作者:Hank Han,Mint Ventures

1. 导读

以太坊质押及其相关的衍生赛道无疑是近一两年最为火热的话题。从 Beacon Chain 到 The Merge 再到上海上级,从LST 到 DVT 再到 Restaking、LSTfi,我们见证了质押以及相关赛道的崛起与迅速发展。究其背后的驱动因素,我们不难发现其发展起源于以太坊质押的范式变化。因此我们也应该思考:以太坊的质押范式在长期会如何演进,又会如何影响相关赛道以及主要玩家。

Vitalik 在 10 月 7 日发表的名为 Protocol and staking pool changes that could improve decentralization and reduce consensus overhead> 的文章中提出了一些对目前的以太坊质押机制进行优化的方案,为以太坊进一步降低中心化程度、减小共识负载提供了一种参考路径。其中部分设想会对质押机制产生较大的改变,同时又符合以太坊发展的主要趋势,因此我们将对文章进行解读,并分析不同方案对质押赛道的潜在影响。

2. 文章回顾

2.1 双层质押现状

Vitalik将以太坊目前的质押格局称为双层质押(two-tiered staking),在该质押模式中存在两层参与者:Node operators 和 Delegators。

- Node operators:即节点运营商,负责运营以太坊节点。

- Delegators:即委托人,通过各种方式参与质押的用户(除了自己运行节点)。

目前 delegators 参与质押的主要方式是使用 Lido、Rocket Pool 等质押服务商提供的服务。

2.2 存在的问题

Vitalik 认为双层质押的模式带来了两个问题,分别是质押赛道的中心化风险和不必要的共识层负担。

- 质押赛道的中心化风险:delegators 在质押 ETH 之后,需要 Lido 等服务商对节点进行选择,具体的选择机制会从不同角度带来节点运营商的中心化风险。例如,Lido 通过 DAO 投票来决定运营商,则节点运营商可能会倾向于大量持有 LDO 来提升自己的市场份额;Rocket Pool 允许任何人质押 8 ETH 后成为节点运营商,这让资金实力雄厚的运营商能够直接“购买”市场份额。

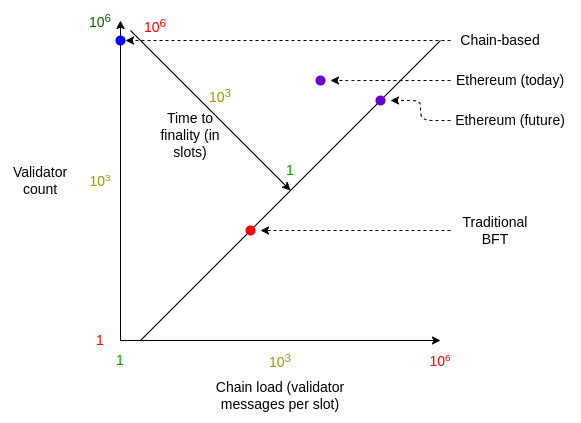

- 不必要的共识层负担:目前以太坊共识层在每个 epoch 需要聚合和验证约 80 万个签名,如果要实现单时隙确定性(Single Slot Finality, SSF)的目标,将需要以太坊在每个 slot 聚合和验证 80 万个签名,即任务不变,时间缩短到原来的 1/32,这对运行节点的硬件提出了更高的要求。从目前的双层质押结构来看,验证工作大多是节点运营商在进行,验证者数量虽然多,但是实际运行验证者的主体不是多样化的。也就是说节点数量的增加没有降低以太坊中心化程度,反而增加了以太坊共识负担。因此可以减少验证节点的个数(减少需要处理的签名个数),从而降低以太坊的共识负载(听起来更加中心化,配套的降低中心化的措施会在下面的部分中讲解)。

背景知识补充:

Slot(时隙):指一个新区块被纳入共识需要的时间,以太坊的一个 slot 约为 12s。在每个 slot 中,网络都会随机选择一位验证者作为区块提议者, 该验证者负责创建新区块并发送给网络上的其他节点。 另外在每个 slot 中,都会随机选择一个验证者委员会,通过他们的投票确定所提议区块的有效性。 即不用所有的验证者都参与某个 slot 的验证工作,仅需被选中的委员会的验证者正常参与即可,委员会的 2/3 票数可以让 slot 的状态获得有效性。每个 slot 不要求所有的验证者参与,可以方便管理网络负荷。

Epoch(时段):指一个包含 32 个 slot 的时间段,以太坊的一个 epoch 大约为 6.4min。在一个 epoch,某验证者只能加入一个委员会,网络中所有的活跃验证者需要出示证明来表明自己在这个 epoch 的“活跃”状态。每个 epoch的第一个 slot(正常情况下如此)也被称为检查点(checkpoint)。

Finality(最终确定性):交易在分布式网络中具有“最终确定性”是指,该交易成为了区块的一部分,而且除非销毁大量 ETH 导致区块链回滚,否则便无法改变。以太坊通过“检查点”区块来管理确定性。如果一对检查点(相邻 epoch 的第一个 slot)获得了质押ETH 总数中 2/3 以上的投票,那么这对检查点将被升级。 这两个检查点中较新的一个会变成“合理”状态,较旧的一个检查点从上个 epoch 获得的合理状态升级为“最终确定”状态。平均而言,用户交易将位于一个 epoch 中间的一个区块中,距离下一个检查点还有半个 epoch,表明交易最终确定为 2.5 个 epoch,约 16min(经过 0.5 个 epoch,到达下个检查点;再经过 1 个 epoch,下个检查点获得合理状态;再经过 1个 epoch,下个检查点获得最终确定状态)。理想情况下,一个 epoch 的第 22 个 slot 将实现该 epoch 检查点的合理性。因此,交易最终确定平均为 14min(16+32+22 个 slot)。

