来源丨硬·AI

作者 | 常嘉帅

今年,生成式AI无疑进入了一个“高速发展”阶段。

ChatGPT、Midjourney、文心一言等“消费级产品”将AI进了千家万户;Adobe、微软等老牌科技巨头借着AI“重焕新生”;而业绩暴增、市值狂飙的“AI卖铲人”英伟达,更成了今年资本市场上的绝对明星。

不过,从领头的微软、OpenAI,到进展神速的谷歌、Meta,大部分科技公司的AI产品还处在赔本赚吆喝的阶段,消费者买不买账还不好说。

尚不明朗的下游前景,引发了一系列疑问——

囤那么多GPU干嘛?需要赚多少钱才能回本?最终由谁买单?

9月20日,风投机构红杉的合伙人David Cahn发文,将这些疑问概述为“AI产业价值2000亿美元的问题”。

David Cahn认为,要想回本,AI行业需要实现2000亿美元的营收,但目前还差1250亿美元……

因此,David Cahn认为,虽然长期来看,企业囤积大量GPU算力可能是件好事,但短期来看,这可能会引起一场混乱。

以下为David Cahn原文精编,诸君enjoy~ ✌️

去年夏天以来,生成式AI浪潮已经进入了超高速模式。这一加速的催化剂是Nvidia的Q2盈利指南及其随后的超预期业绩。这向市场表明了对GPU和AI模型训练的需求是“不可满足”的。

在Nvidia的宣布之前,像ChatGPT、Midjourney和Stable Diffusion等消费者发布的产品已经将AI推向了公众视野。随着Nvidia取得亮眼的成绩,创始人和投资者得到了实证证据,证明AI可以创造数十亿美元的全新净收入,促使这一领域开足马力向前冲。

尽管投资者已经从Nvidia的成绩中推测出很多事情,AI投资现在正以飞快的速度进行,估值也创下了记录,但仍然存在一个重要的问题:所有这些GPU都用于什么?谁是最终的客户?为了使这种快速的投资回本,需要创造多少价值?

考虑以下情况:

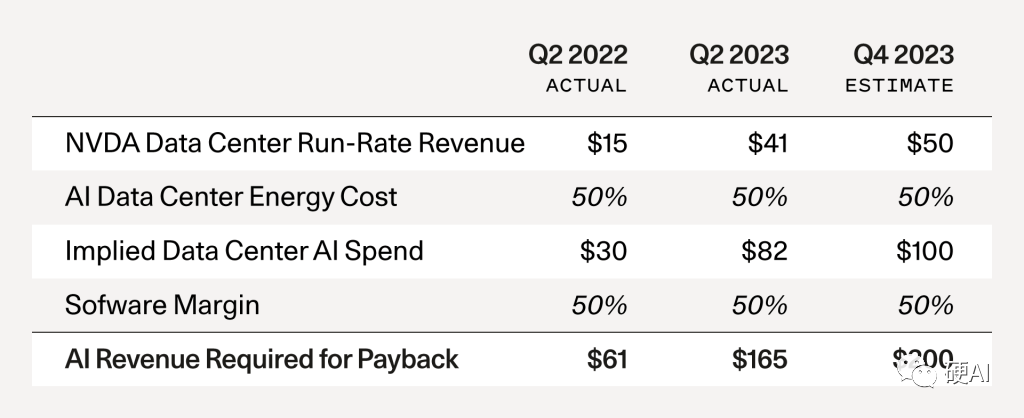

每1美元的GPU支出,大约对应1美元的数据中心能源成本,也就是说,如果英伟达到年底能卖500亿美元的GPU(根据分析师的保守估计),数据中心的支出就高达1000亿美元。

进一步假设,如果GPU的终端客户,即那些做GPU应用的公司,能在AI业务上赚取50%的利润才能不亏,就意味着至少需要2000亿美元的收入,才能收回前期的投资成本。这还没算云供应商的利润,如果要让他们赚钱,总营收要求甚至应该更高。

根据公开文件,数据中心建设的增量,大部分来自大科技公司。例如,谷歌、微软和Meta都报告了数据中心资本支出的大幅增长。另据相关报道,字节、腾讯、阿里这些公司也是英伟达的大客户。展望未来,亚马逊、甲骨文、苹果、特斯拉和Coreweave等公司可能也会在数据中心建设上花费重金。

要问的重要问题是:这些资本支出建设有多少与真正的终端客户需求相关,有多少是根据“预期需求”而建设的?这是一个价值2000亿美元的问题。

根据The Information的报道,OpenAI的年收入约为10亿美元,微软曾表示,预计Copilot等产品有望带来100亿美元的年收入,再把其他公司算进来:假设Meta、苹果也能靠AI年入100亿,甲骨文、字节、阿里、腾讯、X、特斯拉等公司的AI业务能赚50亿美元,加一块也只有750亿美元——

——这些都是虚拟的假设,重点是,即使你从AI中获得极大的收益,以今天的支出水平来看,离回本至少还差1250亿美元。

创业公司有很大的机会填补这个差距,我们的目标是“跟随GPU”,找到利用AI技术创造真正终端客户价值的下一代创业公司——我们希望投资于这些公司。

这个分析的目标,是突出显示我们今天看到的差距。

AI炒作终于赶上了自2017年以来开发的深度学习技术突破。这是好消息。正在发生主要的资本支出建设。这应该会在长期内大幅降低AI开发成本。以前,你必须购买一个服务器机架来构建任何应用程序。现在,你可以以更低的成本使用公有云。

同样,今天许多AI公司将大部分风险投资用于GPU。随着今天的供应限制让位于供应过剩,运行AI工作负载的成本将下降。这应该会刺激更多的产品开发。它还应该吸引更多的创始人来在这个领域创业。

在历史上的技术周期中,基础设施的过度建设往往会焚烧资本,但同时也会通过降低新产品开发的边际成本来释放未来的创新。我们预计这种模式将在人工智能领域重演。

对于初创公司来说,教训很明显:作为一个社区,我们需要将思维从基础设施转向终端客户价值。满意的客户是每个伟大企业的基本要求。为了让AI产生影响,我们需要想办法利用这项新技术来改善人们的生活。我们如何将这些令人惊叹的创新转化为客户每天都使用、喜爱并愿意付费的产品?

AI基础设施的建设正在进行中。基础设施不再是问题。许多基础模型正在被开发出来——这也不再是问题。而且,今天AI的工具也相当不错。

因此,2000亿美元的问题是:

你打算如何利用这些基础设施?你将如何用它们改变人们的生活?

本文编译自:

https://www.sequoiacap.com/article/follow-the-gpus-perspective/?utm_source=bensbites&utm_medium=referral&utm_campaign=dall-e-3-image-generation-in-chatgpt

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。