Author: Asher Zhang

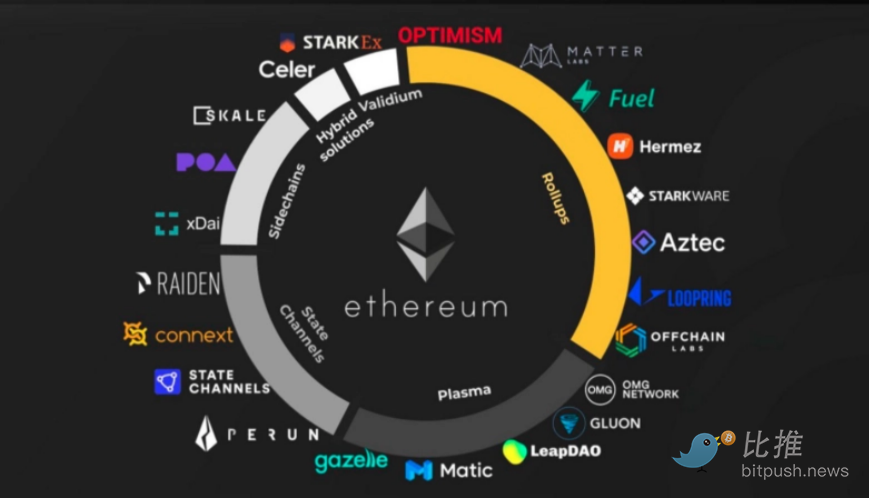

Ethereum founder Vitalik Buterin once outlined the future Ethereum 2.0 upgrade roadmap in six concise stages: The Merge, The Surge, The Scourge, The Verge, The Purge, and The Splurge. The Dencun upgrade belongs to an important technical upgrade in the Surge stage, and among several EIPs, EIP-4844 is the most important. From the results, EIP-4844 has the most direct impact on Layer2, so Layer2 is likely to become the most noteworthy track in the cryptocurrency industry in 2024. Recently, many leading projects in the Layer2 track have begun to exert their efforts. This article believes that there will be three main narratives around Layer2 in the future.

Narrative One: Decentralization of Sorters, Empowering Layer2

The significance of Layer2 lies in increasing ETH throughput and reducing transaction fees, and it is the sorter that largely enables Layer2 to achieve this goal. In Layer2, the sorter's role is to organize and compress hundreds or thousands of transactions into one, and then submit it to Layer1 for confirmation. In this process, the sorter charges a fee, which is currently one of the main sources of income for Layer2.

Currently, the sorters in Layer2 are centralized, mostly operated by project parties, such as the OP Foundation and Arbitrum Foundation. From a security perspective, if a centralized sorter fails or is attacked, it can easily threaten the entire Layer2. Decentralizing the sorter is very important, and at the same time, this will also give birth to an important L2Fi (Layer2 Decentralized Finance) market.

According to the official plan, the OP chain can choose from the following sorting methods: self-sorting, using the sorting service of Optimism Collective, and adopting a decentralized sorting service. Self-sorting introduces a new revenue model, where developers can obtain fees and MEV from the chains they deploy. Decentralized sorters will serve multiple rollups and use cryptographic economic incentives to hold operators accountable. Shared sorters can achieve atomic and trust-minimized cross-chain rollup communication, as nodes generate blocks on various chains simultaneously. The early model of the super-chain sorting model involves auctions, where potential sorters pay for sorting rights to the network and earn their share of fees and MEV. Sorters may also need to share part of the fee income with the Retrospective Public Goods Fund (RPGF).

The OP chain's plan for sorters has not yet been implemented, but Metis's sorter is already emerging and is expected to further accelerate the implementation of major Layer2 sorters.

Metis is a layer2 developed based on Optimistic Rollup, which went live on the mainnet in 2021, making it the earliest second-layer network to go live with Rollup. In 2024, it will be upgraded to a Hybrid Rollup that combines the Optimistic Rollup architecture with zero-knowledge proof (zk).

Metis's decentralized PoS sorter is now running on the Holesky testnet, which can be divided into three rounds, including simulating the behavior of real nodes, increasing the number of nodes, and staking tests, etc. It will start on January 3, 2024, and open testing for the community, where users can interact with new ecosystem dApps on the Holesky testnet and receive rewards for a month. Each sorter node needs to stake 20,000 Metis, and mining rewards will be quite generous. 50% of the total supply of Metis will be used for node rewards. For users who do not have enough funds to run nodes, Metis will soon launch a Dapp called Enki for staking liquidity, allowing these community users to participate in node staking and receive corresponding returns.