Single Slot Finality(SSF,单时隙确定性):即每个 slot 产出区块后立即实现最终确定性。目前以太坊最终确定区块所需的时间太长,大多数用户都不希望等待约 15min 才能最终确定交易,而且制约了希望实现高交易吞吐量的应用的发展。此外,区块提议和最终确定之间的延迟也为短时间重组创造了机会,攻击者可利用这种方式审查某些区块或进行 MEV 提取。处理分阶段升级区块的机制也相当复杂,是以太坊代码库中较容易出现细微漏洞的部分之一。 这些问题都可以通过将最终确定时间缩短到一个 slot 来解决。SSF 在以太坊路线图中处于 The Merge 分支(参考:https://twitter.com/VitalikButerin/status/1588669782471368704/photo/1),是以太坊长期的目标之一。但以太坊官方预计 SSF 不会在几年内推出,其需要 Verkle Trees 和 Danksharding 等重大升级作为前置工作。

2.3 解决方案

Vitalik 指出目前的 delegators 并没有发挥好应有的作用,同时认为上述两个问题都可以通过赋予 delegators 更多的权利和义务来解决。主要的两个解决问题的方向是 Expanding delegate selection powers 和 Consensus participation。

2.3.1 Expanding delegate selection powers

Expanding delegate selection powers,即拓展 delegators 的选择权,让他们在选择质押服务商和节点运营商时具有更主动的地位。目前这种方式实际上是部分存在的,因为持有 stETH 或者rETH 的 delegators 可以直接提款,再质押到别的 staking pool 中,但其中存在较多局限,比如不能直接选择运营商、提款不够灵活等。

Vitalik 提及了三种拓展 delegators 选择权的方式:

- Better voting tools within pools,优化池内投票:即优化 staking pool 内的投票,让池内的用户自己选择节点运行商,但这种方式目前实际上并不存在。Rocket pool 让任何质押者都可以成为节点运营商;而 Lido 是由 LDO holder 决定节点运营商,尽管 Lido 有过提案,建议采用 LDO + stETH 的双层治理模式(提案链接:https://research.lido.fi/t/ldo-steth-dual-governance/2382)。

- More competition between pools,加强池间竞争:即提高 staking pool 之间的竞争程度,让 delegators 具有更丰富的选择。但实际上长尾 staking pool 的 LST 在流动性、可信任度和 dapp 接受度层面处于劣势,其无法与 Lido 这样的头部项目进行竞争,因此 delegators 别无选择。Vitalik 认为流动性、信任程度和 dapp 接受度三个问题都可以通过一系列的措施来解决,比如降低 slash 罚金数额来降低 delegators 面临的 slash 风险,让用户能随时取出质押的 ETH 成为可能,从而解决 LST 流动性和难以信任的问题;同时还可以引入一个统一的 LST 代币标准,让所有 staking pool 的 LST 都通过一个统一的合约来发行,来保证 LST 的对不同 dapp 的兼容程度和安全性。

关于slash:

什么是 slash(罚没):以太坊共识需要一定的激励机制让验证者积极表现。验证者参与以太坊共识需要提前质押一定数量的 ETH。如果验证者出现不当行为,其质押的 ETH 可能会被销毁(slash)。 主要有两种行为被视为不诚实:在一个 slot 中提出多个区块(模棱两可)和提交相互矛盾的投票。

为什么降低 slash 数额能减少 delegators 面临的风险:在当前的双层质押结构中,delegators 只提供了质押的 ETH,而验证者的行为实际上是节点运营商的行为,因此运营商作恶时会导致 delegators 代为受惩罚。Rocket Pool 等项目要求节点运营商也需要贡献一定的质押 ETH,以减小其中的委托代理问题。如果在以太坊层面把可以 slash 的 ETH 数量降低到节点运营商的份额可以覆盖的程度,那么 delegators 可以消除 slash 风险,质押服务商也就可以让 delegators 随时取款,而不必储备一定的流动性。

- Enshrined delegation,原生集成 delegation:即以太坊直接原生集成上述相关的 delegation 功能,如在以太坊协议层面强制要求 delegators 参与质押时就选择节点运营商,等等。

2.3.2 Consensus participation

Consensus participation,即让 delegators 以某种更轻量的方式参与以太坊的共识,同时不给以太坊共识带来额外的负担。Vitalik 坦言许多 delegators 并不想这么做,他们只想最简单地持有 LSTs,但他也认为会有 delegators 会主动参与到共识中。Vitalik 提供了以太坊原生集成,和第三方项目集成两种实现方案,下面将逐一讨论。

