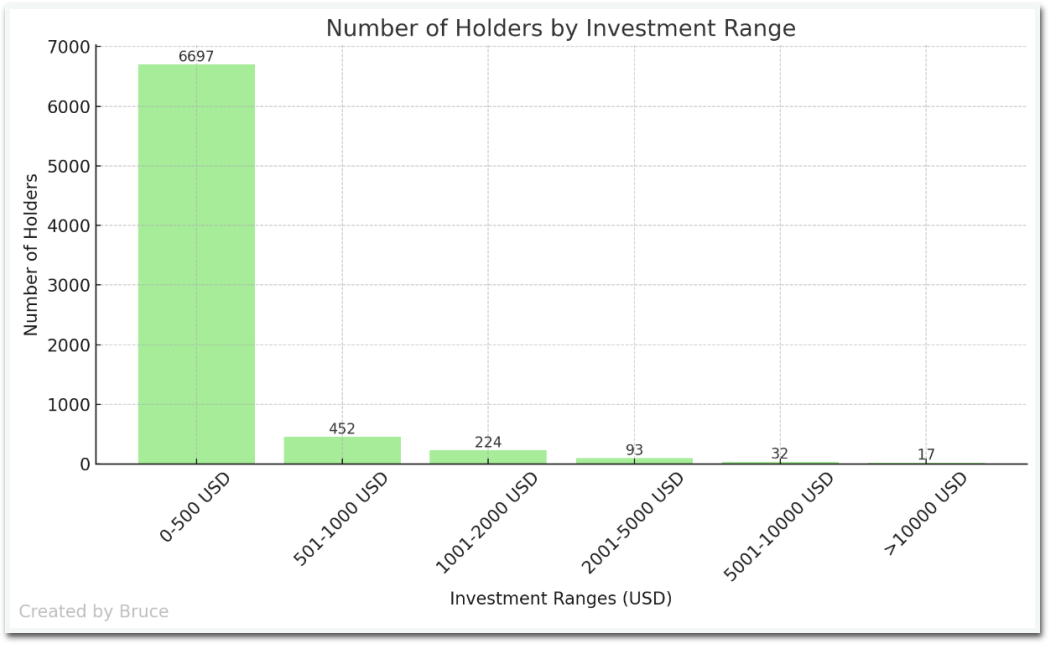

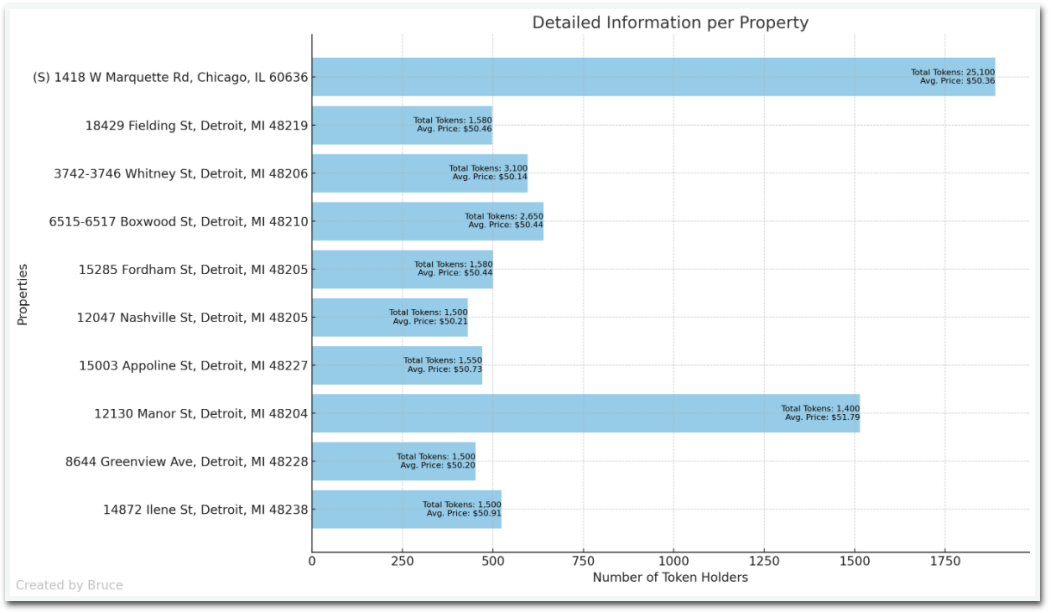

通过查看了RealT市场上最新售罄的十个房产代币,并使用相关的区块链浏览器来找出每个房产有多少持有者。正如你在图表中看到的,RealT将房产分散成不同数量的代币,以确保每个代币的价格在50美元左右。大多数房产位于底特律,并且大约有500个代币持有者,其中两个房产的持有者超过了1,000人。现在,结合每个持有者的代币数量来计算出RealT投资者的投资范围。

大约90%的RealT投资者投资少于500美元,约9%的投资者投资500到2,000美元,1%的投资者投资超过这个数额。这表明RealT在一定程度上成功地为散户投资者创造了一个房地产投资市场,并增加了住房市场的流动性。

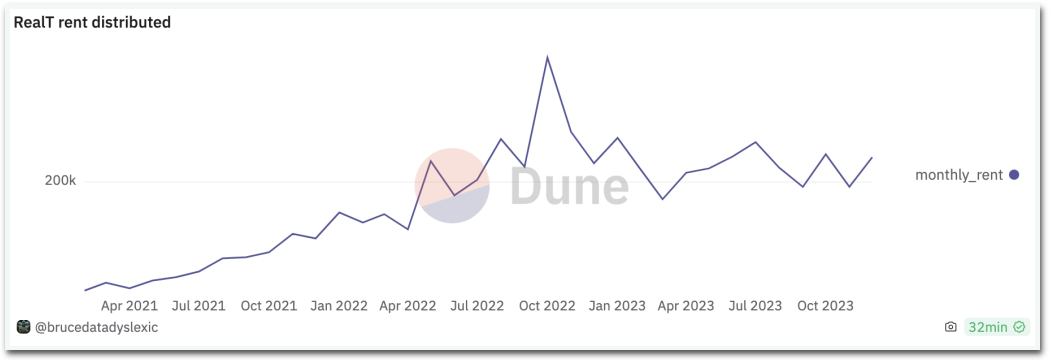

再根据RealT在其主要运营网络Gnosis的钱包地址上查询交易数据(钱包地址:0xE7D97868265078bd5022Bc2622C94dFc1Ef1D402),RealT总共大约分发了600万美元的租金。平台费用根据维护费用、保险和税费的波动,大约在租金的2.5%-3%之间,相当于过去两年来平台收入大约150K到180K美元。然而,由于RealT没有被强制要求参与房地产投资,且如果选择参与,其参与程度没有特定的限制或说明,因此RealT从租金收入中获得的利润不得而知。

从公司结构的角度来看,RealT在特拉华州成立了Real Token Inc.作为公司的核心实体。这个实体不拥有任何房地产资产;它仅作为RealT项目的运营实体。此外,RealT还在特拉华州成立了Real Token LLC作为一系列房地产公司的母公司。像Real Token Inc.一样,Real Token LLC(LLC:有限责任公司)不拥有任何房地产资产;其主要目的是简化法律程序,允许用户通过仅与一个公司签约就能投资所有房产。最后,RealT为每个投资的房产成立了相应的系列LLC。作为Real Token LLC的子公司,每个系列LLC拥有特定的房产和相应的代币。这种结构旨在确保一个房产的财务或法律问题不会影响RealT下的其他房产或母公司的运营。

‣Parcl

Parcl是一个DeFi投资平台,允许用户交易全球房地产市场的价格变动。Parcl用于通过AMM架构使房地产相关的合成资产的面向市场。Parcl推出了Parcl LabsPrice Feed,以创建基于其销售历史记录的特定区域房地产指数。历史记录时间长短可以根据房产的交易频率而变化。在指数创建后,投资者有机会对房产价格走势进行投机下注,该区域房地产价格建立看涨或看跌仓位。

