Author: 0XNATALIE

Not long ago, five staking service providers including RocketPool, StakeWise, and Stader Labs jointly signed a proposal to limit validator shares to below 22%, while the leading protocol Lido Finance, with a market share of up to 32%, did not express its stance on this. The Ethereum community has expressed concerns about Lido's expanding influence in the liquid staking market, and criticism from the community is growing. Can improvements be made to the Ethereum protocol layer to directly enable liquid staking, thereby eliminating the centralization threat posed by the excessive market share of applications?

The idea of Two-tiered staking was initially proposed by Ethereum Foundation researcher Dankrad in April 2023. After discussion, Ethereum Foundation researcher mike further expanded and elaborated on it. The Two-tiered staking mechanism divides staked ETH into two layers, Node Operator Bonds (C1) and Delegated Stake (C2), similar to a structured fund. C1 may still face slashing risk, while C2 will not. The current LST ecosystem relies on user trust in node operators, with the main purpose being to reduce the slashing risk that ordinary users need to bear when choosing validators and to improve capital efficiency.

Two-tiered staking design

Node Operator Bonds (C1): Holders of C1 are node operators who provide network services and maintain network security. These bonds are slashable, and staked funds may be slashed if node operators violate network rules.

Delegated Stake (C2): C2 is ETH delegated by delegators to node operators. Unlike C1, the ETH deposited in C2 is non-slashable, even if the staked funds of node operators are slashed, the funds of delegators will not be affected.

Delegation ratio (g): Each C1 is eligible to receive g units of C2 delegation. This parameter ensures the maximum ratio between slashable funds (C1) and non-slashable funds (C2).

r1 (Node operator's interest rate): r1 is the interest rate received by node operators, which is usually higher than r2 to compensate for the operating costs and slashing risk borne by node operators. Node operators need to receive sufficient rewards to encourage their participation in Ethereum network validation.

r2 (Delegator's interest rate): r2 is the interest rate received by delegators for the staking they delegate. This rate is usually lower because delegators do not bear slashing risk. r2 is considered an "Ethereum risk-free rate" and can be obtained by simply staking without bearing risk.

LST: Each unit of C2 will generate a corresponding native liquid staking token (LST). These LSTs are unique to each node operator and are minted through their delegations. Only non-slashable ETH can be minted into LST.

These two interest rates are key components of this design. If r1 is set too high, the rewards for becoming a node operator may exceed the rewards for delegating, potentially leading to more people choosing to become node operators rather than delegating, or the emergence of LST layers based on trust assumptions like Lido, rendering the Two-tiered staking model meaningless. If r1 is set too low, there may not be enough incentive for people to become node operators, and the profits of node operation may be compressed, allowing only efficient, large-scale operators to survive, leading to centralization of nodes.

Characteristics and potential issues of the Two-tiered staking model

In this model, each unit of C1 is associated with a certain quantity (with a coefficient of g) of C2. In general, C1 can earn a higher interest rate r1 to compensate for the operating costs of running nodes and the opportunity cost of holding non-liquid staking, and the security of the consensus layer depends only on C1, which must go through an activation and exit queue, while C2 can be flexibly redelegated.