2.3.2.1 以太坊原生集成

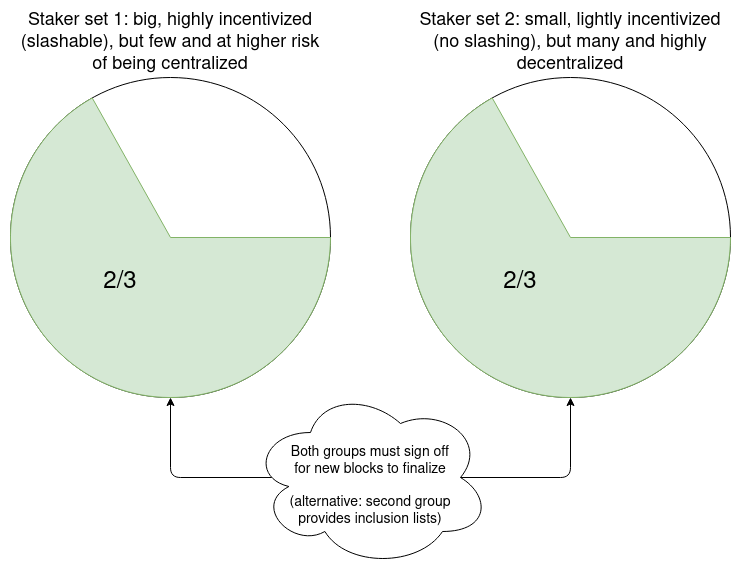

在以太坊协议层面,首先把验证者分为复杂验证者(higher-complexity slashable tier)和简单验证者(lower-complexity tier)两类,分别承担不同的工作来保证以太坊的性能和去中心化。

- 复杂验证者:承担以太坊主要的验证和计算工作,需要时刻保持在线。每个复杂验证者质押 ETH 的数量要求将会被提高到 2048 ETH(Vitalik举的例子),要承受 slash 的风险。整个网络中复杂验证者的数量被限制在 1 万个。

- 简单验证者:没有名额限制,没有质押门槛,可以免受 slash,仅需要在部分 slot 参与共识。

- 简单验证者来源:通过质押服务商参与质押,为复杂验证者提供 ETH 的 delegators;以及网络中想独立成为简单验证者的用户。(注:Vitalik 原文中用small-stakers代指简单验证者,下文会混用小质押者和简单验证者)

- 简单验证者几种可能的工作方式

- 每个 slot 会有 1 万个简单验证者被随机选择,来投票选择他们赞成的状态。

- 一个 delegator 可以发送一笔交易来声明自己在线,并且愿意在下个小时成为简单验证者,来投票选择他们赞成的区块头,在工作结束后需要签退。

- 一个 delegator 可以发送一笔交易来声明自己在线,并且愿意在下个小时成为简单验证者。每个 epoch,10 个随机的 delegators 将被选择来形成区块推荐列表,还有 1 万多个 delegators 将被选择成为投票者。该部分简单验证者无需签退,在线要求随着时间过期。

- 以上三种方案的特点:都是为了防止节点运营商的 51% 攻击和提高以太坊的抗审查程度。第一种和第二种方案主要防止最终确定性被逆转;第三种方案则更关注网络的抗审查,简单验证者需要做的工作更多。

- 轻量参与的前提:有一个超轻客户端来供简单验证者使用,让其能够通过手机或者网页即可完成验证工作;这里涉及对以太坊客户端轻量化的相关研究(如引入Verkle Tree、无状态等),旨在降低验证者的参与门槛。

2.3.2.2第三方项目集成

第三方项目集成指主要通过 staking pool 自身的升级来实现 delegators 对以太坊共识的参与。核心思想是在共识投票环节引入 delegators 和验证者的联合签名来反映 delegators 群体的意愿。以下是 Vitalik 提出的三种方案:

- Staking pool 在开设验证者账户时声明两把 staking keys,分别是 P(persistent staking key)和 Q(quick staking key,实际上是一个以太坊地址被调用时的输出结果)。节点分别跟踪 P 和 Q 对某个分叉选择的消息的签名,如果 P 和 Q 的选择相同,则验证成功;如果不同,则验证失败。Staking pool 负责随机选取 delegators 作为当前 slot 的 Q-key 持有者。

- 验证者在每个 slot 里都随机生成一个质押公钥 P + Q,每个 slot 的投票签名都需要验证者和 delegaotrs 进行联合计算。由于每个 slot 都会随机生成不同的密钥,当发生 slash 时有相关的归咎问题,需要针对该问题进行一定的设计。

- 把 Q 放进智能合约,而不作为一种 delegators 直接持有的密钥。智能合约管理的 Q 可以引入多样化的触发条件,从而为 staking pool 内带来更丰富的投票逻辑。

2.3.3 总结

Vitalik 认为上面的方案如果采用得当,对权益证明设计的调整可以实现一举两得(降低质押中心化程度、减小以太坊共识负载):

- 为那些目前没有资源或能力参与 PoS 的人提供一个机会来参与,使他们更多地掌握权力(包括选择他们支持的节点的权力),并以一种更加轻量但仍有意义的方式参与。同时 Vitalik 也指出并不是所有的参与者都会选择这两个或其中之一的选项,但任何选择的方案都能够改善现状。

- 减少以太坊共识层在每个 slot 需要处理的签名数量,即使在单时隙确定性实现的情况下,也能够减少到大约 10,000 个。这有助于去中心化,使每个人都更容易运行一个验证节点。

