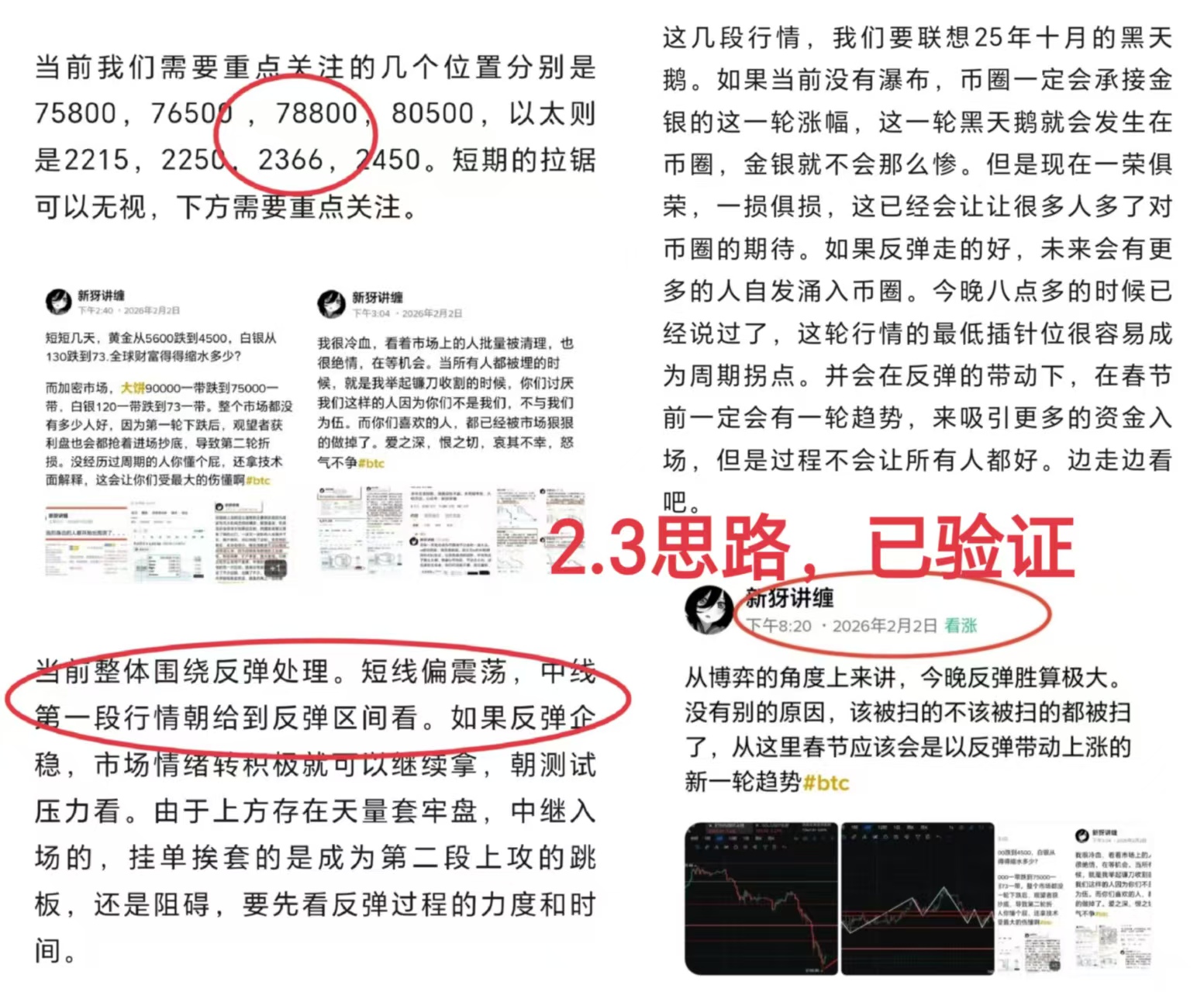

Good evening everyone, I am Xin Ya. Last night I indicated a rebound, with a short-term bias towards consolidation. Well, Bitcoin bounced back nicely, Ethereum at 2366, around 2250, the levels provided were barely acceptable.