这种方法因为并不存在现实的房产买卖,使Parcl避免了牵扯进实际房地产运营中的法律问题。你也可以怀疑它是否真的算是一个房地产RWA项目,因为它不符合上述提到的标准。然而,它是一个相对受欢迎的RWA项目,得到了Coinbase、Solana Ventures、DragonFly以及行业内许多其他知名公司的投资,且因其独特性在讨论房地产RWA的产品多样化时把它囊括进去是合理的。

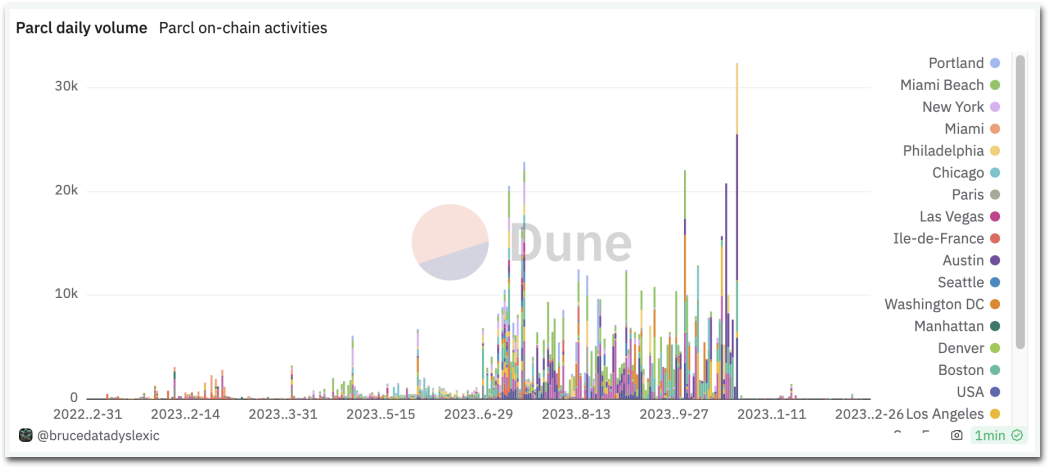

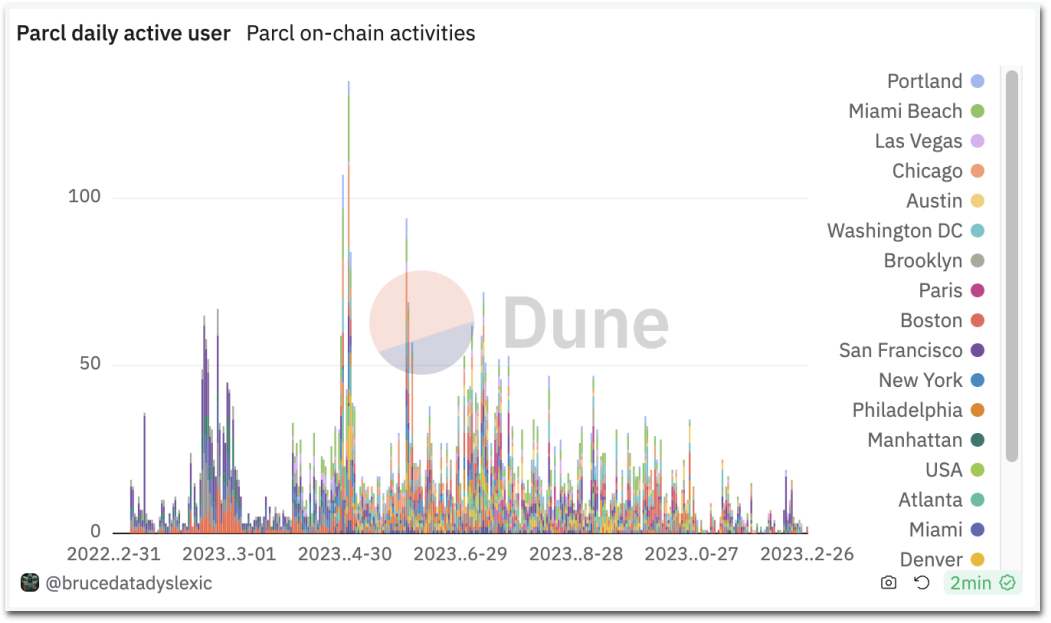

Parcl的测试网在2022年5月在Solana上启动,目前其TVL有1600万美元。然而经过一年多的运营,Parcl似乎并没有引起太多关注,每日交易量不到10,000美元,每日活跃用户不到50人。

