Good evening, everyone. I am Xin Ya. It's been a few days since we last met, and I wonder how everyone is doing now. The New Year is approaching, and I hope you have chosen gifts for those around you. I also wish everyone a Happy New Year in advance. For us, happiness depends on the results. In early February, it should be difficult for the majority of the market to feel happy in such a market atmosphere.

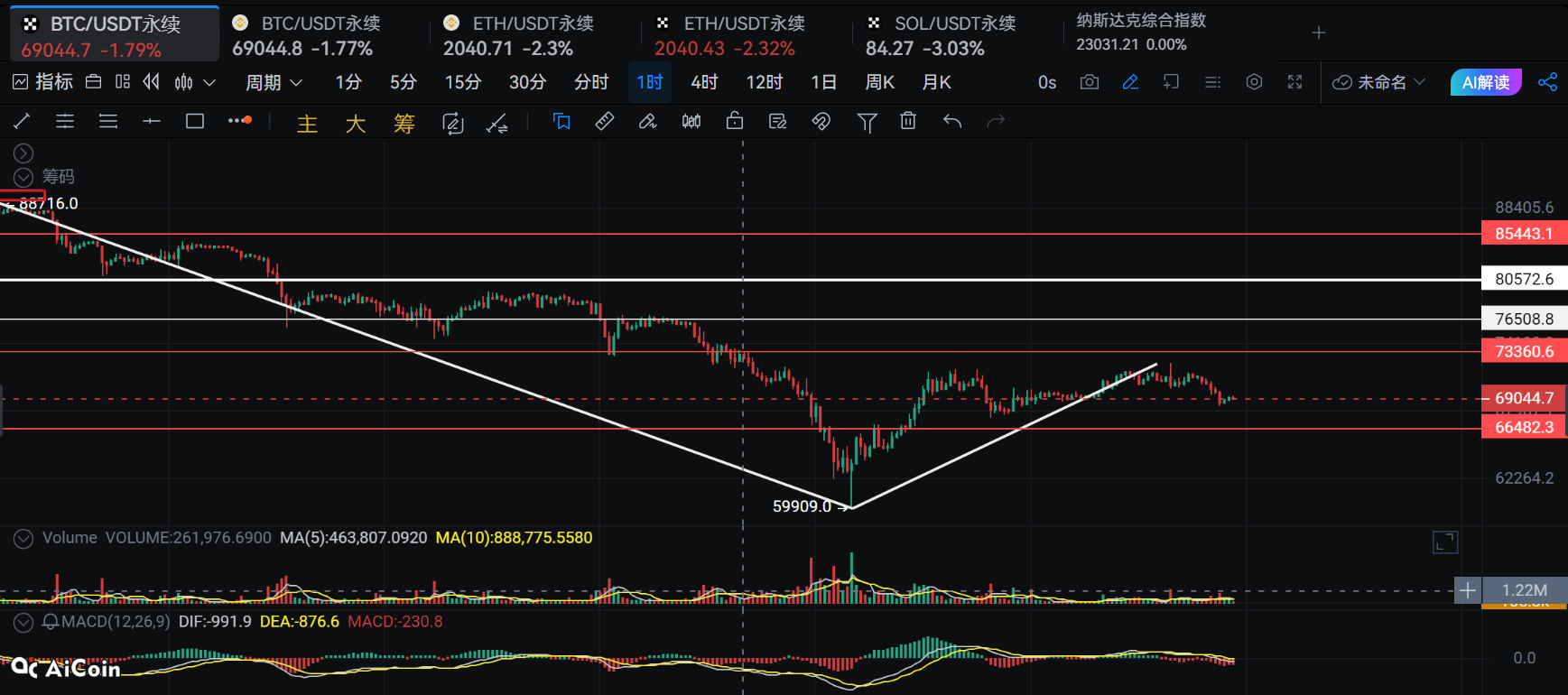

Let's briefly review the recent trends. On the morning of February 6, Bitcoin spiked to around 60,000, then rebounded by 5,000 points during the day session, and continued to push up to around 71,500 in the evening session. If you remember, this was a reasonable expectation for a rebound that I mentioned on the 5th regarding the future market. On the afternoon of the 7th, due to insufficient buying to stabilize the market, Bitcoin's price collapsed from 70,000 to around 67,000, bounced back to 69,000, and then consolidated until the afternoon of the 8th.

From a game-theory perspective, the range of 66,000 to 70,000 can definitely wipe out high-leverage short sellers, while the 70,000 level will certainly attract new short positions. The first push to 71,700 may scare off some, and those who are optimistic about the future market will take positions in the 70,000 range. This creates the first divergence. However, when it first fell back to 67,500, the 70,000 level became a short entry point for short-term traders, creating a second divergence. Today, when it broke through 72,000 in the morning, most people who are optimistic about the future market inevitably took positions at this level, forming the third divergence.

Initially, when it dropped to 67,500 on the afternoon of the 7th, the shorts who took profits and the longs who entered at 70,000 formed a combined force, allowing it to rebound to 72,000 without much trading volume, hitting a second high. The subsequent pullback did not see buying support. The price movement was 71,500-67,500-72,000-68,500. The overall market volatility is particularly good, but it can be seen that those who are market-making around the 70,000 level, regardless of which side, did not achieve very good results. As for those who entered during the divergence, most of the time they should be in a losing position.

The times when trading volume increased were on the morning of February 7 when it first broke below 70,000, the pressure when it rebounded to 70,000 in the early hours of the 8th, and when it pushed up to around 72,300 in the early hours of the 9th before being pushed back to 70,000, and when it fell below 70,000 at 5 PM. The process showed increased selling pressure when breaking below 70, and there was no follow-up buying after it rebounded above 70. Such weakness makes the future market trend clear: a bearish consolidation.

The key levels to pay attention to are 66,600, 68,500, 70,000, and 72,000.

For Ethereum, they are 1,980, 2,050, and 2,120.

Since Ethereum's rhythm is highly synchronized with Bitcoin, they can be handled in parallel.

You can short Bitcoin at 70,000, boldly short at 71,500, and set a stop loss at 72,350. For rebounds, buy at 66,500 and set a stop loss at 64,800.

For Ethereum, trade in the range of 1,980-2,050, with a stop loss set 35 points away. The focus is on consolidation, handled with shorts.

Public account: Xin Ya Talks About Chan

The logic we follow is to choose divergence points for directional selection, with the rebound range being the long accumulation area at 68,500, which is also the lowest spike of the first major drop. The stop loss range is the liquidation area for high-leverage opponents at the whole number. Following this approach is like stepping on the path others have taken, making it hard to lose. As for Ethereum, it has moved in a narrow range, and the future market is expected to see high-frequency back-and-forth movements.

No matter what, I hope everyone gets better and better.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。