对于上述方案,包括优化池内选举、加强池间竞争、以太坊原生集成等,虽然处于不同的抽象层次,但其目标都是为了解决目前以太坊质押中心化和共识负载的问题。Vitalik 认为具体的实现方案应该经过仔细考虑才能被采纳,最优的方案应该在最小化协议改动的同时仍然能够实现所期望的目标。

3. 对质押相关赛道的影响分析

3.1 质押相关赛道概览

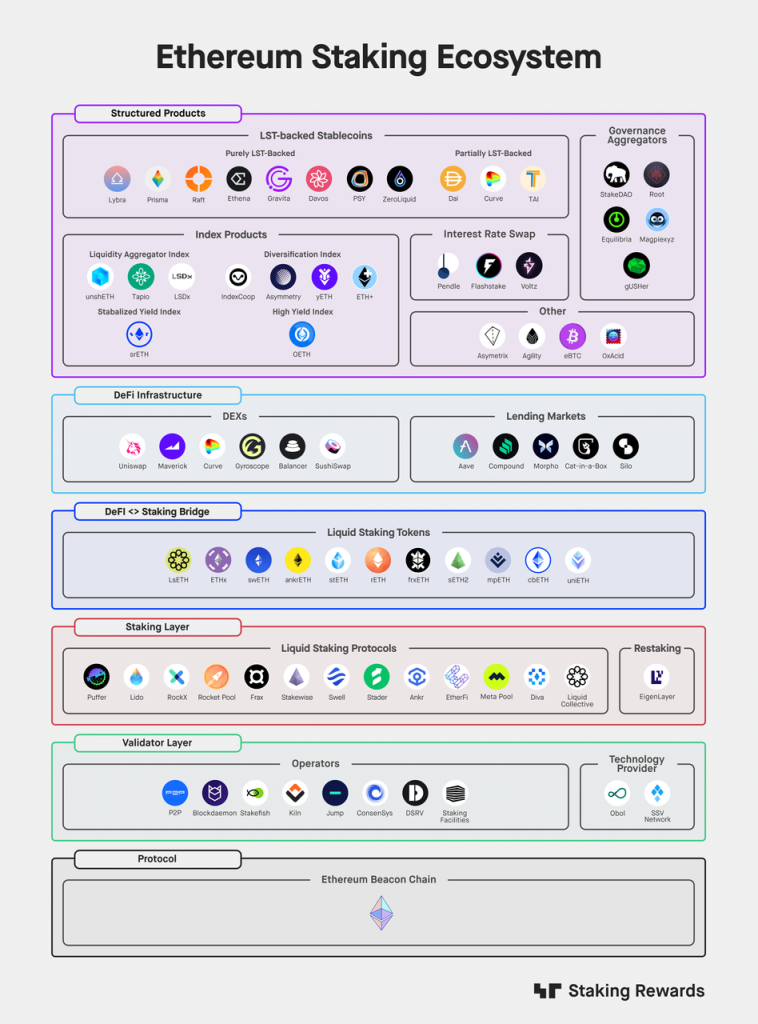

参考 @StakingRewards 对以太坊质押生态的划分,从底层向上可以分为验证者层、质押层、桥接层、DeFi基础设施层以及最上层的结构化产品层。内部的逻辑关系和各自的价值可梳理如下:

- 验证者层:以 P2P、Stakefish 等节点运营商为代表,为质押层或者 solo 质押的客户提供最底层的硬件资源。其中还包括提供 DVT 技术的服务商 SSV 和 Obol。验证者层为质押层解决了硬件的相关的问题。

- 质押层:以 Lido、Rocket Pool 为代表的质押服务商,接收 delegators 的资金,并代表 delegators 与节点运营商对接,开展以太坊的共识验证,其中还包括提出 restaking 概念的 EigenLayer。质押层把 delegators 间接参与 PoS 的行为封装成理财产品,降低了参与门槛,为以太坊引入了更多质押份额。

- 桥接层:这里指质押层发行的 LST(Liquid Staking Token),用户通过 LST 参与各种 DeFi 协议;质押服务商在 Curve 等协议中添加 LST-ETH 交易对,为 delegators 提供提前退出质押的流动性,降低 delegators 参与质押的机会成本。

- DeFi 基础设施与结构化产品层:利用 LST 的价值贮藏与收益能力开发衍生的产品和服务,创造更多 LST 的应用场景,丰富 DeFi 生态,吸引用户前来质押。

在质押生态中,质押层扮演了承上启下的核心角色:为以太坊引入更多的质押份额,并通过 LST 向 DeFi 系统输送流动性。质押层的核心位置使得自身的变化能够引起整个质押生态的变化,因此我们将着重分析相关方案对质押层项目的影响。本文中的质押赛道将主要代指质押层。

3.2 上述方案对质押赛道的潜在影响

以上方案的实现角度不同,但都会对质押赛道产生影响。我们将在下文中分析不同方案带来的影响,并推断对应方案被采纳的可行性。

3.2.1 Expanding delegate selection powers

以下简要分析 Vitalik 提及的三种拓展 delegators 选择权的方案带来的潜在影响。

- 优化池内投票(Better voting tools within pools):即优化 staking pool 内的投票,让池内的用户自己选择节点运行商。

