Original | Odaily Planet Daily (@OdailyChina)

Author|Azuma (@azuma_eth)

The liquidity pool (Vault) model in DeFi is no stranger to everyone.

To explain it in the simplest terms, the gameplay of the liquidity pool is: everyone puts money into a certain pool, and then a so-called professional team (commonly referred to as Curator) manages the funds; the Curator uses various complex and dynamic strategies to earn higher returns, and in the end, everyone shares the profits — the funding users take away the majority of the profits, while the Curator earns a management fee or performance fee.

But have you heard of liquidity pools focusing on prediction markets?

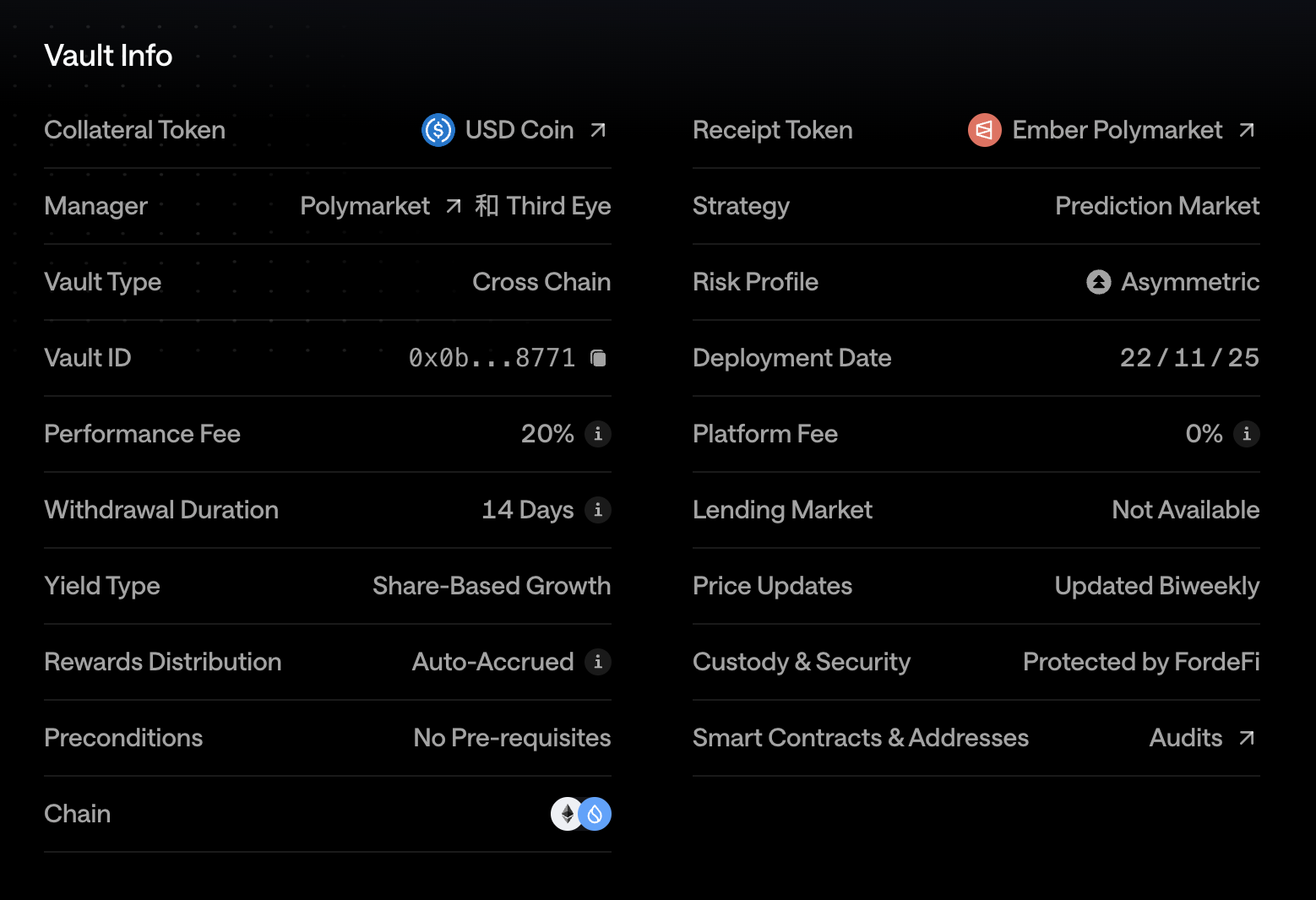

On January 19, Ember Protocol, a liquidity pool management protocol in the Sui ecosystem, officially announced the launch of a new liquidity pool product, Polymarket Vault. This liquidity pool is managed by the liquidity fund Third Eye, which is responsible for running strategies and generating profits on Polymarket, allowing users to deposit USDC into the pool and share the returns.