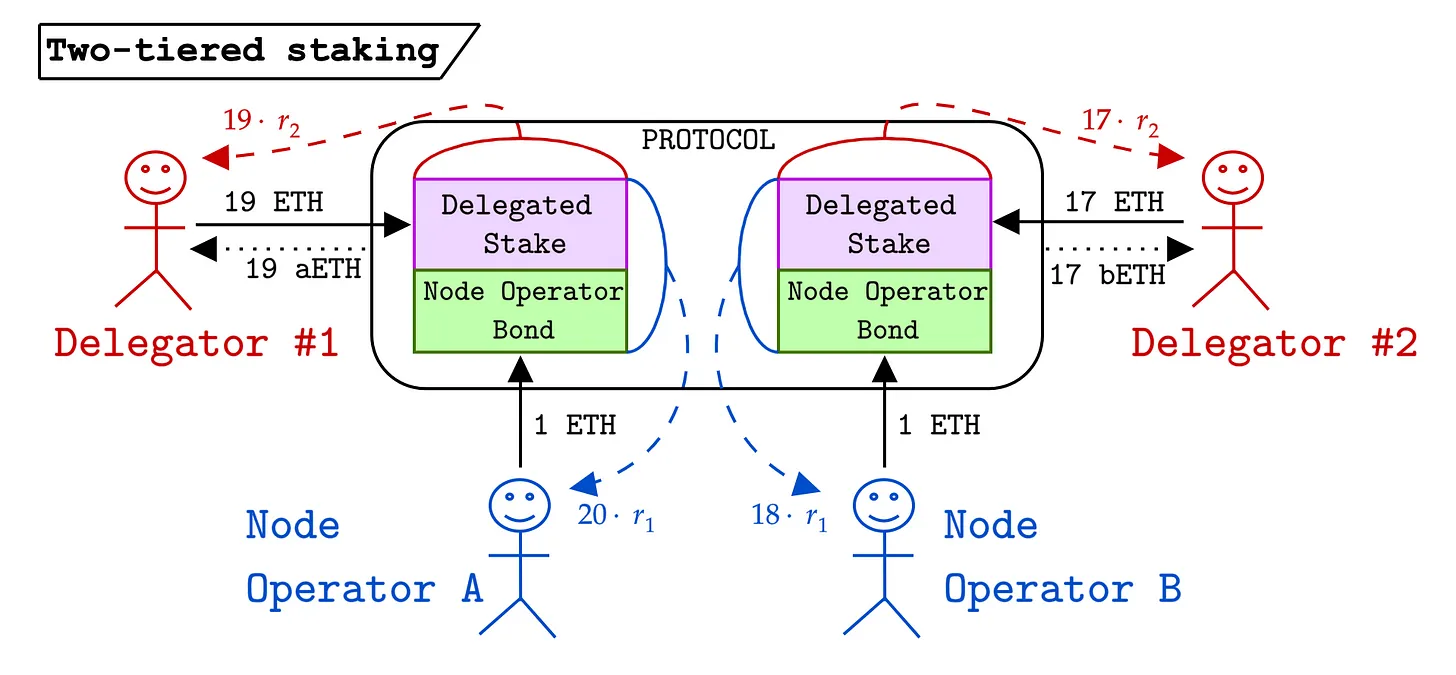

For example, there are two delegators, Delegator 1 and Delegator 2, and two node operators, Node Operator A and Node Operator B. Each node operator will provide 1 ETH bond to obtain authorization, which is subject to interest rate restrictions and slashable. The red and blue dashed lines in the figure below represent the interest earned by each participant. Delegator: Delegated staking * r2 = interest, Node operator: (Delegated staking + bond) * r1 = interest. Node Operator A's g is 19, meaning Delegator 1 delegates 19 ETH to Node Operator A, and A provides 1 ETH bond to obtain authorization. The interest earned by Delegator 1 is 19 * r2, and the interest earned by Node Operator A is 20 * r1.

Two-tiered Staking improves capital efficiency by dividing staking into two levels, allowing more ETH to be used for delegation, thereby increasing liquidity. Continuing the example above, Node Operator A's C1=1, C2=19 (collateral ratio is 1:19, leverage ratio is 19x), meaning 19 out of 20 ETH are in circulation, with a capital efficiency of 95%. Node Operator B's C1=1, C2=17 (collateral ratio is 1:17, leverage ratio is 17x), meaning 17 out of 18 ETH are in circulation, with a capital efficiency of 94.4%. In comparison, A has higher capital efficiency but also higher risk, as a larger proportion of ETH is used for delegation, and a relatively smaller proportion of ETH is used for slashing.

Through different interest rates and reward mechanisms, this mechanism attempts to encourage more people to participate in node operation and increase the decentralization of the network. It also raises the issue that because a portion of staked assets in the model no longer face slashing risk, attackers may perceive the cost of attacking the network to be lower. In the event of a large-scale attack, attackers may only need to attack the slashable portion, rather than the entire network, reducing the theoretical economic security.

In addition, the proposal also raises some open issues, and community discussions on these issues will help researchers delve deeper into how the new model interacts with the existing blockchain ecosystem. One issue that personally interests me is whether there is a dynamic way to set interest rates and whether LST will form a monopoly or oligopoly in the market, and how to ensure diversity and competition. I look forward to more community discussions on these issues.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。