The world is bustling, all for profit; the world is bustling, all for benefits! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. Welcome to all cryptocurrency friends for your attention and likes, and reject any smoke screens in the market!

In the first article of the new year, I want to first thank everyone for their company. Lao Cui officially resumed work yesterday. Looking back, the overall trend is almost consistent with our predictions from before the New Year, and there has been no significant fluctuation around the New Year. However, looking at the trends over the past week, the bottom seems to have been established, and it is difficult to have a bottom-building market emerging again. But I still need to remind everyone that there has always been the possibility of sudden spikes in the cryptocurrency space, and it is likely that a liquidation trend could emerge before a breakout. Currently, various indicators show signs of the early stage of a bull market explosion. Although I have mentioned this multiple times and you might have developed an immune response, Lao Cui is a firm bull analyst for the 26-27 years timeframe, and it is very hard for me to change my mind to see the bearish trend in the short term. I must admit that the bearish trend established at the end of 25 was the beginning of a bear market phase. As long as there is a halving, the concept of a bear market must be established.

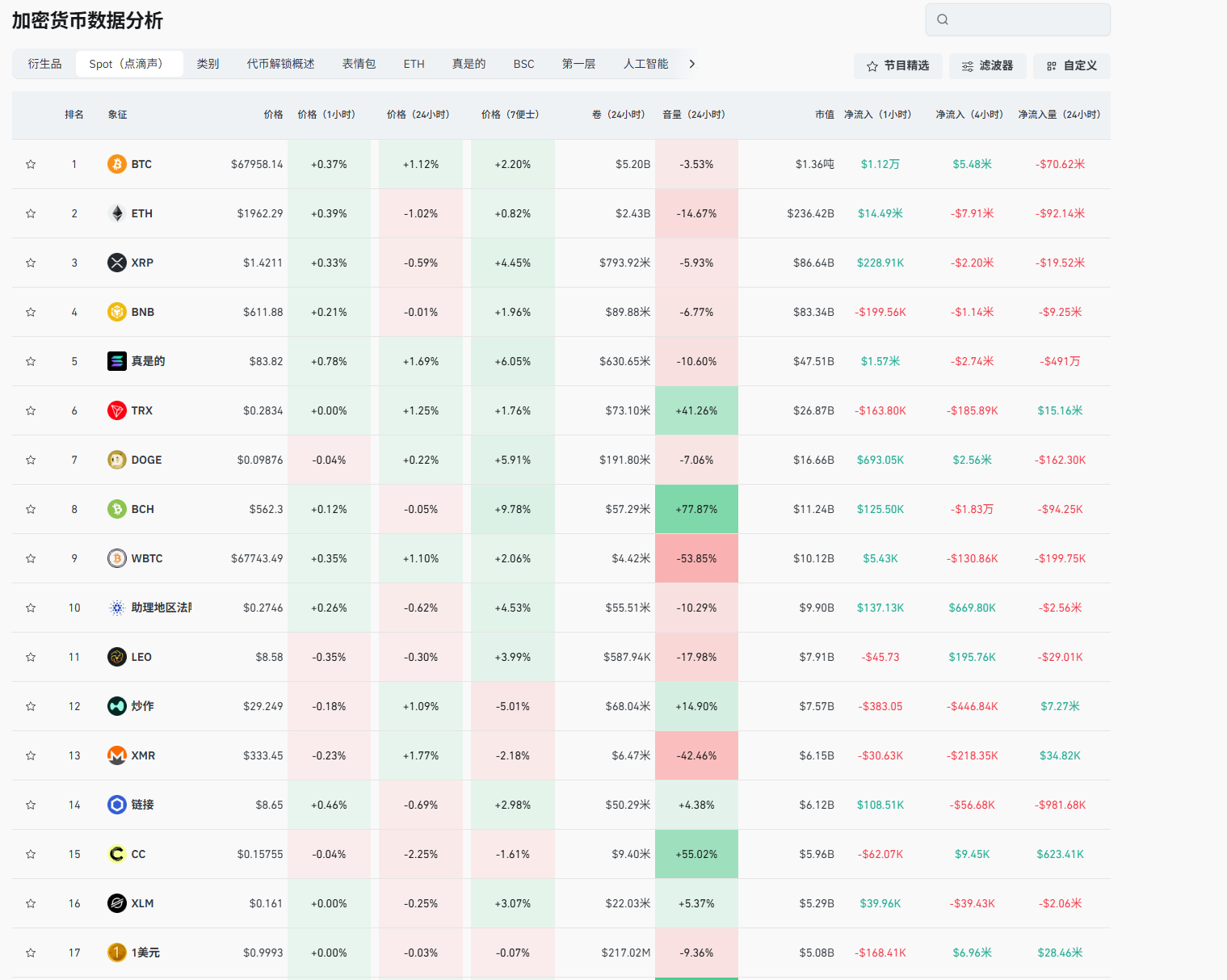

From the greed index, we can see that recent market panic has further intensified, with the fear & greed index and hoarding index showing extreme states simultaneously for the first time in a month: the fear and greed index reached a new low for the past month, currently reported at 7, categorized as "extreme fear"; the BTC-ahr999 hoarding index is at its lowest level in nearly a month, currently reported at 0.4278, having entered the bottom-buying zone. This data feedback indicates that if the market is again dominated by bears, retail exit will be an inevitable choice. Once retail investors are at the exit stage, the arrival of the bull market may explode in just a few months. Meanwhile, today’s article will provide you with a timeline of the months of growth in the bull market for your reference. During the break period, Lao Cui noticed important data from the U.S.: the number of initial jobless claims dropped to 206,000, which can be seen as preparing for no interest rate cuts in the first half of the year. For Bitcoin, it may see another upgrade, as the quantum security upgrade for Bitcoin may take 7 years to complete.