According to the official page of Ember Protocol, this liquidity pool has currently absorbed $1.3 million in deposits, with a current real-time annualized yield of 8.52% (6.82% after deducting a 20% performance fee).

Odaily Note: The detail page of the pool shows a performance fee of 20% and a redemption period of 14 days.

In terms of profit sharing, risk structure, and so on (with risk structure being the focus, which will be elaborated on later), the operational logic of Polymarket Vault is no different from the common liquidity pools found in DeFi, with the core difference being that the management party, Third Eye, has shifted its “money-making” focus from the relatively mature DeFi market to the earlier-stage prediction market.

The earlier the market, it often means that advanced players have greater opportunities to capture additional returns. In this regard, if the management can effectively utilize its professional advantages (such as capturing order book subsidies through high-frequency dynamic market making or performing more precise data modeling around sports markets), there is indeed some market space for prediction market liquidity pools. However, after reviewing the operational strategies of Polymarket Vault, it is hard not to worry about the potential risks involved.

According to disclosures from Polymarket Vault, the operational account name on Polymarket is third-eye (https://polymarket.com/@third-eye). We attempted to extract the trading records of this account and analyzed its trading patterns using AI tools like Deepseek.

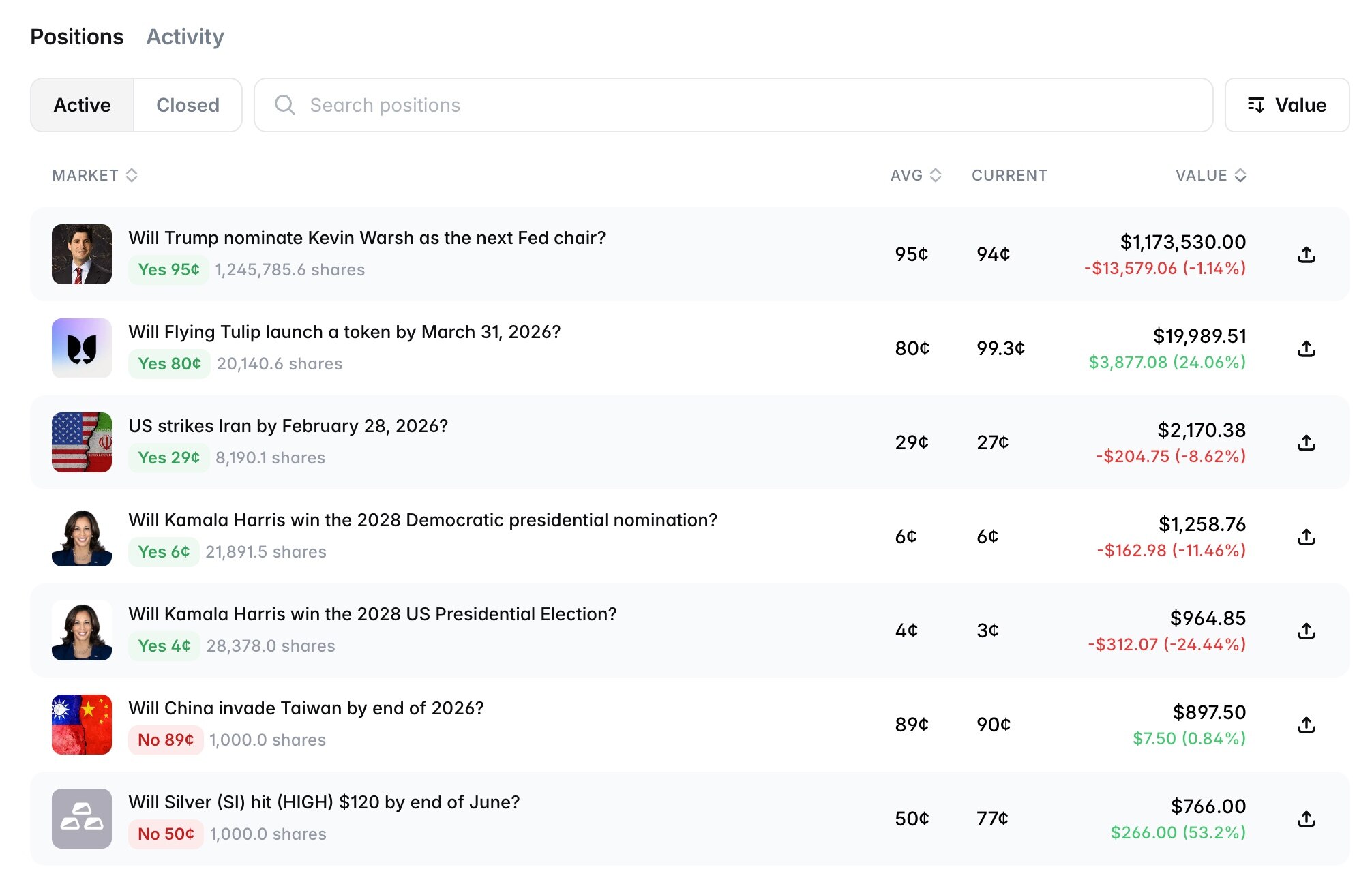

On-chain records show that this account's main bets on Polymarket are concentrated in the political arena, particularly on popular events related to the Federal Reserve, and the operation leans towards what the community often refers to as the “tail-end betting” strategy — focusing on highly certain events to capture the last profit margin of specific events with relatively small risks (which also implies higher costs).

There is always a divide in the community about whether the “tail-end betting” strategy itself is feasible; some believe it is a stable financial management method, while others feel it will inevitably lead to a significant loss (one pitfall replaces a hundred gains). This is precisely the issue faced by Third Eye. If the institution can manage the position size of each individual bet effectively, the problem might not be so glaring (even if there is a drawdown, the overall impact would be limited), but the current situation is that — Third Eye's positions are too concentrated, binding both risk and return to the outcome of a single event.

More specifically, Third Eye placed a bet of nearly $1.187 million at an average price of $0.95 on the event of “Will Trump nominate Kevin Warsh as the next Fed chair?” (currently a floating loss of $13,000), and did not hedge by betting on other candidates. This accounts for more than 90% of the $1.3 million raised by this liquidity pool, almost equivalent to an all-in bet.

Although Trump has previously stated he will nominate Kevin Warsh to run the Federal Reserve, this still requires confirmation from the U.S. Senate to take effect, and objectively, there is certain resistance on both the Democratic and Republican sides (some members of Congress believe they should wait until the investigation into Powell is completed). This is also why, after Trump's statement, the probability of this event still hovers around 95%.

