原文标题:《TeleBot 赛道龙头数据分析》

作者:日月小楚

寻找下个可能炒作的赛道,TeleBot。整个赛道总市值大约只有 2 亿美金,日收入有 50 万美金,妥妥的印钞机啊.

1.TeleBot 交易类的 Bot 的主要项目有三个,banana Gun、Maestro、Unibot。其中 Maestro 未发币,Unibot 的流通市值为 61M,banana 的流通市值 38M。

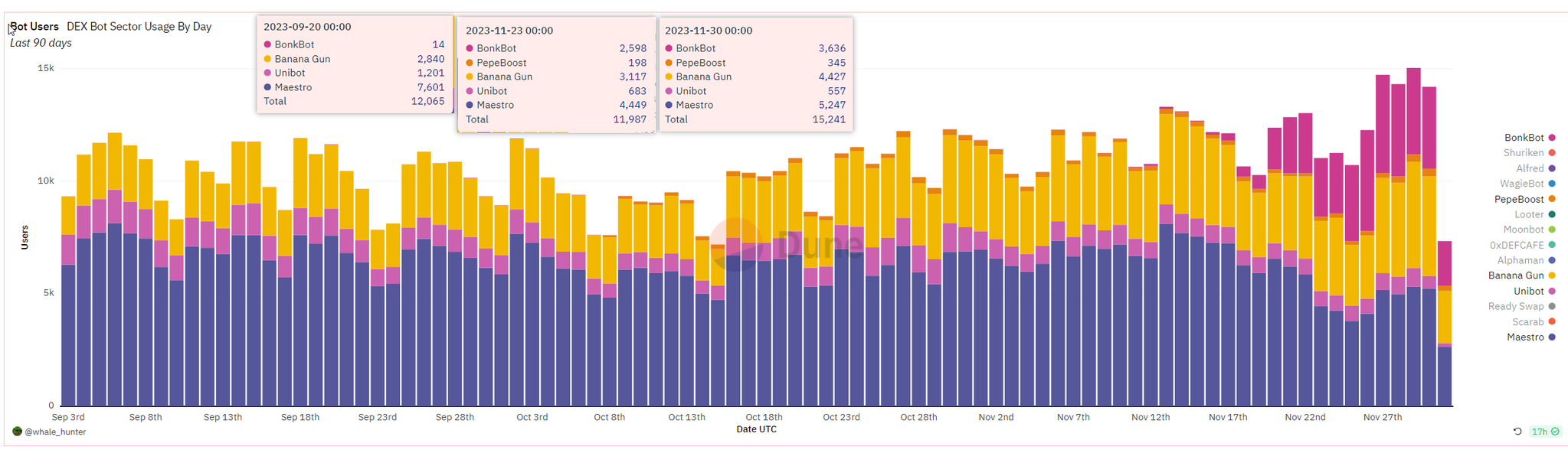

2.用户数量

1)用户数量第一名的始终是 Maestro(未发币),第二名是 banana Gun,最近 2 周第三名是 BonkBot。而 Unibot 的用户数量比前三名相差好几倍,以 11 月 30 日为了,前三名的用户数量分别为 5247、4427、3636。那 Unibot 却只有 557,与第一名相差 9 倍之多。

2)我们发现,随着行情的好转,但是从 9 月到 11 月,用户数量并没有明显增加,这说明 Telebot 的用户现在来看,还是比较固定的。

3)同时我们也发现,从 9 月到 11 月,unibot 的用户数量在被 banana 进一步挤压。在 9 月时候,banana 的用户数量差不多是 unibot 的 2 倍,但是到了 11 月,已经变成了 8 倍左右。

