Stripe and PayPal are shifting from payment tools to AI business infrastructure, competing to become the default engine for AI transactions.

Original title: AI: PayPal's $200M Wake-Up Call in AI Commerce

Original author: LUKE SPILL, FintechBlueprint

Translation: Peggy, BlockBeats

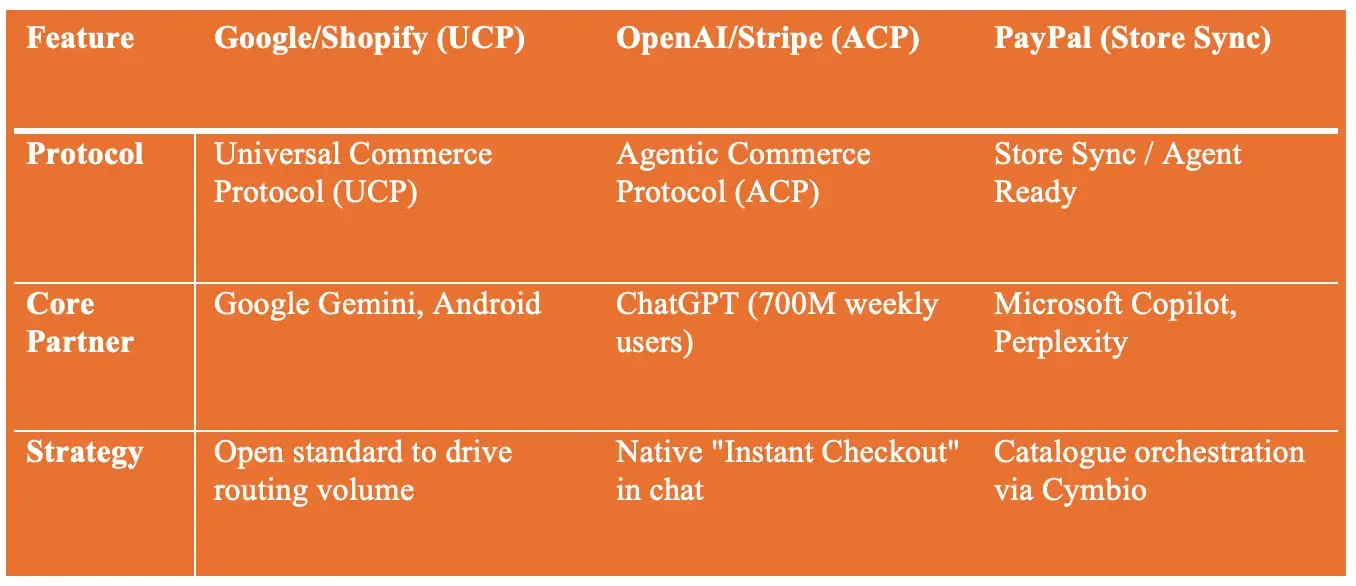

Editor's note: As AI agents begin to replace humans in product discovery, decision-making, and ordering, the traditional e-commerce funnel is being rapidly compressed, and payment is no longer the endpoint of a transaction, but part of an embedded infrastructure. This article uses PayPal's acquisition of Cymbio as a starting point to outline the new competitive landscape emerging from the rise of Agentic Commerce: Google and Shopify are trying to control the routing layer with UCP, OpenAI and Stripe are seizing the agency execution layer through ACP, while PayPal is working hard to transition from a "payment button" to a key player in the "business workflow."

For fintech companies like PayPal and Stripe, whether they can embed themselves in the underlying protocols of AI commerce will determine whether they can continue to sit at the table; for banks and the crypto industry, the window of opportunity is equally short.

