Fidelity Director of Global Macro Jurrien Timmer shared on social media platform X on Feb. 13 that bitcoin’s recent decline to around $60,000 reached a support zone he had identified months earlier, signaling the likely floor of the prior phase and the potential start of a new expansion.

“Finally, bitcoin fell to $60K last week, which is in the support zone that I suggested a few months ago when I wrote that another 4-year cycle bull market had likely ended,” he wrote. “A decline to ‘only’ $60K would be relatively shallow for a bitcoin winter, but as the commodity currency matures, its ups and downs should become less dramatic.”

Timmer added: “It’s anyone’s guess whether $60K is the low, but my guess is that it is, and that after a few months of backing and filling the next cyclical bull market will get underway.” The Fidelity director of global macro further shared:

“Based on the mathematical harmony of past cycles, which of course are not a guarantee of future cycles, my sense is that any future waves could eventually take us to new highs.”

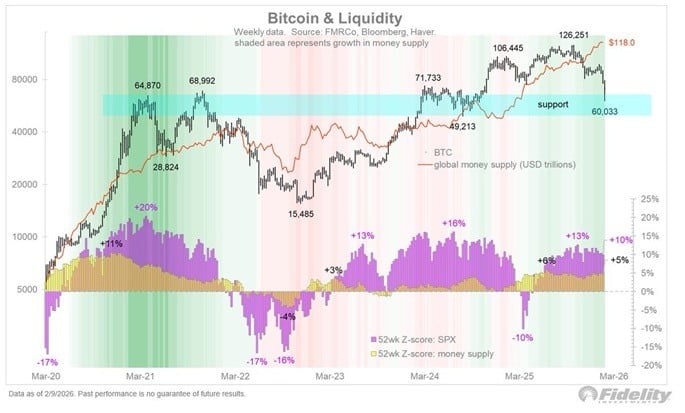

Alongside his comments, he shared two charts. The first chart, titled “ Bitcoin & Liquidity,” overlays bitcoin’s price with global money supply growth. The graphic highlights prior cycle peaks near $64,870, $68,992, $71,733, and $126,251, and marks the $60,033 area as technical support, while also showing a recent global money supply level of roughly $118 trillion.

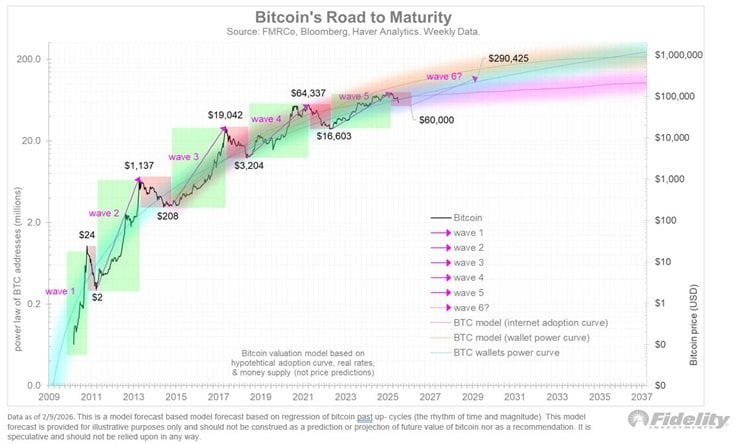

In the second chart labeled “ Bitcoin’s Road to Maturity,” Timmer mapped bitcoin’s historical waves from early price levels near $2 and $24 to later highs above $64,000 and a projected wave 6 zone pointing toward $290,425. The model incorporates adoption curves, wallet growth, and macro variables, presenting a long-term framework that extends toward the $1 million range over time. While the forecast is described as illustrative and not a price prediction, the visual analysis suggests that, if prior cyclical patterns and adoption trends persist, bitcoin could continue progressing along a structured maturation path following the current consolidation around $60,000.

- Why does the Fidelity director of global macro see $60,000 as a critical level for bitcoin?

He believes bitcoin’s decline to around $60,000 aligns with the end of its prior four-year bull cycle, potentially marking a cyclical bottom and limiting downside risk compared to past crypto winters. - Could bitcoin’s recent pullback signal the start of a new bull market?

Timmer suggests that after a period of consolidation around $60,000, bitcoin may enter a new cyclical uptrend consistent with historical four-year market patterns. - How does bitcoin’s maturation impact its volatility outlook?

As bitcoin evolves into a more established macro asset or “commodity currency,” Timmer expects its price swings to become less extreme, which could attract more institutional capital. - What is the long-term investment thesis behind bitcoin’s cycle analysis?

Based on recurring mathematical cycle structures and continued adoption growth, Timmer argues bitcoin could reach new all-time highs over time if historical patterns continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。