撰文:深潮 TechFlow

在 DEX 赛道中,除了老牌的 Uniswap 和 Sushiswap , 还有哪些后起之秀值得关注?

当今的 DEX ,早已过了单纯拼交易对数量、流动性与深度的时代,更多需要考虑的是用户交易的降本增效---即如何花更少的交易费用,更有效率的执行交易。

因此,考察新协议,还需考虑与当下热点叙事结合,比如“意图”与MEV。前者能显著提升交易执行的效率,而后者则可以降低交易成本。

按照这个思路去寻找,Cowswap 肯定是一个绕不过去的项目。

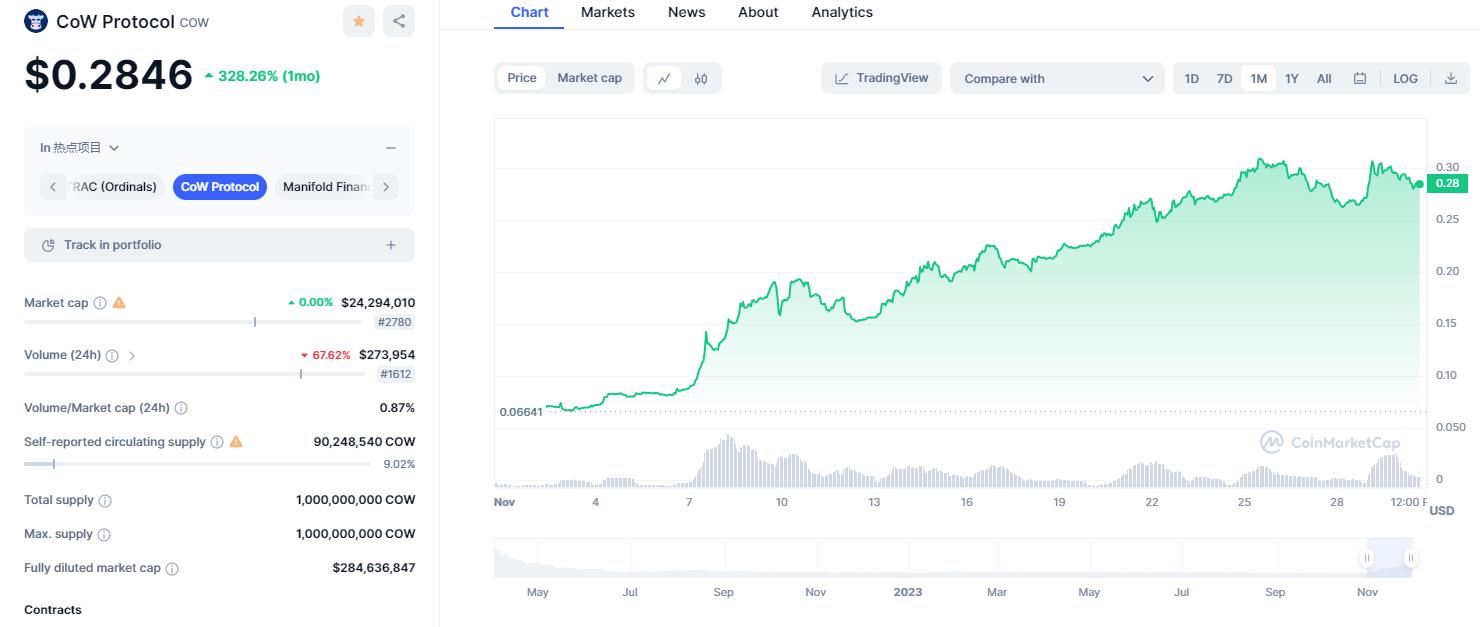

集批量交易、意图与MEV保护等功能点于一身,瞄准用户交易的降本增效,Cowswap 在这轮小牛市中快速崛起,其代币COW在近1个月内上涨了360%;