Here is the original text:

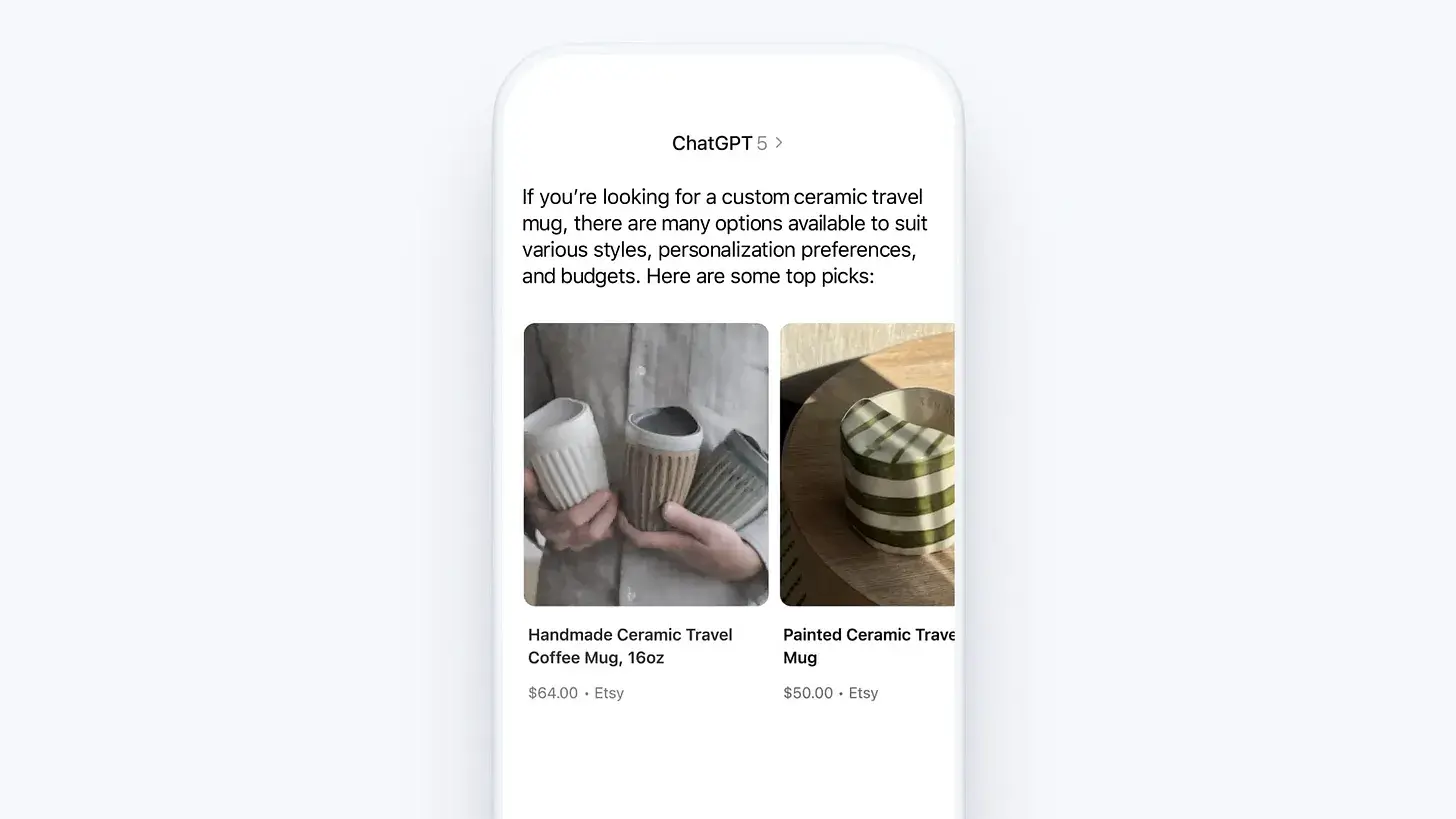

Last week, PayPal acquired Cymbio, a platform that helps merchants sell across various AI interfaces, including Microsoft Copilot and Perplexity. Market insiders estimate the transaction is worth between $150 million and $200 million. It is widely believed that this is a critical strategic move by PayPal to remain competitive in the field of Agentic Commerce.

As a result, with AI agents continuously compressing and reconstructing the traditional e-commerce funnel, PayPal is transitioning from a typical Web2 payment tool to more upstream and core commercial processes like product discovery, product catalog distribution, and order orchestration. This shift nearly completely corroborates our analysis in January regarding exponential growth, power law effects, and increasing returns to scale in Agentic Commerce.

