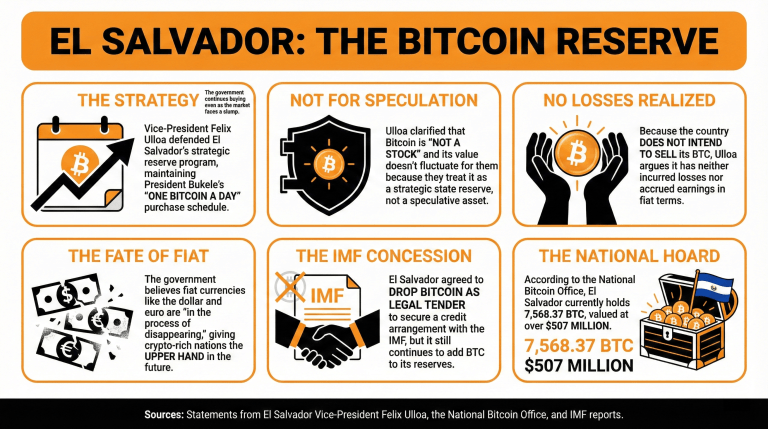

The government of El Salvador has faced brazen criticism for sustaining a continuous bitcoin purchase strategy even as the market is facing a slump.

Felix Ulloa, Vice-President of El Salvador, defended the strategic reserve program and the “one bitcoin a day” purchase schedule proposed by President Bukele. In recent statements, Ulloa highlighted the relevance of bitcoin as a reserve asset for El Salvador’s future.

When asked about the persistence of the national bitcoin purchasing program, Ulloa declared:

“ Bitcoin is not a stock; it’s not traded on the stock market, its value doesn’t fluctuate, and it’s not for speculation. We understand bitcoin as a strategic state reserve.”

Ulloa also remarked that, as the country does not intend to sell BTC, it has neither incurred losses nor accrued earnings regarding its bitcoin holdings. He stressed that the nation’s treasury was not betting on winning or losing in fiat currency terms, as these currencies are in the process of disappearing, with the nations holding more cryptocurrency having the upper hand in a future digital world.

“When people understand that, and the world understands that we are no longer dealing with paperwork and the dollar, the pound, and the euro, but that there will be this financial freedom in the world, in the international market, they will understand,” he concluded.

While El Salvador agreed to drop bitcoin as legal tender and confine the public sector’s bitcoin-related economic activities as it inked a credit arrangement with the International Monetary Fund (IMF), it has continued to add bitcoin to its reserves. According to the National Bitcoin Office (ONBTC), El Salvador holds 7,568.37 BTC valued at over $507 million at the time of writing.

What has prompted criticism of El Salvador’s bitcoin purchasing strategy?

The government faces backlash for its continued “one bitcoin a day” purchase strategy amid a declining market.How does Vice-President Felix Ulloa justify the bitcoin reserve strategy?

Ulloa described bitcoin as a strategic state reserve, emphasizing its future importance for El Salvador rather than viewing it as a speculative asset.What is El Salvador’s current stance on selling its bitcoin holdings?

Ulloa stated that the country does not intend to sell its bitcoin, claiming it has neither incurred losses nor realized gains from its BTC assets.What recent developments have occurred regarding El Salvador’s bitcoin holdings?

Despite agreeing to limit bitcoin’s role as legal tender following an IMF arrangement, El Salvador has continued to add to its reserves, holding approximately 7,568.37 BTC, valued at over $507 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。