- 潜在影响:可以让质押服务商自身更加去中心化,但无法降低质押赛道的集中程度,因为用户可以更加信任头部的质押服务商;原本更多由质押服务商控制的运营商选择权被部分转移给了 delegators,可能会降低原本治理代币的价值捕获。

- 采纳可能性分析

- 总体成本小:无需以太坊共识层改动,仅仅需要质押服务商改变自身机制。

- 现存质押服务商缺少激励:该方案需要现存质押服务商主动改变,并承担较大的成本,包括开发成本和治理代币效用减小的成本。

- 总结:部分解决了质押中心化的问题,但无法解决共识负载的问题,最终效果可能一般。实现成本较低,但现存质押服务商没有动力做,采纳的可能性较小。可能有新的质押服务商以此为特性来切入市场。

- 加强池间竞争(More competition between pools):即加强 staking pool 之间的竞争,让 delegators 具有丰富的选择。目前不同 staking pool 在吸引用户层面的核心差异在于 LST 的流动性、可信任度和 dapp 接受度。Vitalik提出减少 slash 数额、引入统一 LST 标准来减小上述三种差异,加强质押服务商之间的竞争程度。

- 潜在影响:质押服务商差异减小,Lido 等头部项目市场份额下降,降低了质押赛道的中心化程度;LSTfi 生态可能更加繁荣,因为相应 dapp 可以支持更多 staking pool 的 LST;质押服务商会谋求其他方面的差异化,竞争方向可能转向 LST 本身的质押收益,尤其是在 MEV 提取策略上。

- 采纳可能性分析

- 总体成本中等:技术方面的成本较低,因为该方案无需以太坊协共识层变动,仅需引入新的 LST 代币标准,并让质押服务商配合降低用户的 slash 份额和采用新的 LST 标准。但在采用过程中,需要大量现存 LST 持有者将手中的 LST兑换成新的统一标准的LST,因此这里存在着较大的迁移成本。

- 现存质押服务商缺少激励:该方案需要现存的质押服务商进行一定的主动改变,需要承担一定的升级开发成本,还有大量 LST 转换的成本和风险。该方案的采用也使得现存服务商面临市场份额下降的压力。

- 总结:较大程度上解决了质押中心化的问题,但无法解决共识负载的问题,问题解决不完整。总体实现成本中等,但现存质押服务商没有动力做,采纳可能性较小。可能有新的质押服务商以此为特性来切入市场。

- 原生集成 delegation(Enshrined delegation):将上述相关的 delegation 功能直接纳入以太坊协议层,如用户直接选择节点运营商、以太坊自行推出 LST 代币标准等。

- 潜在影响:同上述池间竞争方案的影响,但以太坊协议层的支持将会在一定程度上保证相应转变的安全性。可能会给以太坊共识增加负担,因为用户在以太坊协议层参与 delegation 会给以太坊共识带来更多验证工作。

- 采纳可行性分析

- 总体成本大:需要以太坊共识层的升级来原生支持相关的 delegation 功能。

- 可能违背升级的初衷:加重了以太坊的共识负担;delegators 通过协议层面直接选择节点运营商进行托管的方式在本质上更接近 DPoS,这可能是 Vitalik 不愿意看到的结果。

- 总结:较大程度上解决了质押中心化的问题,但会加重共识负载的问题。同时,升级的成本较大,需要对以太坊做出一定改动。采纳可能性极小。

3.2.2 Consensus participation

Consensus participation 的基本思想是让更多简单验证者参与共识,两个方案的区别在于通过以太坊原生集成实现,还是在第三方项目内部实现。

3.2.2.1 原生集成

根据 Vitalik 的想法,以太坊原生集成的方案将会直接在网络中划分复杂验证者和简单验证者两种群体。复杂验证者的质押门槛会提高到 2048 ETH,验证者数量限制在 1 万个,需要实时保持在线,负责主要的验证和计算工作;而简单验证仅需利用自己的设备运行轻量客户端,在特定时间参与共识,并且仅承担投票等轻量级的工作。

注:2048 ETH 是 Vitalik 在原文中举的例子,但其有较大可能成为后续方案中采纳的数字。结合 Vitalik 在文章 Paths toward single-slot finality> 中的阐述以及 Vitalik 在原文中引用的 EIP-7251,我们可以得知这个数据具有现实意义:2048 ETH 能够将均衡状态下的验证者个数限制在一个理想的水平,降低以太坊的共识负担,为实现 SSF 铺平道路。同时在 Protocol and staking pool changes that could improve decentralization and reduce consensus overhead> 中,Vitalik 提出了一种实践做法:以太坊可以先集成 EIP-7251 作为过渡,即把验证者余额上限提高到 2048 ETH,同时保留 32 ETH的下限;随后再把 2048 ETH 作为整体的质押限制,来让验证者自行选择分层。综上可知,在下面的分析中用 2048 ETH 这个数字进行分析是具有较大参考价值的。

- 潜在影响

- 能够同时解决质押中心化和以太坊共识负载问题:原生集成让广大 delegators 和其他普通用户有了简单、低成本的方式参与共识,较大地提高了以太坊网络的去中心化程度;同时,1 万个复杂验证者的数量限制降低了每个 slot 的共识达成难度和聚合签名大小,减小了以太坊的共识负担。