Meanwhile, the industry infrastructure is rapidly taking shape:

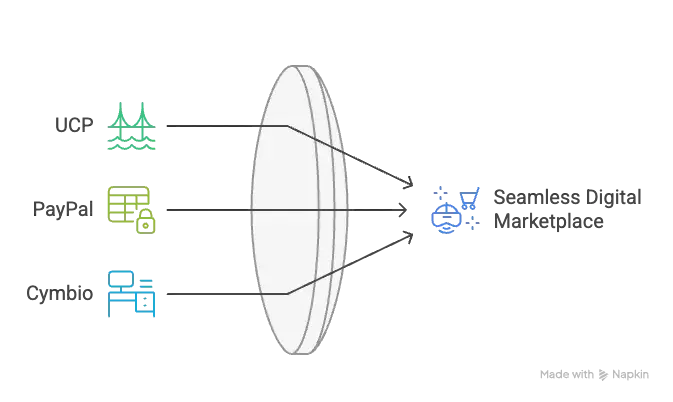

Google and Shopify are promoting the Universal Commerce Protocol (UCP);

OpenAI and Stripe are jointly advancing the Agentic Commerce Protocol (ACP);

Microsoft is embedding settlement capabilities directly into Copilot.

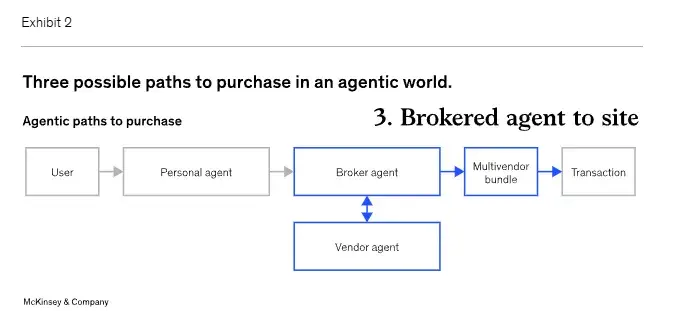

The shopping infrastructure centered around "machines" rather than "human users" is being rewritten at an unprecedented speed. Agentic Commerce is fulfilling the expectations of exponential growth in real-world ways. The forecasts given by various parties are both astonishing and increasingly converging:

McKinsey predicts that by the end of this decade, Agentic Commerce is expected to generate $1 trillion in revenue in the U.S. retail market, accounting for about one-third of all online retail sales.

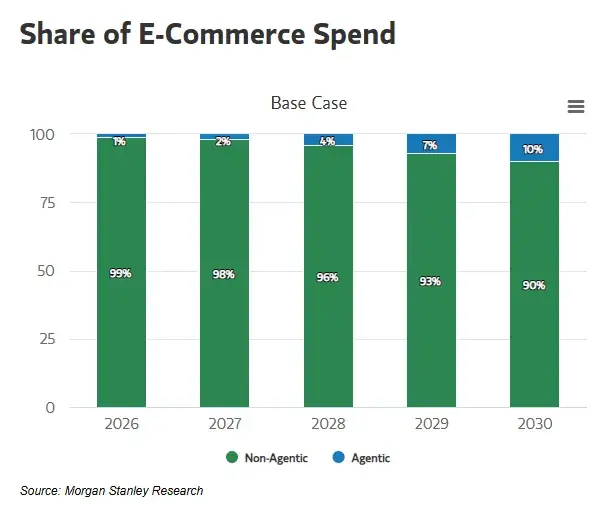

Morgan Stanley predicts that by 2030, Agentic Commerce will drive U.S. e-commerce spending to $190 billion to $385 billion, corresponding to a 10%-20% market penetration rate.

Bain predicts that by 2030, the market size of Agentic Commerce will reach $300 billion to $500 billion, accounting for 15%-25% of total online retail sales.

Existing adoption data indicates that we are at the inflection point of an exponential growth curve: by November 2025, 23% of American consumers will have completed a purchase using AI.