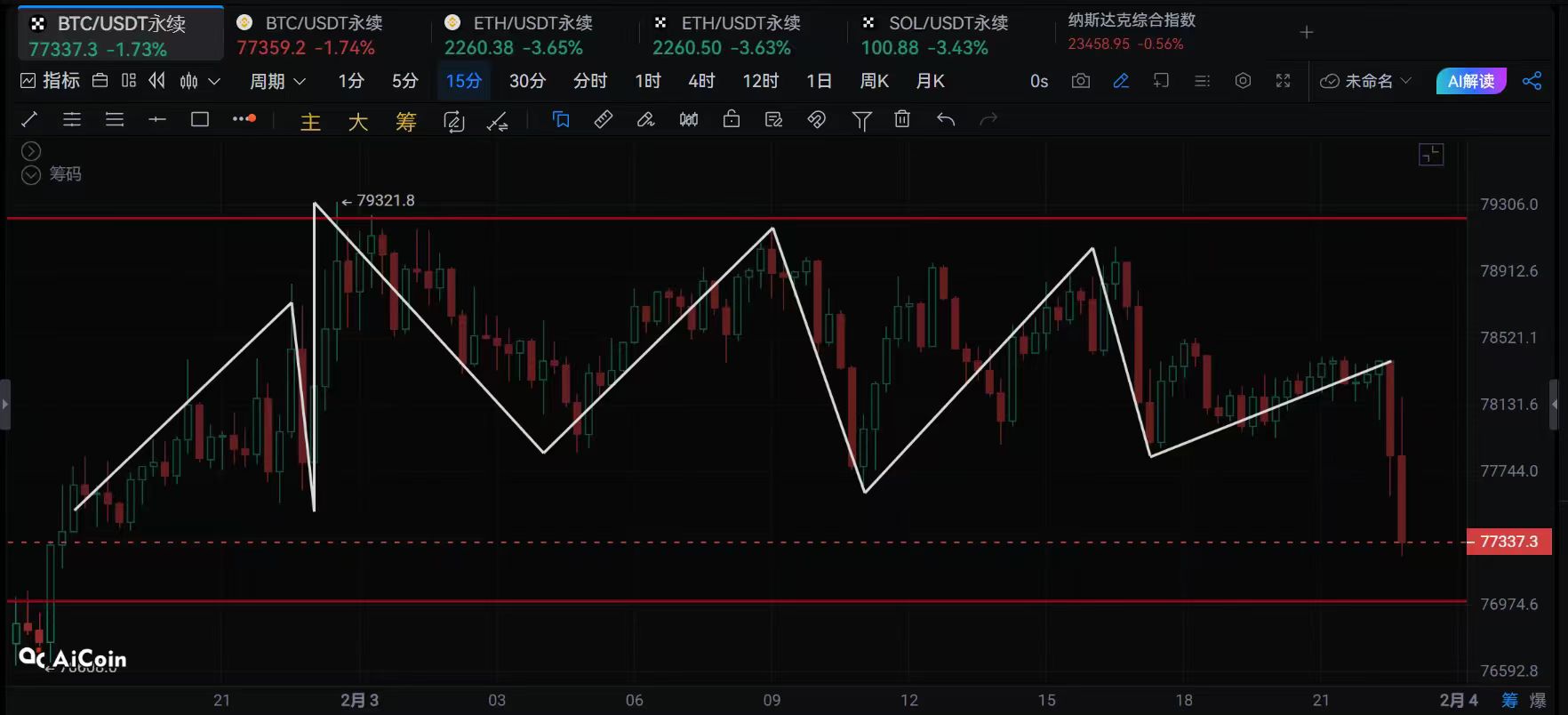

Let's briefly review the situation on February 2nd. After Bitcoin fluctuated around 78800, there were signs of selling, and after dipping to around 77500, there were signs of support. Throughout the night session until now, it has fluctuated back and forth five times. The main range of consolidation is also around 77500-78800. It is running on reduced volume, and each time it tests upwards, there is selling pressure pushing it back down. Whether this is digesting divergences or selling pressure release needs further observation.