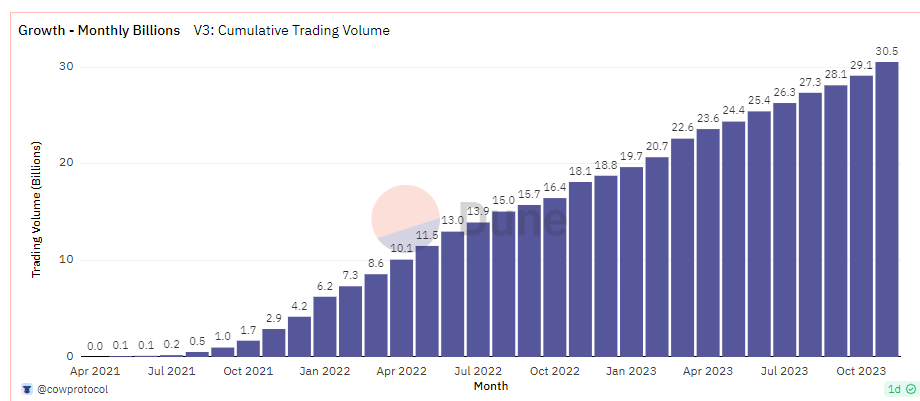

同时在基本面上,Cowswap上的交易量持续增加,最近一个月已经来到了三百亿美金;虽然体量上无法与Uniswap等老牌DEX相比,但上升势头显现,也使得其成为了近期各类加密社媒和投研中关注的焦点项目之一。

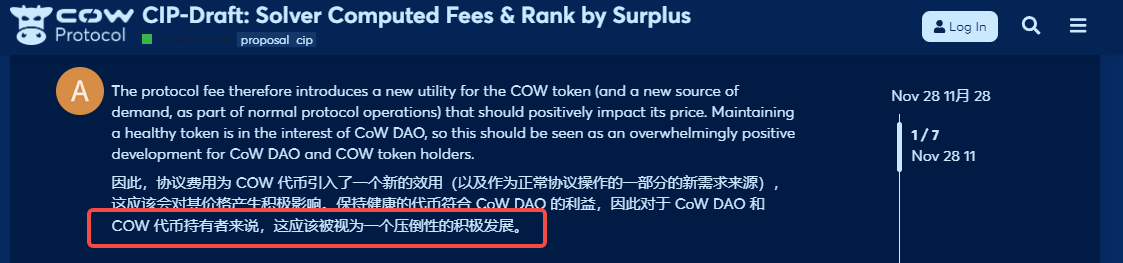

在这些背景信息之外,11月28日 Cowswap的社区也悄悄上线了一项提案,希望改进目前该协议中的费用分配结构,让用户、求解者(Solver,该协议中一种处理交易的角色)和协议本身达到多赢的局面。

同时,提案也提到了协议费用的概念,意味着Cowswap自己有了收入。

但对于我们来说,更加需要关注的重点在于:Cowswap 官方的这份提案中直接表示,提案本身对于 COW代币的持有者来说极具正向意义。

换言之,COW 代币的价值可能会因这份提案而会增加,这对于二级市场的价格来说,或许也是一种潜在利好。

鉴于COW代币已经在近期取得了不错的涨幅,这份提案会成为新的催化剂,延续 COW 代币的涨势吗?

