Recently, the outlook for the US stock market has left most people feeling confused. When Qihuohua released its financial report, the market panicked and plummeted, whether it was Microsoft or Google; they all pointed to one contradiction: excessive capital expenditure!

Although the S&P 500 index has been hovering at high levels, the 7000-point mark has been fluctuating back and forth. On the surface, the market seems unremarkable, without sharp declines or tremendous gains, and even the Wall Street Journal headlines were too lazy to write "market fluctuations." However, in fact, the capital within the market is already surging beneath the surface, asset allocation strategies have started to quietly transform, and assets are gradually being repriced!

Recently, our research into US stocks and reading investment bank reports has found that institutions have begun to show a strong interest in cash flow companies and hardware companies. Three undercurrents are converging here: the economy is “not landing,” AI is reconstructing industrial logic, and capital is migrating from the “virtual” to the “real.” Today, let's briefly talk about where money should go in 2026 when #AI is no longer a concept but a productive force.

1️⃣ "Good news = bad news": We have encountered the "no landing paradox."

Yesterday, as soon as the US non-farm payroll data was released, the market turned on a dime: 130,000 new jobs were created (expected 70,000), the unemployment rate fell to 4.3%, and wages rose by 0.4% month-on-month. In 2023, this would have undoubtedly been a reason for stock market celebration. But last night, it became “poison.”

Why? Because the market was expecting a “soft landing” (economic cooling + mild inflation + Federal Reserve interest rate cuts), but instead, it ran into a strange cycle: the economy is too strong, inflation is hard to dissipate, and interest rate cuts are nowhere in sight. This is the "no landing paradox."

The bond market reacted the most honestly: the 10-year US Treasury yield jumped to 4.2%. Remember this number; it has become the "lifeline" for highly valued growth stocks. As risk-free rates rise, all stocks that relied on “future stories” to sustain their valuations (such as tech stocks relying on discounted distant cash flows) were directly hit on the denominator side. Therefore, the Nasdaq fell harder than the Dow, and small-cap stocks like the Russell 2000 went down directly; the logic is simple: money is no longer cheap, and the era of storytelling has ended.

Additionally, it is interesting that we previously talked about Kevin Warsh taking over as Fed Chair and his policy logic. He is a typical "supply-side reformist" with extremely low tolerance for asset bubbles. If he takes office, it could mean a steeper yield curve: strong economy + tight monetary policy + high interest rates, coinciding with the current "no landing paradox." Under this double whammy, capital is forced to change its positions.

2️⃣ Major diversion in tech stocks: AI is killing “pseudo growth” and stimulating “hard tech.”

This is currently the most concerning signal; tech stocks are tearing apart internally. Wall Street even coined a new term: “SaaS apocalypse.”

For the past decade, our logic of buying software stocks (like Salesforce, Adobe, Workday) has been very stable: high margins, subscription models, charged per headcount, truly “making money while lying down.”

But a report from Morgan Stanley yesterday burst the bubble, pointing out two major vulnerabilities:

· Debt trap: Over $200 billion in debt borrowed during the zero interest rate era is now facing downgrades under a 5% financing cost, and many companies find it hard to cover even interest with their cash flows.

· #AI's dimensionality reduction attack: SaaS charges per "headcount," but generative AI, such as various AI Agents, is replacing junior white-collar workers, capable of writing code, reviewing contracts, and replying to emails. Companies no longer need as many employees; who will software accounts be sold to? This is not an emotional sell-off but a devastating reassessment of the business model.

However, the money hasn’t left technology; it has shifted towards “hard tech,” those companies providing the physical infrastructure for AI. Yesterday, Cisco's after-hours earnings report was pivotal, securing $2.1 billion in AI orders for the quarter, equivalent to the entire order volume of last year. Currently, AI giants' money is flowing from "only buying Nvidia chips" to networking pipelines, optical modules, and switches; the stronger the computing power, the faster the data flows, necessitating thicker pipelines.

What’s even more shocking is #BorgWarner's rise of 22%. How does an auto parts manufacturer achieve this? Because it secured massive orders for power generation and heating systems in data centers. This reveals an overlooked truth: the endpoint of AI is energy. Every watt of computing power requires 2-3 watts of electricity to support it, and cooling costs account for over 40% of total expenses in data centers.

An Nvidia GB200 chip set requires 800G optical modules for interconnectivity, with a single cabinet's power consumption exceeding 100kW. Cisco mentioned yesterday that 70% of its AI-optimized switch orders come from hyperscale data center expansions. Therefore, as the AI competition intensifies, networking equipment vendors benefit more; they are not betting on which model will win; they are just profiting from "all players needing to pave the way."

In the energy sector, Microsoft recently signed an agreement with a nuclear power company to supply electricity directly to data centers; Amazon is building its own natural gas power plant in Texas. The attributes of energy stocks have changed; ExxonMobil (XOM) is no longer just an “old oil stock,” but the “electricity supplier” of the AI era.