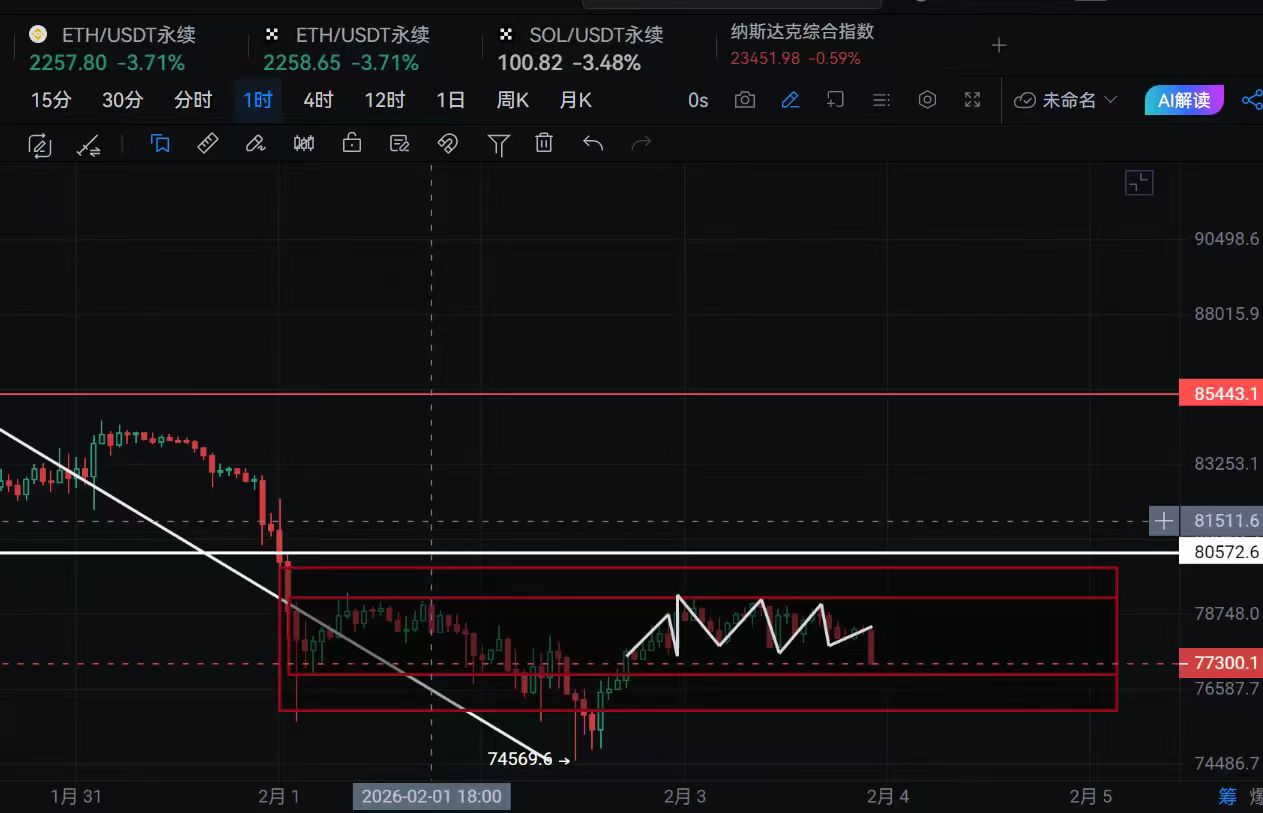

Ethereum's performance on February 2nd saw a rise to around 2366 at 10:30 PM, which faced resistance. After a pullback to 2320, it pushed up to around 2395, then fell back to 2320 for a second rebound, and then it moved down to the lowest point around 2260, which is better than the 2250 I provided.

In fact, the answer to the market's movement was already mentioned yesterday. The market is sufficiently panicked for the main players to be interested in entering. It is clear that the market was not sufficiently panicked yesterday; it was mostly the trapped bulls trying to support the market. If you look at the daily and weekly charts, the bottom seems far away. You can see that there hasn't been enough buying at critical levels. Normally, this is judged by whether there is buying pressure when it dips down, rather than testing selling pressure after a rise. Observing the key consolidation range, you can see the trading rhythm of buying and selling.

The area around 74500 can easily become a turning point in the cycle, as several large institutions have their cost lines nearby. Due to their massive size, they can dilute costs in a quantitative manner, and a big rise or fall does not significantly impact them.

Currently, since a rebound has already occurred, market panic has dissipated, and the market will not experience the explosive rises and falls like in the previous days. This month will not be as clear as previous market movements, and it will not present obvious opportunities for everyone. In the rebound starting from the turning point, the market will operate in an irregular manner. We maintain yesterday's viewpoint, with a short-term bias towards consolidation, prioritizing rebounds within the secondary central range.

Since the levels of 78800, 2366, and 2250 provided yesterday were so effective, we also need to pay attention to the other levels of 76500 and 2215. Currently, Bitcoin's four-hour EMA30, one-hour EMA120, and 144 are around 80500. We take the highest test point of 79450 to its halfway point, considering 80000 as potential resistance. As for Ethereum, we still regard 2366 as a potential pressure point.

So for the future market, during the consolidation process, it is good to make waves within the central construction range. Bitcoin 75800-80000, Ethereum 2186-2368. Just high sell and low buy around the actual situation. When making rebounds, stop losses should be set, and multiple attempts can be made. There is no other reason, as the central construction market will have many trapped bulls continuously doing T trades to average down their costs.

Public account: Xin Ya Talks About Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。