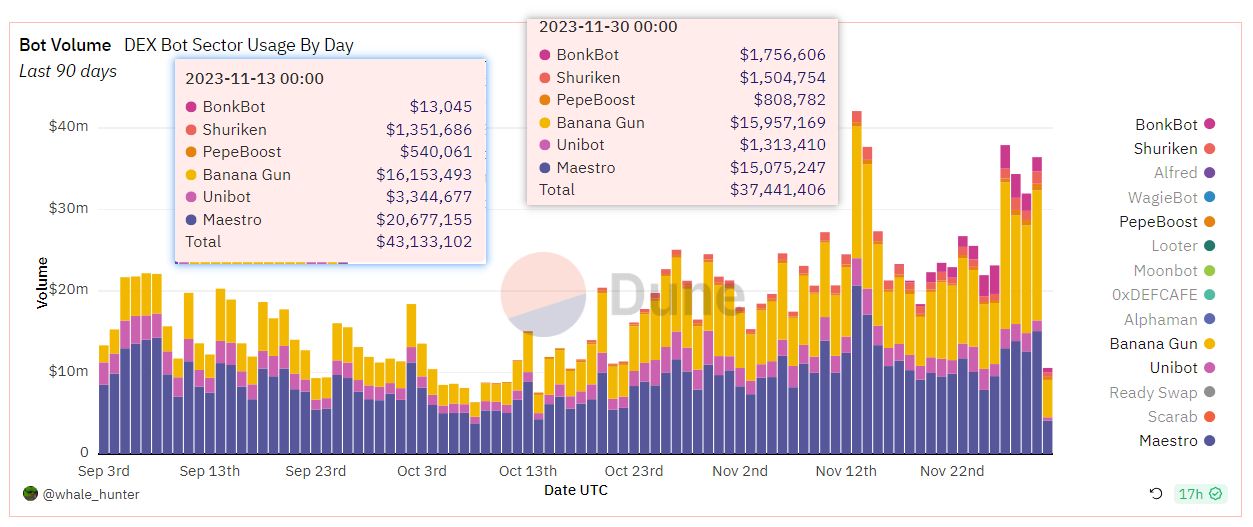

3.交易量数据

1)从整体的交易量来看,Telebot 的交易量在 11 月行情火热的时候,与 10 月相比增加了 3~4 倍。但是以 11 月 30 日数据来算,日交易量在 4 千万美金左右。同期,作为对比,Uniswap 的日交易量是 11.4 亿。Balancer 的日交易量在 3700 万美金,跟 Telebot 基本相当。考虑到 dex 有很多搬砖的机器人,还有 mev 机器人。所以实际 Telebot 的交易量可以在 dex 内排名 6~10 名区间。

2)Banana Gun 和 Maestro 处于领先的地位,不分伯仲。但是按照 11 月 30 日的数据,Unibot 的交易量却只有前两者的 1/10。并且这个差距在 10 月份相比,拉开了差距。简单来说,unibot 的交易量增长了 0.5~1 倍左右,而 banana 增长了 5~10 倍左右。

3)用户量并没有大量增长,而交易量增长,也能说这批是老用户,是在行情好的时候交易更加频繁。

4)我们也注意到用户数量排名第二的 BonkBot 在交易量上却比较低,也是只有 Banana Gun 和 Maestro 的 1/10。这可能是跟 solana 链上的单笔交易量比较低有关。

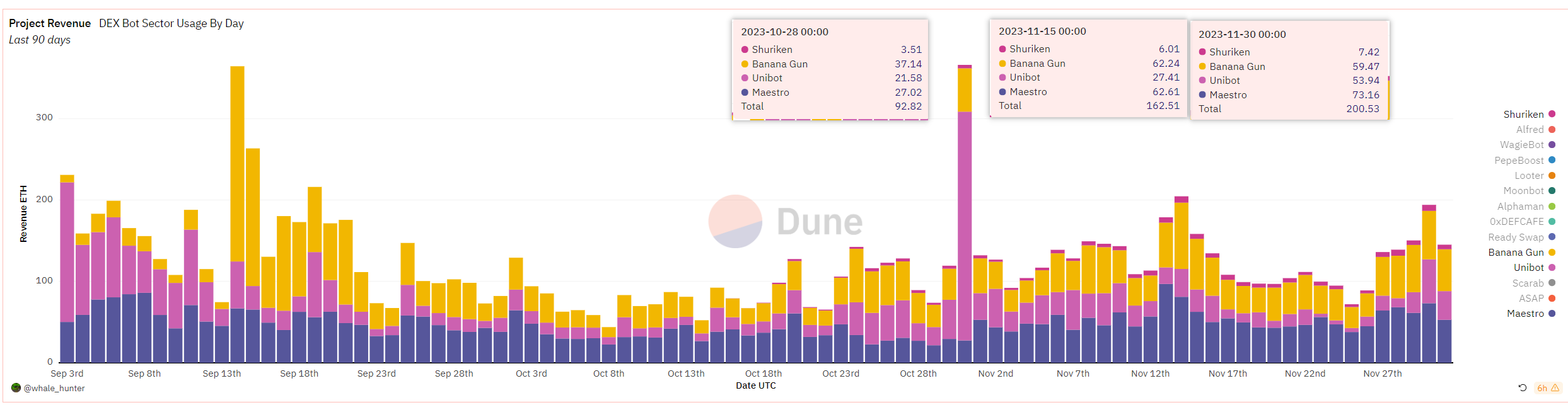

4、Bot 收入

从收入来看,收入最高的一般都是 Maestro,其次是 banana 和 unibot。为什么说呢?因为三个协议的收入经常会有变化。其中变化最大的是 unibot。这主要原因是协议收入有两部分组成,一部分是用户使用 bot 交易支付的手续费,一部分是买卖项目代币交的 tax。比如说 unibot 在 10 月底的时候,出现了一次黑客事件,导致很多人恐慌抛售又有很多人抄底,unibot 代币交易量放巨量,tax 收入也就增加了好几倍。但是 unibot 协议本身并没有增加太多用户。

从平均而言,收入最高的是 maestro,其次是 banana,第三是 unibot。平均而言,banana 是 unibot 收入的 2 倍左右。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。