本期内容,我们将对该提案进行解读,并对整个Cowswap的创新点进行研究。

治理提案更新:引入协议费用,更加鼓励 Solver 竞争

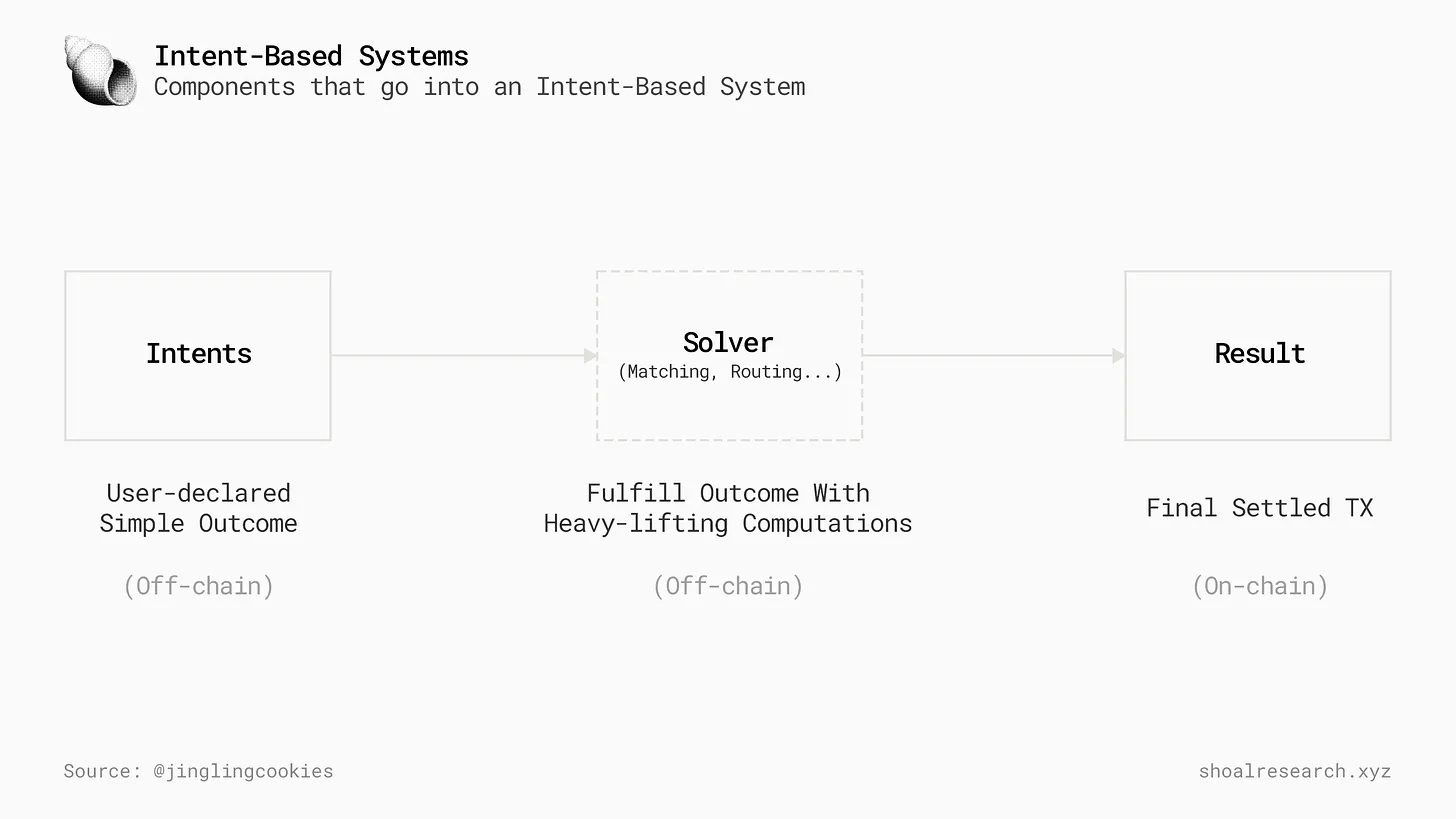

在理解这份提案前,需要明确 Cowswap 中的一个重要角色 :Solver。

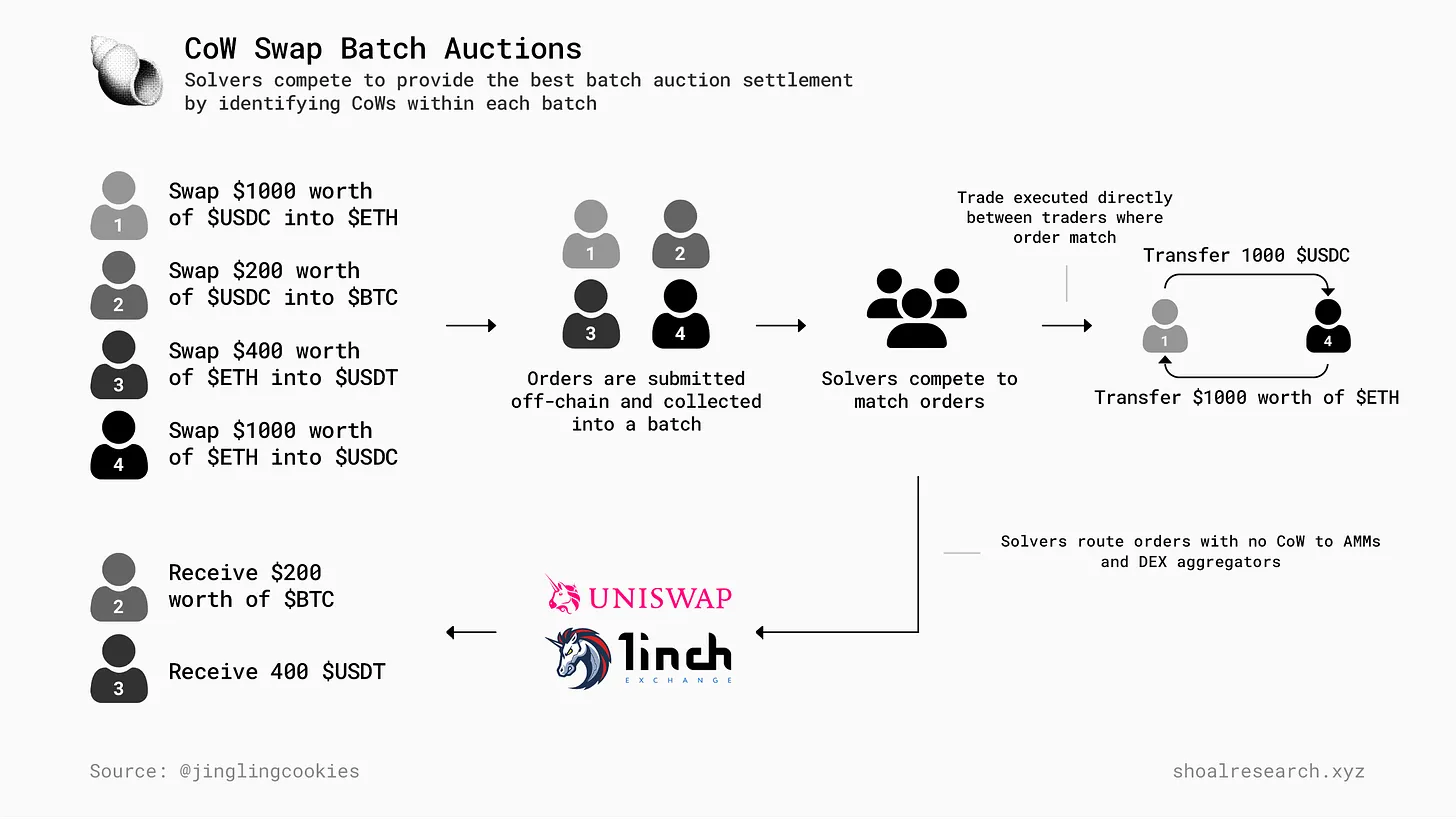

和一般的AMM和订单簿不同,Coswap 的交易撮合中,Solver起到了关键作用:

-

用户基于意图,指示他们想要的交易结果;

-

Cowswap 将用户的这些交易意图批量打包,形成一些批量交易的订单;

-

求解器(Solver) 竞相为这些订单提供最优的执行路径,这将使用户盈余(用户在交换后收到的资产量)最大化;

-

求解器使用的执行方法可以是链下匹配和链上交换的组合。求解者在批量拍卖中成功执行订单后将获得奖励。

抛去复杂的defi技术概念,我们可以通俗的理解这套交易流程:

你想交易,我找Solver去帮你完成,并且奖励Solver。

为什么要找Solver?