From these two bits of news, we can almost conclude that the short-term rebound strength will be within a controllable range. At the same time, the security of Bitcoin will be under maintenance, and this maintenance requires a large number of professional teams. To achieve maintenance upgrades, Bitcoin's volatility will certainly be enormous, which is a typical mismatch with traditional finance. One thing everyone needs to be clear about is that maintenance incurs costs, and the essence of human nature is that profits must exceed the maintenance itself; perhaps it needs to multiply many times for people to be willing to engage in this endeavor. And where does their profit come from? It certainly comes from retail spending. If one wants to extract a certain profit from retail investors, it can only be substituted with huge price fluctuations. The very survival of the cryptocurrency space hinges on words; this market lacks regulation and any established rules, which is why the profits of the giants can be infinitely magnified, as one can see some issues from last year’s fluctuations.

Over ten trillion in market value evaporated, while the participants are fewer than ten teams. The top three platforms, BlackRock, MicroStrategy, and even Grayscale, can all be included. Even when averaged, in just half a year, profits reached over a trillion. This is something that cannot be rivaled in any market; as long as liquidity is sufficient and the cake is large enough, the market will continue to exist until retail investors awaken. The concept of the cryptocurrency space is enough to support its price movement; at least this concept will not collapse in the short term of two to three years. The UAE announced it holds $63 million worth of Bitcoin; the involvement of countries with a certain economic strength, such signals will bring tremendous momentum when the bull market arrives. Yet everyone has already been blinded by the short-term downturn; human nature is such that during a plunge, it is hard to maintain strong confidence in bullish prospects. The only thing you need to worry about is the war situation.

Lao Cui's recent focus has also been on many news stories regarding the U.S. and Iran. According to the latest predictions, the probability of local conflicts in March has exceeded 60%. After discussing with many friends, the perspective on whether the war situation is bullish or bearish is somewhat contentious. Iran is unlike other countries, being a holder of cryptocurrency itself, and both countries' holdings both constitute a significant portion. There are too many uncontrollable factors; when war approaches, one still needs to mitigate risks. In fact, this is not limited to the cryptocurrency aspect but includes gold and even U.S. stocks; right now, the funding gap is quite large. The issues they currently need to consider are not whether they can continue to grow. More will use actual actions to answer whether they are really worth their current price levels. Lao Cui needs to remind everyone that at this stage, all financial attribute products have a bubble that is hard to estimate, standing at historically high levels. Historically, whenever a market reaches a historical high, it often goes hand in hand with a historical level of correction. If you want to engage with such assets, you must think twice before acting.

