Jane Street Built a $1B Position in Blackrock’s IBIT — A Closer Look

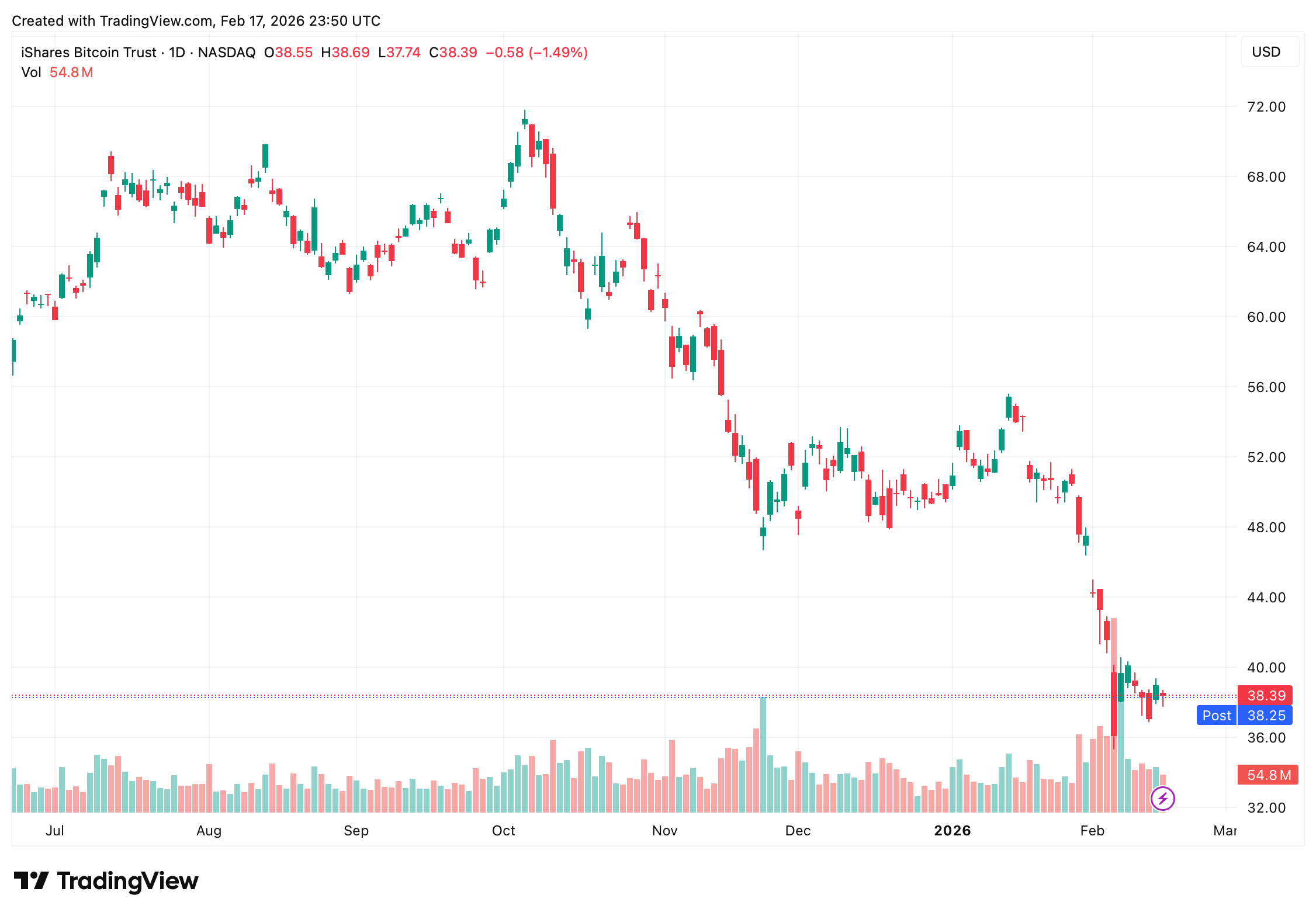

The disclosure comes from the firm’s Form 13F-HR for the period ending Dec. 31, 2025, offering a snapshot of institutional positioning as bitcoin closed out a volatile year. Based on IBIT’s Dec. 31 closing price of $49.65 per share, Jane Street’s total stake was worth approximately $1.01 billion at the end of the quarter.

By mid-February 2026, however, IBIT traded near $38.39, trimming the estimated value of the position to roughly $790 million. The shift reflects the broader pullback in bitcoin’s price, which slid from late-2025 highs to around $70,400 in recent weeks.

Founded in 2000 and headquartered in New York, Jane Street Group is a global proprietary trading firm specializing in quantitative strategies and market making. The firm trades across more than 200 venues in 45 countries and provides liquidity in equities, fixed income, exchange-traded funds (ETFs), options, and digital assets.

Quants treat markets like a giant video‑game scoreboard: every tick, every volume spike, every correlation is just another stat to leverage. Jane Street is widely known for its mathematical rigor and technology-driven approach, employing thousands of traders, researchers, and engineers.

Though private and discreet, it has become one of Wall Street’s most profitable trading firms, frequently acting as a liquidity provider during periods of market stress. IBIT, launched in early 2024, is one of the leading U.S. spot bitcoin ETFs. The fund holds bitcoin directly and allows investors to gain exposure to price movements without managing private keys or crypto custody.

Jane Street serves as an authorized participant for IBIT. In that role, it can create or redeem ETF shares directly with Blackrock in exchange for underlying bitcoin. This structure allows authorized participants to arbitrage price discrepancies between the ETF and its net asset value, helping keep share prices closely aligned with the underlying asset.

