Written by: BlockBeats

On September 26, the "EDGE Summit" AI&Web3.0 investment summit, led by Vertex Labs, officially opened in Hong Kong. The opening ceremony of the summit was addressed by former Deputy Director of Innovation and Technology Bureau, Eric Yeung, who delivered a speech on "Hong Kong Investment and Cross-Border Data Policy Sharing." He mentioned, "In terms of investing in innovation, Hong Kong has been committed to innovation in areas such as technology investment, digital banking, virtual assets, and cross-border investment services. We aim to develop the digital economy and be at the forefront of Web3.0 and artificial intelligence development."

During the summit, BlockBeats had an in-depth conversation with former Deputy Director of Innovation and Technology Bureau, Eric Yeung, to understand his thoughts and views on Web3.0 in Hong Kong.

In January 2016, Eric Yeung was appointed as the Deputy Director of the Innovation and Technology Bureau by the government and assumed office on March 1 of the same year. As an expert in the information technology industry with rich administrative experience, he was invited by the Director, Nicholas Yang, due to his active involvement in the industry. Earlier in his career, Eric Yeung was involved in information technology management and entrepreneurial development, having served in various technology companies. In March 2004, he joined Hong Kong Cyberport Management Company Limited, where he was responsible for promoting information technology infrastructure and nurturing entrepreneurs. When he left in February 2016, he held the position of Chief Technology Officer.

Before assuming the role of Deputy Director of the Innovation and Technology Bureau, Eric Yeung had worked with Director Nicholas Yang at Cyberport for many years. His technical background and industry image have played a positive role in the work of the Innovation and Technology Bureau. In August 2017, Eric Yeung was reappointed by the new government for another term, continuing his tenure as Deputy Director on August 2 of the same month.

BlockBeats: Please introduce yourself and talk about what you have been doing recently.

Eric Yeung: I am a native Hong Konger and have worked at Microsoft in Beijing and the United States. After leaving Microsoft, I started my own business. After feeling that entrepreneurship was not enjoyable, I worked in the government and public institutions for over ten years. In recent years, I have decided not to retire and still have the drive to continue entrepreneurship, so I have returned to the market.

In fact, there are many excellent companies in Hong Kong, but they are not very familiar with other cities in mainland China. I have worked more in Beijing and mainland China over the past decade, so I have been traveling abroad. Before joining the government, I was always involved in the field of innovation and technology, as well as financing. Now, I work as a consultant, helping different companies find market directions and opportunities.

BlockBeats: When did you first encounter the concepts of blockchain and Web3.0?

Eric Yeung: It was quite early. I was still working at Cyberport at the time and witnessed the very early Consensys conference. Bitcoin was only worth less than $300 at that time. So, I was quite early in this field. As someone involved in IT, I was bound to encounter Bitcoin. However, to this day, I still consider it unsafe and would not put a significant amount of assets into virtual currency, as there are many hackers and it is easy to be stolen.

Hong Kong's Web3.0, incomparable to Singapore

In mid-September, Vitalik Buterin spoke at the Token 2049 conference in Singapore, stating that although Hong Kong has shifted to a crypto-friendly stance since the end of last year, cryptocurrency projects setting up offices in Hong Kong should consider the stability of its friendly policies. Subsequently, Hong Kong Legislative Council member Wu Chi-wai responded to the issue of "Vitalik's statement that projects seeking development in Hong Kong should consider the continuity of local policies," expressing respect for Vitalik's right to speak, but also believing that he does not understand the specific situation in Hong Kong. He believes that "Hong Kong's policies and laws will not change overnight, and all related strategies and regulations have undergone significant social consensus and complete procedures, so I can tell Mr. Vitalik that Hong Kong's policies are very stable."

BlockBeats: Recently, Ethereum founder Vitalik Buterin spoke in Singapore and mentioned that projects seeking development in Hong Kong should consider the continuity of local policies. How do you view this matter?

Eric Yeung: Vitalik has actually been to Hong Kong very early. I think we in Hong Kong have already thought very clearly about what can be done and what cannot be done, just like the internet, as I mentioned in my previous statement. I experienced the internet bubble of Web 1.0, and there were some bad actors who disrupted the market. But if you are involved in construction and creating an overall framework, Hong Kong will not forget you.

