Written by: Mahe, Foresight News

Polymarket hides numerous top smart minds who can make money; a player nicknamed noovd (0x063aeee10fbfd55b6def10da28e87a601e7deb4b) has earned hundreds of thousands in profits just by predicting the number of tweets from the richest person on Earth, Musk.

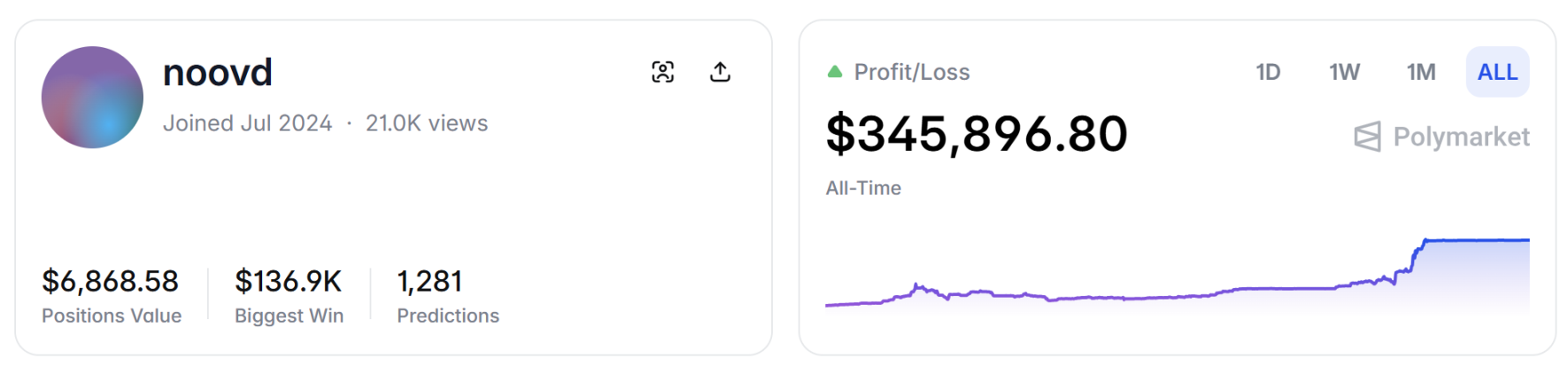

The official homepage shows that he entered the market in July 2024 and has already netted $345,000. This player has made a total of 1,281 predictions, with a maximum single win of $136,000, and currently holds a position of $6,877.

Looking at his profit curve, it was almost a flat line for the first few months, but starting from the end of 2025, it suddenly pulled up several nearly vertical steep slopes, each surge coming from the same source: the range of bets on how many tweets Elon Musk sends each week.

As the richest tycoon on Earth, Musk certainly has no motive to manipulate the market.