Cymbio may become PayPal's "middle layer" in AI commerce

For PayPal, the potential positioning of Cymbio is as a middle infrastructure layer within the AI commerce ecosystem. Its core value propositions include:

Synchronizing product catalogs across different markets and channels

Real-time management of inventory availability

Routing orders to merchants' existing OMS (Order Management System) and fulfillment systems

Allowing merchants to continue to act as the legal entity for the transaction (Merchant of Record)

Among them, the Store Sync product enables merchants' product catalogs to be directly discovered by AI agents like Microsoft Copilot and Perplexity, with plans to also integrate with ChatGPT and Google Gemini in the next step.

The reason AI agents can complete transactions is that product data, prices, inventory, and fulfillment information must be machine-readable and highly reliable.

From 'Checkout' to 'Agentic Commerce Workflow'

PayPal processes over $1.7 trillion in payments each year, with over 142 million monthly active accounts. In the traditional model, PayPal's core leverage point is at the moment payment occurs.

In the Agentic Commerce system, however, the AI system can complete product discovery, option comparison, and even place orders on behalf of users, while PayPal handles identity verification and payment authorization.

After integrating Cymbio, PayPal covers the complete link:

Discovery: Products are recommended and presented within AI agents

Decisioning: Continuously narrowing down options through conversational interactions

Checkout: Identity verification and payment completed by PayPal

Fulfillment: Orders are directly injected into the merchant systems for execution