Hong Kong's strengths lie in the free flow of talents, capital, and information, which are our best assets, constantly coming and going. But look at Singapore, can you transfer a large amount of money out in a day? Can you do that in Japan? In South Korea? Which country or region in Southeast Asia can have a free flow of capital like Hong Kong? Only the Hong Kong financial center can achieve this, so I think Hong Kong is a beautiful place.

BlockBeats: However, some people now say that Hong Kong has had friendly policies for a long time, has enacted some laws, but it still seems to be incomparable to Singapore, such as the number of attendees or the level of excitement at the conference. Some people feel that Singapore is more lively than Hong Kong. What do you think?

Eric Yeung: Really? I don't agree. My friends said they went for just one day and left immediately, thinking it would be lively and they could discuss many things, but it turned out to be nothing. Everything at Token 2049 is expensive, the hotels, dining, everything is expensive, just one word—expensive. But Hong Kong is relatively better because we are pegged to the US dollar. Singapore is not pegged to the US dollar, it fluctuates, so it will be expensive. This is a capacity issue, we can still overflow to Shenzhen and other places. In fact, many people come from Shenzhen today, they may not necessarily live in Hong Kong, but it's not the same for Singapore. So, this is a matter of scale, and there are many other issues, such as tax, Hong Kong's tax is relatively low and very transparent.

BlockBeats: For example, in the next five years, how do you think Singapore will compare to Hong Kong?

Eric Yeung: I don't think it's possible to compare. We are so close to the mainland, Singapore is a four-hour flight away, so it's incomparable. Hong Kong is a financial center, and I think this issue has been made very clear, especially in recent years.

In the past, many people used to say that Shanghai would surpass Hong Kong, Shenzhen would surpass Hong Kong, Guangzhou would surpass Hong Kong, but who says that now? The positioning of Hong Kong people is very important, we are an international gateway. So, we have been working very hard, including the government and many people who have flown in from all over the world. The forum is an international event, and we fully support it. Look at the Asian Financial Forum in January in Hong Kong, does Singapore have such a large conference?

But I don't want to compare with them because it's not good for comparison. Singapore is a country, we in Hong Kong are a city in China, there is no comparison. We are an international financial center, and our recent issue is because we are pegged to the US dollar. The interest rate is high, but it has already reached a "high point," so it will definitely decrease in the future.

BlockBeats: Is it possible for Hong Kong to create its own stablecoin, a stable Hong Kong dollar?

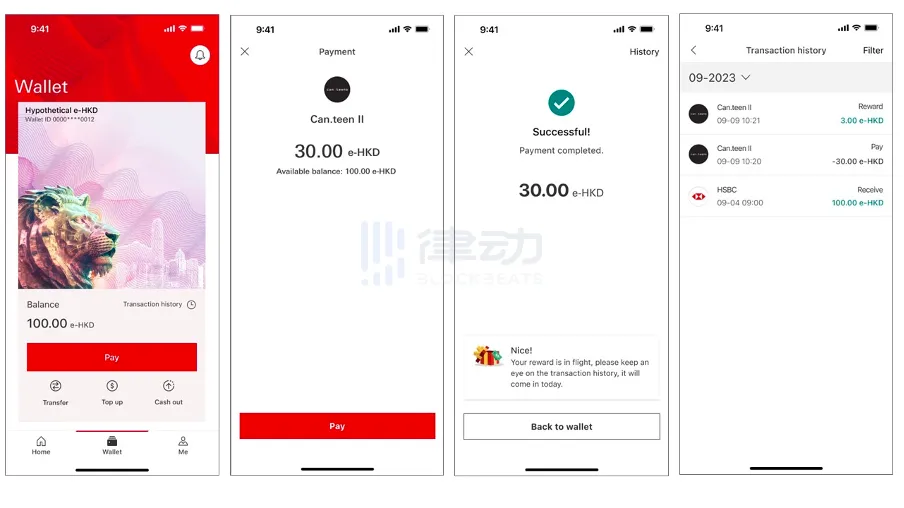

Eric Yeung: We have a stablecoin called "e-HKD," similar to e-CNY, which is basically the same as the Hong Kong dollar, but it is a digital currency. It was previously only used by banks, but now it has been made available for general use.