Regarding the correction, Lao Cui's prediction at the beginning of 25 was that the correction should start at the beginning of 26, but it began to enter a bear market as interest rates were cut; the factors involved are more man-made than natural. Based on this definition, Lao Cui still views it as a premature bear market. The deep correction from the end of 25 to the beginning of 26 merely arrived ahead of time, not marking the end of the bull market. This definition is also based on traditional financial practices. In traditional finance, a bear market's arrival does not only manifest as an expanded decline, but also lasts for many years on the timeline. Shortest it would last 2-3 years, and longest it may extend to 5-10 years, while the cryptocurrency space only takes about half a year. This cycle definition hinges critically on the amount of capital; compared to gold and U.S. stock markets, the amount of capital in the cryptocurrency space is negligible, hence the huge volatility and frequent turnover by the major players. Especially in the staking system, it will also allow platform parties to obtain enough chips to crash the market and then hold them back again at the bottom. This mechanism problem is also unavoidable; the major player will always need to earn a corresponding wealth to drive the market growth.

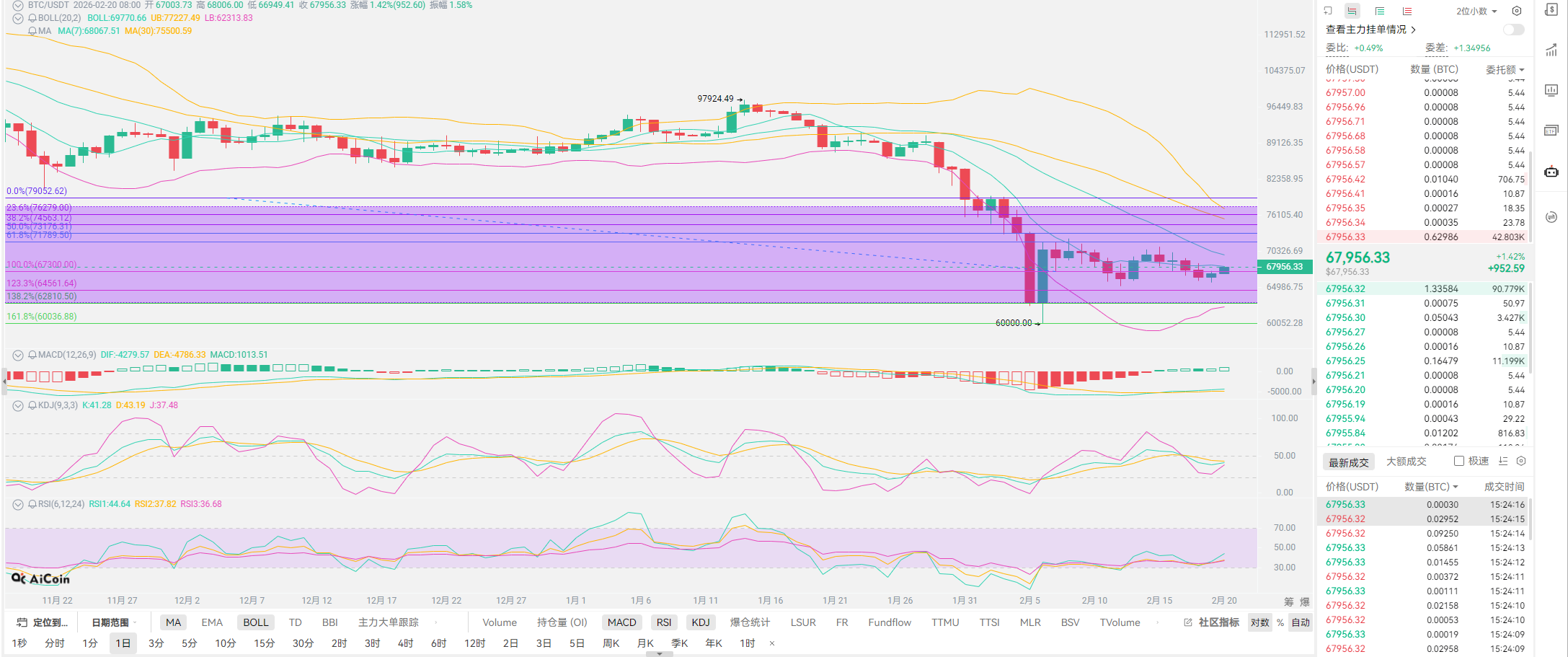

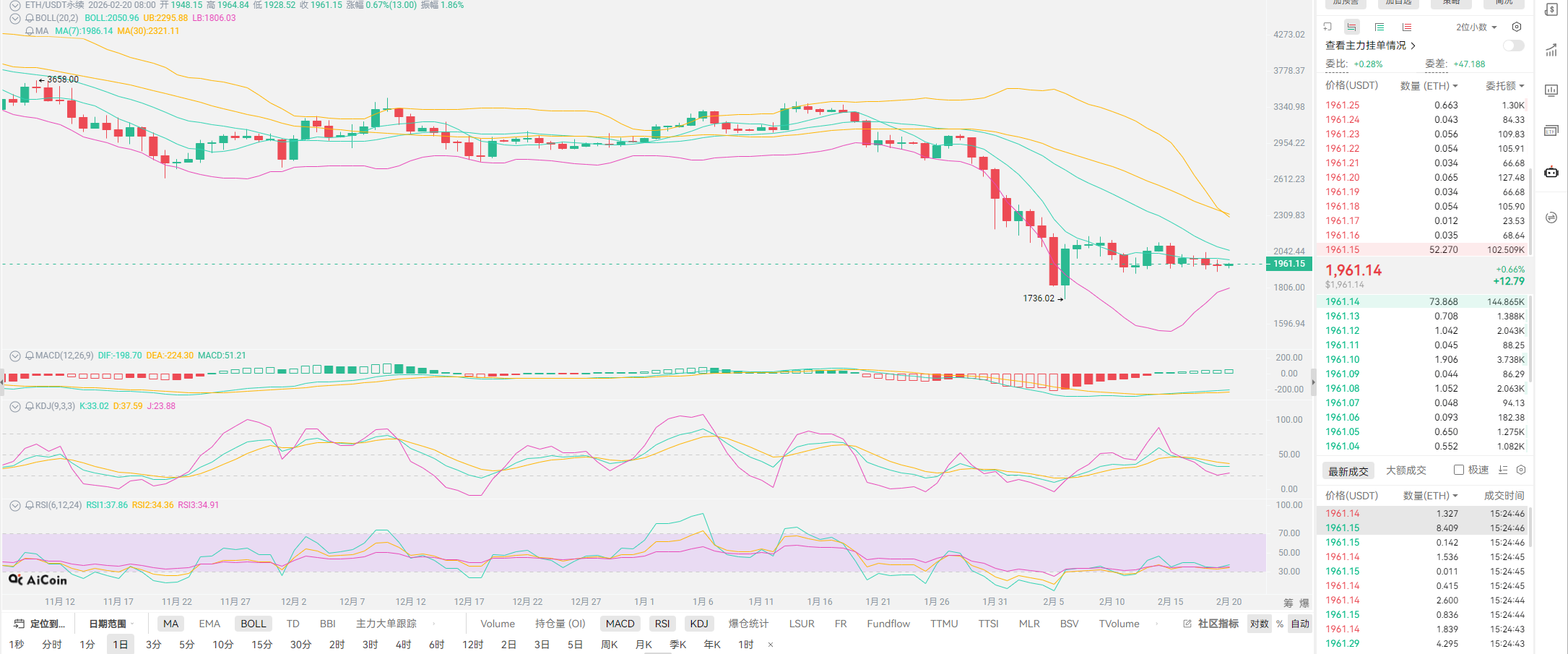

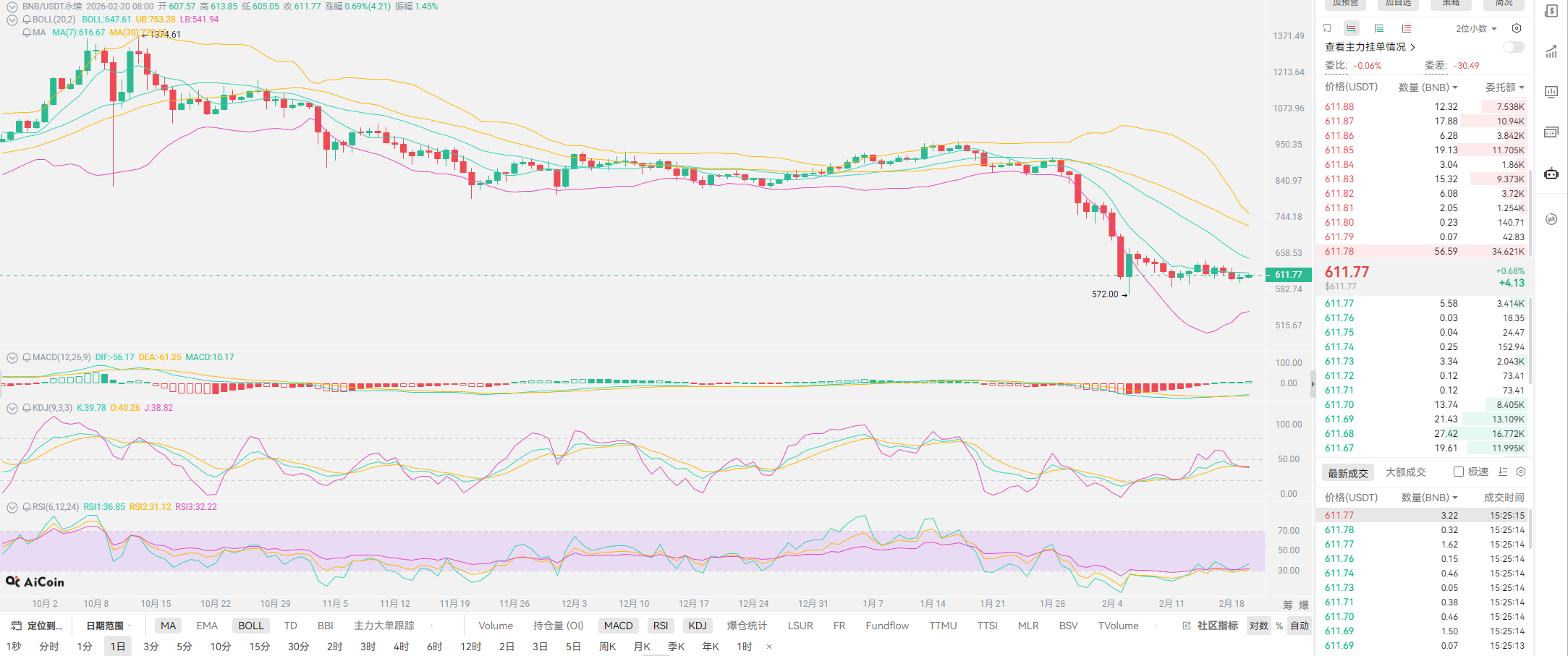

Lao Cui summarizes: Regarding the reversal signals in the cryptocurrency space, after analyzing the market, I have found a clue. The major trend reversal will likely occur around June or July, and there will be another surge towards the end of December. However, before June, the only new lows can be triggered by military factors or significant news events; as long as there are no impacts from these two areas, it is highly likely that the movement will be similar to that of 24, showing a trend of oscillation upwards. Everyone needs to remember that although there are no new lows, the corrections above the new lows will occur repeatedly. Currently, there will not be much growth space for the cryptocurrency space; military conflicts will always hang like the Sword of Damocles over crypto assets. The upper limit is fixed, and so is the lower limit, and there is still room for decline. The U.S. side will definitely have funds involved to buy at the bottom, so Lao Cui defines this as after the spikes, a more intense rebound signal will follow. I have previously explained this kind of oscillation market; you just need to find the right support and pressure to profit. At the end of the article, as the Year of the Horse approaches, I wish everyone continued profit, Happy New Year, and that cryptocurrency assets will multiply. If anyone still has questions, you can directly communicate with Lao Cui. Everyone must also learn to read charts!

Original creation by WeChat Account: Lao Cui Talks About Currency. If you need help, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can foresee five moves, seven moves, or even ten or more moves. The less skilled player can only see two or three moves. The master considers the overall situation, strategizes the dynamics, does not focus on one piece or one space, but aims to win the game ultimately; the less skilled player will fight for every inch, often converting positions back and forth, only contending for immediate short lines, ending up frequently trapped.

This material is for learning reference only and does not constitute trading advice; trading on this basis is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。