The Protocol War: Service vs Standard

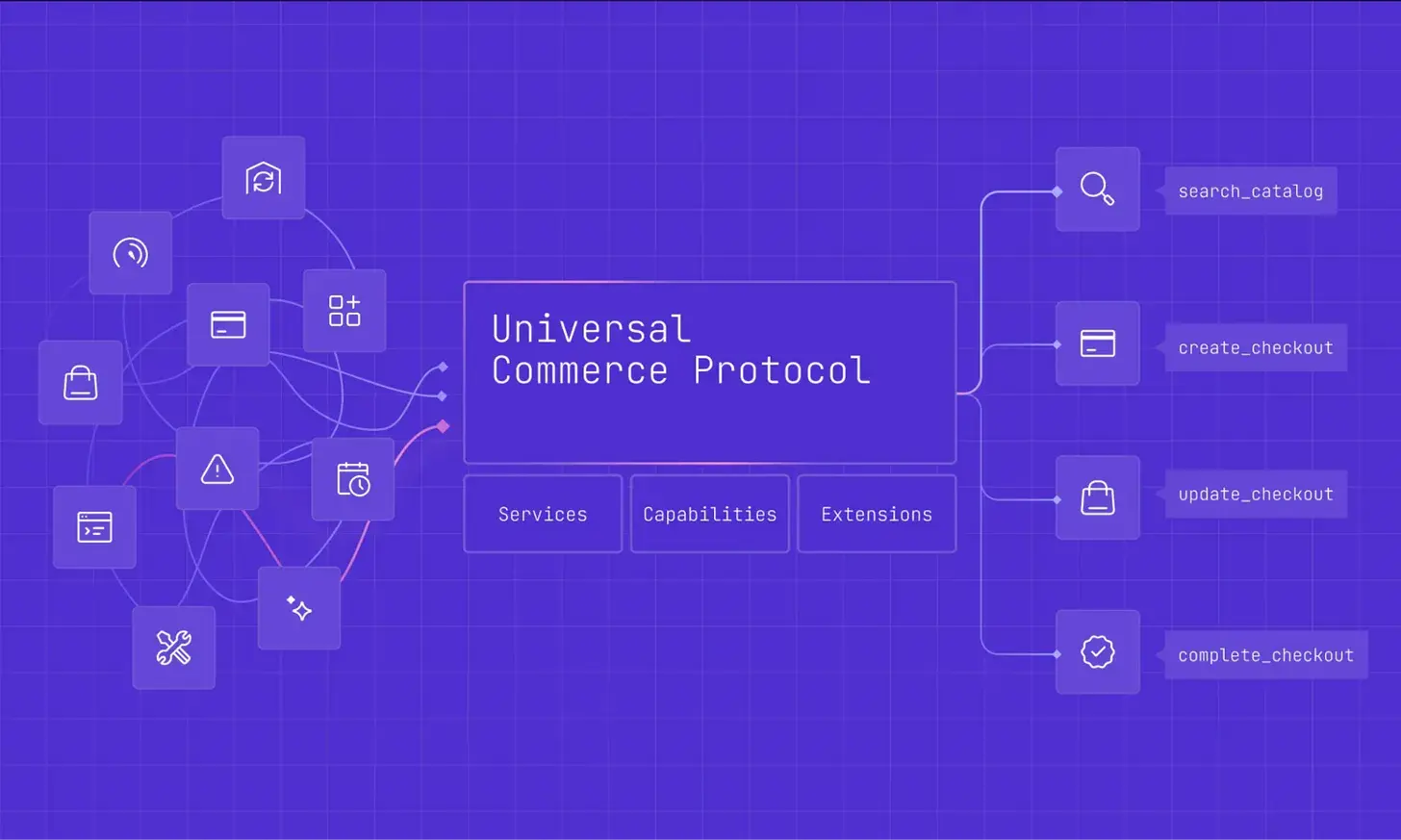

As PayPal promotes Agentic Commerce in the form of "products and services," Google and Shopify are building a cross-functional, standardized Agentic Commerce protocol system.

The key points are:

Google is embedding UCP (Universal Commerce Protocol) directly into search and Gemini

Shopify ensures that its millions of merchants only need to integrate once to reach multiple AI agents

This means that the underlying infrastructure of AI commerce is evolving from "single-point capabilities" to "protocolized networks."

The goal of UCP is to control the "routing layer" of AI commerce, not to directly own or operate the commerce itself.

This resembles a defensive layout: by making this layer a "free" public protocol and introducing strong network effects, it prevents any single competitor from monopolizing the core control of the AI commerce ecosystem.

Therefore, PayPal is not in direct competition with UCP; rather, it is actively embedding itself within this system.

Google has clearly stated that the checkout capabilities based on UCP will support multiple payment service providers, including PayPal and Google Pay.

In other words, UCP aims to be a "neutral highway," while PayPal hopes to become an indispensable toll station and payment point on this highway.

OpenAI and Stripe are major competitors in this field.