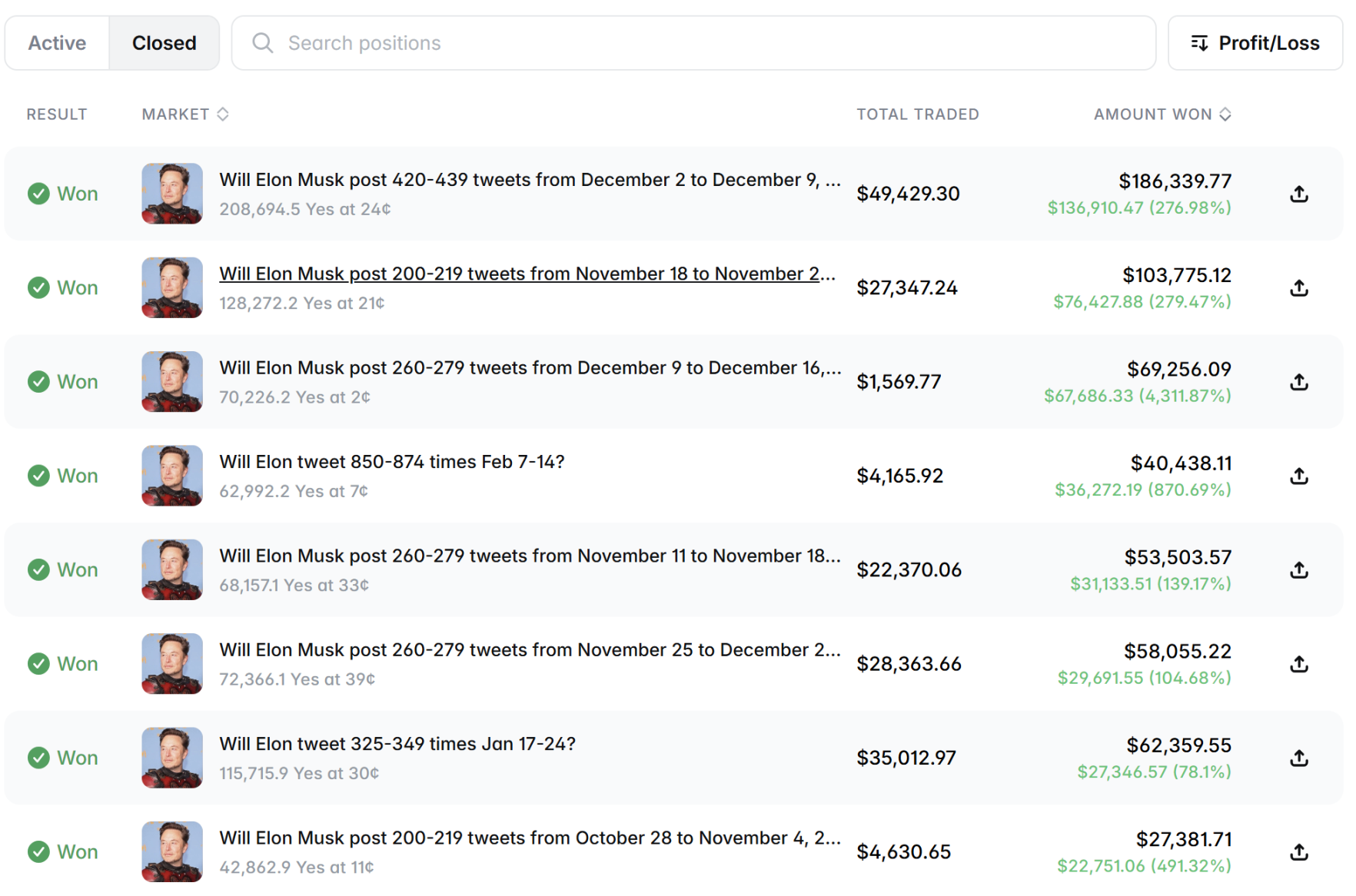

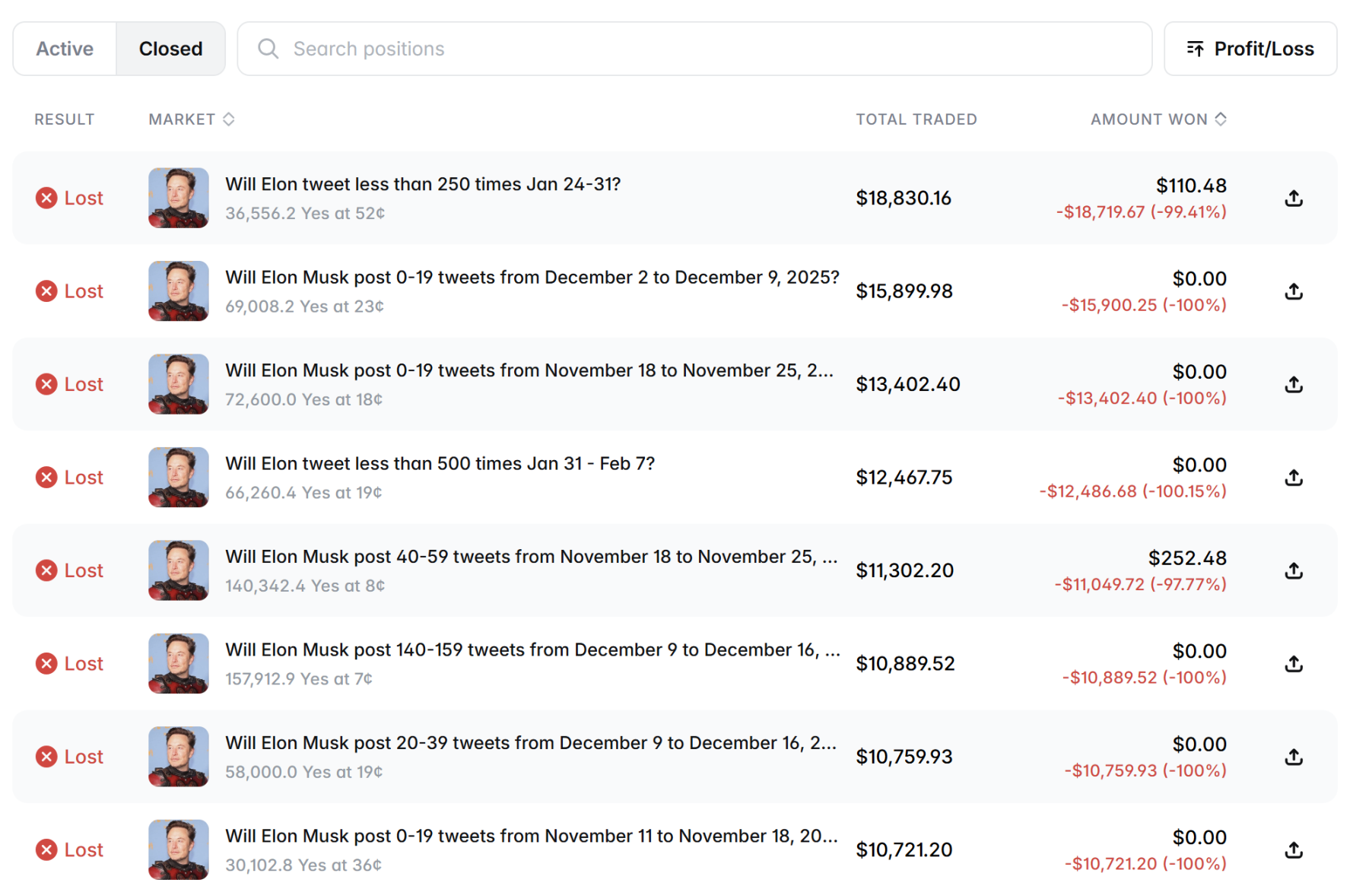

He does not guess NBA scores or bet on various political events, but has focused solely on this one track. Opening his settled records, the top eight profits are all from the question "Will Musk tweet X to Y times this week?" answered with Yes.

Polymarket dissects the number of Musk's tweets every week into dozens of mutually exclusive ranges, with each range spanning about 20 tweets—200-219 tweets, 220-239 tweets... up to 420-439 tweets, and even extreme ranges like 850-874 tweets. Retail investors see so many options and casually pick a middle range, buying a bit for 35-50 cents for psychological comfort. As for those edge ranges? Their prices often drop to 2-24 cents, even though the actual probability is clearly 15-30%.

noovd specializes in these undervalued bargains. He only buys Yes, never buys No, never sells early, and never diversifies for hedging. His bets range from $4,000 to $30,000, with an average entry price between 2-39 cents. Once his model has a clear signal, he bets everything and waits for Sunday settlement. His skill lies in possessing a real-time rhythm model that others cannot see. He does not rely on the vague idea that "Musk will feel like tweeting more this week," but feeds every day's tweet data since 2022 into his model, updating it daily.