在CoW Swap的世界里,求解者就像是一群精明的经纪人,他们不停地寻找最佳交易路径,以确保每一笔交易都能以最优的价格和最低的成本完成。他们的工作是精确且复杂的,需要深厚的市场资源和敏锐的策略思维。

再通俗一点,Solver 像是一个优化的交易代理。

比如,你想用 1000 USDC换ETH, 如果Solver正好能找到一个想用ETH换USDC的人,那你两就匹配上了,直接帮你链下交易即可。这样做交易成本更低,也达到了开篇我们说的降本增效的效果。

同时,这种情况被叫做需求巧合(Coincidence of Wants),也正是 Cowswap 名字的来源。

明白了 Solver 的角色之后,我们就可以来看这份提案的变更。

-

提案之前:先收费,后补偿

提案提出之前,Solver 有什么动力去为你寻找最佳的交易路径?

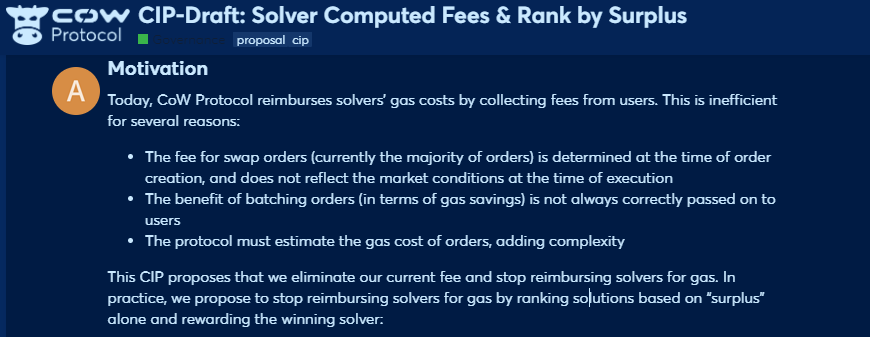

在过去,CoW Protocol会向用户收取交易费用,然后用这些费用来报销求解者(Solver)寻找最优路径时的gas成本;

同时,系统将选择提供最佳清算价格的解决方案,最大化用户交易的回报(例如最低的滑点等),提供最佳方案的Solver 将获得COW代币的奖励。

但是,事先向用户收取费用,再来补贴Solver的gas费会有这么几个问题:

1.用户的swap订单,对其收的费用是在创建订单时确定的,并不反映执行时的市场状况;Solver在执行交易时,很可能面临着gas费升高,而coswap的收费不足以覆盖gas成本的局面;

2.用户先被收了费,会对 Cowswap 请 solver 做订单匹配,打包交易等等各种背后的用心良苦理解不深。即使这么干最后能让交易滑点更低费用更低,但先被收了费总归让人不悦。

3.Cowsap 必须事先去估算用户订单的gas成本,增加了协议的计算压力和复杂性。

-

提案之后:自主收费,鼓励竞争

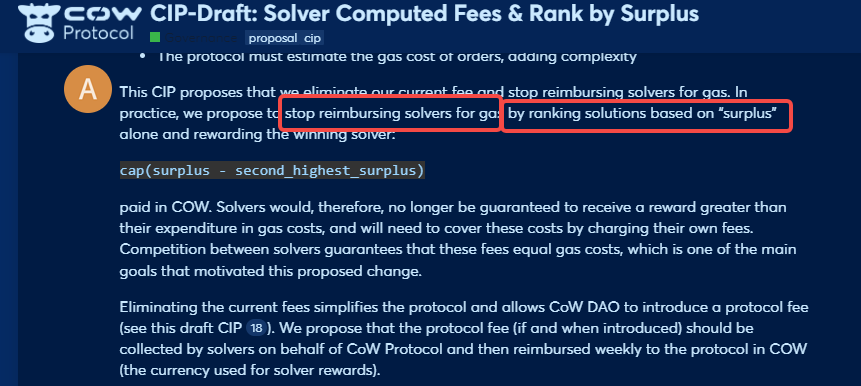

1.新提案下,求解者将不再被保证获得超过gas成本的补偿。

2.Cowswap不再先向用户收费,而是由 solver 在实际执行交易时,依照当前网络情况直接向用户收取“网络费用”,以支付求解成本。

3.Solver的奖励将完全取决于他们能为用户创造多少“盈余”(“指用户因Solver优化的交易匹配而获得的价值,这通常表现为用户的交易滑点低于默认滑点)