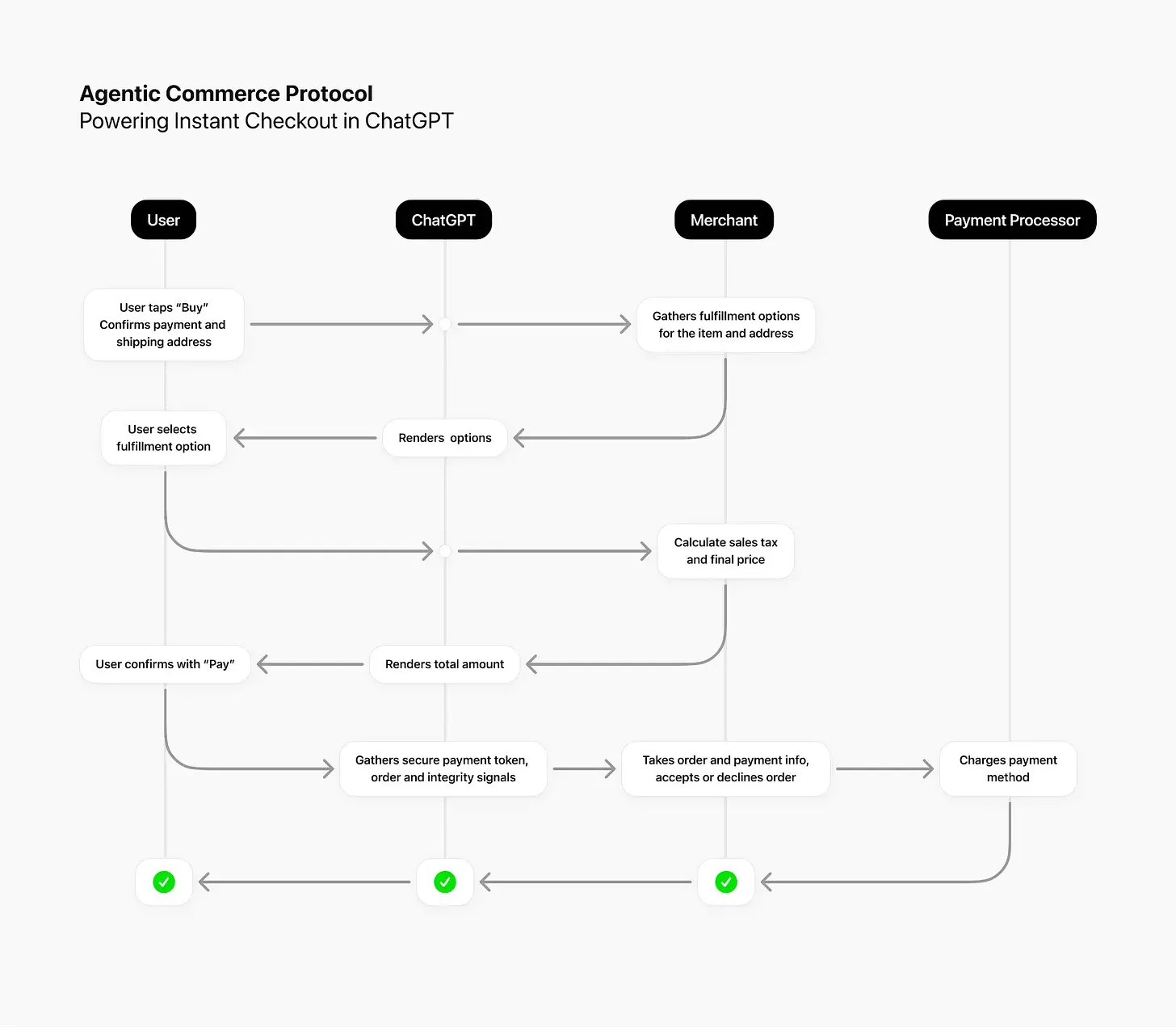

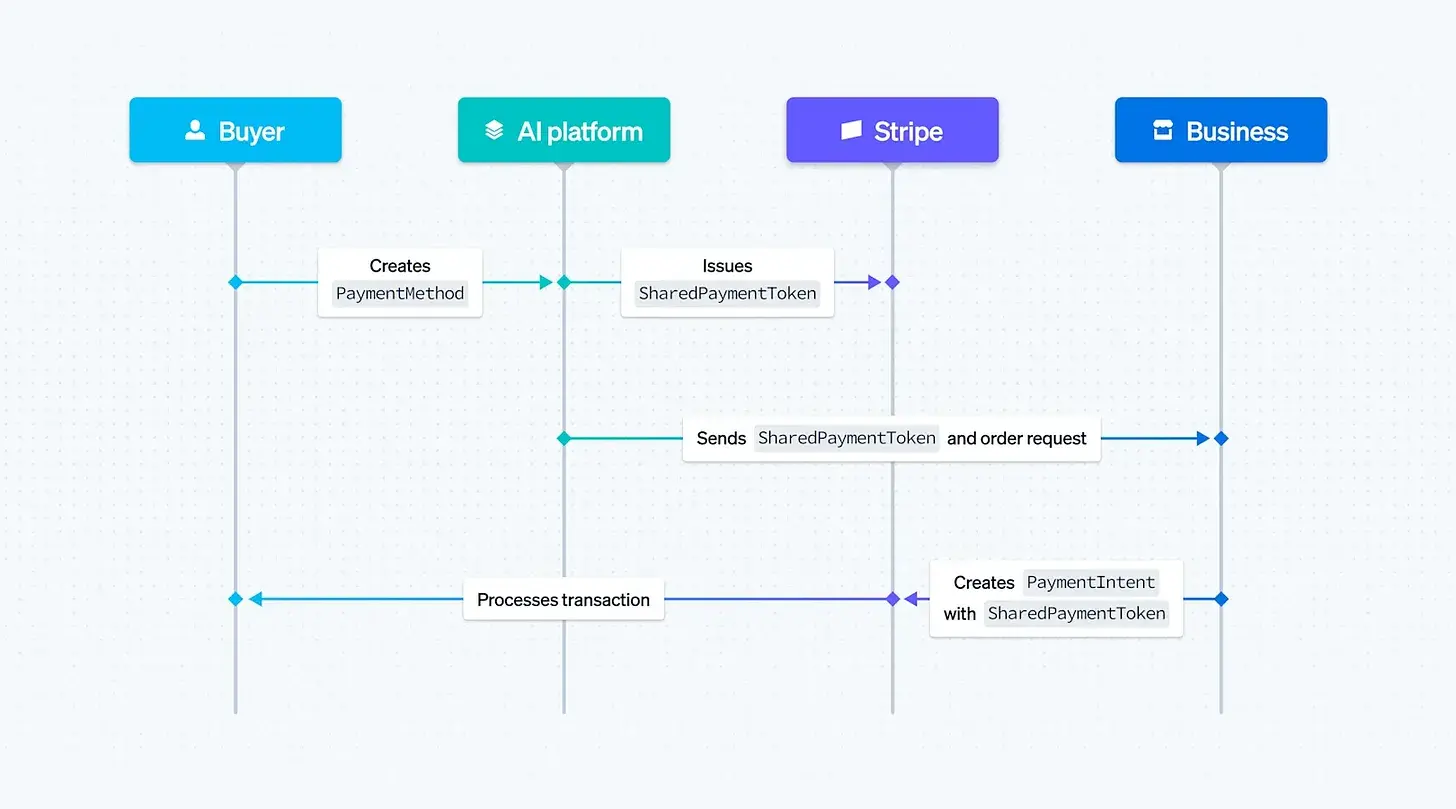

As early as September, Stripe and OpenAI announced the launch of Instant Checkout in ChatGPT, which is supported by the Agentic Commerce Protocol (ACP).

ACP allows AI agents to proactively initiate purchase requests through a structured API, with Stripe issuing shared payment tokens to enable payment confirmation under agency authorization. This allows AI, after obtaining authorization, to complete the entire transaction process from ordering to payment on behalf of users.

Stripe then launched the Agentic Commerce Suite in December 2025, allowing merchants to:

Publish product catalogs for direct access by AI agents

Independently choose which AI agents to sell through

Process payments, risk control, and dispute handling through Stripe

Return order events to existing business systems

Stripe processed over $1 trillion in payments in 2024, serving millions of businesses worldwide. Its competitive strategy is very clear: to become the "default wallet" and "action execution layer" for AI agents—similar to its path of becoming the default payment API for internet businesses.

In this context, PayPal and Stripe are clearly in direct confrontation:

What they are competing for is not just payment itself, but the key control point when AI agents actually "execute transactions."

Comparing the three systems together

This is typically where a horizontal comparison of UCP / ACP / PayPal + Cymbio would occur:

Who controls the routing layer, who controls the protocol, who controls payment and fulfillment execution—along with the sources of each of their respective network effects.

If you would like, I can help you organize the next section into a comparison table or a highly concise "landscape assessment," clearly stating the divisions and competitions among the three parties at once.

Key Takeaways

Three points stand out:

Business actions will become conversational and executable by agents

Purchasing will no longer be a process completed step-by-step by users, but rather understood by AI in conversations and completed on authorization's behalf.

Merchants "integrate once and distribute"

Merchants no longer need to adapt individually for each platform; they only need to complete one integration, and products can reach users through multiple AI agents and channels.

Payment will become embedded infrastructure, no longer the endpoint of transactions

Payment is no longer the "last step button," but a fundamental capability deeply embedded in the discovery, decision-making, and fulfillment processes.

The payment network's preemptive response

By the way, Mastercard announced in January 2026 that it is researching "AI business rules," essentially trying to get ahead and participate in defining the governance framework during this transformation.