Recently, Hong Kong University of Science and Technology and HSBC conducted a one-week test of e-HKD, and there was not much discussion because it is still in the testing phase. But there is indeed a demand for this, and the roadmap is very clear.

e-HKD is being tested in different scenarios, it is not a large-scale test, unlike in the mainland. In the mainland, it may be B2B or B2C testing, but we are testing it using application scenarios. The campus is a very good scenario, and we are collaborating with HSBC to conduct the testing.

Hong Kong Regulation in the JPEX Incident

On September 15, Bitrace's on-chain fund audit revealed severe fund contamination in the related addresses of the virtual trading platform JPEX, with over 190 million risky USDT flowing into a certain hot wallet recharge address in the past 20 months. According to Hong Kong media am730, the Hong Kong police confirmed to the media that they have received notification from the Securities and Futures Commission and the Commercial Crime Bureau is following up and investigating whether the JPEX case involves criminal elements. Previously, the Securities and Futures Commission had issued a warning, stating that JPEX is an unregulated virtual trading platform.

Subsequently, JPEX issued an announcement stating that due to negative news, the platform's third-party market maker temporarily locked funds. Then, on September 19, the Hong Kong police stated at a briefing on the JPEX case that they had received 1641 reports claiming that assets could not be withdrawn from JPEX and suspected fraud, involving approximately HK$1.2 billion.

BlockBeats: What is your view on the JPEX incident in Hong Kong?

Eric Yeung: There are scams at any time, such as the Y2K incident in 2000. Due to design issues in computer programs at the time, computers would misinterpret some dates after the year 2000, leading to computer problems caused by misreading. People were actually looking for sprays that could kill the Y2K bug on the streets and were tricked into buying insecticide sprays, not understanding that the Y2K bug was a computer problem.

BlockBeats: As a citizen or user, how can one judge whether this is a scam or not?

Eric Yeung: Because I am a former official, the content of what I say is only for reference. How to judge whether it is a scam is actually very limited for citizens. It still depends on regulation, so I think regulation is a good thing, as it can provide a more transparent transformation for the market. Let me give an example of a casino. If there is an underground casino and a legal casino, where would you gamble? You would go to the legal one because if you win, they will pay you, just like the Hong Kong Jockey Club. We are legal, if you bet on a horse and win, you will get the money, it's very transparent. If you buy a horse among friends and they don't pay you, that's also a scam.

As an open and transparent market, whether it's virtual currency, future tokenization, or NFT, there will definitely be losses in these transactions. If there are no losses, it will cause a lot of trouble that everyone cannot bear. As an international financial center, we must have a good approach to handle these matters.

However, there are still some people exploiting legal loopholes. In the past two to three months, during the policy window, they came out and disrupted the market, which had a significant impact on many legitimate businesses. For example, several companies that obtained licenses are legitimate, but it is not good for genuine investors.

During this period, just like in the past, there were many incidents in Hong Kong banks 70 or 80 years ago. Every technology, every business behavior, when the policy is well done, everyone can do business more legally. But if it is too strict, it is not good, right?

But we all know that being too strict is not good, we need to strike a balance, and a good balance is very important.

BlockBeats: I know you are currently helping some projects. Is it difficult for them to obtain a license in Hong Kong?

Eric Yeung: The difficulty lies in the relatively large investment amount required. But I think if it's just a trading platform and virtual currency, the trading volume is not enough, it cannot rely solely on virtual currency. The daily trading volume of virtual currency is only for one or two currencies, it cannot handle so much trading volume. They need to do other businesses. So, I think overall healthy development should be the focus, such as NFT, GameFi, and so on.

BlockBeats: But the market for NFT and GameFi is not particularly good right now, what do you think?

Eric Yeung: In the long run, it's like the era of the internet 1.0, but there was no so-called business behavior behind it, how to make money was not clear, it was just using a lot of money. But later, there was BAT, so there is still a process. Now we are going through this process, but I think this cycle is relatively short because each technological cycle is getting shorter and faster. Unlike AI, which is developing very quickly, last year there were still many concepts, but this year AI has emerged. So, I think this field is still very good for me in terms of technology because there are many opportunities.