Musk's posting habits from Monday to Friday, the weekend low points, Starlink launches, Tesla earnings reports, DOGE news, and new features from xAI—all these catalysts are quantified. By Wednesday or Thursday, he can accurately calculate how many tweets need to be sent each day for the remaining days to just hit a certain range of 20 tweets.

The market is still guessing with historical averages, but he has reduced the error to within plus or minus 10-15 tweets. If he notices that a 2-cent range has an actual probability of 18-25%, he directly goes in big. The expected value advantage of a single bet can often reach 8-20 times. A big win can wipe out many previous small losses and leave a massive profit.

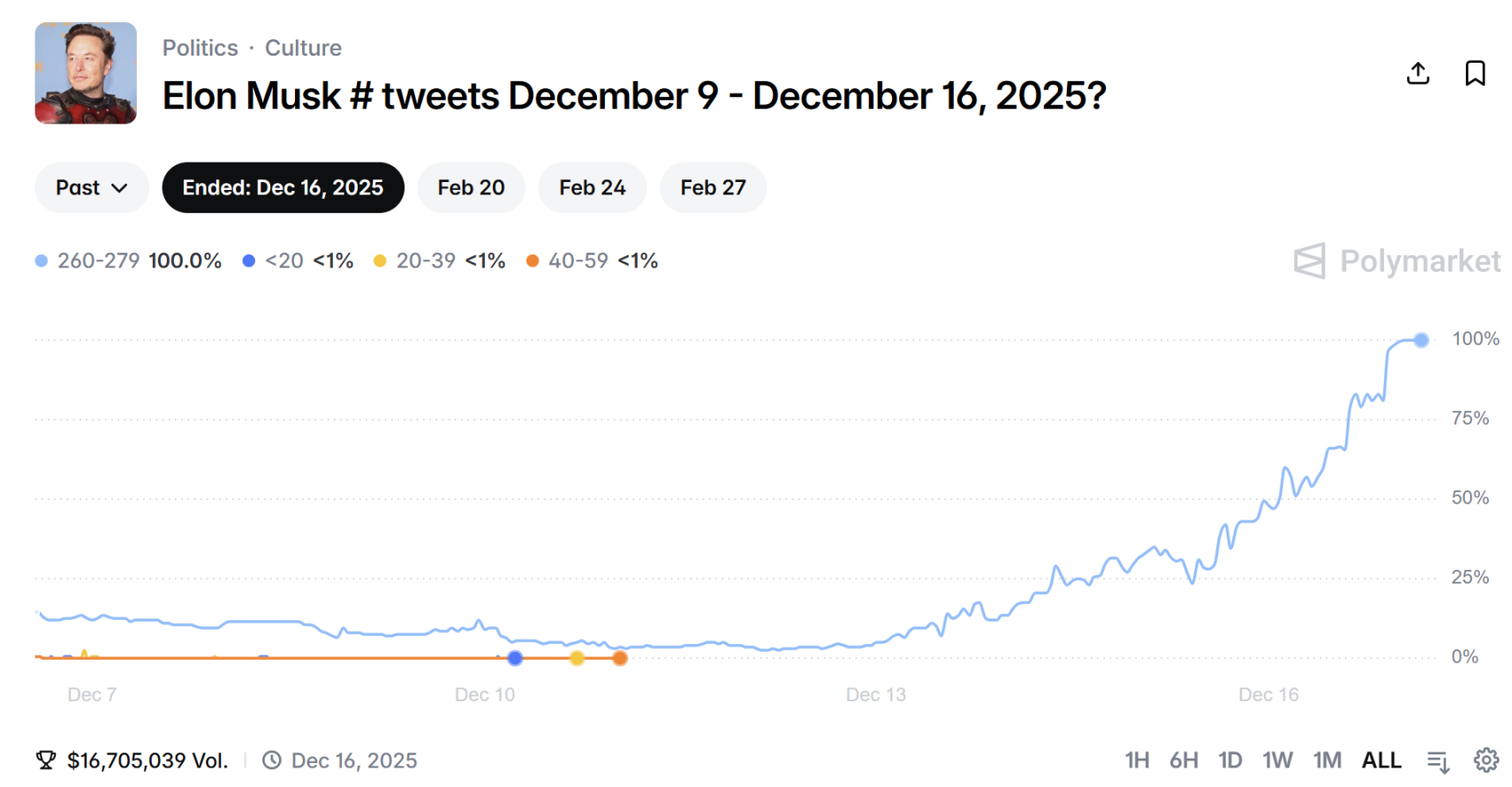

Taking the prediction for December 9-16, 2025, for instance, on Wednesday night, Musk had already tweeted more than 130 times, and for the remaining four days, he needed to maintain 32-35 tweets daily to fit precisely within the 260-279 range. There were no explosive news that week, but discussions about xAI and Tesla were ongoing. Yet the market offered this range at a very low price, as everyone thought it would either be a bland 180-220 or shoot straight to 400+.

noovd's model might have captured some pattern of Musk's "intermittent activity." The player bought in at an average price of 2 cents, invested about $1,569, and ultimately made a profit of $67,686.33, with a return rate of 4311.87%.

He entered when the odds were highly skewed, locking in this narrow profit range with a minimal cost. This is a typical approach to buying "deep out-of-the-money options," seizing tail opportunities in the probability distribution.

The previous case reached an astonishing 43 times in terms of return rate, while the next example became his largest profit bet.

