A calmer tone settled over crypto exchange-traded funds (ETFs) as the week got underway, with capital cautiously rotating back into bitcoin and ether products after recent volatility. It wasn’t explosive. But it was constructive.

Bitcoin spot ETFs recorded $145 million in net inflows, extending their rebound to a second straight session. Grayscale’s Bitcoin Mini Trust led the charge with a commanding $130.54 million entry, signaling renewed institutional appetite.

First consecutive inflow days for bitcoin ETFs since Jan. 15.

Ark & 21Shares’ ARKB added $14.09 million, while Vaneck’s HODL contributed $12 million. Smaller inflows of $6.14 million into Franklin’s EZBC and $3.08 million into Fidelity’s FBTC rounded out the gains. A $20.85 million exit from Blackrock’s IBIT briefly weighed on sentiment but failed to derail the broader green close. Trading activity reached $4.47 billion, pushing total net assets up to $90.05 billion.

Ether spot ETFs also turned positive, posting a $57.05 million net inflow despite notable internal divergence. Fidelity’s FETH led all ether funds with a strong $67.32 million inflow, followed by $44.62 million into Grayscale’s Ether Mini Trust. These gains absorbed outflows of $44.99 million from Blackrock’s ETHA and $9.90 million from Bitwise’s ETHW. Total value traded came in at $1.19 billion, lifting ether ETF assets to $12.42 billion.

XRP spot ETFs quietly extended their resilience with $6.31 million in inflows. Franklin’s XRPZ attracted $3.15 million, Canary’s XRPC added $2.31 million, and Grayscale’s GXRP chipped in $846,190. Trading volume remained muted at $15.89 million, while net assets held steady at $1.04 billion.

Solana spot ETFs saw little movement, with minimal trading activity and net assets unchanged at $733.18 million, reflecting a pause in directional conviction.

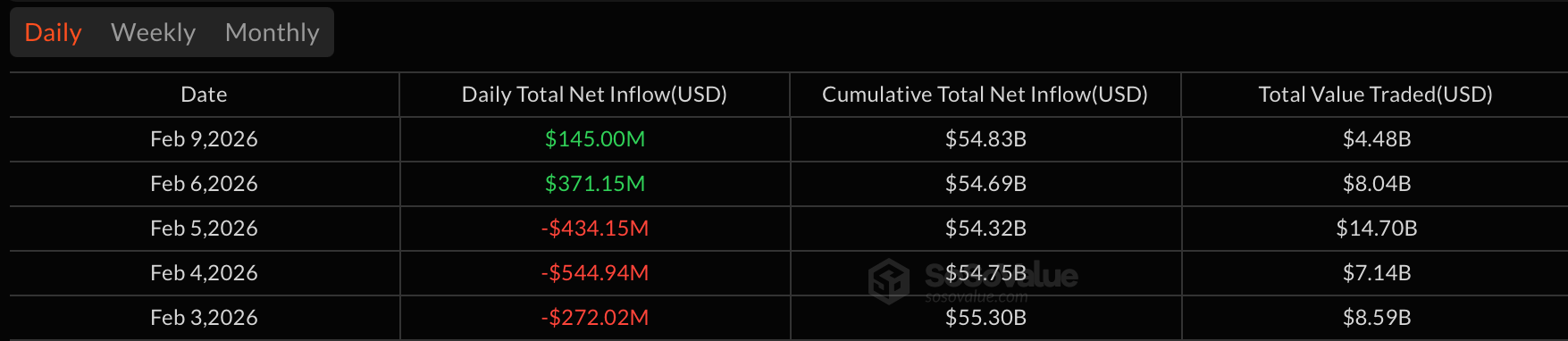

Read more: Volatile Start for Crypto ETFs in February as Bitcoin Lags and XRP Shines

Overall, Monday’s flows painted a picture of cautious re-entry rather than aggressive positioning. Bitcoin continues to stabilize, ether is finding selective support, XRP remains quietly constructive, and solana waits for its next catalyst.

- Why did bitcoin ETFs see inflows again?

Investors appear to be selectively rebuilding exposure after last week’s heavy volatility and drawdowns. - Which bitcoin ETF saw the largest inflow?

Grayscale’s Bitcoin Mini Trust led the day with over $130 million in new capital. - Why were ether ETFs green despite large outflows?

Strong inflows into Fidelity’s FETH and Grayscale’s Mini Trust outweighed selling in ETHA and ETHW. - Why was solana ETF activity muted?

Traders largely stayed sidelined, signaling uncertainty rather than outright bearishness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。