- 质押服务商的服务、DVT 等安全技术的价值将会变高,渗透率会得到进一步提升:单个复杂验证者需要进行更主动的网络验证,并且要保证极高的在线率,因此相关的硬件运维门槛提高,DVT 等安全技术的价值进一步凸显;2048 ETH 的质押门槛让大部分原本能 solo 质押的用户转向 delegators;综合以上,质押服务商和 DVT 等技术服务商的渗透率将会提高。

- 质押赛道市场规模将出现天花板:在 Vitalik 的设想中,简单验证者参与共识的方式是自行运行超轻节点。来自 delegators 部分的质押 ETH 不会为质押服务商创造更多 TVL,而其他成为简单验证者的用户则无需通过质押服务商成为 delegators,因为他们本身就需要运行超轻节点,没有必要再托管给质押服务商并支付相应的托管费用。因此质押服务商能够捕获的 TVL 将迎来 2048 万 ETH 的上限。

- 质押服务商及相关项目长期增长可能停滞

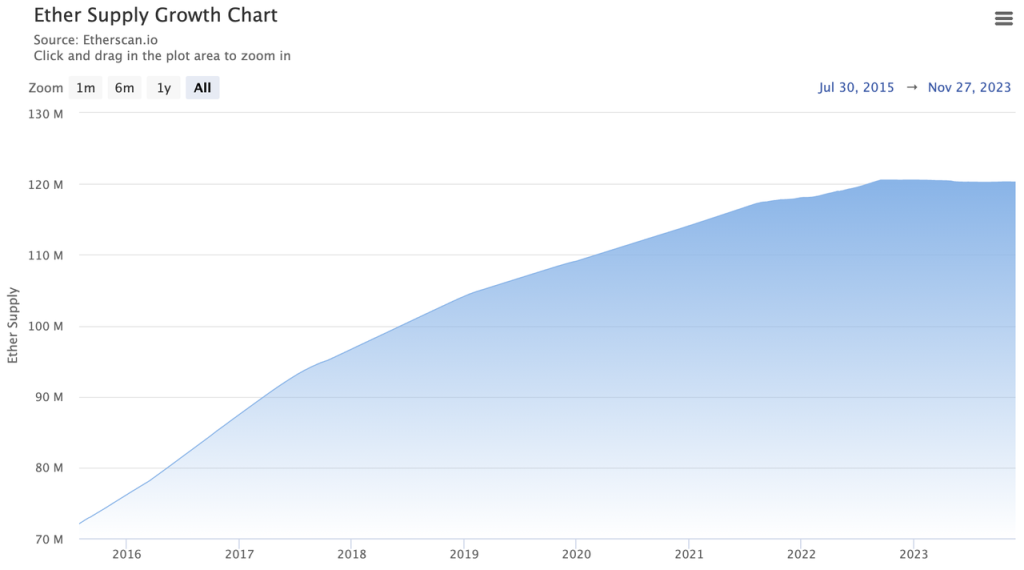

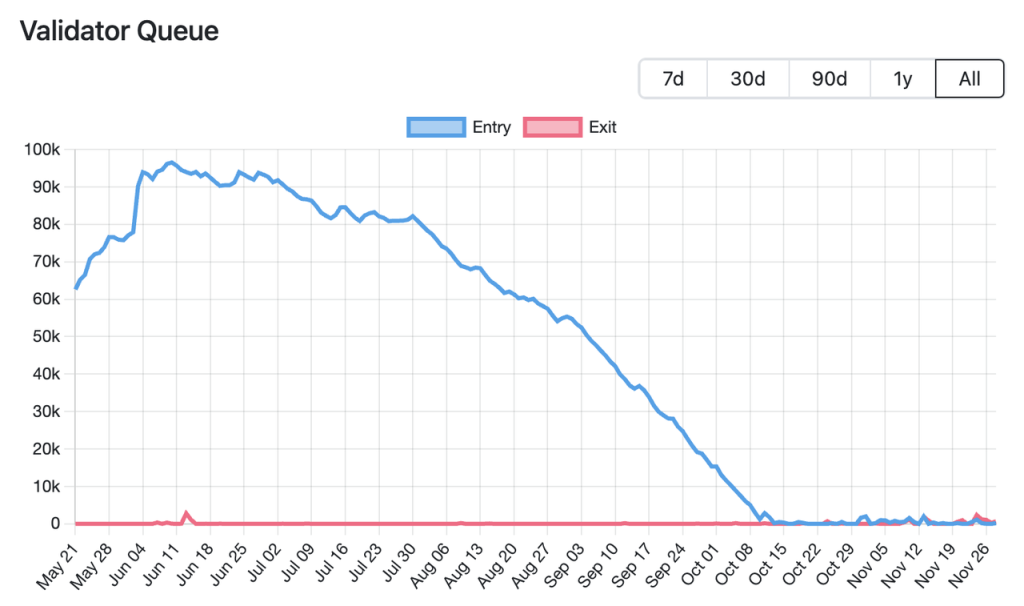

- 短中期仍有空间,但是动力不足:从目前的市场规模看,ETH 的总供应量在 EIP-1559 以及 Merge 之后稳定处于 1.2 亿枚左右,参与质押的以太坊约为 2800 万枚,质押率约为 23.29%,质押赛道仍然有部分提升空间;但从验证者进入和退出的排队情况来看,ETH 质押的增长随着质押收益的降低已经到达了瓶颈,如果没有链上交易量上升带来的 MEV 收益大幅上涨,则质押数量会处于稳定的均衡状态,增长缺乏动力。

