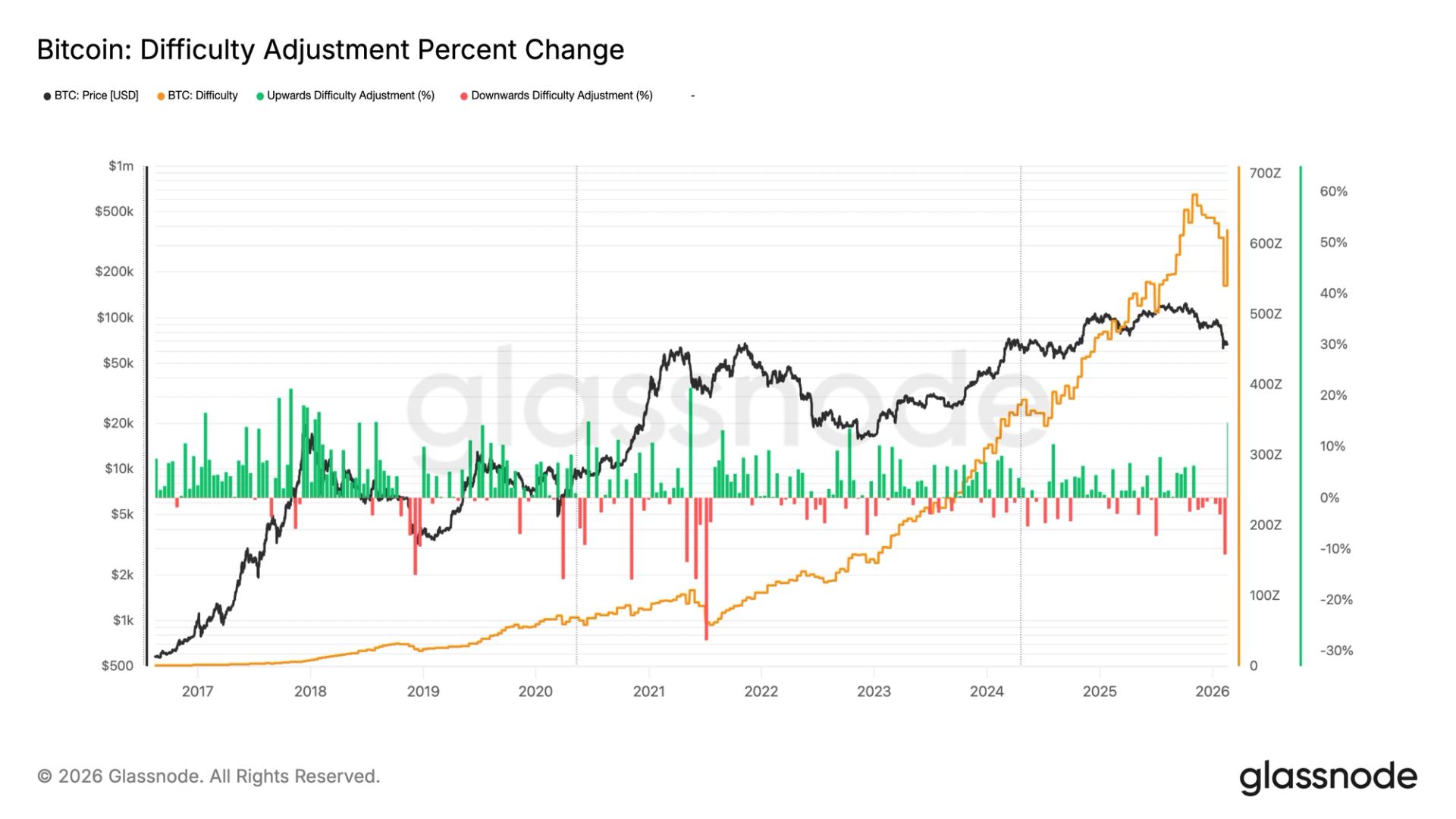

What to know : Bitcoin mining difficulty rose to 144.4T, jumped 15%, the biggest percentage increase since 2021. Hashrate has recovered to 1 ZH/s from 826 EH/s, even as hashprice sits at multi year lows around $23.9 per PH/s.

Bitcoin mining difficulty has climbed to 144.4 trillion (T), up 15%, the largest percentage increase since 2021, when the China mining ban led to a major disruption, which followed a 22% upward adjustment as the network stabilized.

Difficulty adjustments measure how hard it is to mine a new block on the network. It recalibrates every 2,016 blocks, roughly every two weeks, to ensure blocks continue to be produced about every 10 minutes, regardless of changes in the hashrate.

The adjustment follows a 12% decline in difficulty after a drop in the bitcoin hashrate, which is the total computational power securing the network. Mining activity suffered its sharpest setback since late 2021 after a severe winter storm in the United States forced several major operators to scale back operations.

In October, when bitcoin reached an all-time high of around $126,500, the hashrate also peaked at 1.1 zettahash per second (ZH/s). As prices fell to as low as $60,000 in February, the hashrate dropped to 826 exahash per second (EH/s). Since then, the hashrate has recovered to 1 ZH/s while the price has rebounded to around $67,000.

At the same time, hashprice, the estimated daily revenue miners earn per unit of hashrate, remains at multi-year lows ($23.9 PH/s), squeezing profitability.

Despite this profitability pressure, large-scale operators with access to low-cost energy continue to mine aggressively. The United Arab Emirates, for example, is sitting on roughly $344 million in unrealized profit from its mining operations.

Well-capitalized entities that can mine efficiently are helping keep the hashrate elevated and resilient, even amid subdued bitcoin prices.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。