Stablecoin issuer Circle Internet Financial is rebalancing the reserves backing the $30 billion USD Coin (USDC) as it braces for the risk of a U.S. government debt default.

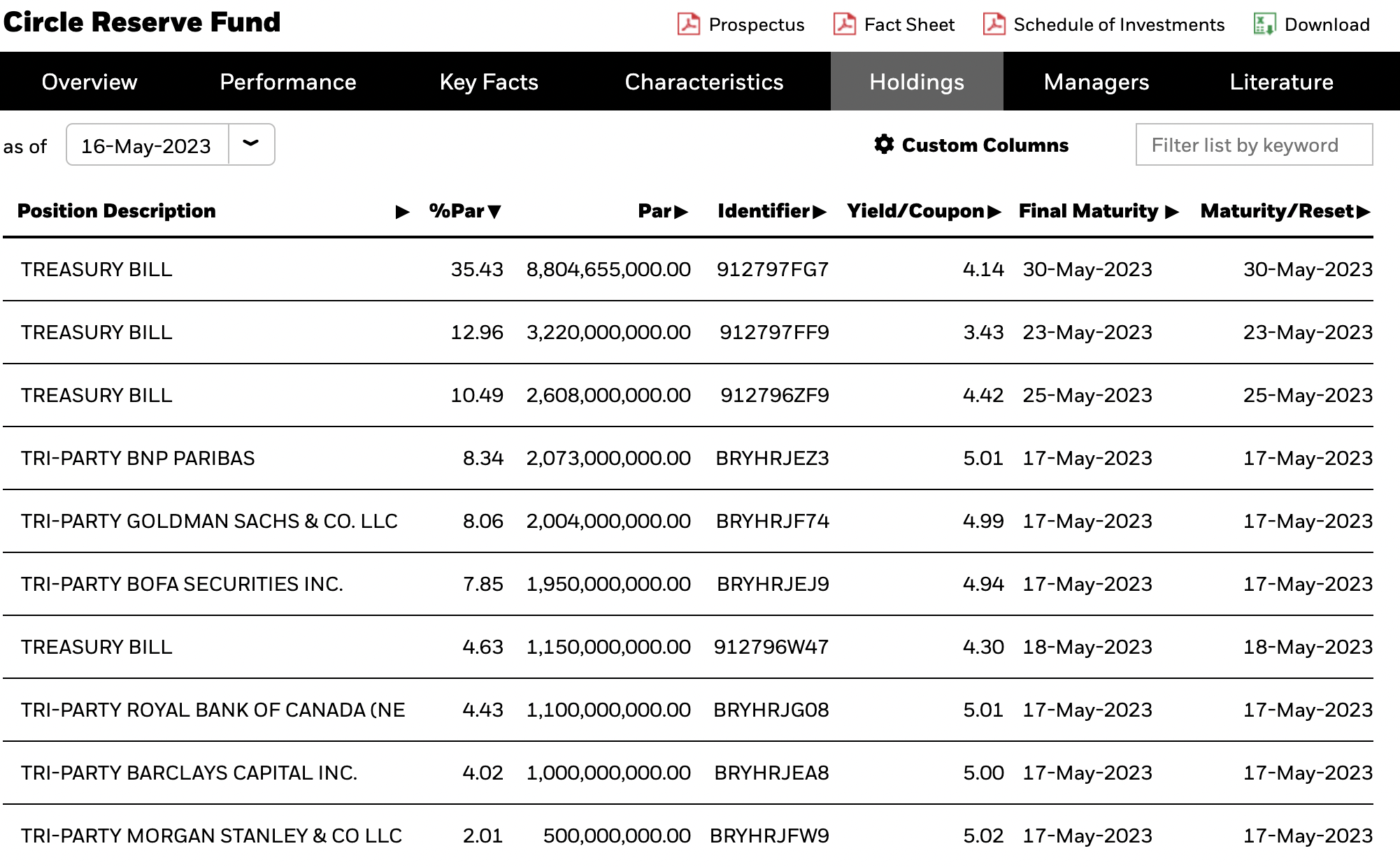

The Circle Reserve Fund, managed by global investment management giant BlackRock, added $8.7 billion in overnight repurchase (repo) agreements to the portfolio as of May 16, according to the fund’s website. The so-called tri-party repo agreements involve banking giants such as BNP Paribas, Goldman Sachs, Barclays and Royal Bank of Canada.

Overnight repo transactions are effectively short-term collateralized loans. The borrower is selling a security – in this case, U.S. Treasurys – for cash, and agrees to buy back the collateral the next day for a slightly higher price. What’s really happening, though, is that big institutional investors with cash to spare are parking that with Wall Street dealers that need funding.

“While this plan has been underway for many months, the inclusion of these highly liquid assets also provides additional protection for the USDC reserve in the unlikely event of a U.S. debt default,” a Circle spokesperson emailed in a note.

Circle is doing this as U.S. lawmakers are locked in discussions with President Joe Biden’s administration over raising the government’s ability to issue new debt, also known as the debt ceiling. Treasury Secretary Janet Yellen said that the Treasury Department is set to run out of cash by early June unless the debt limit is raised.

Read more: What Does the Debt Limit Showdown Mean for Bitcoin?

As part of the preparations, Circle’s fund ditched Treasurys that mature beyond the end of this month as of May 10, with rotating the assets into cash or government repo transactions instead, the Circle spokesperson said. The collateral for any such repo transactions exclude securities maturing within three days, the spokesperson added.

“We don’t want to carry exposure through a potential breach of the ability of the U.S. government to pay its debts,” Jeremy Allaire, chief executive officer of Circle, said last week in an interview with Politico.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。