- 质押服务商、DVT 等技术项目增长在长期会停滞:从以 Lido 为代表的质押服务商到以 SSV 为代表的 DVT项目,其收入模式均是在这部分资金的质押收益上收取一定比例的费用。当 delegators 的资金上限为 2048 万 ETH,那么这部分的资金会少于目前的 2800 万枚,如果未来的 MEV 收入上升幅度不足(意味着质押率提升不足),质押赛道的绝对收入规模会不增反降,且在长期没有增长来源。

- 采纳可能性分析

- 总体成本极大:需要改变以太坊的共识参与规则。

- 符合以太坊长期发展利益,验证者分层架构可能在长期引入。

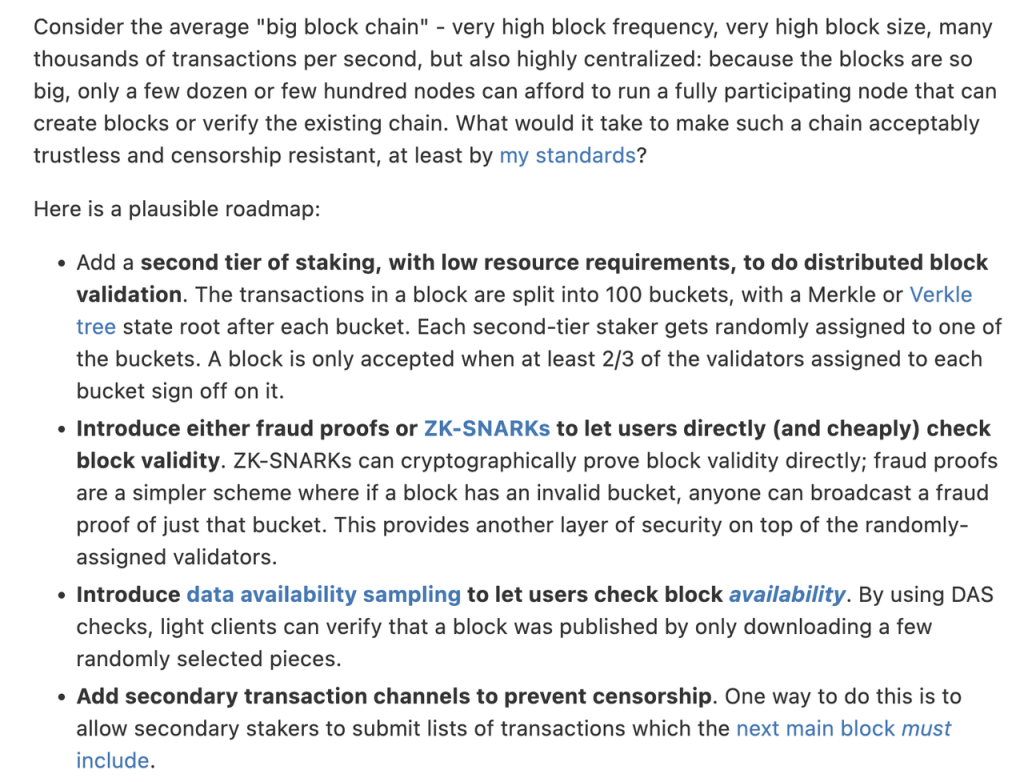

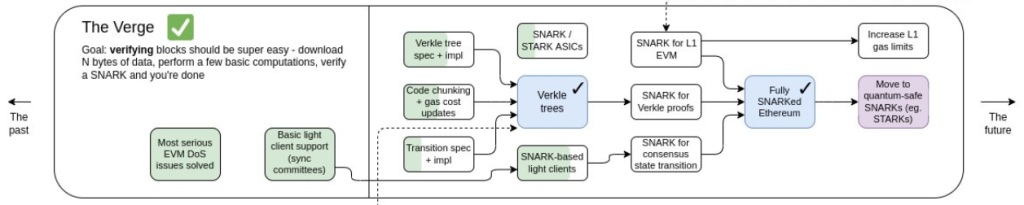

- 以太坊长期的发展目标之一需要引入类似的验证者分层架构:Vitalik 在 Endgame> 中指出,随着区块变大(状态膨胀问题),未来只有几百个大节点具有运行全节点的条件,以太坊需要找到另外一种轻量级的方式让更多人参与共识,确保有可以接受的免信任性和抗审查性。同时为了实现单时隙确定性(SSF)等提升以太坊性能和安全性的特性,也需要两种验证者来分工合作。两种验证者承担的责任不同,适用于不同的质押规则(分层)较为合理。

- 验证者分层结构已经多次出现在以太坊路线图和相关文章中,并且有大量轻量客户端相关的方案在规划和研究当中,旨在为简单验证者参与共识创造条件。

- 从 PBS、Danksharding 等重要升级中,我们都可以看到类似的分层与分工思想:让专业节点来承担更加繁重的工作(如存储 blob、构建区块),保证效率;让更多轻量化的节点来参与共识,保证去中心化。