So the list of true future winners is quite clear:

Computing layer: Nvidia (chip leader)

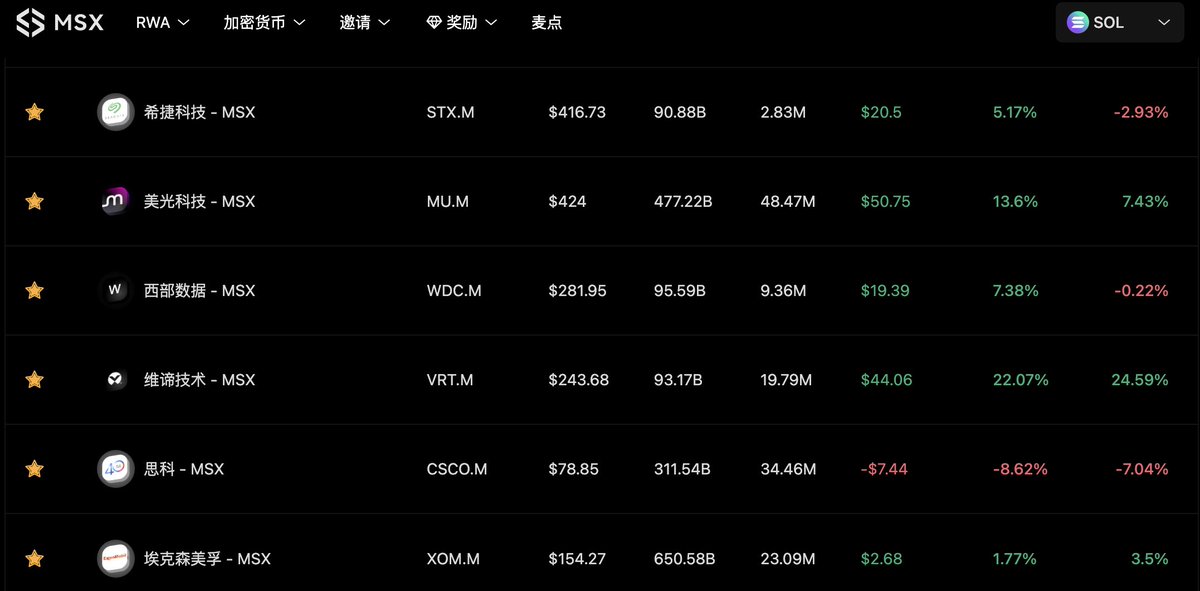

Storage layer: SanDisk, Micron Technology, Western Digital

Networking layer: Cisco, Arista (data highways)

Energy layer: Vertiv (cooling), BorgWarner (power systems), ExxonMobil (traditional energy transitioning to AI power supply)

This is a massive migration of funds from the "byte world" to the "atomic world"; software is retreating, and physical assets are rising.

3️⃣ High capital expenditure in AI, capital shifts towards stable cash flow + high dividend companies.

Recently, the three major cloud service providers in the US have shocked the market with their capital expenditure budgets for 2026, totaling as high as $650 billion.

Amazon: $200 billion capital expenditure in 2026 (vs. $125B in 2025, +60%)

Google: $175-185 billion capital expenditure in 2026 (vs. $91B in 2025, +93%)

Microsoft: Although Microsoft did not provide an annual forecast, its quarterly capital expenditure reached a record $37.5 billion, a 66% year-on-year increase. The market estimates the annual total will be around $105 billion.

Meta: $115-135 billion capital expenditure in 2026 (vs. +60%-87% in 2025)

This aggressive spending pattern has also led market investors to have some concerns about the long-term viability of the companies, especially regarding free cash flow and whether it can be sustained under the current high interest rate environment.

For example, "the spendthrift" Amazon saw its free cash flow drop sharply from $38.2 billion at the end of 2024 to $11.2 billion over the past 12 months. Morgan Stanley analysts predict its free cash flow for 2026 will be -$17 billion; Bank of America expects the losses to hit $28 billion.

Such uncontrolled investments, once AI demand weakens, will result in capital expenditures with high input long cycles being like an arrow let loose, with no turning back; this uncertainty has caused many investors to turn their heads and invest in high-dividend, reliable companies.

For instance, Walmart, which recently surpassed a market cap of one trillion dollars, offers stable cash flow, stable buybacks, and dividends. Companies like Coca-Cola, McDonald's, Pfizer, and Johnson & Johnson also exemplify this.

Finally, to summarize, the investment logic in the current US stock market has quietly changed; funds have split into two forces: one seeking hard infrastructure in the AI sector, which offers high certainty and stable cash flow, while the other seeks defensive stocks in the consumer and pharmaceutical sectors, focusing on high dividends, low valuations, and stable cash flow.

At the doorstep of 7000 points on the S&P, the market is undergoing the cruellest survival of the fittest; liquidity cannot save us; only solid logic and fundamentals can. Embrace hard assets and be wary of pseudo growth that relies on "user numbers" to tell stories, and perform certain risk controls. Keep up with the market strategies post-AI in energy, networking, storage, and cooling—those silent yet indispensable cornerstones. Also, pay attention to Friday's CPI fluctuations. Until then, hold steady and keep your hands in check. 🧐

The companies mentioned above are all listed on #MSX. When trading US stocks, I choose to use the #RWA tokenized platform #MSX to participate in the US stock market: http://msx.com/?code=Vu2v44

Early fans and partners of US stock investment can DM me, and after filling out the form, you can enter the US stock exchange and discussion community for free (currently limited to 10 people per week, with assistant review, which may take some time, thank you 🙏)!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。