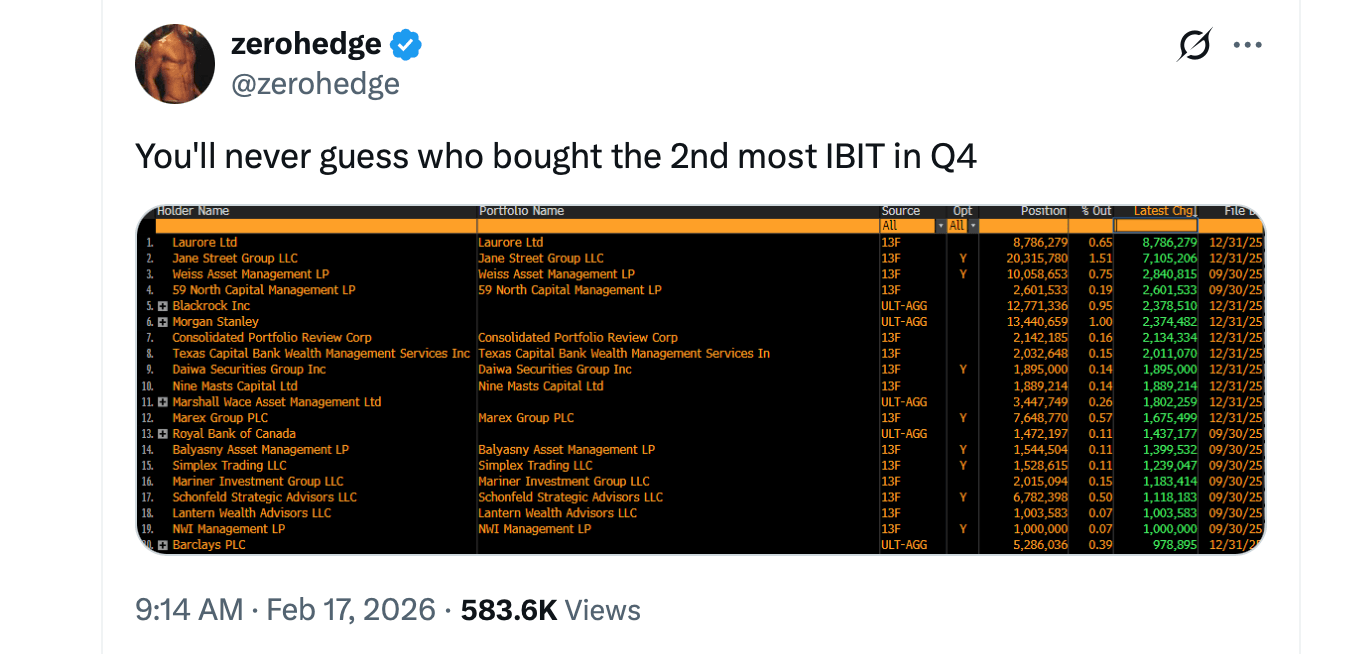

The 7.1 million-share addition represented one of the largest institutional inflows into IBIT during Q4 2025. The newly acquired shares were valued at roughly $276 million based on average trading prices during the quarter. The increase brought Jane Street’s ownership to about 1.51% of IBIT’s outstanding shares.

Blackrock’s IBIT Feb. 17, 2026.

During the fourth quarter, bitcoin traded in a broad range, fluctuating between roughly $87,000 and $109,000 before finishing the year near $87,500. ETF flows remained active as institutional investors continued integrating spot bitcoin exposure into portfolios.

Other large investors, including sovereign wealth funds and hedge funds, also expanded positions in IBIT during the period. Some, like Harvard Management Company, cut positions back. IBIT’s assets under management surpassed $40 billion by early 2026, solidifying its status as one of the fastest-growing ETFs in recent years.

Online speculation has periodically linked Jane Street to intraday bitcoin sell pressure, particularly around recurring morning market moves. Critics have suggested that market makers exploit arbitrage between ETF shares and spot bitcoin to influence short-term price action.

However, market makers typically operate delta-neutral strategies, hedging ETF exposure through futures, options, or spot transactions to manage risk rather than to take outright directional bets.

Because 13F filings disclose long equity positions but not hedging instruments, outside observers see only one side of the balance sheet. In practice, authorized participants’ activity often enhances liquidity and tightens spreads, improving price discovery for retail and institutional investors alike.

Jane Street’s expanded IBIT position highlights how deeply integrated spot Bitcoin ETFs have become within traditional market infrastructure. Large trading firms now sit at the center of liquidity provision for crypto-linked products, bridging conventional finance and digital assets.

At the same time, the decline in IBIT’s share price since year-end illustrates the sensitivity of ETF holdings to bitcoin’s market swings. For institutions operating at scale, volatility remains part of the calculus.

Whether viewed as a liquidity provider’s routine inventory management or as a signal of long-term conviction, Jane Street’s Q4 acquisition adds another chapter to the institutionalization of bitcoin exposure through regulated vehicles.

FAQ ⏱️

- What did Jane Street acquire in Q4 2025? Jane Street acquired 7,105,206 additional shares of Blackrock’s Ishares Bitcoin Trust, increasing its total stake to over 20.3 million shares.

- How much was Jane Street’s IBIT position worth at year-end 2025? At IBIT’s Dec. 31 closing price of $49.65, the firm’s holdings were valued at approximately $1.01 billion.

- What does IBIT invest in directly? IBIT holds bitcoin as its underlying asset, giving investors regulated exchange-traded exposure to spot price movements.

- What does Jane Street do as an authorized participant? As an authorized participant, Jane Street creates and redeems ETF shares in exchange for underlying bitcoin, helping keep ETF prices aligned with net asset value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。