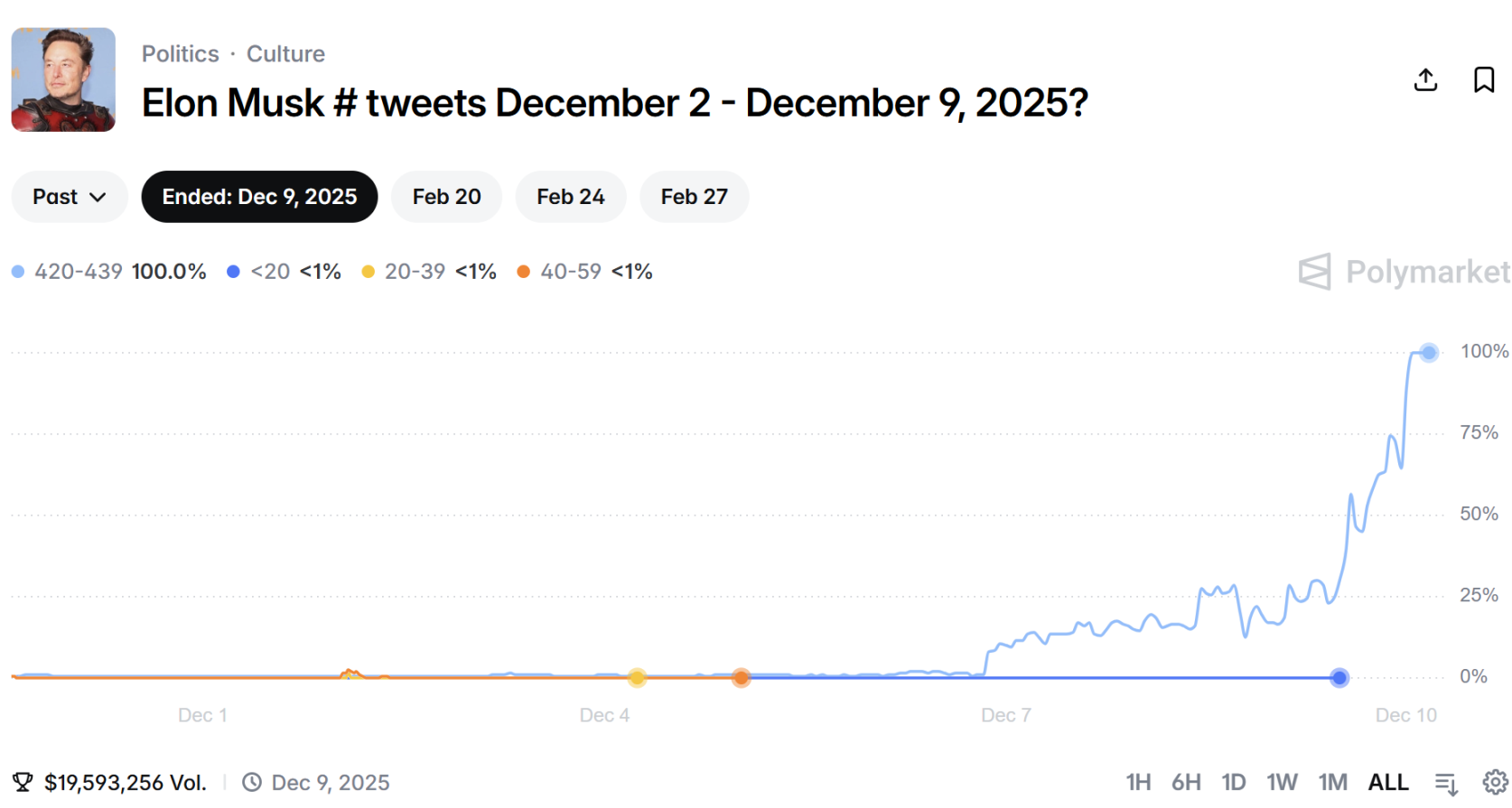

From December 2 to 9, did Musk tweet 420-439 times?

He bought in at an average price of 24 cents, heavily investing $49,429, and ultimately profited more than $130,000.

At that time, the number of Musk's tweets had already surged to over 180 on Tuesday, and in the following days, he had to maintain 65-70 tweets daily to firmly stay within the 420-439 range. There were lingering impacts from the elections and product preheating that week; the market offered it at 24 cents, but he identified that others were spreading their bets across the ranges 400-419, 420-439, and 440-459, with the middle one being the most probable landing zone. He directly bought all 208,694 shares, costing $49,000, and at settlement received $186,000—close to triple return. Just these two transactions in December accounted for over $255,000. The rest of the thousands of bets were mostly small stakes or auxiliary ranges in the same track, effectively greasing the machine continuously.

Why can this strategy continue to make profits, and nearly no one can replicate it?

First, the information threshold is too high. You need to crawl the timeline daily, ideally have a complete historical dataset, and also write a Poisson distribution model that refreshes every 6-12 hours. Ordinary people either can't crawl, or if they do, they are too lazy to adjust parameters. They can't get over the psychological hurdle. Ranges of 2 cents, 7 cents look like throwing money into water. Those who have never gone through 100 weeks without a withdrawal, or have never seen 100 settlements in person, simply dare not go in heavily. When you open his settled loss screenshots, you might breathe a sigh of relief; this player is not a 100% winning deity.

Second, the execution requirements are extreme. He only builds a large position when the advantage is greater than 10 times; small losses are considered tuition, while big wins are compounded to snowball. The key is that market inefficiencies continue to persist.

From noovd, ordinary people might genuinely learn that one should stop fantasizing about sweeping across all markets. First, find an extremely narrow and repeatable signal and thoroughly research it. Depth always beats breadth, as long as your advantage is real. Completely abandon feelings and let numbers and data do the talking. Making spreadsheets, crawling data, running regressions is a thousand times more reliable than relying on "a feeling that Musk is going to tweet a lot this week."

2 cents but with a real probability of 20% is far better than 50 cents with only a 5% advantage. Most people do the exact opposite. In a casino shouting for 100 times, the quietest but fiercest wealth was earned by counting tweets better than everyone else.

Now, predictions for Musk's tweet range are still being opened on time every week; the only issue is that very few can turn it into their own money printer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。