4.同时,允许 CoW DAO 引入协议费用(Protocol Fee)。由求解器代表 CoW 协议收取,然后每周以 COW代币的形式向协议报销。

这就等于说,之前是以协议的名义向用户收取交易优化的费用,而现在则是由sovler来直接收取,并且收取费用其中的一部分将以COW代币的形式流入DAO,形成协议收入。

从用户视角看,在Swap时看到的报价不会产生任何变化,只是其中的账目发生了变化。

在新提案下,求解者被激励去创造更多盈余,也就是比预期滑点更好的交易结果。这不仅更能提高用户的交易体验,也可能使求解者更加有效率地寻找最佳交易路径。

利好 COW 代币?

这个提案的变化,会对 COW 代币产生怎样的影响?

正如之前深潮在译文《CoW Protocol:高收入预期与 MEV 业务加持下的潜力项目》中提到的,Cowswap 在过去 18 个月里,与$ETH 相比,$COW 代币的表现一直表现不佳。

造成这种情况的原因之一是支付给求解器(Solver) 的通货膨胀奖励。

从提案前的现状中我们可以看到,协议先向用户收费,然后再报销给Solver来支付他们的gas费,顺带再奖励 Cow代币以支付他们对交易优化的付出。

而提案后,Solver 自己可以先对用户收费,也就意味着收到的费用在预期上肯定是要能覆盖gas费的,以及在此基础上有点赚头;

但一个明显的转变是,直接向用户收,收的大概率是ETH,因为Cowswap在以太坊上交易,那么先手eth当gas费就很合理了。

这种情况下,协议给solver的就不再是COW代币,而有可能是他们自己收到的ETH中扣除gas费后的余额;同时,由于“协议费用”的提出,solver每周还要倒给coswap 一定数量的COW代币,这就意味着:

流通中的COW代币会减少。

按照海外分析师的进一步估计,如果Cowswap能够“打开费用开关”,以ETH或者稳定币的形式支付solver奖励,预期COW的发行量将会减少40%以上。

而这个提案就是打开费用开关的一种体现。协议现在有自己能够收取的协议费用了,只要有交易需求在,这个提案通过后就能持续收到协议费用,以COW代币的形式进入对应的DAO国库,确实起到了减少流通量的效果。

真实收入 + 流通量减少 + MEV保护/意图叙事,理论上看确实利好COW代币的价格。

但同时需要考虑的是,Cowswap的市值和体量相较于DEX龙头仍有不小差距,是否会有用户一直实用,以及如何争取更大的市场份额谋求发展,也决定着项目发展的成败。

提案本身的变化只是在经济上提供了一种可以预期的看涨视角,但项目具体发展如何,还需要市场的检验和用户的选择。

同时,该提案目前还没有正式通过,按照决策和讨论流程,很有可能等到明年才能生效。

作为一个实用性而非MEME的协议,基本面的健康才是下限;短期叙事和激励计划可能会瞬间提高上限,大家需要综合长短期信息,以及自己的策略来综合进行判断。

最后,由于篇幅所限和同行们的努力,在此并不详细介绍Cowswap的产品设计和代币经济学,相关内容也是多如牛毛。

一些参考:

Cowswap 发展预估:《CoW Protocol:高收入预期与 MEV 业务加持下的潜力项目》

Cowswap 产品设计详解:《CoW Swap: Intents, MEV, and Batch Auctions》

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。