(10月26日的交易量下降是因为Parcl V3升级并更改了池地址,并关闭了许多交易对,因此该日期之后的交易量未被包括在内)

Parcl的产品易于使用且升级迅速,Parcl Labs价格提供者和指数市场设计较为成熟。在运营方面,Parcl团队积极推出Parcl Point、Real Estate Royale和其他用户获取计划。尽管有这些优势和众多知名投资机构的支持,Parcl仍然保持相对较低的市场关注度和市场份额,用户基础小,交易量有限。也许从一定程度上证明了加密货币市场还没有准备好迎接房地产指数产品。

‣Reinno

像Ripple和MakerDAO这样的大型加密货币公司也在探索房地产RWA方向的产品。Ripple在7月宣布,他们的中央银行数字货币团队正在尝试支持用户将房产代币化并依此进行抵押贷款。MakerDAO也与Robinland合作以支持房产抵押借贷。RealT也提供使用代币化房地产作为贷款抵押的选项,但这一服务仅限于他们发行的房地产代币。本质上,这项服务更类似于代币借贷产品,并没有实质上增强个人房地产所有者的资本流动性。

Reinno是一个在2020年推出并在2022年停止运营的荒废项目,虽然没有在市场上留下太多痕迹,但它引入了两个与房地产RWA相关的产品值得一提。

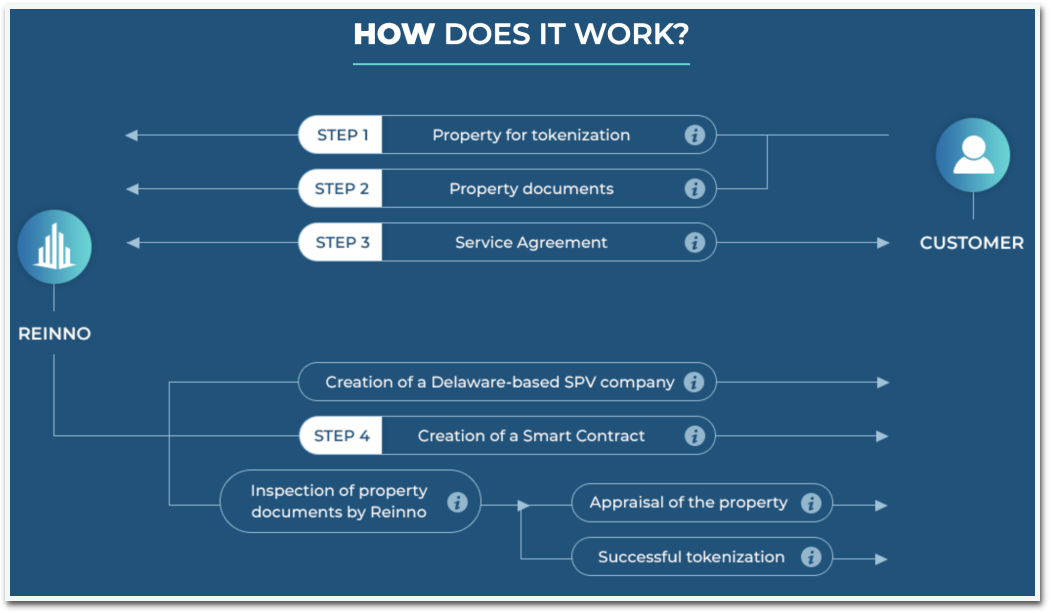

第一个产品是基于代币化房地产的贷款服务。当房产所有者需要融资时,他们可以将房产文件提交给Reinno。获得批准后,Reinno将在特拉华州为其创建一个特殊目的载体公司(也称为SPV,是由母公司创建的子公司,用来隔离财务风险。其作为独立公司的法律地位使其义务即使母公司破产也是安全的。在美国,SPV通常与LLC相同。)然后,Reinno将为房地产代币创建一个智能合约,所有者可以将代币作为贷款的抵押品存入并进行借贷,贷款限额将基于代币价值。

