Europe is taking its heavy reliance on foreign payment groups seriously, as the lack of sovereign solutions risks upending the financial system in the event of a foreign relations crisis.

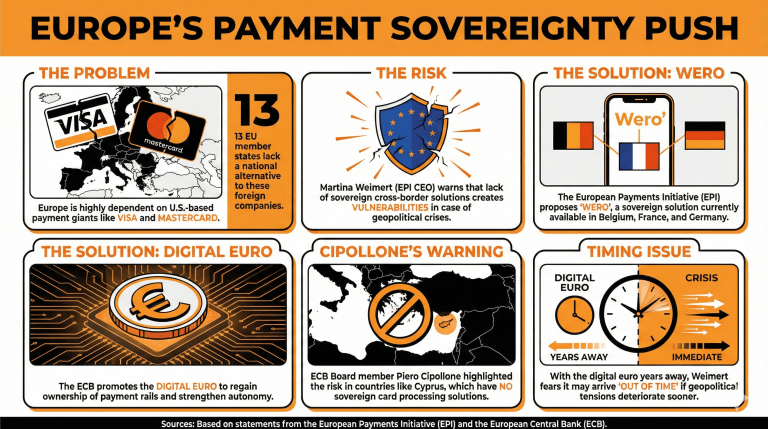

Martina Weimert, chief executive of the European Payments Initiative (EPI), called for taking action to reduce the reliance on U.S.-based groups such as Visa and Mastercard. 13 member states of the European Union (EU) lack access to a national alternative to these foreign companies.

She stated:

“We are highly dependent on international payment solutions. Yes, we have nice national assets like domestic payment card schemes, but we don’t have anything cross-border. If we say independence is so crucial and we all know it’s a timing issue, we need action urgently’’

The EPI has proposed its own solution, called Wero, to address this problem. Nonetheless, it is only available in Belgium, France, and Germany, with more countries expected to adopt this initiative in the future.

The European Central Bank (ECB) is also aware of this problem and has proposed accelerating the adoption of the digital euro to address this issue.

In Cyprus, where there are no sovereign solutions to process card payments, ECB Executive Board member Piero Cipollone highlighted that this dependence created vulnerabilities that they “cannot afford to ignore.”

Cipollone promoted the digital euro, stressing that it would “allow Europe to regain ownership of the rails on which its payment system runs and thereby strengthen our autonomy.”

But the digital euro is set to be launched in at least a couple of years, and Weimert states that it could arrive a “little bit out of time,” given that if geopolitical tensions deteriorate, the EU would be vulnerable to an attack in the payment processing sector.

Read more: EU Council Sets Position on Digital Euro and Cash

Why is Europe focusing on reducing reliance on foreign payment groups?

Europe aims to mitigate the risk of financial disruptions that could arise from dependence on U.S.-based companies like Visa and Mastercard during foreign relations crises.What did Martina Weimert highlight about the current payment landscape in the EU?

She pointed out that while some member states have domestic payment solutions, there is a lack of cross-border alternatives, necessitating urgent action.What initiative has the European Payments Initiative (EPI) proposed?

The EPI has presented Wero as a potential solution, though it is currently accessible only in Belgium, France, and Germany, with plans for broader adoption.How is the European Central Bank (ECB) addressing this payment dependency?

The ECB is advocating for the rapid implementation of the digital euro to enhance Europe’s payment autonomy, although its launch is expected to take a few years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。