Trava is the next generation of Lending Protocols, employing an innovative model of multiple lending pools created by users. This groundbreaking cross-chain lending development is something you have to check out if you ever wanted to create and manage your own lending pool, starting an online lending business and potentially earn big profits from it. The Trava smart contract is now live on both Binance Smart Chain and Fantom Network.

Trava.Finance is the world’s first decentralised marketplace for cross-chain lending and offers a flexible mechanism in which users can create and manage their lending pools to start a lending business. Initially deployed on the Binance Smart Chain, Trava allows for lending with BSC tokens at initial stages, with cross-chain lending with various tokens on Ethereum and other blockchain networks enabled after. Established in 2018 with an initial 20+ members, the team has gathered outstanding specialists and individuals in blockchain, security, finance, risk management, and law to aid its growth.

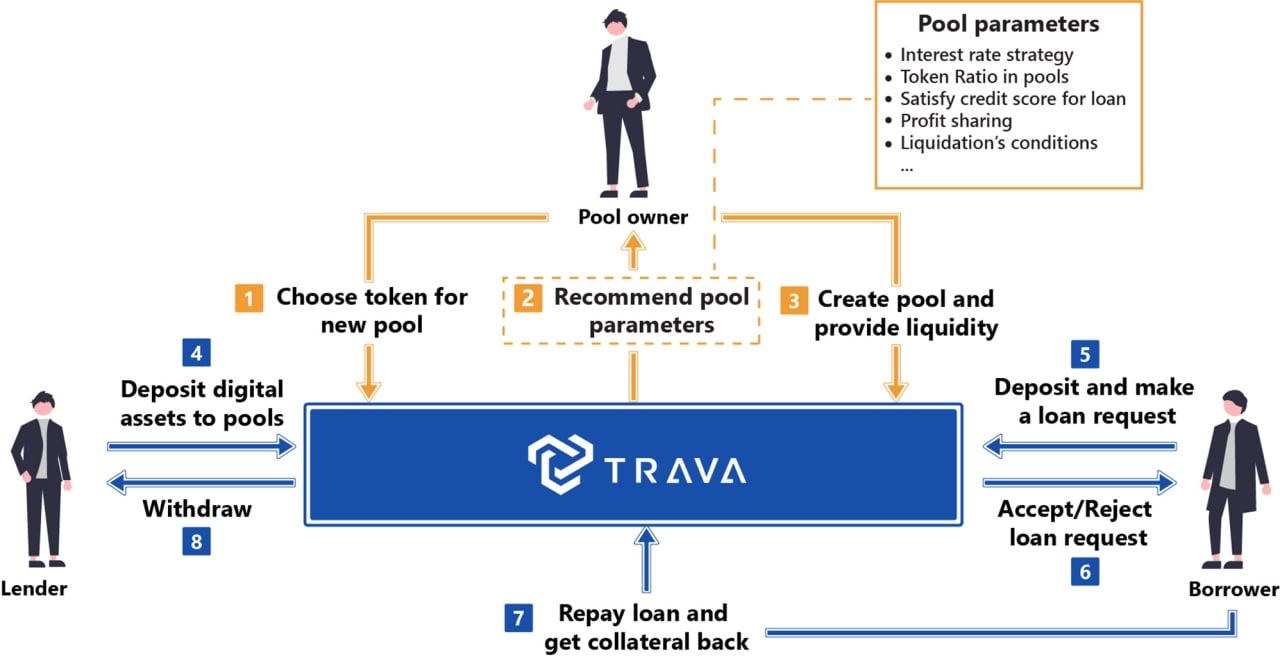

The BSC Trava lending pool supporting 14 assets. While existing approaches provide only one or a few lending pools with their own parameters such as borrow/supply interest rate, liquidation threshold, Loan-to-Value ratio, or a limited list of exchangeable cryptocurrencies, Trava offers a flexible mechanism in which users can create and manage their own lending pools to start a lending business. Trava also offers the credit score function based on financial data on-chain analysis as a useful tool that reduces risk and increases profits for all users.

The main innovation behind Trava is that it allows users to create their own pools with their own parameters such as borrow/supply interest rate, liquidation threshold, etc. However, there are other important differences between Trava and existing solutions. Trava provides users with a credit score – The pool owners can define a credit-score threshold for borrowers to reduce the lending risks and set a high Loan-to-Value ratio for borrowers with high credit scores. NFT, stock tokens, and other digital assets as collaterals: to increase the liquidity. This service will be released in Q4, 2021.

Cross-chain identification and cross-chain lending is another Trava advantage. It can identify all wallet addresses of the same users on different chains. After that, users can use up all of their cryptos as collateral for a huge loan in a single transaction. Trava plans to offer many statistical functions and analyze data for users, so they can reduce the risks and increase profits in a professional manner.

The Trava team recently announced that they will open a Lending Pool on Fantom Network on November 4th. Together with the launching of the lending system on Fantom Network, Trava will run its W2.1 Liquidity Mining Program for depositors and lenders when participating in the Lending Pool on Fantom Network. At this early stage the lending pool supports six assets, covering: FTM, DAI, USDC, USDT, ETH, and BTC.

Trava has a lot more developments coming up, such as opening rTrava vault on Fantom, launching NFTs staking and NFT marketplace, adding more tokens on BSC and FTM pools, creating a credit score-based lending pool, sharing profits from Trava Bridge for rTrava holders, new partnerships and listings on top-tier exchanges. So to keep up the project visit the website, and make sure to follow the team on Twitter, Telegram, Reddit, and Medium.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。