(之所以RealT、Reinno以及许多其他项目都选择在特拉华州注册是因为:1,特拉华州拥有美国乃至全球最全面、更新速度最快、最专业的公司法律体系,与美国其他州和全球其他司法管辖区相比提供了更多的安全性和可靠性;2,大多数美国科技初创公司、三分之二的财富500强公司以及80%的美国IPO公司都选择特拉华州进行公司注册;3,全球任何个人都可以轻松地使用在线服务在家中设立特拉华公司,最低仅需几百美元。这项注册服务甚至提供运营公司所需的所有工具和文件的访问权限,包括雇主识别号(EIN)和税务ID,并自动生成公司章程。)

第二种产品是房贷融资,在用户用银行房贷购买房产后,他们可以将房产所有权代币化以进行融资。所获得的资金用来偿还银行房贷,之后客户随后按固定利率向协议偿还该笔贷款。

Reinno的运营仍然是一个中心化和线下模式,通常客户需要访问办公室并提交房产文件。采取像Reinno这样的方法有一些明显的风险。首先,如果借款人选择违约停止偿还贷款,Reinno作为代币化服务商而不是贷款人,会难以起诉借款人。Reinno实际上并不拥有抵押的房产;贷款本质上是由选择在Reinno上提供资金的用户提供。由于缺乏借款人和贷款人之间的直接贷款合同,特别是在碎片化房地产代币融资的背景下,没有完善的法律框架来保护这些贷款人。Reinno没有提供详细的措施来减轻这种违约风险。其次,如果房产所有者在借款后决定出售房屋或在Reinno完成抵押融资后停止继续向银行偿还抵押贷款,这种导致房屋产权转移的行为不能有效的被Reinno阻止,导致贷款人实际上对房产价值的“双花”。这些明显的风险可能是致使项目停止运营的原因之一,未来房地产RWA将需要更为成熟的法律框架来解决这些问题。

还有一些其他的房地产RWA项目没有包括在内,原因如下:1,与提到的项目非常相似且市场份额更小;2,仍处于概念阶段,缺乏足够的信息进行有意义的讨论;3,是一个的RWA项目并且可以支持房地产业务,但其业务目前集中在其他RWA上,如债券或证券。这是这些项目的列表,感兴趣的人可自行查看。

结论

房地产RWA是一个相对较新的概念,尚未确立明确的市场规模或产生龙头项目。目前在这一领域运营的项目在市场规模和用户基础方面相对较小。这一领域需要严格的合规化运营和成熟的法律框架进行规制。一些项目采用了风险隔离的公司结构,或选择与房产相关的金融产品作为投资目标,以降低运营风险。然而,要充分发挥房地产RWA的最大潜力——购买、出售房产和抵押贷款立法进步和运营合规是不可缺少的。

在立法方面,关于房地产RWA尚未建立清晰一致的框架供人遵循。美国证券交易委员会将大多数代币分类为证券,商品期货交易委员会认为部分代币是商品,美国财政部金融犯罪执法网络将某些代币分类为货币,而内部收入服务局认为某些代币是应税财产。此外,没有国际监管框架可供参考。监管机构对如何分类房地产代币的不一致导致规则不清晰和过程混乱,这两者都会威胁潜在投资者,并危及房产代币化的长期可行性。

然而在如此混乱的监管状态下仍然有许多知名金融企业、加密货币公司在努力尝试房地产RWA,并且少量项目已经在1-2年的运营中有限的证明了产品的可行性,房产作为金融投资领域中规模庞大的一个板块,相信随着相关法律框架的建立和完善,房地产RWA将引来迅速蓬勃的发展。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。