Payment networks clearly realize that the rights to establish rules and standards will determine their future position before AI agents complete transactions on a large scale.

As we pointed out in our analysis from January, banks, fintech companies, and the crypto industry must ensure they are "sitting at the table," rather than being included afterward.

If financial institutions cannot embed themselves in these platforms in advance, their financial functions may ultimately be internalized by Big Tech.

The situations and choices of different camps

For Banks

Traditional banks lack the technical infrastructure to compete directly with Google, OpenAI, or Microsoft at the level of Agentic Commerce. However, they still hold three key resources: payment clearing channels, customer credit relationships, and compliance and regulatory experience.

These assets ensure that banks will not disappear, but they must reposition themselves.

For Fintechs

Companies like PayPal, Stripe, and Adyen realized early on that simply focusing on payments is no longer sufficient to secure a long-term position.

Therefore, they are proactively moving upstream into areas like commerce orchestration, merchant services, and the infrastructure layer for the AI era.

For Crypto

So far, the publicly announced Agentic Commerce protocol system is almost entirely based on traditional financial pathways, with credit cards, Google Pay, PayPal, Stripe, etc., occupying core positions.

In UCP, ACP, and Store Sync, cryptocurrencies and stablecoins are essentially absent, except for a few scattered experiments involving Stripe or Coinbase.

Whether this is a significant strategic oversight or an intentional exclusion remains to be seen.

For crypto companies, the opportunity window is very clear: if they can build payment tracks that natively adapt to AI agents (instant settlement, programmable currency, globally reachable) and successfully embed into AI platforms before the protocols are fully solidified, they may achieve a leapfrog over traditional finance; conversely, they may be permanently excluded from the ecosystem.

Conclusion

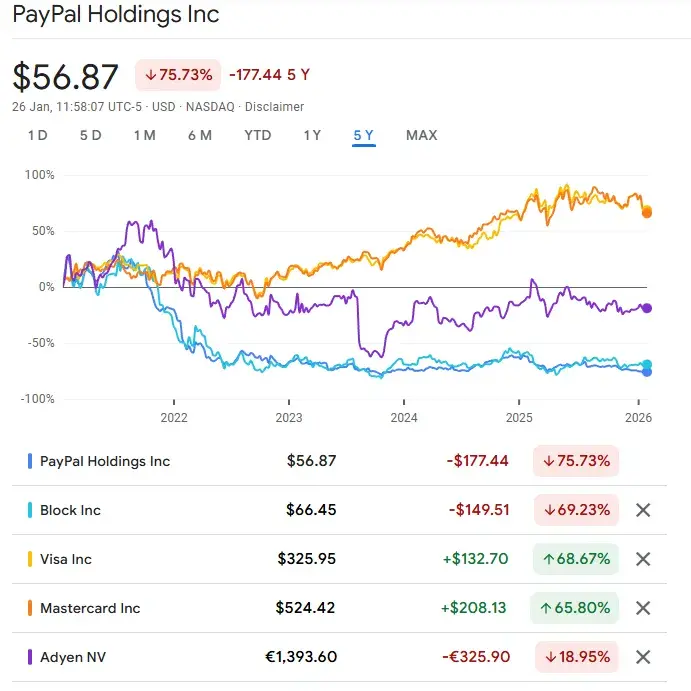

Fundamentally, PayPal is striving to catch up with Stripe and adapt to rapidly changing consumer behaviors.

As people increasingly make daily life decisions through AI platforms, these platforms will gradually evolve into brands' "default virtual storefronts."

Whoever can embed themselves in the infrastructure behind these storefronts will remain at the table.

PayPal's stock price has been sluggish for some time, down about 37% from its 52-week high. Investors continue to question whether the company still maintains structural relevance in the long term, and the rise of the Crypto + AI narrative has only intensified these concerns.

In this context, the diversified layout surrounding Agentic Commerce is not an aggressive choice, but a "necessary cost" to maintain relevance. For PayPal, this is not an extra benefit but an entry fee that must be paid: only by completing this transition can it hope to remain at the core of next-generation business infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。