If you were trading on Polymarket yourself, I would agree that this is a valid bet, after all, Kevin Warsh being appointed is a high-probability event. However, Third Eye’s situation is entirely different; it is using funds that users have deposited into Polymarket Vault, and if an unexpected situation arises, what do you think the result will be?

Regarding the strategy execution risk of the management, Ember Protocol describes it as follows: “Execution risk arises from the possibility that the manager may not be able to effectively implement their strategy or deploy collateral as expected. This can be caused by various factors, such as delays in trade execution, network congestion, or technical failures of the DeFi protocols themselves. Furthermore, poor timing or execution errors may lead to returns falling short of expectations or direct economic losses. Although managers will use automation tools and operational safeguards to mitigate these risks, execution risk remains an inherent feature of decentralized markets and smart contract-based trading.”

So the answer to the previous question is quite simple, if Third Eye's bet on Kevin Warsh experiences an unexpected situation, all users with deposits in Polymarket Vault will collectively bear the loss; let alone the 8.5% interest, even preserving the principal would be a luxury.

In DeFi liquidity pools, the negligence of risk control by Curators is also a common issue. This is a result driven by the Curator's profit model, as well as a lack of effective supervision and accountability mechanisms in the market — more details can be found in "What is the role of Curator in DeFi? Could it be a hidden danger in this round of cycle?"

Compared to DeFi, the risk control pressures faced by prediction markets may be even more severe. This is because the price changes of assets in DeFi markets are often continuous, allowing management to control drawdowns through hedging, stop-losses, or even liquidation when strategies fail. However, the volatility of prediction markets is often driven by discrete real-world events, and price changes tend to be abrupt; when sudden changes occur, it is difficult for management to control the magnitude of the drawdown.

Simply imagine, if at any given moment, the market suddenly reports that Kevin Warsh is unable to assume the office of the next Federal Reserve chair (regardless of whether the reason is Senate obstruction, Trump changing his mind, or a personal incident), the YES share price in this event will undoubtedly plummet from $0.95 to zero in an instant, and you will find it hard to do anything to reduce your losses during this process — even if you sell at a discount, there will be no one to take over.

Under the condition where this assumption has a probability of realization, it is difficult to recognize the risk control quality and strategy rationality of Third Eye. Just to ask a simple question, knowing where its profit comes from, would you dare to deposit funds for this 8.5% return?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。