- 从 Endgame> 的主要设想中我们可以看到,验证的 SNARK 化(轻量化)就是为简单验证者参与共识提供参考方式。在以太坊路线图中我们也能够看到,包括无状态、The Verge 等相关的研究都是为用户能够运行超轻节点做准备。

- 总结:能够同时解决质押中心化和共识负载的问题。采用成本极高,需要在以太坊共识层改变 PoS 规则,但符合以太坊的长期发展利益,并且以太坊路线图中已经部分体现了相关准备工作。在较长期可能得到采纳,但短期实现可能性较小。

3.2.2.2 第三方项目集成

Vitalik 还提出了仅仅通过 staking pool 来实现,而不必以太坊原生支持的实现方案。其核心是把验证者私钥再次拆分为 P 和 Q 两把,分别给验证节点和用户,通过 P 和 Q 的联合签名来让用户参与共识。

- 潜在影响:能够在一定程度上解决质押服中心化问题,但效果不确定,因为用户参与流程相对复杂,参与意愿可能较小。该方案更多是质押服务商内部的调整,对赛道的格局影响不大。

- 采纳可行性分析

- 实现成本中等:无需以太坊共识层做出较大改变,但需要现存质押服务商进行较为复杂的升级,包括密钥拆分、保管和联合签名的设计,同时还要吸引用户参与简单共识验证。

- 质押服务商承担成本变大,现有项目可能没有激励升级:首先是验证者私钥的拆分以及保管,其次是用户 UX的设计,都会给现存质押服务商带来一定的升级成本,但难以给现有服务商带来更高的收益。

- 由于验证逻辑变复杂,可能会给以太坊增加工作负担:更复杂的验证逻辑包括对比 P 和 Q 签名的消息等等。

- 总结:能够在一定程度上解决质押服中心化问题,但效果不确定,且对赛道项目的格局影响不大。现有项目采纳可能性较小,但可能有新的质押服务商以此为特性来切入市场。

3.3 总结

Vitalik 在文章中并未明确表达对某种方案的偏好,但我们仍然可以通过分析方案的效果和影响,并结合 Vitalik 往期文章和以太坊路线图等信息来推断可能发生的事情。

- 对于 Expanding delegate selection powers 方向的三个方案

- 问题解决不彻底:Expanding delegate selection powers 相关方案主要针对质押中心化的问题进行优化,但解决效果具有不确定性。因为目前围绕 delegators-staking pools 的双层质押结构在本质上已经接近于 DPoS,而针对 Expanding delegate selection powers 的方案并没有打破现存的结构,甚至可能突出 DPoS 的特征。同时,该相关方案不解决以太坊共识负载的问题,原生集成 delegation 的方案可能还会给以太坊共识增加负担。

- 现存者采纳激励小:该方向的方案都会损害现有质押服务商的利益,同时优化池内选举和加强池间竞争的方案还需要质押服务商的支持,因此现有质押服务商采纳相关方案的激励较小。

- 短期可能由新项目采用:可能出现新的质押服务商以此作为更去中心化的特性来切入市场,与现存项目开展竞争。

- 对于 Consensus participation 方向的方案

- 原生支持方案可能是长远的解决方案:原生支持方案能够同时解决 Vitalik 提到的质押中心化和以太坊共识负载问题。同时,为实现类似的分层验证者架构的准备工作正在进行。从短期看难以实现,但从长期看极有可能发生。

- 第三方集成方案相对 Expanding delegate selection powers 能够较大程度上解决质押中心化的问题,但也不能解决共识负载的问题。与 Expanding delegate selection powers 类似,也存在现存者采纳激励小的问题,短期可能有新的质押服务商以此为特性来切入市场。

4. 结语

在 Vitalik 的众多演讲和文章中,我们可以看到一个核心思想:以太坊应该保持中立和极简主义。虽然许多特性(如账户抽象、流动性质押服务、隐私账户等)对以太坊的竞争力有所提升,但以太坊并没有选择直接集成所有特性,而是将部分功能留给第三方项目来建设。众多第三方项目也很好地解答了以太坊留下的命题,找到了自己的市场定位。然而,随着以太坊自身的不断演进,第三方项目面临的问题和机会也在变化。对于这些参与者而言,这不仅是一场适应性的考验,更是一次深思熟虑未来、预见并把握终局机遇的时刻。

在本文的分析中,我们尝试基于 Vitalik 的设想,对当前质押赛道相关项目在未来可能面临的变数进行了一次全面的推演。尽管 Vitalik 在相关文章中规划了以太坊的可能终局,但未来仍充满不确定性,因为现在的规划可能随着新的市场需求和技术进步而改变。在这种不断变化的场景中,唯有具备终局思维和捕捉当前窗口红利能力的玩家,才能在长期的竞赛中保持领先。

参考材料

- Protocol and staking pool changes that could improve decentralization and reduce consensus overhead>

- Should Ethereum be okay with enshrining more things in the protocol?>

- Paths toward single-slot finality>

- Etheream Roadmap: Single slot finality

- A Proof of Stake overview>

- Can we find Goldilocks? Musings on “two-tiered” staking, a native Liquid Staking Token design.>

- Endgame>

- The Beacon Chain Ethereum 2.0 explainer you need to read first>

- FAQ on EIP-7251; Increasing the MAX_EFFECTIVE_BALANCE – HackMD

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。