Narrative Two: Making Up for Shortcomings, the Emergence of Parallel EVM

Former Polygon co-founder JD recently expressed a premonition on social media that in 2024, every L2 will rebrand itself and label itself as "parallel EVM"; Georgios, CTO of Paradigm, also believes that 2024 will be the "year of parallel EVM" and stated that Paradigm is also exploring and designing related technologies internally. Why is everyone so optimistic about parallel EVM?

EVM is the core of Ethereum, responsible for running smart contracts and processing transactions, and its transaction logic is executed sequentially. This design prioritizes security and reduces potential complexity and vulnerabilities associated with parallel execution. However, in the face of high loads, it may lead to network congestion and delays. Parallel EVM (Ethereum Virtual Machine) is a concept aimed at improving the performance and efficiency of the existing EVM, like expanding this single lane into a multi-lane highway, allowing multiple vehicles to travel simultaneously.

Some projects in the market have begun to explore the design of parallel EVM. In the Layer2 track, representative projects that combine the capabilities of other chains with EVM include: Neon, Eclipse, and Lumio. In addition to L2 projects, some L1 representative projects with parallel EVM capabilities include: Monad and Sei.

Narrative Three: ZK Series Launch Imminent, Wealth Effect in Layer2

Compared with the ZK Rollup solution, Optimistic Rollup is easier to implement in the short term, mainly because it has greater portability, but the market is more optimistic about ZK Rollup. According to L2Beat data, among 65 Rollup projects, 26 are ZK-Rollup solutions, while in comparison, there are only 21 OP-Rollup solutions. In the ZK-Rollup solutions, projects like Scroll and Taiko pursue ultimate EVM equivalence, aiming to improve compatibility with the Ethereum mainnet; zkSync and Starknet pursue comprehensive scalability of the chain, attempting to increase incremental users for the mainnet by improving transaction processing speed and throughput; Aztec focuses on solving transaction privacy issues through ZK. Along with the Ethereum Cancun upgrade, the ZK series has also been making continuous efforts recently, and a new round of wealth creation stories in the ZK series is likely to unfold in the new bull market.

Due to the greater technical difficulty of the ZK series, its development is relatively slower, but from various indications, some projects are expected to go live in this round of the bull market. For example, the leading projects in the ZK series, Starknet and zkSync, are expected to distribute STRK to DApp developers to incentivize them to build projects; distribute STRK to early contributors to the ECMP community (contents, meetups, workshops, etc.); and distribute 9 billion STRK for future user rebates, etc.

In addition to the traditional narrative of the ZK series, ZKFair is conducting another interesting ZK L2 network experiment. It proposes to build a fair, community-driven, and community-governed ZK L2 network, where users can contribute to the network's development and receive substantial rewards based on their contributions. This innovative L2 network narrative has the potential to rival the craze for NFTs. ZKFair advocates for a community-driven Layer2 value system as follows: 100% of the tokens will be fairly launched, with the initial valuation set in a relatively low range to ensure everyone can participate; Gas fee income will be distributed back to all community contributors and users of the L2 network; ZKFair encourages more creative projects to participate, allowing anyone to propose ideas and suggestions for community development and initiate proposals. ZKFair utilizes ZK technology and has the following core highlights: using USDC as the Gas token for L2, providing users with a stable and transparent fee structure; ZK-Rollup based on Polygon CDK and Celestia DA; L2 supporting atomic cross-rollup communication, allowing users to interact directly with Dapps on Ethereum L1; L2 supporting a decentralized prover network, providing more stable and reliable zero-knowledge proof computation.

Summary

The EIP-4844 in the Dencun upgrade will effectively reduce transaction fees for Layer2, and with the improvement in Layer2 performance, its competitiveness will significantly increase. Additionally, the sorter in Layer2 is crucial, and with the introduction of decentralized sorters, a new staking track is likely to emerge. Although the Dencun upgrade will improve Layer2 performance, its gap compared to Solana remains significant, but the emergence of parallel EVM will further enhance the competitiveness of Layer2. Furthermore, the emergence of ZK series Layer2 may also become a major focus in the market.

Further Reading

Overview of the Advantages and Recent Developments of 5 Emerging Layer2 Projects

In-Depth Discussion of Bitcoin Layer2: New "Impossible Triangle" Trade-offs

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。