BlockBeats: If AI develops, will it also greatly help the development of Web3.0?

Eric Yeung: It will be of great help, they will definitely complement each other. But you can't just interview it every day and expect it to answer a bunch of questions for you. If it can't handle it, you can program it again, answer it, and optimize it. So in the future, we really have the opportunity to pass on the data and knowledge in our minds to the next generation, your son can not only have a conversation with your database but also directly access your database. I think Web3.0 + AI is very powerful.

BlockBeats: What are your thoughts on Worldcoin? Do you think Hong Kong could produce someone like Sam who can combine AI with Crypto Web3.0?

Eric Yeung: Worldcoin is basically a form of DID. I think Hong Kong has a relatively strong application scenario. If you say our innovation is mainly in application innovation, these infrastructure technologies require a lot of money, and other countries and regions may be better at it. But in terms of implementation and application scenarios, I believe Hong Kong is relatively strong. But this is just because everyone's roots are different, everyone's soil is different. Our city is quite complex, and it is already a very developed financial center, so I think application scenarios are more effective. But we can attract different companies to do this configuration in this field.

BlockBeats: I also want to know your thoughts on FTX, after all, FTX also started in Hong Kong.

Eric Yeung: This is again a regulatory issue, or it could be that FTX's risk management level is problematic, they used this money as collateral. The same logic applies to looking at Lehman, a bank that had been in operation for 200 years, would it have problems? I don't think it has problems, it's just that the risk management was not done well. But at that time, there was no very good conclusion or framework, so the problem arose at that time.

But if today we have a very good virtual asset framework in Hong Kong, then (FTX) may not necessarily have problems, it's just that the number of problems should be relatively small. Just like banks, banks also have problems, and in the United States, there have been investment banks operating for many years, and they still encounter certain detailed problems. So I think it's still a human problem, a management problem. It's not just in the virtual asset field, whether it's software or electric cars, if there is no good risk management, almost all will encounter this problem.

4 Trading Platforms Applying for Licenses

On September 25, as the scandal surrounding JPEX in Hong Kong continued to escalate, the Securities and Futures Commission (SFC) held a press conference to announce that they will further strengthen the release of information on virtual asset investment and investor education, and enhance public awareness of virtual trading platforms. The SFC stated that they will publish the "List of Applicants for Virtual Asset Trading Platforms," and currently, there are preliminary applicants from 4 institutions.

According to the Hong Kong Economic Daily, the 4 institutions are HKVAX, HKBitEx, Hong Kong BGE Limited, and Victory Fintech Company Limited, all from Hong Kong.

Related reading: "What are the backgrounds of the four licensed encrypted trading platforms confirmed by the Hong Kong Securities and Futures Commission?"

BlockBeats: Will Hong Kong intervene in the risk management of licensed trading platforms?

Eric Yeung: In fact, the overall regulation is very clear, but for example, in the area of risk management, we certainly don't do this every day, but they already have a so-called framework, and they are very clear about how to implement this structure. Although we are relatively late to the game, we have thought it through very clearly. We have learned a lot from cases in various places, including the UK, the US, Turkey, India, and even Singapore, where we were relatively late in setting up, but now many problems have arisen, and we are still optimizing. However, in these past few months, some have already obtained this license.

BlockBeats: Why were the trading platforms applying for licenses suddenly announced?

Eric Yeung: Because I am no longer in the government, I am not very clear about the specific situation, but the ones that are currently applying have already been announced. If a platform has not applied, it can be more effectively regulated.

I think it's because of the JPEX incident that these were announced. This incident involved a lot of money and affected many people, as many people bought in through these KOLs. Now these KOLs often take other people's money and then promote it, which is also a problem of Web3.0, sometimes I don't even know if they are experts.

BlockBeats: So, do you have a very positive view of the current cryptocurrency market?

Eric Yeung: Actually, I am generally optimistic about two areas, one is environmental technology, and the other is Web3.0. Environmental technology is definitely the future, it is very important for our next generation. In addition, there is financial technology, the new payment system for the next generation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。